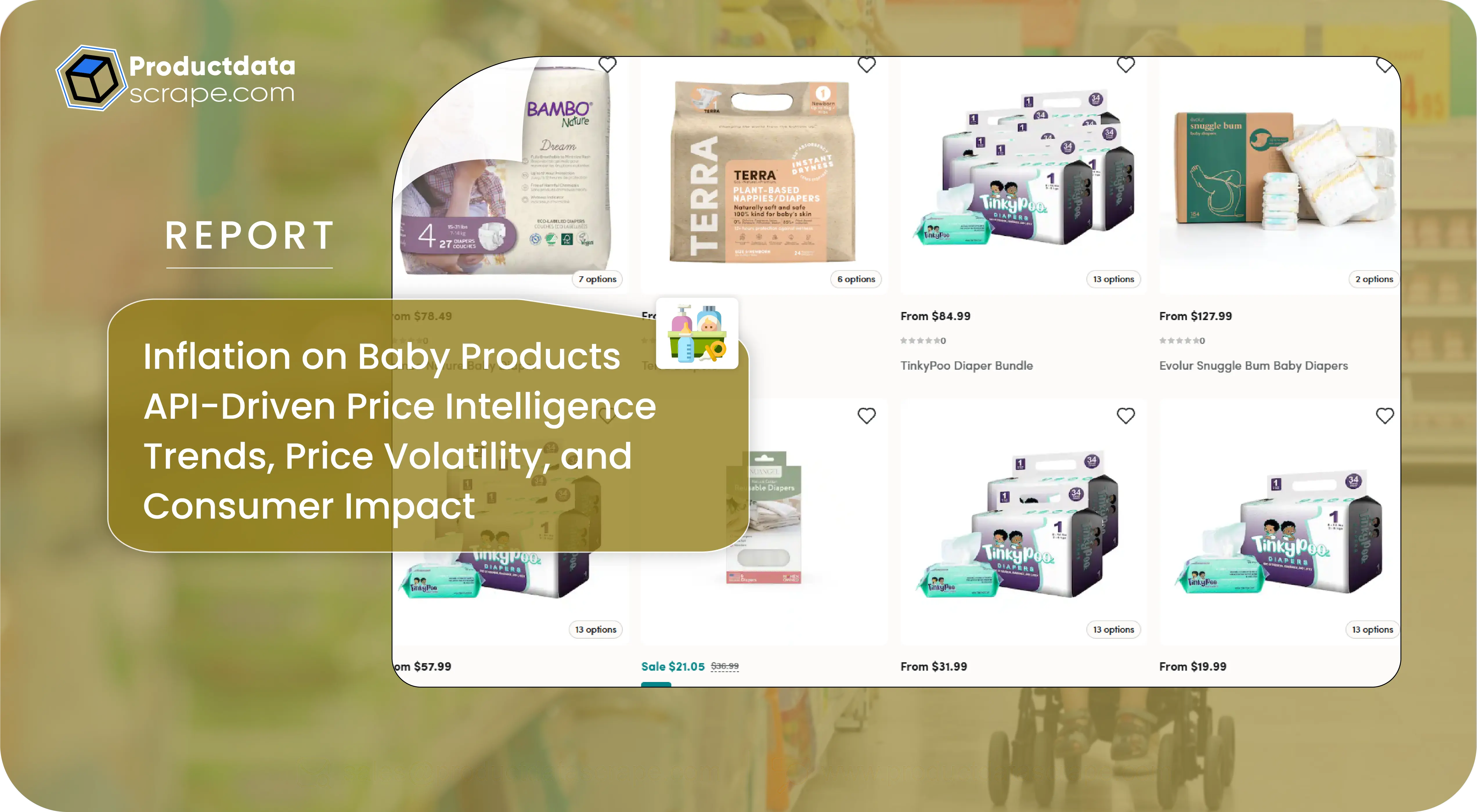

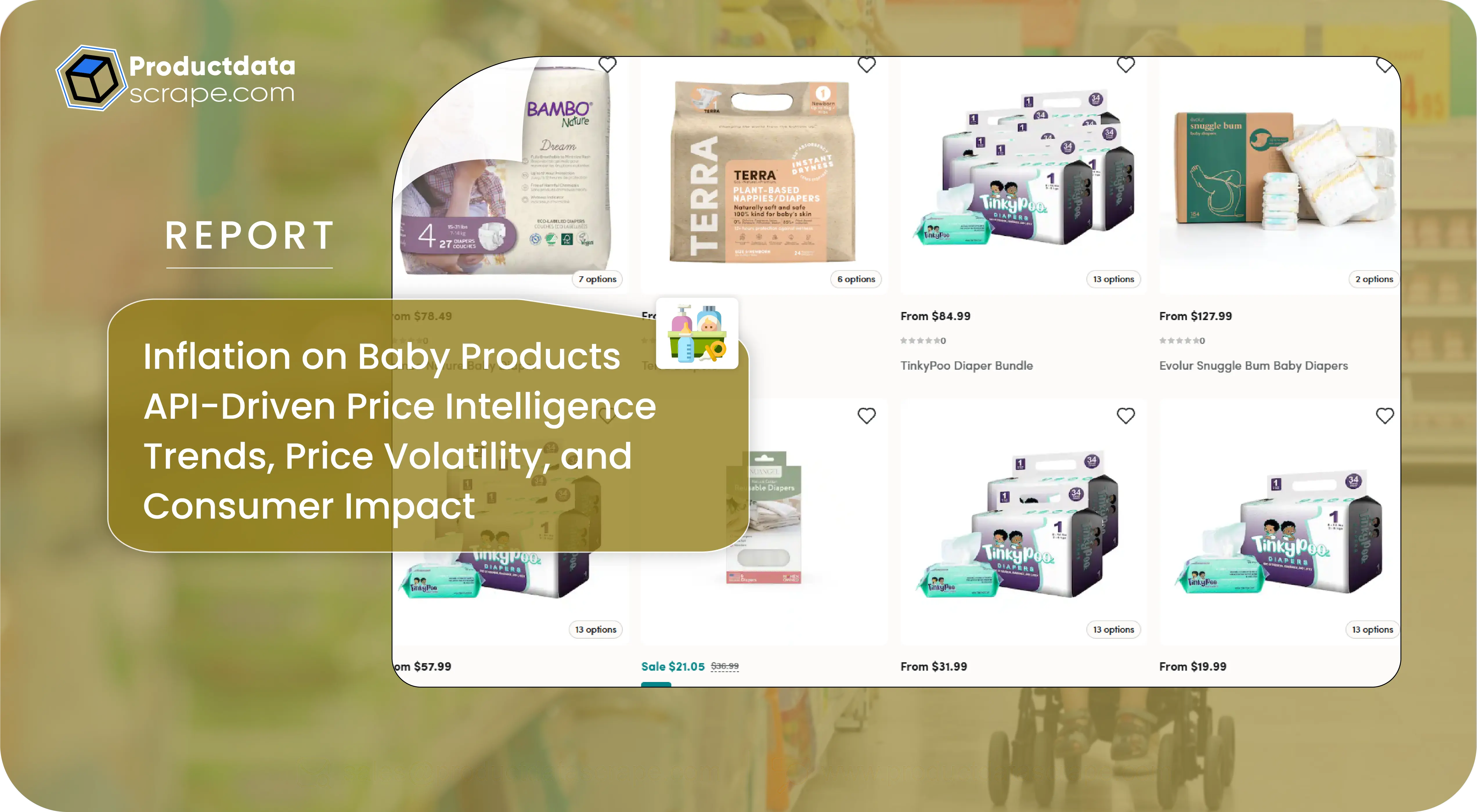

Introduction - Inflation Impact on Baby Products – An API-Driven Price Intelligence Study

Rising inflation over the last few years has significantly reshaped consumer spending, especially in essential categories like baby products. From diapers and infant formula to skincare and feeding accessories, parents are facing sustained price increases driven by raw material costs, logistics disruptions, and changing retail dynamics. Brands and retailers now need near-real-time visibility into pricing trends to stay competitive and responsive. This is where Inflation on Baby Products - API-Driven Price Intelligence becomes critical, enabling businesses to move from reactive pricing to proactive decision-making. By combining large-scale data extraction with advanced Pricing Strategies, organizations can understand inflationary patterns, benchmark against competitors, and protect both margins and customer trust in a highly sensitive market.

Understanding Cost Movements in Essential Infant Categories

To analyze inflation accurately, businesses require structured, high-frequency data across multiple

retail channels. A Baby Products Price Intelligence API powered by a reliable eCommerce Dataset helps

consolidate prices from marketplaces, D2C websites, and regional retailers into a single analytical layer.

This unified view allows companies to detect subtle price movements that may otherwise go unnoticed.

Between 2020 and 2026, inflation in baby essentials has not followed a linear path. Pandemic-era supply

shocks caused sharp spikes, followed by short periods of stabilization and renewed increases due to fuel

and packaging costs.

Average Price Index for Baby Essentials (2020–2026)

.webp)

Such data enables brands to correlate cost increases with external factors and plan pricing adjustments

without alienating price-sensitive parents.

Capturing Real-Time Retail Shifts During Inflationary Pressure

During periods of inflation, prices can change weekly—or even daily—across online platforms.

