Introduction

In fast-moving urban markets like Kolkata, grocery demand patterns change rapidly based on seasons, festivals, pricing sensitivity, and digital buying behavior. For retailers and brands, missing even small shifts in consumer demand can result in excess inventory, product expiry, and major revenue leakage. This is where Scrape Kolkata Grocery Trends on Flipkart Grocery becomes a game-changing strategy for businesses aiming to reduce stock losses in 2026 and beyond. By systematically collecting pricing, availability, and demand movement across Flipkart Grocery, companies can build smarter forecasting models and prevent overstocking or understocking situations.

To operationalize this approach at scale, organizations increasingly rely on automation frameworks such as the Web Data Intelligence API, which enables real-time extraction of structured product data across thousands of SKUs. Instead of depending on historical sales alone, decision-makers now combine marketplace signals with store-level analytics to understand how products perform across neighborhoods, income clusters, and seasonal demand cycles. As grocery eCommerce penetration continues to rise in metro cities, the ability to capture and act on these insights determines who thrives and who struggles with inventory inefficiencies.

Turning Local Demand Signals into Predictive Inventory Intelligence

Retailers seeking to minimize losses must move beyond static spreadsheets and adopt intelligent tracking systems that reflect real-time consumer behavior. By using a City-Wise Grocery Trend Tracking API, brands can monitor how grocery demand in Kolkata differs across zones such as Salt Lake, New Town, Garia, and Behala. This allows inventory planners to forecast hyperlocal consumption rather than relying on citywide averages that often distort supply decisions.

Between 2020 and 2026, grocery demand in Kolkata’s online ecosystem has shown steady growth, especially in essentials and fresh categories.

Kolkata Grocery Demand Growth (2020–2026)

.webp)

This steady increase highlights why relying on outdated stocking strategies leads to inefficiencies. For example, demand for ready-to-cook items rises sharply during festive months, while staples peak during monsoon due to bulk buying behavior. By tracking such micro-trends continuously, retailers can adjust procurement cycles, reduce waste, and align promotions with actual consumer needs rather than assumptions.

Transforming Marketplace Data into Actionable Business Intelligence

Advanced automation has made it possible to turn large-scale data extraction into decision-ready insights. With AI-Powered Flipkart Grocery Trend Analytics, organizations can process thousands of daily price changes, stock updates, and consumer signals without manual intervention. Instead of merely collecting data, AI models classify trends—flagging early signs of demand spikes or slowdown patterns across categories.

From 2020 to 2026, Kolkata has seen a noticeable shift in category demand.

Category Demand Shift in Kolkata (2020 vs 2026)

| Category |

2020 Share |

2026 Share (Projected) |

| Staples |

42% |

34% |

| Ready-to-Eat |

18% |

26% |

| Beverages |

15% |

17% |

| Fresh Produce |

14% |

13% |

| Health Foods |

11% |

10% |

AI-based trend detection enables retailers to respond faster to these structural changes. For example, the rising share of ready-to-eat meals means faster stock turnover but also higher risk of spoilage if forecasts are inaccurate. Automated intelligence systems help brands adjust reorder points, warehouse allocation, and last-mile delivery planning—directly impacting profitability and waste reduction.

Understanding Consumer Behavior through Market-Level Intelligence

One of the biggest challenges for grocery brands is distinguishing temporary spikes from long-term shifts. Access to Kolkata Market Trend Data for Flipkart Grocery allows businesses to study how macro factors—like inflation, fuel prices, or festive seasons—affect purchasing behavior.

Between 2020 and 2026, price sensitivity in Kolkata has increased steadily.

Price Sensitivity Index (2020–2026)

.webp)

This shift means consumers are increasingly responsive to discounts and bundle offers. Retailers using market-level data can identify optimal pricing windows and prevent unsold inventory buildup after promotional cycles end. Instead of pushing blanket discounts, brands can deploy targeted markdown strategies that move stock faster while protecting margins.

Using Sales and Pricing Intelligence to Prevent Overstocking

Effective inventory management depends heavily on understanding how price fluctuations influence sales velocity. Leveraging a Flipkart Grocery sales and pricing dataset For Kolkata enables retailers to link pricing changes directly to demand response.

