Introduction

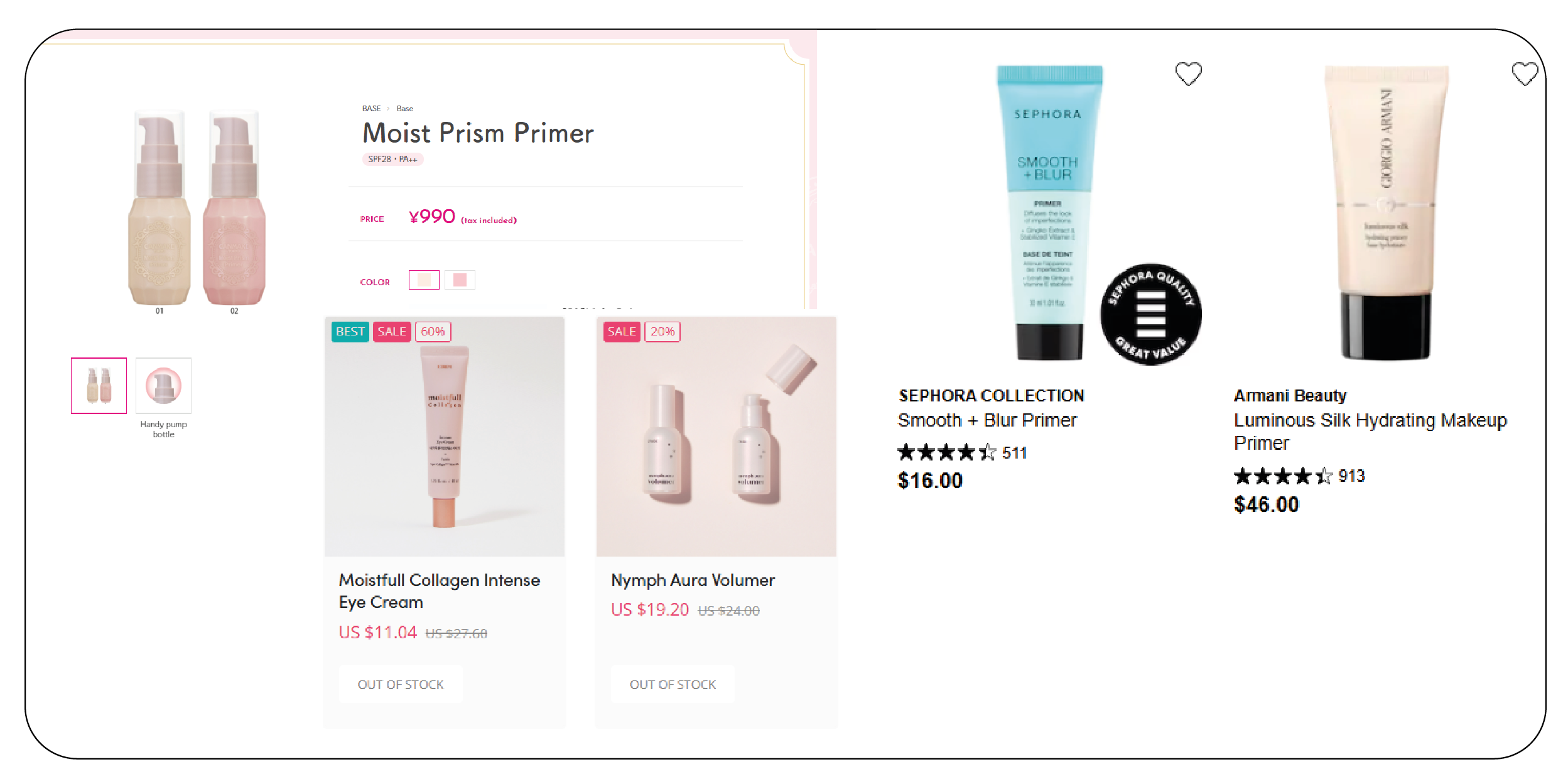

The global beauty industry thrives on cultural diversity, with K-Beauty, J-Beauty, and Western

Beauty leading the way in setting trends and consumer expectations. Each segment brings

skincare, makeup, and wellness innovation shaped by distinct philosophies, ingredients, and

aesthetic values. By Scraping K-Beauty, J-Beauty & Western Beauty Product Data, businesses can

analyze the nuances in formulations, packaging, and brand messaging. Whether it's Korea's

skincare layering, Japan's minimalist purity, or the bold innovation of Western brands, these

categories reveal evolving beauty ideals. Companies aiming to compete globally must Extract

Korean, Japanese & Western Skincare Product Data to understand customer preferences and stay

ahead of the curve. Furthermore, to gain deeper insights into global market dynamics, it's

essential to Extract US and Korean Beauty Product Information—uncovering cultural influences,

ingredient trends, and product positioning strategies that resonate with modern consumers across

different regions.