Web Scraping Baby Product Prices During Inflation provides granular visibility into these fluctuations

by continuously collecting live pricing, discounts, and pack-size variations. This approach is especially

valuable when retailers quietly adjust prices without public announcements.

From 2020 onward, scraped data shows that promotional frequency declined while base prices increased,

signaling a shift in retailer strategy to preserve margins. Parents responded by switching brands or

buying in bulk, creating further volatility.

Observed Online Price Change Frequency (2020–2026)

| Year |

Avg. Monthly Price Changes |

| 2020 |

1.2 |

| 2021 |

1.8 |

| 2022 |

2.6 |

| 2023 |

3.1 |

| 2024 |

3.4 |

| 2025 |

3.8 |

| 2026 |

4.0 |

By analyzing these patterns, companies can predict competitor moves and time their own price revisions more strategically.

Long-Term Visibility into Infant Care Cost Trends

While short-term price shifts matter, long-term trend analysis is equally important.

A Baby Care Products Price Tracking API allows businesses to monitor historical pricing

alongside volume and availability signals. This helps distinguish temporary inflationary

spikes from structural cost increases.

From 2020 to 2026, baby care products experienced an average cumulative price increase

of over 40%, with nutrition products rising faster than accessories. Brands that tracked

these trends early were able to reformulate products, renegotiate supplier contracts,

or introduce value packs.

Cumulative Inflation by Product Type (2020–2026)

.webp)

Such insights support data-driven planning and reduce the risk of sudden margin erosion.

Monitoring Inflation Signals Across Channels

Effective Baby Products Inflation Price Monitoring goes beyond price tags. It involves tracking

stock levels, regional variations, and retailer-specific markups. Inflation does not impact all

geographies equally; urban areas often see faster price hikes than smaller towns.

Between 2022 and 2026, monitoring data revealed widening regional price gaps, driven by logistics

and local demand patterns. Businesses that accounted for these differences optimized regional

pricing rather than applying blanket increases.

Regional Price Variance Index (2020–2026)

| Year |

Metro Areas |

Non-Metro Areas |

| 2020 |

100 |

100 |

| 2022 |

120 |

112 |

| 2024 |

135 |

122 |

| 2026 |

150 |

130 |

This level of monitoring ensures pricing decisions remain fair, competitive, and aligned with

consumer purchasing power.

Structuring Large-Scale Pricing Intelligence Pipelines

Inflation analysis requires clean, standardized data at scale. A Baby Products Pricing Data Extraction API

automates the collection of prices, SKUs, pack sizes, and promotional details from thousands of sources.

This reduces manual effort and ensures consistency across datasets.

From 2020 to 2026, brands using automated extraction were better positioned to react quickly to cost shocks,

as they could run scenario analyses within hours instead of weeks.

Data Coverage Growth Using APIs (2020–2026)

.webp)

Such scalable pipelines form the backbone of modern price intelligence systems.

Turning Raw Pricing Data into Strategic Insights

Raw data alone does not create value; actionable insight does. Baby Care Market Price Analytics

combines pricing, inflation indicators, and consumer behavior to guide smarter decisions.

Analytics models can forecast demand elasticity, identify price thresholds, and recommend

optimal pack configurations.

Between 2020 and 2026, analytics-driven brands were more likely to retain customers despite

higher prices by aligning increases with perceived value.

Impact of Analytics on Pricing Outcomes

| Metric |

With Analytics |

Without Analytics |

| Margin Stability |

High |

Volatile |

| Customer Retention |

85% |

68% |

| Price Adjustment Speed |

Fast |

Slow |

This demonstrates how analytics transforms inflation from a threat into a manageable variable.

Why Choose Product Data Scrape?

At Product Data Scrape, we specialize in delivering accurate, scalable, and real-time pricing intelligence tailored for inflation-sensitive markets like baby care. Our data solutions are built to handle high-volume product catalogs, frequent price changes, and multi-channel retail environments. With advanced automation, robust APIs, and quality validation frameworks, we ensure clean and reliable datasets you can trust. Our expertise helps brands uncover hidden pricing patterns, track competitors efficiently, and respond faster to market changes. Backed by domain experience and flexible delivery models, we enable smarter, faster, and more confident pricing decisions.

Conclusion

Inflation will continue to influence baby product pricing, consumer behavior, and competitive dynamics in the coming years. Businesses that rely on manual tracking or delayed insights risk losing both margins and customer loyalty. By adopting API-driven price intelligence, organizations gain real-time visibility, historical context, and predictive insights needed to act strategically. From monitoring inflation trends to optimizing pricing decisions, data becomes a powerful advantage. Partnering with Product Data Scrape ensures you stay informed, agile, and competitive in a constantly evolving market. Get in touch with Product Data Scrape today to future-proof your pricing strategy with data-driven intelligence!

.webp)

.webp)

.webp)

.webp)