Quick Overview

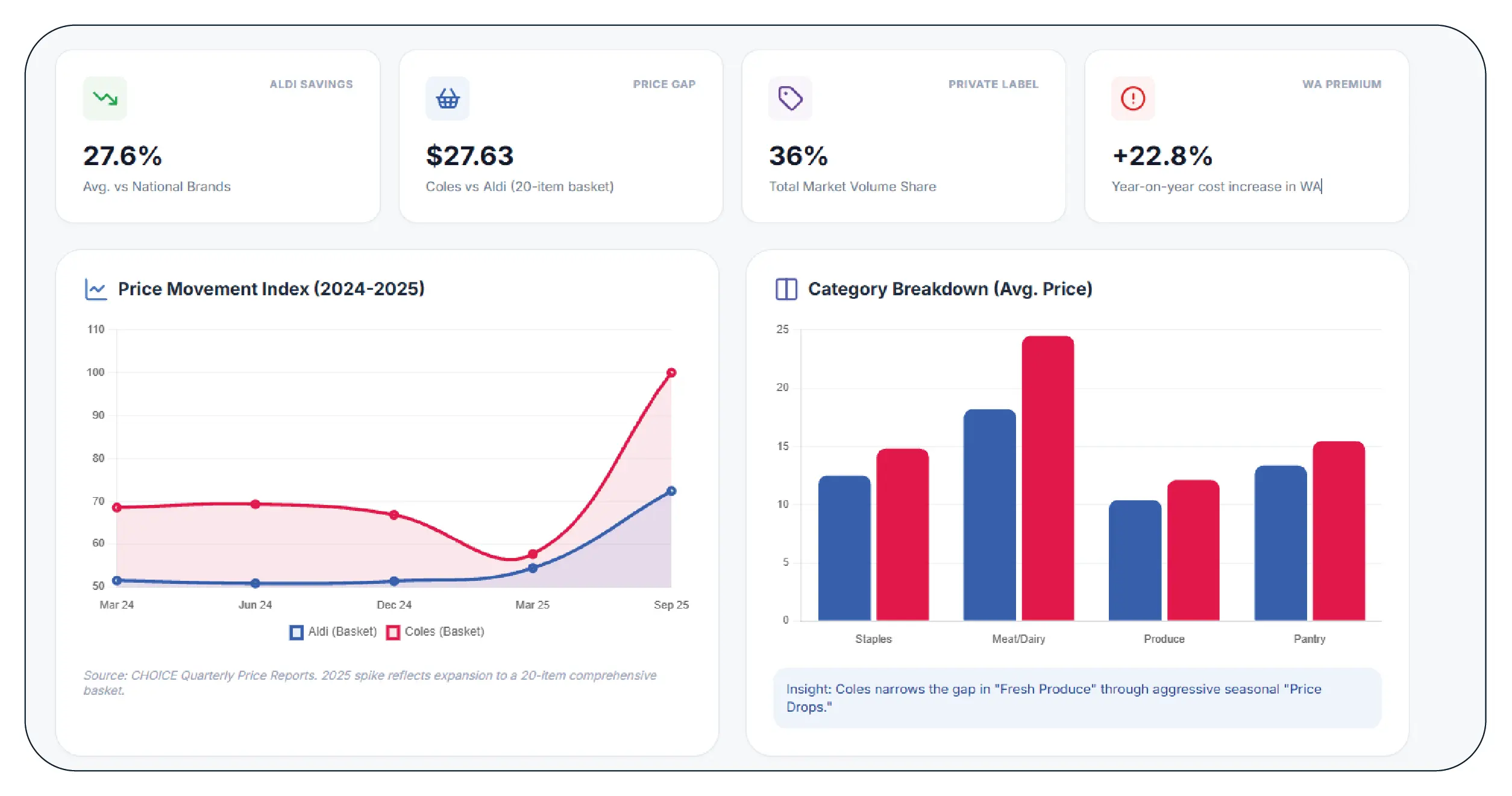

This case study showcases how a retail intelligence firm leveraged Weekly Grocery Price Tracking from Coles & Aldi to uncover actionable pricing trends in Australia’s highly competitive grocery market. The client operates in the retail analytics and consumer insights industry, serving brands, distributors, and strategy teams. Over a five-month engagement, Product Data Scrape implemented automated Web Scraping Grocery & Gourmet Food Data workflows to track weekly price movements across key grocery categories. The initiative delivered measurable improvements, including faster data refresh cycles, enhanced pricing accuracy, and clearer competitive benchmarks—enabling data-driven pricing decisions and stronger market responsiveness.