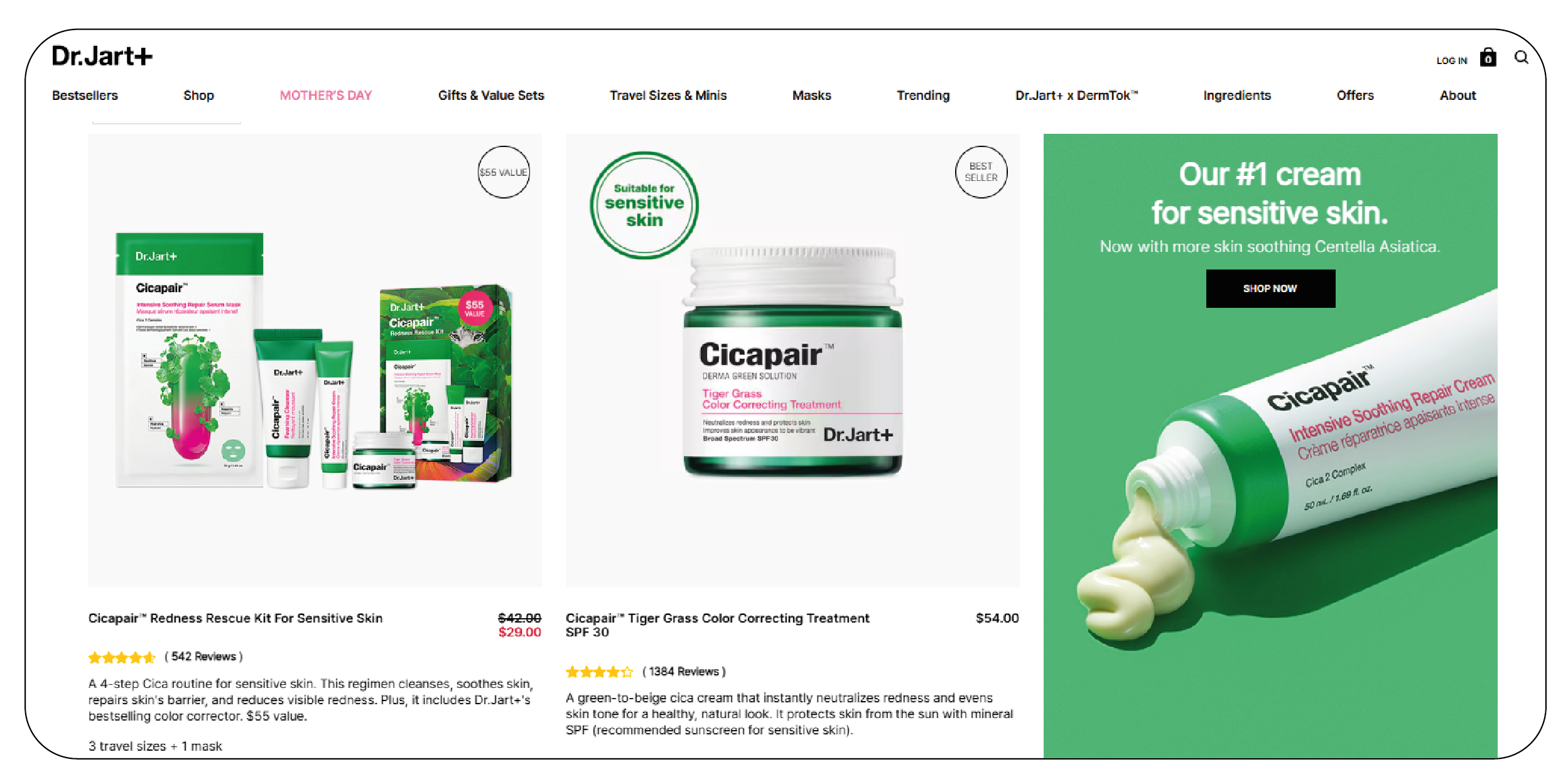

K-Beauty: The Art of Ritual and Innovation

K-Beauty has become synonymous with innovation, accessibility, and a holistic approach to

skincare. Rooted in South Korea's cultural emphasis on flawless skin as a marker of health and

beauty, K-Beauty products prioritize hydration, gentle exfoliation, and long-term skin health

over quick fixes. The iconic 10-step skincare routine—cleansing oil, foam cleanser, exfoliator,

toner, essence, serum, sheet mask, eye cream, moisturizer, and sunscreen—epitomizes this

philosophy.

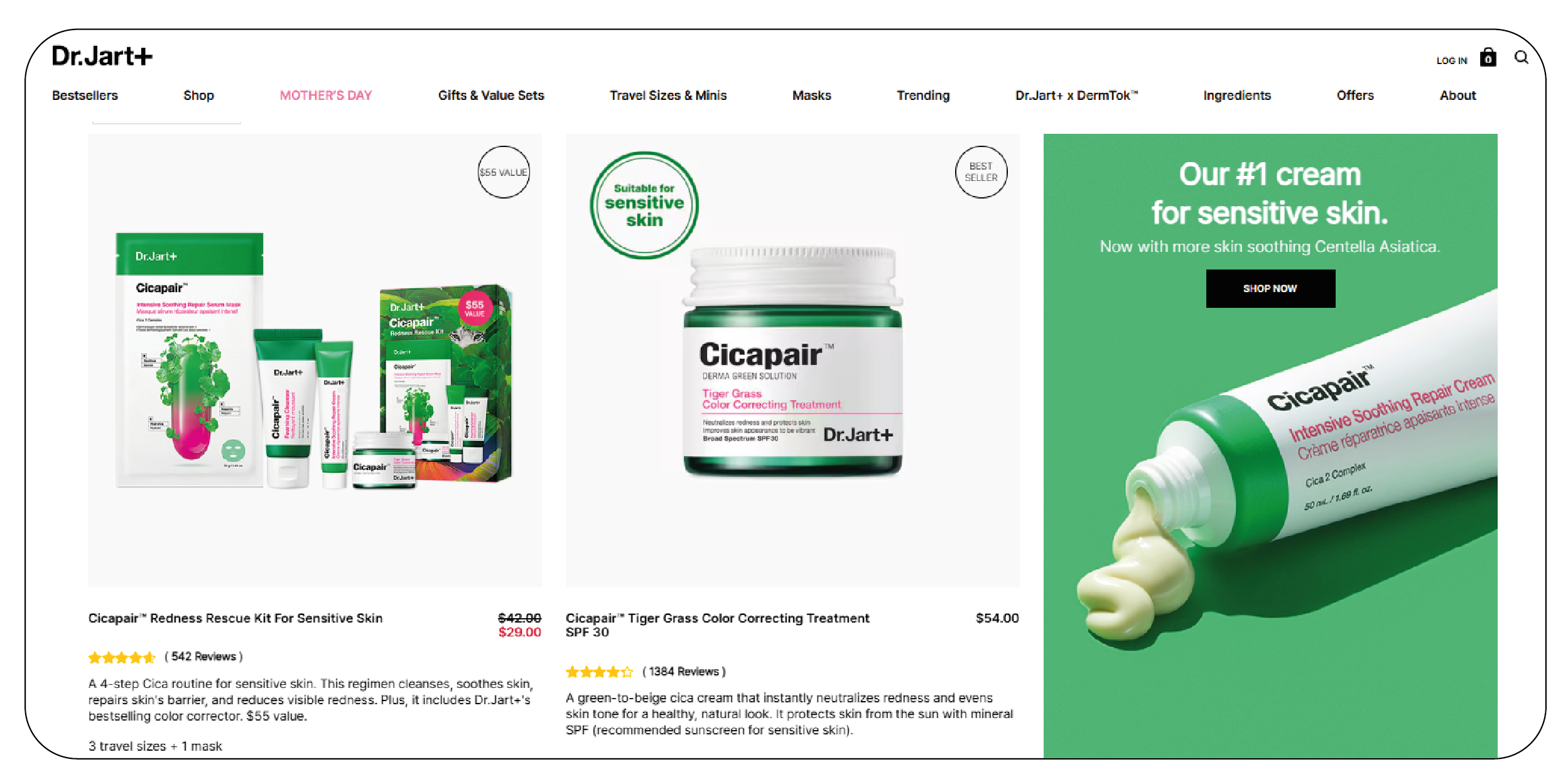

Data Scraping US and Korean Beauty Products helps analyze routine adoption, product popularity,

