Introduction

Walmart remains one of the largest and most influential retail chains in the United States, operating thousands of stores across various states. Understanding the total number of Walmart stores in 2025 is essential for multiple stakeholders, including investors, market analysts, logistics providers, and competitors. By tracking Walmart's store count, businesses can gain insights into the company's expansion strategies, market penetration, and the overall landscape of the retail industry.

With the rising demand for real-time data, leveraging advanced web scraping techniques can help extract accurate and up-to-date information on Walmart's store locations, types, and distribution patterns. This study explores how to scrape Walmart store location data in the USA in 2025 to gain valuable insights into Walmart's retail footprint. By using real-time Walmart store data extraction techniques in the USA in 2025, businesses can analyze store openings, closures, and geographic trends.

This research report focuses on methods to extract real-time Walmart store data in the USA in 2025 to determine Walmart's store presence and evolution. The study includes a comparative analysis of past store counts, offering key insights into Walmart's growth trajectory, regional dominance, and shifting retail strategies. By utilizing real-time data extraction, businesses can make informed decisions about supply chain logistics, competitor analysis, and investment strategies in the retail sector.

Methodology

To gather precise data on the number of Walmart stores in 2025, the research employed the following methods:

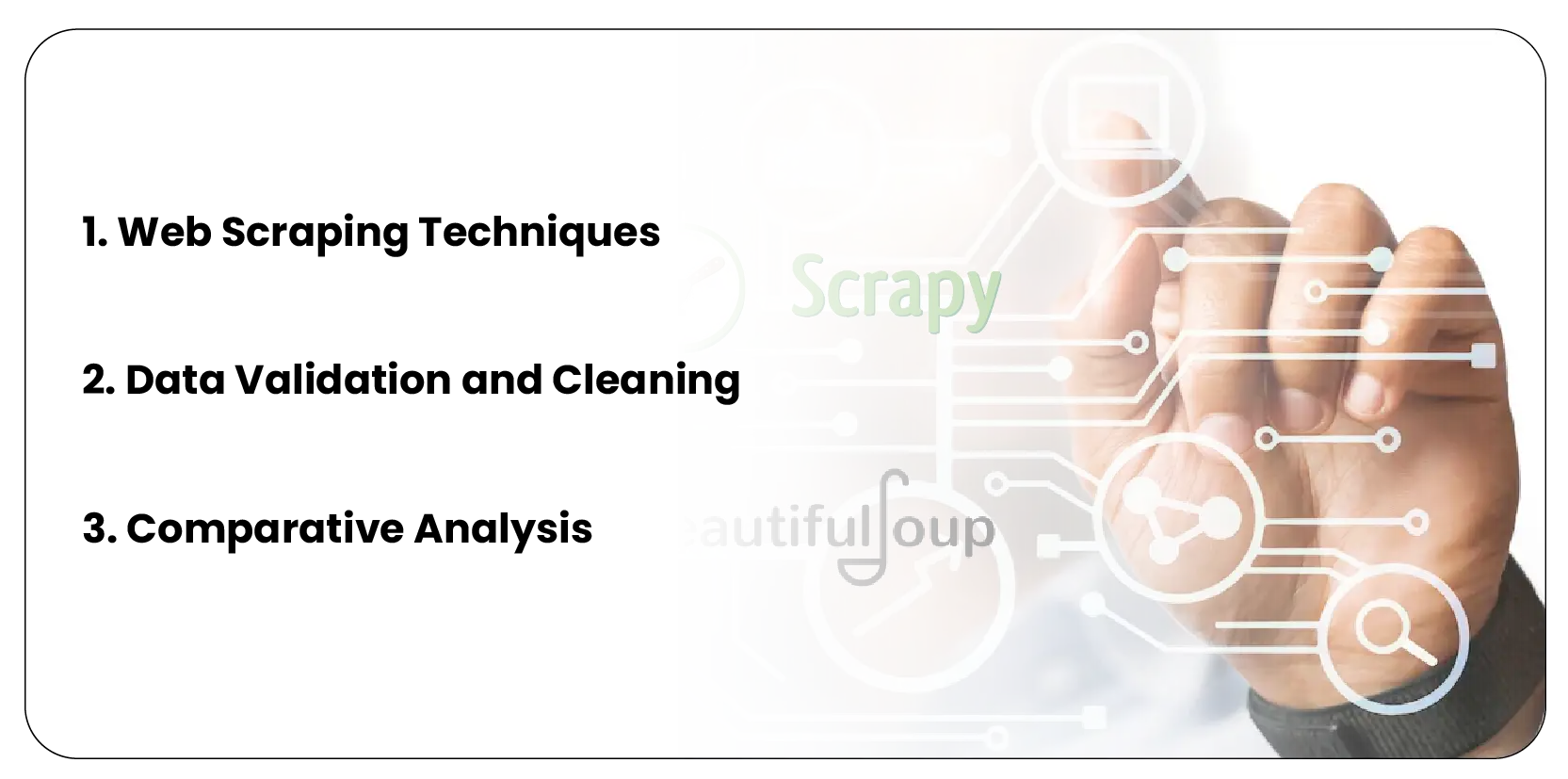

1. Web Scraping Techniques

- Data was extracted from Walmart's official store locator, third-party retail databases, and business directories.

- Python-based scraping tools such as BeautifulSoup and Scrapy were used to automate data collection.

- API integration with Walmart's public data sources (if available) was explored.

2. Data Validation and Cleaning

- The scraped data was cross-referenced with Walmart's quarterly and annual reports.

- Duplicates and outdated entries were removed to ensure accuracy.

- Manual validation was performed for random samples to confirm data reliability.

3. Comparative Analysis

- The number of stores in 2025 was compared with previous years (2024 and 2023).

- Changes in store openings and closures were analyzed state-wise and nationally.

- Economic conditions, e-commerce competition, and consumer trends were considered.

Key Analysis of the Number of Walmart Stores in 2025

The extracted data highlights Walmart's continued dominance in the U.S. retail market, maintaining a substantial presence with a steady number of stores nationwide. The availability of real-time data allows businesses and analysts to assess Walmart's market penetration and operational strategies effectively. By utilizing web scraping Walmart store locations data in the USA in 2025, stakeholders can comprehensively understand Walmart's store distribution and its impact on the retail sector.