The Client

The client is a mid-to-large retail analytics company specializing in grocery pricing intelligence and competitive benchmarking. With inflationary pressures rising and consumers becoming increasingly price-sensitive, grocery retailers faced intense scrutiny over weekly price changes. Industry demand for transparent, data-backed insights surged as brands and retailers sought to justify pricing strategies and remain competitive.

Before partnering with Product Data Scrape, the client relied on a mix of manual data collection and delayed third-party reports. This approach limited their ability to conduct reliable Grocery Price Monitoring Coles and Aldi at scale. Data inconsistencies, missing SKUs, and slow refresh cycles meant weekly price fluctuations often went unnoticed until it was too late to act. As inflation concerns escalated, the lack of real-time Price Monitoring became a strategic risk.

Transformation was essential to move from reactive reporting to proactive intelligence. The client needed a solution capable of capturing granular price movements weekly, across hundreds of SKUs, without compromising accuracy. Their goal was to provide clients with dependable, up-to-date insights that reflected true market conditions rather than static averages.

Goals & Objectives

The primary goal was to establish scalable Coles & Aldi Grocery Price Data Intelligence that delivered accurate, weekly pricing insights across essential grocery categories.

From a business standpoint, the client aimed to improve speed, scalability, and confidence in pricing insights, enabling customers to respond quickly to market shifts. Strategically aligned Pricing Strategies required consistent, comparable data across retailers.

On the technical side, the objective was to automate data collection, integrate outputs into existing dashboards, and enable near real-time analytics without manual intervention.

Reduction in data collection and processing time

Increase in SKU-level price coverage

Improvement in weekly pricing accuracy

Faster delivery of pricing reports

Higher client adoption of analytics outputs

The Core Challenge

The biggest challenge stemmed from the fragmented nature of grocery pricing data. Prices varied weekly due to promotions, supply shifts, and competitive responses. Manual tracking methods failed to consistently Extract Grocery Price Data from Coles & Aldi, leading to data gaps and outdated insights.

Operational bottlenecks emerged as analysts spent excessive time validating prices and reconciling discrepancies across sources. Without a centralized Grocery store dataset, including insights from Web Scraping Coles Data, the client struggled to maintain historical continuity or perform reliable trend analysis. Performance issues included delayed updates, incomplete SKU coverage, and inconsistent categorization.

These challenges directly impacted data accuracy and speed. Weekly pricing trends—critical for inflation tracking and competitive benchmarking—were often identified after the fact. The lack of automation reduced analytical efficiency and limited the client’s ability to deliver timely, high-confidence insights to stakeholders.

Our Solution

Product Data Scrape deployed a phased solution built around Web Scraping Grocery Price from Coles & Aldi, designed to deliver reliable, scalable weekly pricing intelligence.