and global influence. K-Beauty formulations often feature novel ingredients that have captured

global attention. Snail mucin, found in products like COSRX Advanced Snail 96 Mucin Power

Essence, is prized for its hydrating and healing properties. Centella Asiatica, or circa,

dominates soothing creams like Dr. Jart+ Cicapair Tiger Grass Cream, calming irritated skin.

US & Korean Skincare Brand Data Scraping reveals how brands leverage these ingredients to build

trust and scientific credibility. Fermented ingredients, such as galactomyces in SK-II Facial

Treatment Essence, enhance absorption and efficacy. These ingredients reflect K-Beauty's blend

of tradition and cutting-edge science, often backed by rigorous research and development. Data

Scraping Korean Skincare Prices provides competitive pricing insights across mass and luxury

product lines.

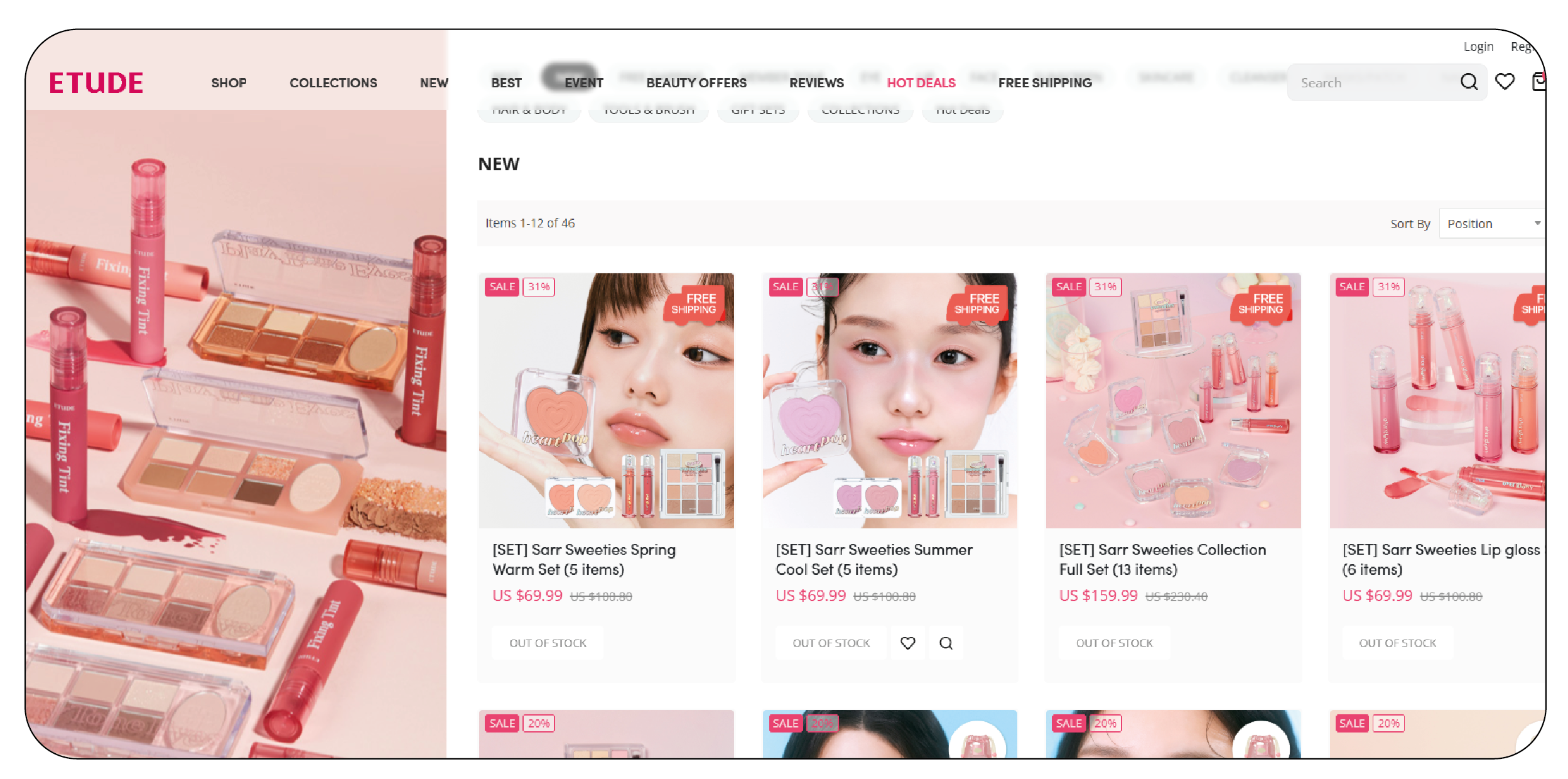

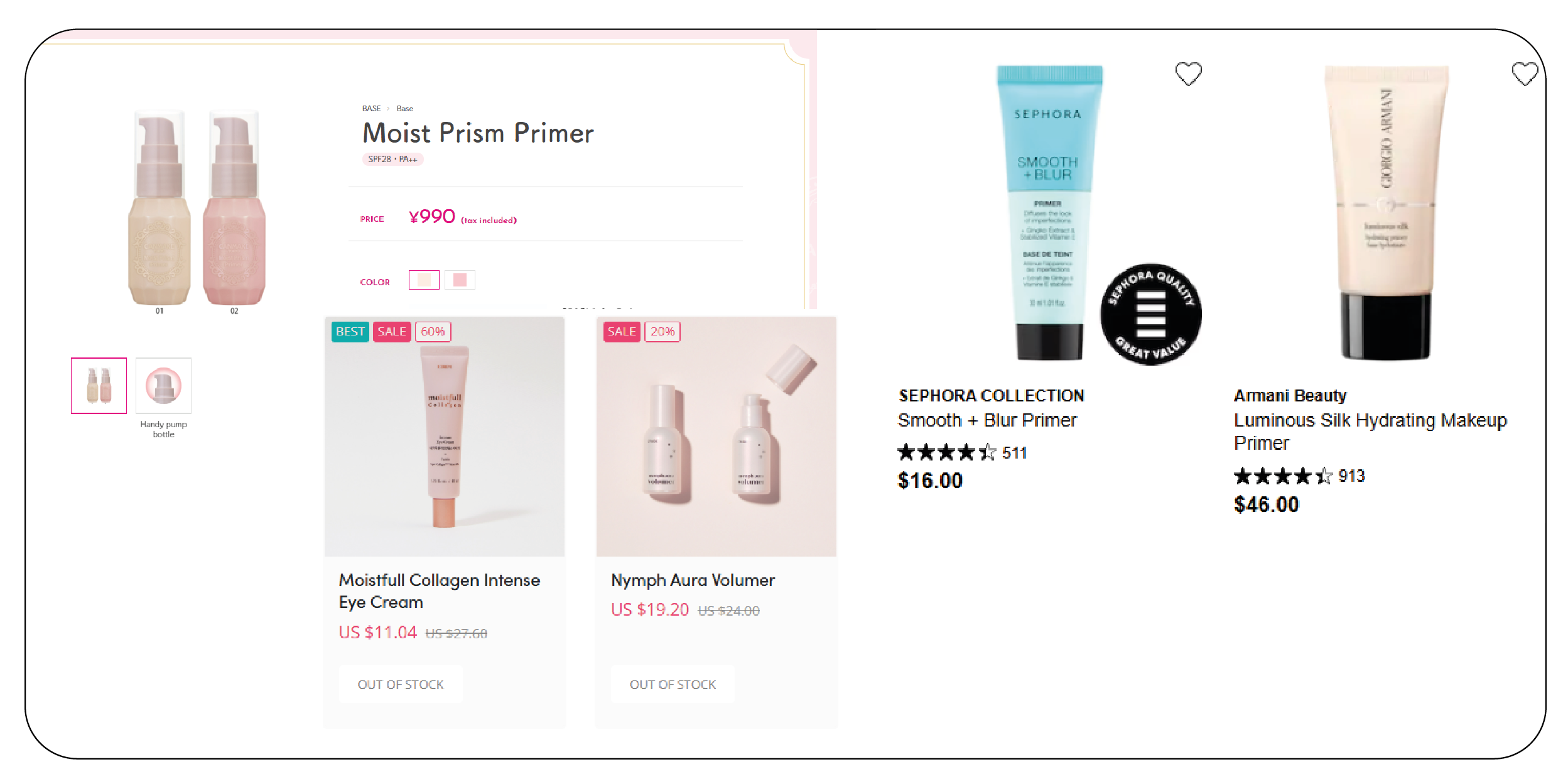

Packaging in K-Beauty is a feast for the senses. Brands like Laneige and Innisfree use pastel

hues, playful designs, and compact containers to appeal to younger demographics.

Data Scraping US and Korean Beauty Products supports packaging trend analysis and market

segmentation strategies.