From 2020 to 2026, dynamic pricing strategies have become central to grocery profitability.

Price Elasticity Trends (Sample Categories)

| Category |

Avg Price Change |

Avg Sales Change |

| Cooking Oil |

-6% |

+14% |

| Packaged Snacks |

-5% |

+18% |

| Dairy |

-3% |

+9% |

| Fresh Fruits |

-4% |

+11% |

| Ready Meals |

-7% |

+21% |

These insights allow inventory planners to forecast how promotional campaigns will impact stock movement. Instead of over-ordering in anticipation of sales, teams can simulate scenarios using historical elasticity patterns—reducing the risk of surplus stock that leads to markdown losses or wastage.

Achieving Precision Forecasting with SKU-Level Intelligence

At the heart of stock-loss reduction lies granular visibility. With a Kolkata SKU-level data scraper For Flipkart Grocery, retailers can track performance down to individual products rather than broad categories.

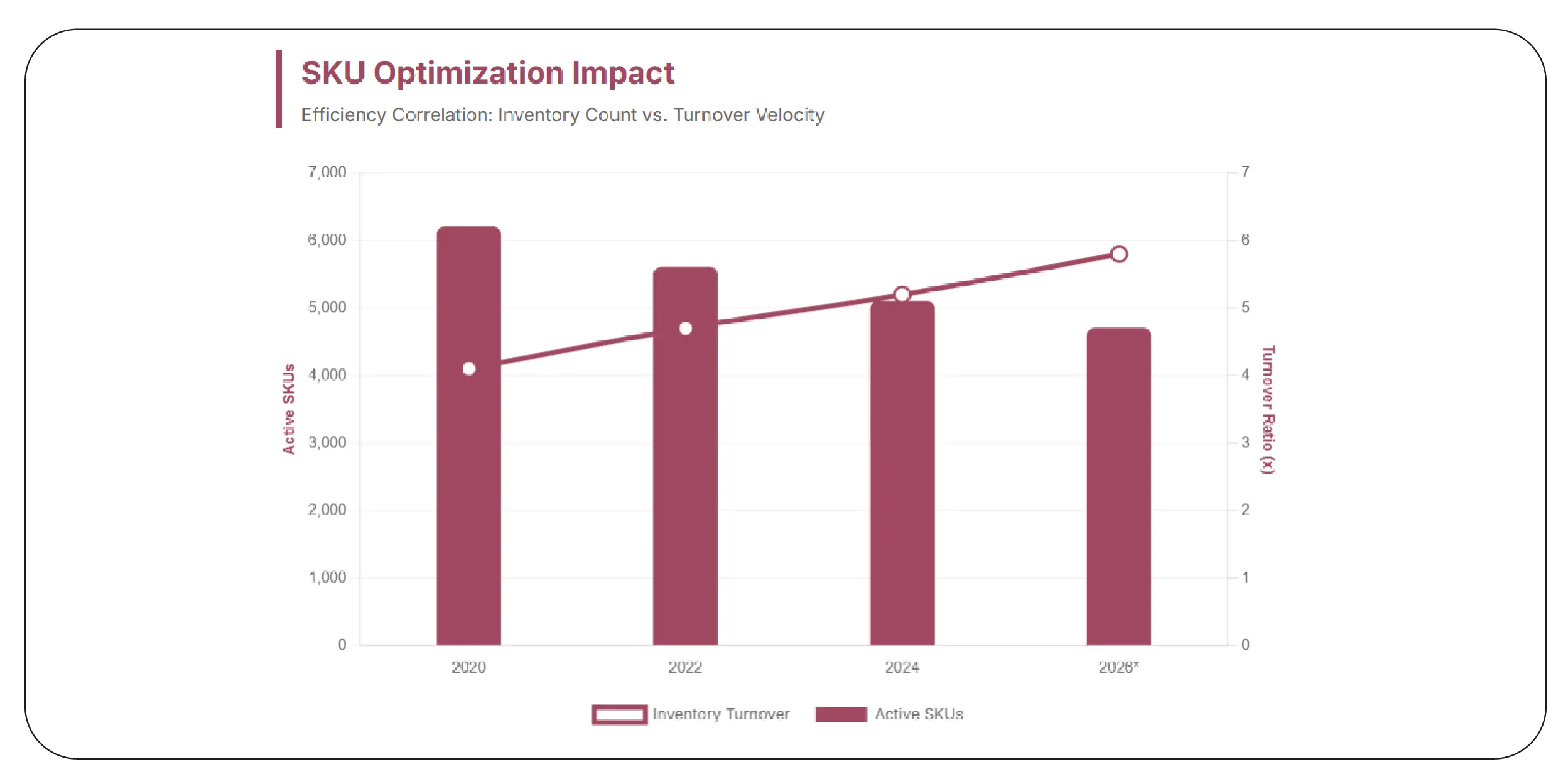

Between 2020 and 2026, SKU rationalization has become a major trend in grocery retail.

SKU Optimization Impact

By identifying underperforming SKUs early, retailers reduce shelf clutter and free up capital for high-velocity products. SKU-level scraping helps flag declining items before they become liabilities—allowing timely discontinuation or re-pricing decisions that directly lower stock write-offs.

Building a Centralized Intelligence Framework for Store Performance

For chains and aggregators, the ability to consolidate performance data across outlets is critical. Using a Flipkart Grocery Store Dataset, businesses can compare how different store clusters perform and tailor stock allocation accordingly.

From 2020 to 2026, store-level optimization has driven major efficiency gains.

Store Performance Snapshot (2026 Projection)

| Store Cluster |

Avg Monthly Orders |

Stock Loss Rate |

| North Kolkata |

18,400 |

2.1% |

| Central Kolkata |

22,900 |

1.8% |

| South Kolkata |

25,300 |

1.6% |

| New Town |

28,700 |

1.3% |

This data enables regional managers to implement location-specific stocking strategies rather than uniform policies. High-turnover zones receive faster replenishment, while slower areas adopt conservative stocking—dramatically reducing waste and carrying costs.

Why Choose Product Data Scrape?