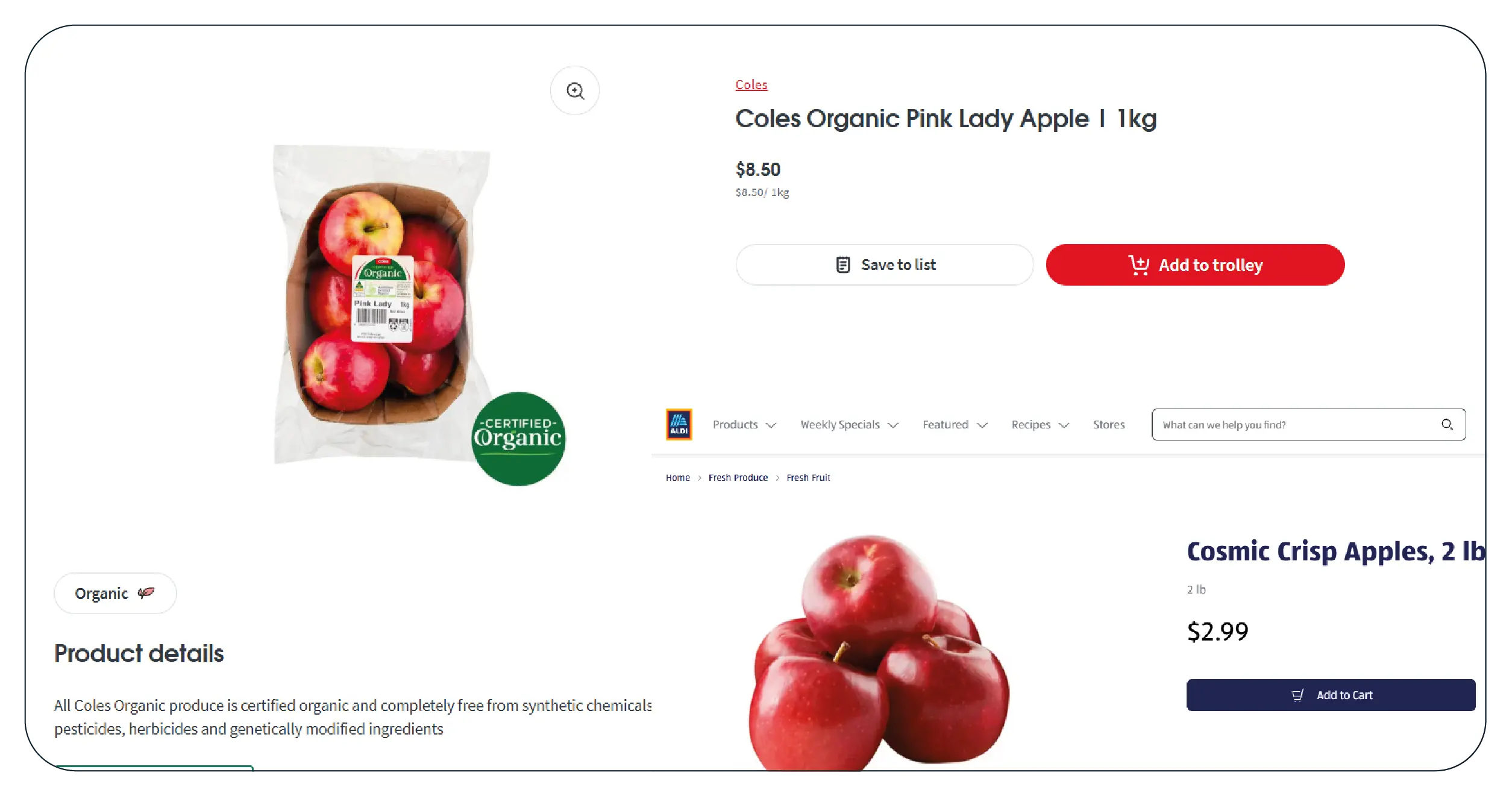

The first phase focused on requirement mapping and SKU prioritization. High-impact categories such as staples, fresh produce, and FMCG items were identified to ensure meaningful insights from the outset.

In phase two, automated scraping workflows were implemented to capture weekly price points, promotions, pack sizes, and product availability. These workflows supported consistent Weekly Grocery Price Tracking from Coles & Aldi without manual intervention.

Phase three introduced data normalization and validation frameworks. Intelligent rules handled duplicate SKUs, promotional anomalies, and category mismatches. This ensured clean, comparable data across both retailers.

The final phase integrated structured datasets into the client’s analytics environment, enabling weekly trend dashboards, historical price comparisons, and inflation analysis.

Each phase directly addressed a key challenge—speed, accuracy, scalability, and usability—resulting in a robust pricing intelligence system that adapted seamlessly to retailer updates and promotional cycles.