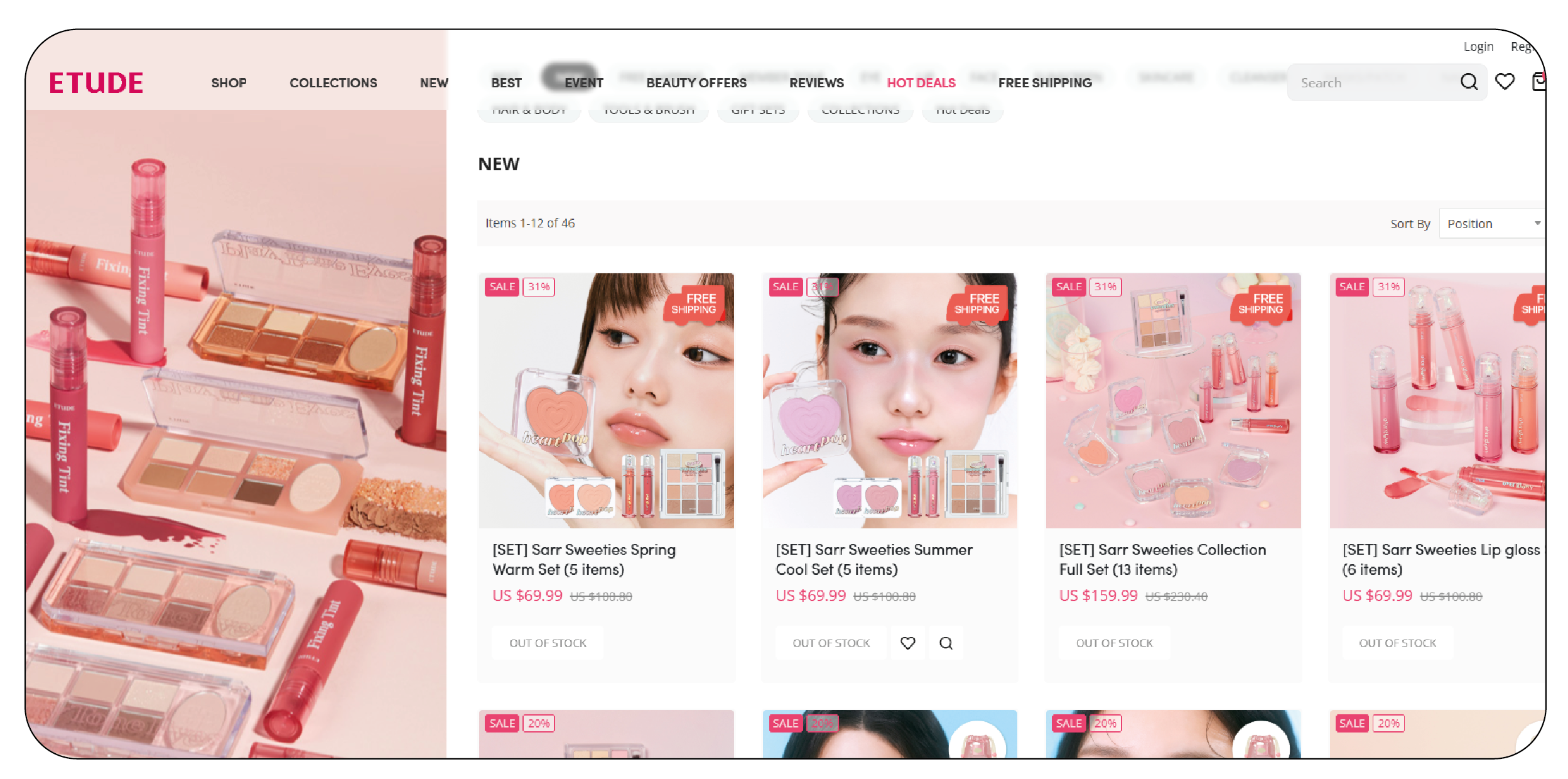

K-Beauty brands also excel at affordability without compromising quality. Etude House and The

Ordinary's Korean counterpart, The Face Shop, offer serums and masks at affordable prices.

Luxury K-Beauty, like Sulwhasoo's ginseng-infused creams, caters to premium buyers. US & Korean

Skincare Brand Data Scraping helps track how pricing tiers resonate with global consumers.