Businesses aiming to reduce inventory losses in 2026 need more than surface-level reports—they need scalable intelligence systems. By using solutions that Scrape Flipkart Quick Prices Data, brands gain immediate visibility into pricing shifts that influence consumer buying decisions. Combined with the ability to Scrape Kolkata Grocery Trends on Flipkart Grocery, organizations can build demand-led supply chains that adapt in real time. This approach replaces reactive firefighting with proactive planning—allowing teams to optimize stock levels, reduce markdowns, and protect margins. The result is not just lower losses, but a stronger competitive edge in one of India’s fastest-evolving grocery markets.

Conclusion

The future of grocery retail in Kolkata depends on how intelligently businesses harness marketplace data. By adopting advanced scraping and analytics frameworks, companies can move from guesswork to precision—transforming how they forecast demand, manage pricing, and allocate inventory. With rising competition and shrinking margins, leveraging Extract Promotional Insights alongside Scrape Kolkata Grocery Trends on Flipkart Grocery empowers decision-makers to align stock strategies with real consumer behavior rather than outdated assumptions.

Organizations that act now will not only minimize stock losses in 2026 but also build resilient supply chains ready for the next wave of digital commerce evolution.

Start turning grocery data into your competitive advantage—partner with us today to unlock smarter inventory strategies for tomorrow.

FAQs

1. How does scraping grocery trends reduce stock losses?

Scraping reveals real-time demand and pricing shifts, enabling better forecasting and preventing overstocking that leads to expiry, markdowns, and unnecessary warehouse holding costs.

2. Is marketplace data reliable for inventory planning?

Yes, when structured correctly, marketplace data reflects live consumer behavior, helping retailers adjust stock levels faster than traditional sales-only models.

3. Can this approach support regional grocery strategies?

Absolutely. Localized data insights help brands tailor assortments and promotions based on neighborhood-level demand patterns and seasonal buying behavior.

4. How often should grocery trend data be refreshed?

Weekly refresh cycles are ideal for pricing and stock insights, while daily tracking benefits high-velocity categories like dairy, snacks, and fresh produce.

5. Does Product Data Scrape support long-term grocery analytics?

Yes, Product Data Scrape delivers scalable solutions that integrate trend tracking, forecasting, and competitive analysis for sustained inventory optimization and reduced stock losses.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)