Results & Key Metrics

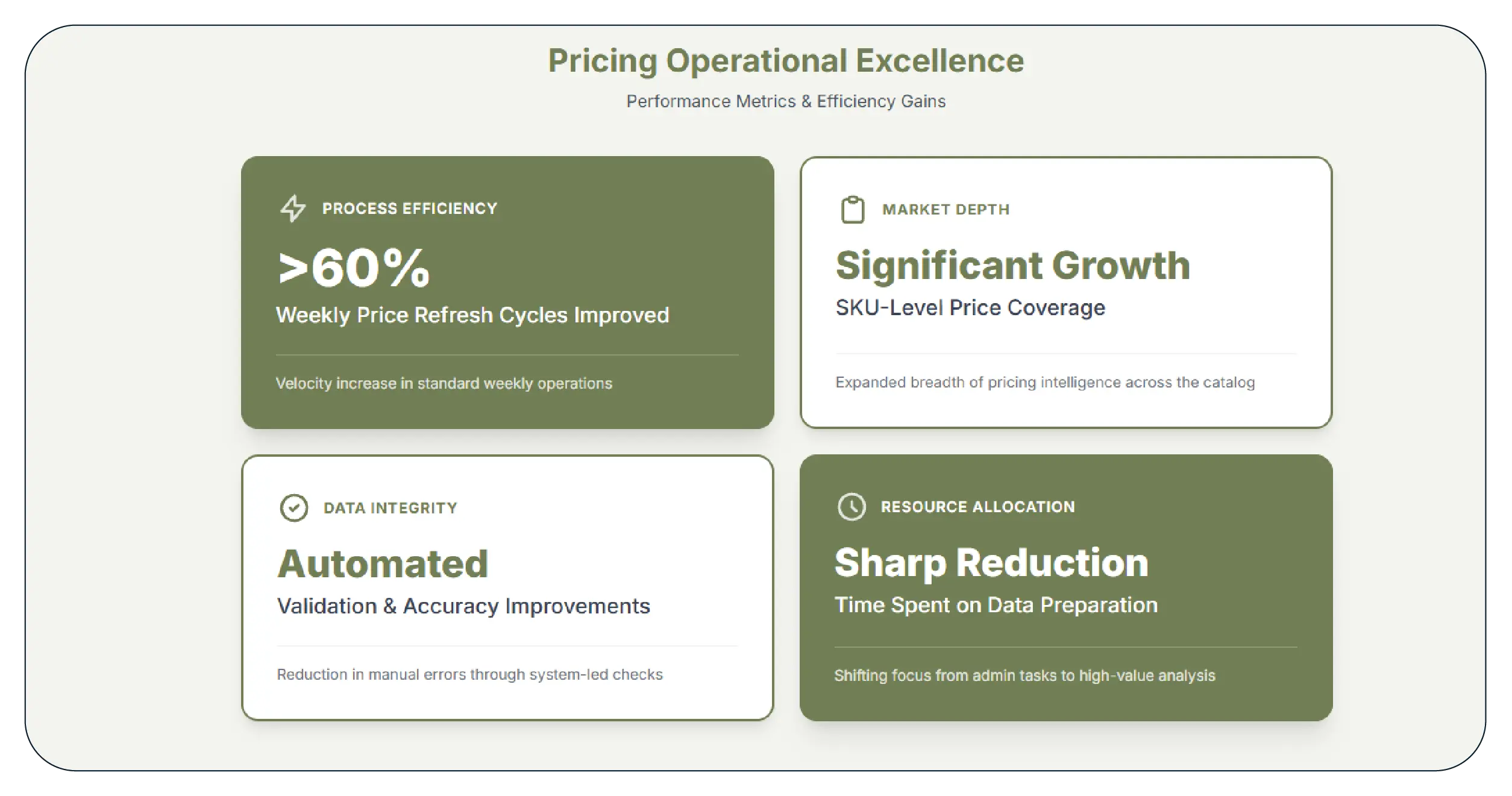

Weekly price refresh cycles improved by over 60%

SKU-level price coverage increased significantly

Data accuracy improved through automated validation

Analyst time spent on data preparation reduced sharply

The deployment of the Coles Grocery Product Listing Data Scraper enabled dependable Weekly Grocery Price Tracking from Coles & Aldi at scale.

Results Narrative

With automated tracking in place, the client identified pricing trends earlier and with greater confidence. Weekly inflation signals became clearer, promotional impacts easier to quantify, and competitive price positioning more transparent. Analysts shifted focus from data cleaning to insight generation, improving overall productivity. The client reported stronger customer engagement and increased trust in their pricing intelligence outputs.

What Made Product Data Scrape Different?

Product Data Scrape differentiated itself through proprietary automation logic, retailer-aware scraping frameworks, and scalable infrastructure. Advanced change-detection ensured accurate weekly comparisons, while modular design supported rapid expansion. The use of the Aldi Grocery Product Listing Data Scraper alongside Coles-specific frameworks delivered balanced, retailer-neutral insights without data bias.

Client’s Testimonial

“Product Data Scrape helped us transform our pricing intelligence capabilities. Their expertise in Web Scraping Coles Data allowed us to track weekly grocery prices with a level of accuracy and consistency we had not achieved before. The automation reduced manual effort significantly and enabled us to deliver faster, more reliable insights to our clients.”

— Head of Retail Analytics, Market Intelligence Firm

Conclusion

This case study demonstrates the power of automated pricing intelligence in an inflation-sensitive grocery market. By implementing scalable workflows and leveraging Web Scraping Aldi Data, the client moved from reactive analysis to proactive insight generation. Weekly pricing trends became visible, comparable, and actionable. The solution not only addressed immediate operational challenges but also established a future-ready foundation for expanded retail intelligence and deeper market analysis.

FAQs

1. What data was tracked in this project?

Weekly product prices, promotions, pack sizes, and availability across Coles and Aldi.

2. How often was pricing data updated?

Data was refreshed weekly to capture consistent pricing trends and promotional cycles.

3. Was the solution scalable across categories?

Yes, the system supported rapid expansion across grocery categories without performance loss.

4. How was data accuracy ensured?

Validation rules and anomaly detection ensured clean, comparable pricing data.

5. Who benefits most from this solution?

Retailers, brands, analysts, and strategy teams seeking reliable grocery price intelligence.

.webp)

.webp)