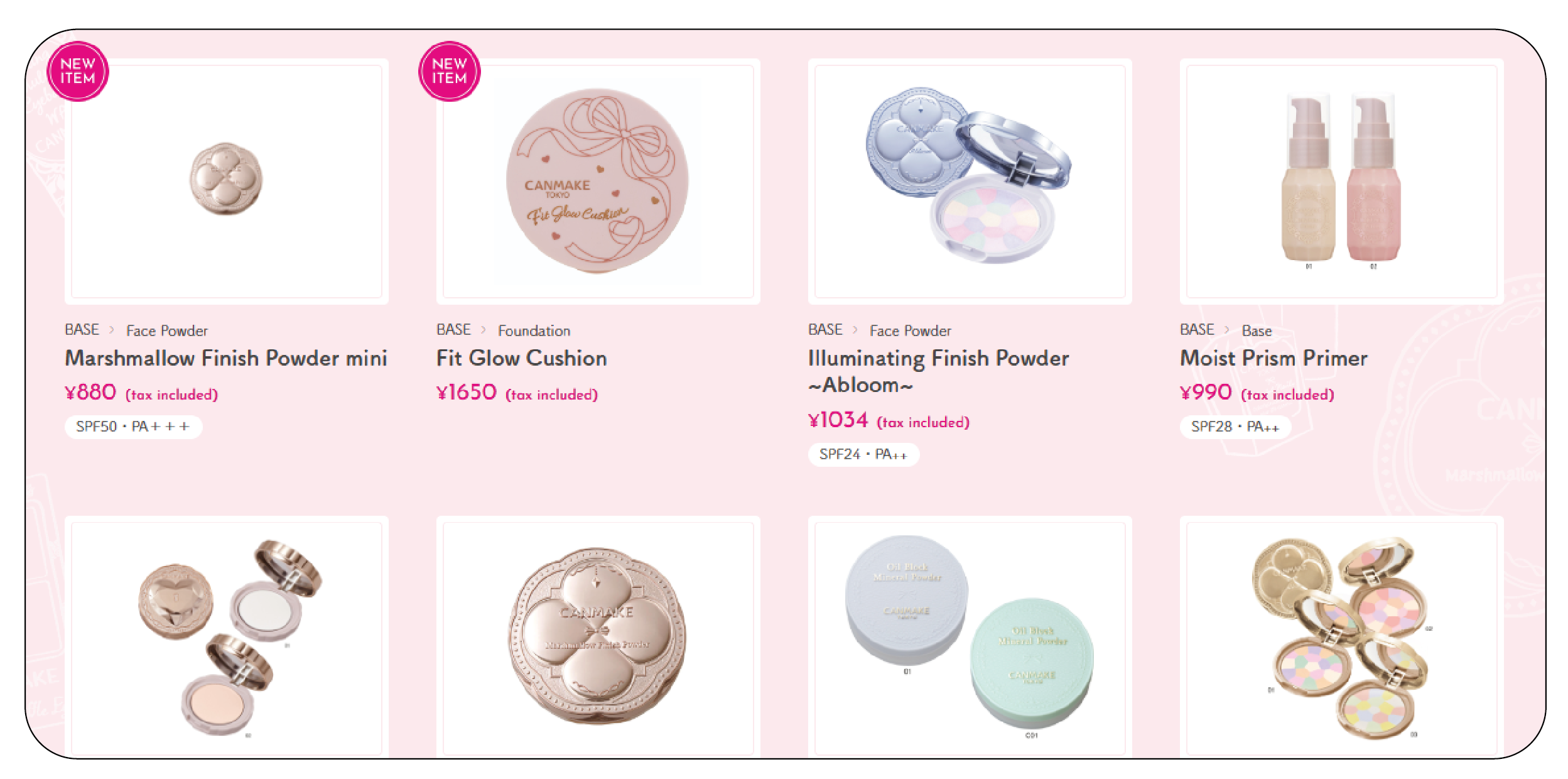

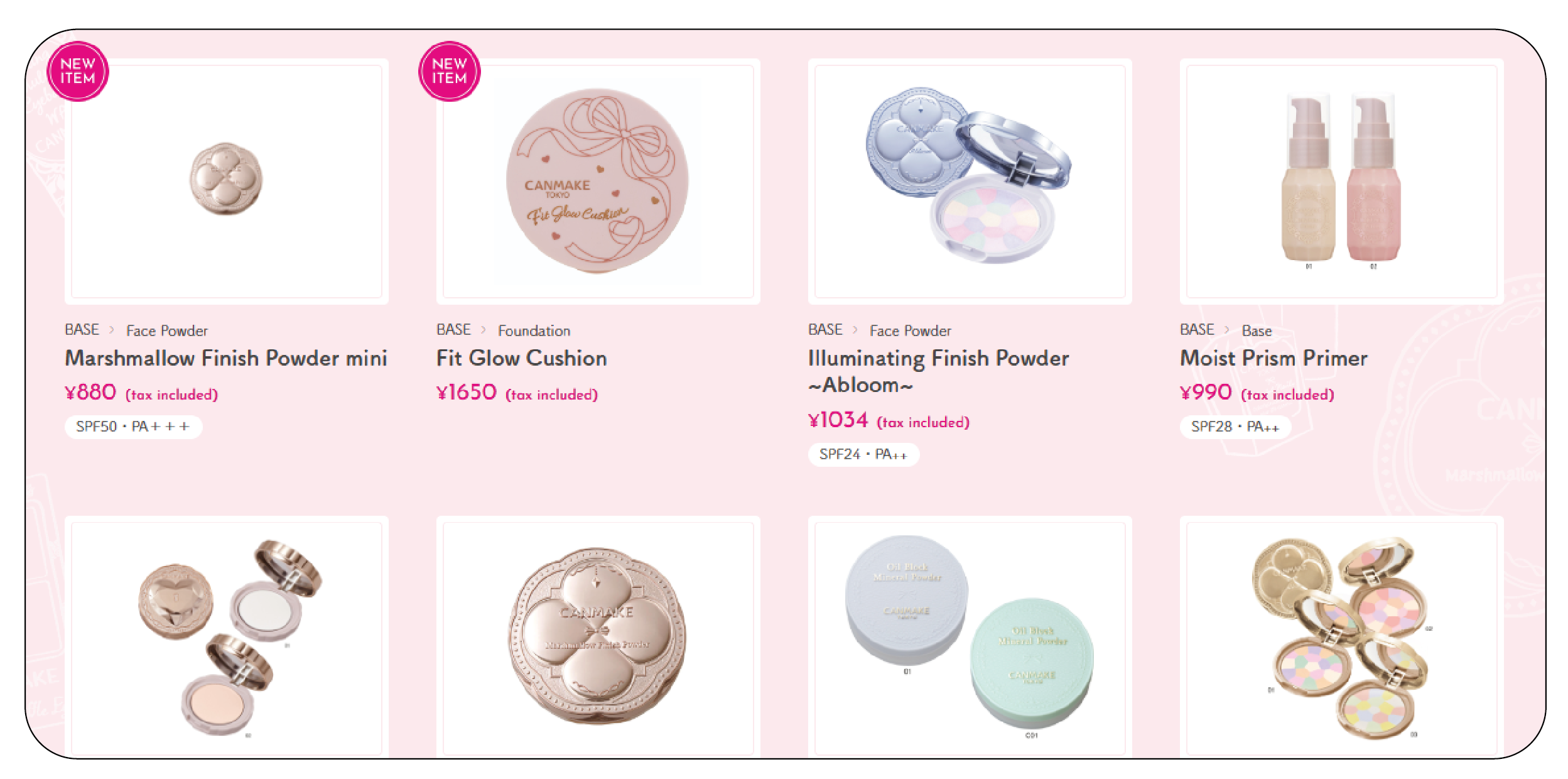

J-Beauty: Simplicity Meets Timeless Elegance

J-Beauty, Japan's contribution to the beauty world, contrasts K-Beauty's exuberance with a

minimalist, disciplined approach. Rooted in centuries-old traditions and a reverence for natural

beauty, J-Beauty emphasizes the prevention of overcorrection. The philosophy is simple:

consistent care with high-quality products preserves the skin's natural radiance. Scraping US

Makeup Products Price Data can help benchmark J-Beauty's price-performance positioning against

global counterparts.

Where K-Beauty revels in multi-step routines, J-Beauty often distills skincare to

essentials—cleanser, toner, serum, and moisturizer—focusing on efficacy over excess. J-Beauty's

ingredients are often tied to Japan's natural resources and cultural heritage. Extract Health &

Beauty Product Data to compare ingredient sourcing, formulation types, and claims across

different regions.

Green tea, rice bran, and yuzu are hero ingredients that reflect purity, tradition, and

performance. J-Beauty pioneered cleansing oils like Shu Uemura's Ultime8, emphasizing deep

cleansing without damage.

Web Scraping Health & Beauty Websites support tracking unique

innovations, helping businesses monitor evolving product formulations and consumer sentiment.

J-Beauty packaging leans toward elegant simplicity—sleek frosted glass, clean lines, and

minimalist branding. This understated luxury reflects the Japanese aesthetic of wabi-sabi, which

values beauty in imperfection. Scraping US makeup products Price Data reveals how J-Beauty's

luxury appeal compares to premium Western alternatives.

J-Beauty appeals to value-conscious and discerning consumers, with prices ranging from

budget-friendly to luxury. Products from brands like Kose, Kanebo, and Pola cater to both

spectrums with an equal commitment to quality.

Extract Health & Beauty Product Data to

map this diverse product range and understand market

gaps for new entrants.

Western Beauty: Diversity and Bold Expression

Western Beauty, encompassing products primarily from North America and Europe, is a broad

category defined by diversity, bold innovation, and inclusivity. Unlike the ritualistic focus of

K-Beauty or the minimalist precision of J-Beauty, Western Beauty celebrates individuality and

versatility. Skincare and makeup here cater to a wide range of skin types, tones, and concerns,

reflecting the region's multicultural consumer base.

Western skincare often emphasizes targeted solutions. Retinol, a gold-standard anti-aging

ingredient, dominates serums like The Ordinary's Retinol 1% in Squalane and SkinCeuticals

Retinol 0.5. Vitamin C, for brightening, appears in CeraVe's Skin Renewing Vitamin C Serum.

Hyaluronic acid, a hydrating powerhouse, is ubiquitous across brands like Neutrogena and La

Roche-Posay. These ingredients are formulated for maximum potency, often with clinical studies

to back their claims, appealing to consumers who prioritize visible results.

Makeup is where Western Beauty truly shines. Brands like Fenty Beauty and Charlotte Tilbury

offer foundations in 40+ shades, catering to diverse skin tones. Bold lipsticks from MAC and

highlighters from Becca encourage self-expression, while Glossier's "no-makeup makeup" trend

taps into the desire for an effortless glow. Western brands also lead in clean beauty, with

lines like Ilia and Drunk Elephant avoiding controversial ingredients like parabens and

sulfates, aligning with growing consumer demand for transparency.

Western Beauty's packaging is as varied as its products. High-end brands like Estée Lauder use

weighty glass jars to convey luxury, while indie brands like Herbivore favor recyclable,

Instagram-friendly amber bottles. Drugstore giants like L'Oréal and Maybelline opt for

practical, colorful designs that pop on shelves. This diversity reflects Western Beauty's

adaptability to different markets and aesthetics.

Pricing spans a vast spectrum. Drugstore staples like Cetaphil cleansers cost under $10, while

luxury creams from Crème de la Mer can exceed $300. Mid-range brands like Paula's Choice and

Sunday Riley offer professional-grade products at accessible prices, bridging the gap. Western

Beauty's inclusivity extends to its price points, ensuring something for every budget.

Comparing the Three: Philosophy, Trends, and Appeal

While K-Beauty, J-Beauty, and Western Beauty each have distinct identities, they share a

commitment to innovation and consumer satisfaction. K-Beauty's strength lies in its playful,

trend-setting approach—think cushion compacts and lip tints that double as blush. Its multi-step

routines appeal to those who view skincare as self-care, though the time commitment can

overwhelm busy consumers. J-Beauty, by contrast, offers a streamlined alternative, attracting

those who value efficiency and heritage. Its focus on prevention suits mature skin or minimalist

lifestyles but may feel too restrained for trend-chasers.

Western Beauty's greatest asset is its inclusivity. By addressing diverse skin concerns and

offering bold makeup options, it resonates with a global audience. However, its emphasis on

quick results can sometimes overshadow long-term skin health, a cornerstone of both K- and

J-Beauty. Ingredient-wise, all three overlap—hyaluronic acid and niacinamide are universal

favorites—but their applications differ. K-Beauty layers them for hydration, J-Beauty uses them

for balance, and Western Beauty targets specific issues.

The packaging reflects cultural priorities: K-Beauty's whimsy, J-Beauty's elegance, and Western

Beauty's versatility. Price points also vary, with K-Beauty leaning toward affordability,

J-Beauty balancing budget and luxury, and Western Beauty spanning both extremes. Trends show

cross-pollination—Western brands like Glow Recipe adopt K-Beauty's glass-skin aesthetic, while

Japanese brands like Shiseido incorporate Western-style serums. K-Beauty, meanwhile, borrows

Western inclusivity by expanding shade ranges in BB creams.

The Future of Global Beauty

As global beauty markets merge, K-Beauty, J-Beauty, and Western Beauty increasingly influence

each other. K-Beauty's innovative formulations inspire Western brands to explore new textures

like gel creams, while J-Beauty's emphasis on purity and quality contributes to the clean beauty

movement. Western Beauty's inclusive approach pushes Asian brands to expand shade ranges and

cater to diverse consumers. Sustainability is a shared focus, with all three regions adopting

eco-conscious practices such as refillable packaging and natural ingredients. Businesses seeking

to understand these shifts can Scrape Cosmetic & Beauty Product Data to uncover trends, product

evolutions, and consumer preferences shaping the future of skincare and makeup.

How Product Data Scrape Can Help You?

-

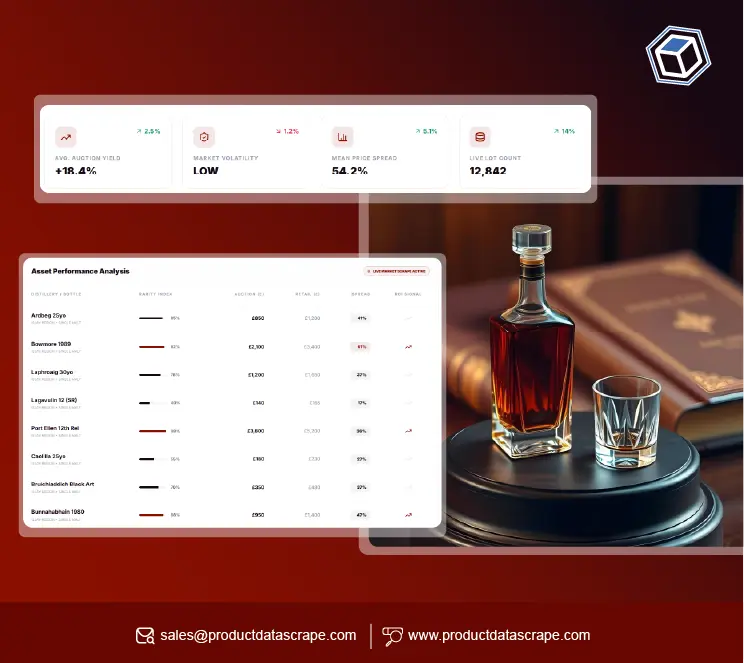

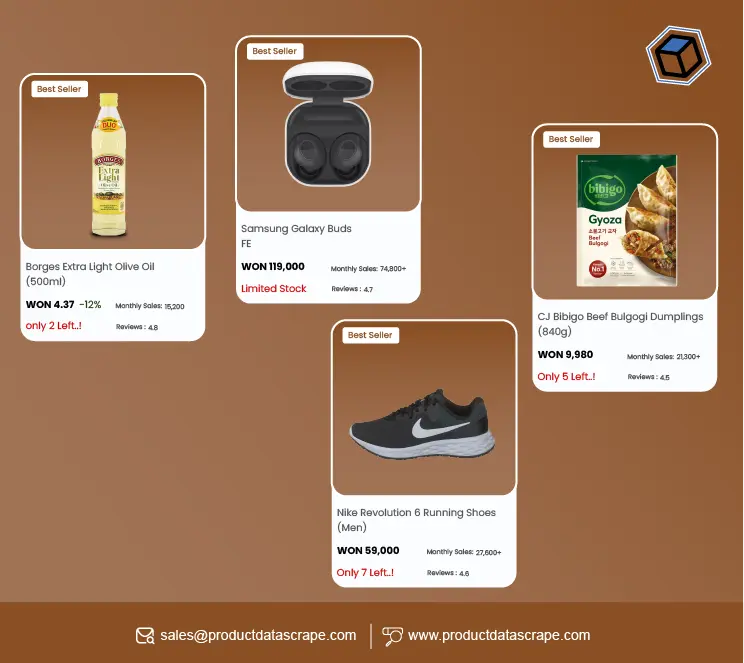

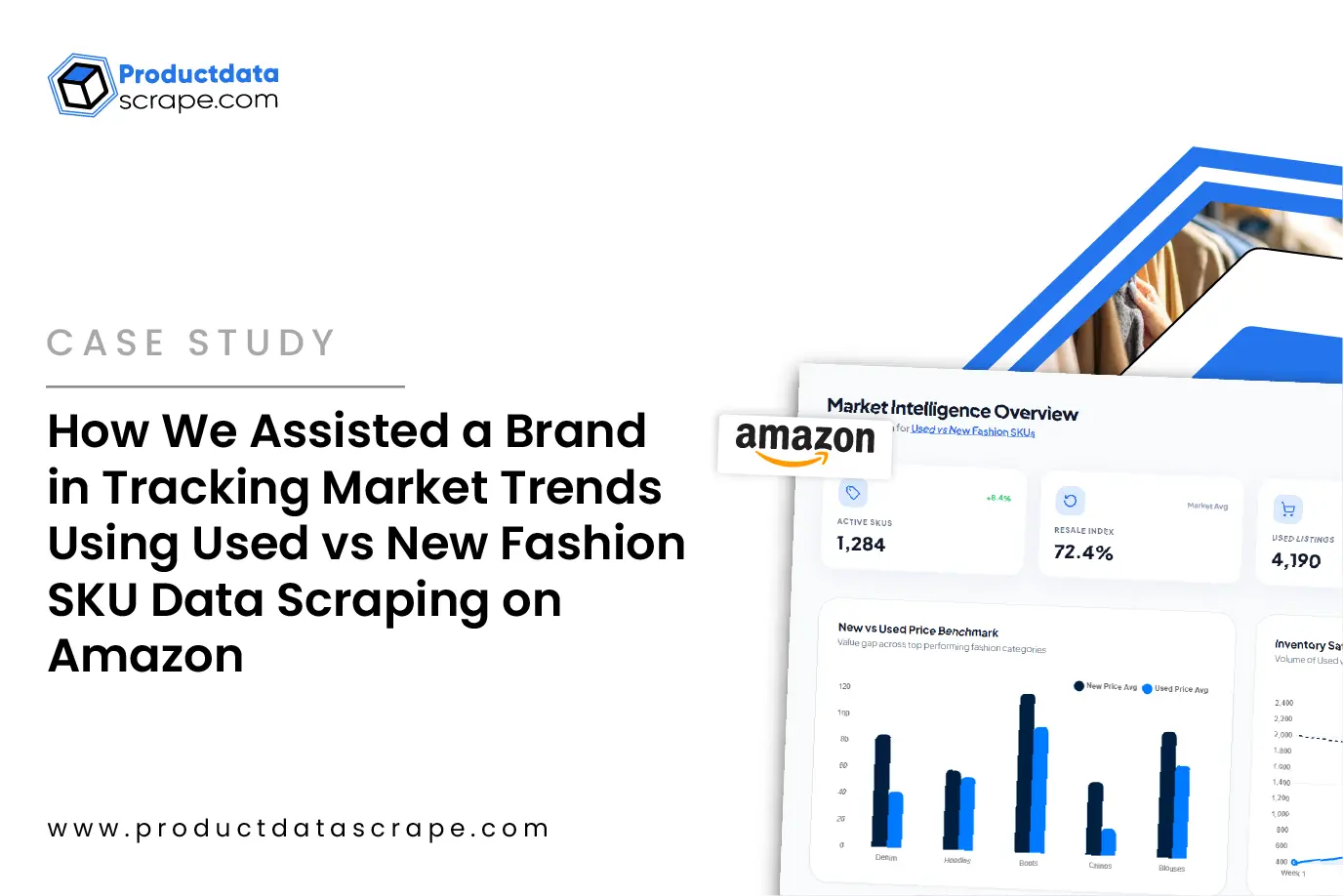

Discover Emerging Product Trends: We track real-time listings, top-selling

items, and trending keywords

across e-commerce platforms to help you uncover what's gaining traction before your

competitors do.

-

Map Competitive Brand Positioning: We help you evaluate your competitors'

market positioning by analyzing

seller listings, product placements, sponsored ads, and customer feedback.

-

Optimize Dynamic Pricing Strategies: Our scraping services monitor price

fluctuations across multiple vendors,

allowing you to adjust pricing strategies dynamically based on current market conditions.

-

Collect Marketplace Performance Metrics: We extract seller ratings,

shipping times, delivery options, and return

policies to give you deeper insights into the performance and reliability of different

marketplace players.

-

Geo-Targeted Product Data Extraction: Do you need location-specific data?

We can scrape region-wise product

availability, local promotions, and delivery constraints tailored to different markets or

pin codes.

Conclusion:

K-Beauty, J-Beauty, and Western Beauty each bring something extraordinary to the global stage,

reflecting the values and aspirations of their respective cultures. Extract Health and Beauty

Data from these diverse markets offers insights into what drives their enduring appeal. K-Beauty

invites us to embrace skincare as a joyful ritual, blending affordability with cutting-edge

ingredients. J-Beauty teaches us the power of simplicity, offering timeless elegance through

disciplined routines and heritage-inspired formulations.

Beauty & Personal Care Data Scraping enables businesses to analyze packaging styles, product

popularity, and evolving preferences across these regions. Western Beauty champions inclusivity

and bold expression, catering to every skin tone and lifestyle with unmatched versatility.

Together, they form a dynamic ecosystem where innovation, tradition, and individuality coexist.

As these worlds continue to intersect, Extract Cosmetics Pricing Data to uncover trends in

affordability, luxury, and product accessibility. Consumers are empowered to curate routines

that transcend borders—blending playful hydration, refined balance, and vibrant

confidence—turning beauty into a celebration of choice, culture, and connection.

At Product Data Scrape, we strongly emphasize ethical practices across

all our services,

including Competitor Price Monitoring and Mobile

App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.

.webp)