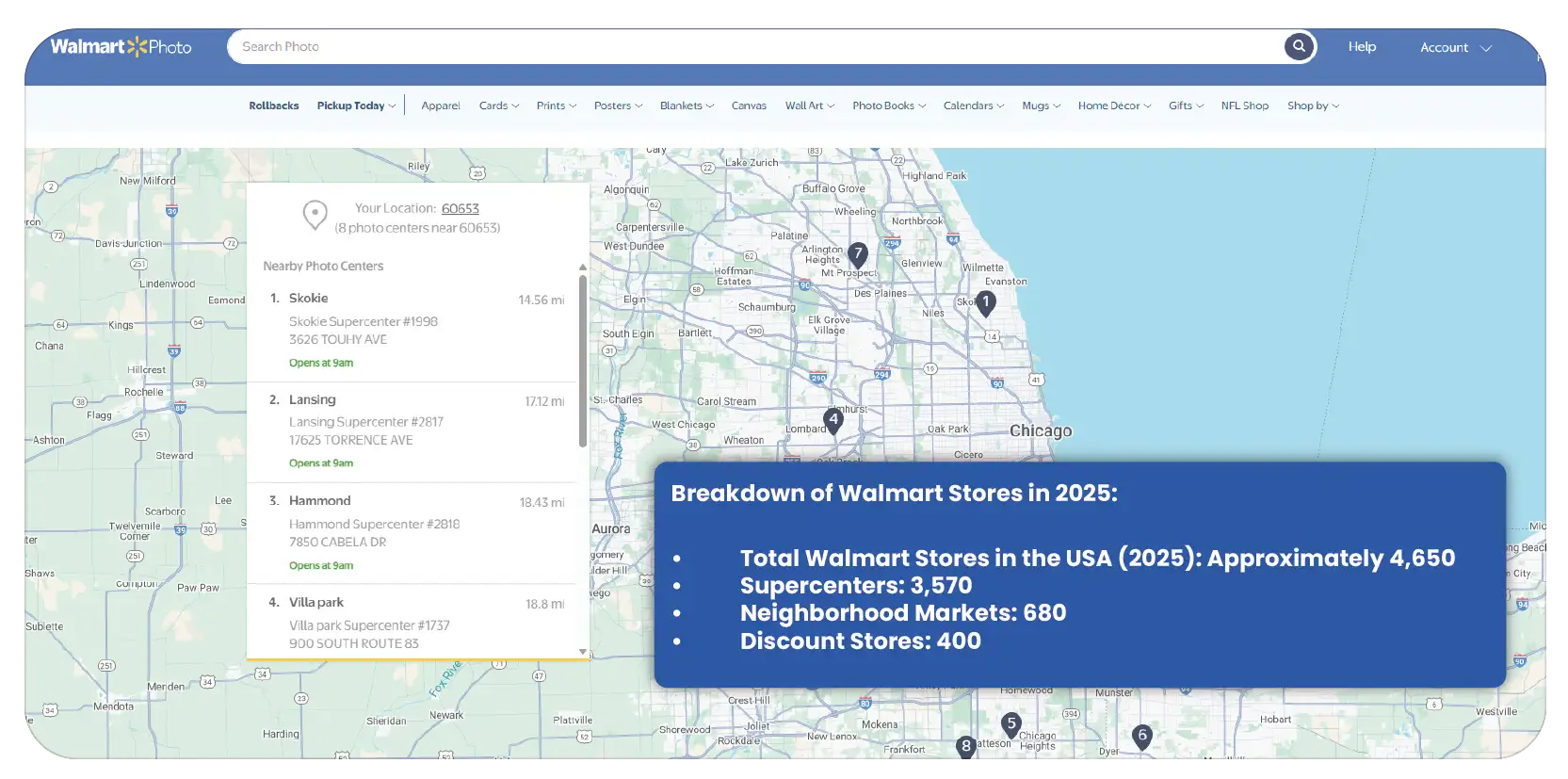

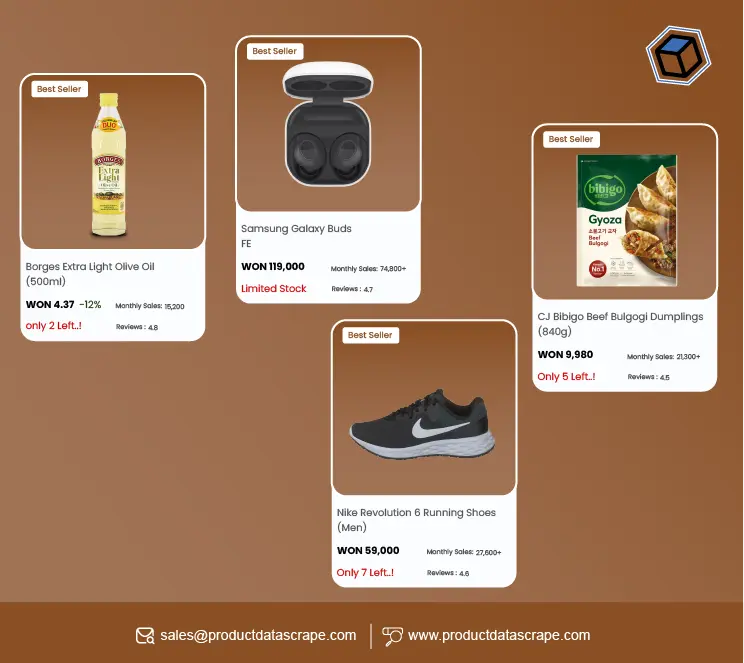

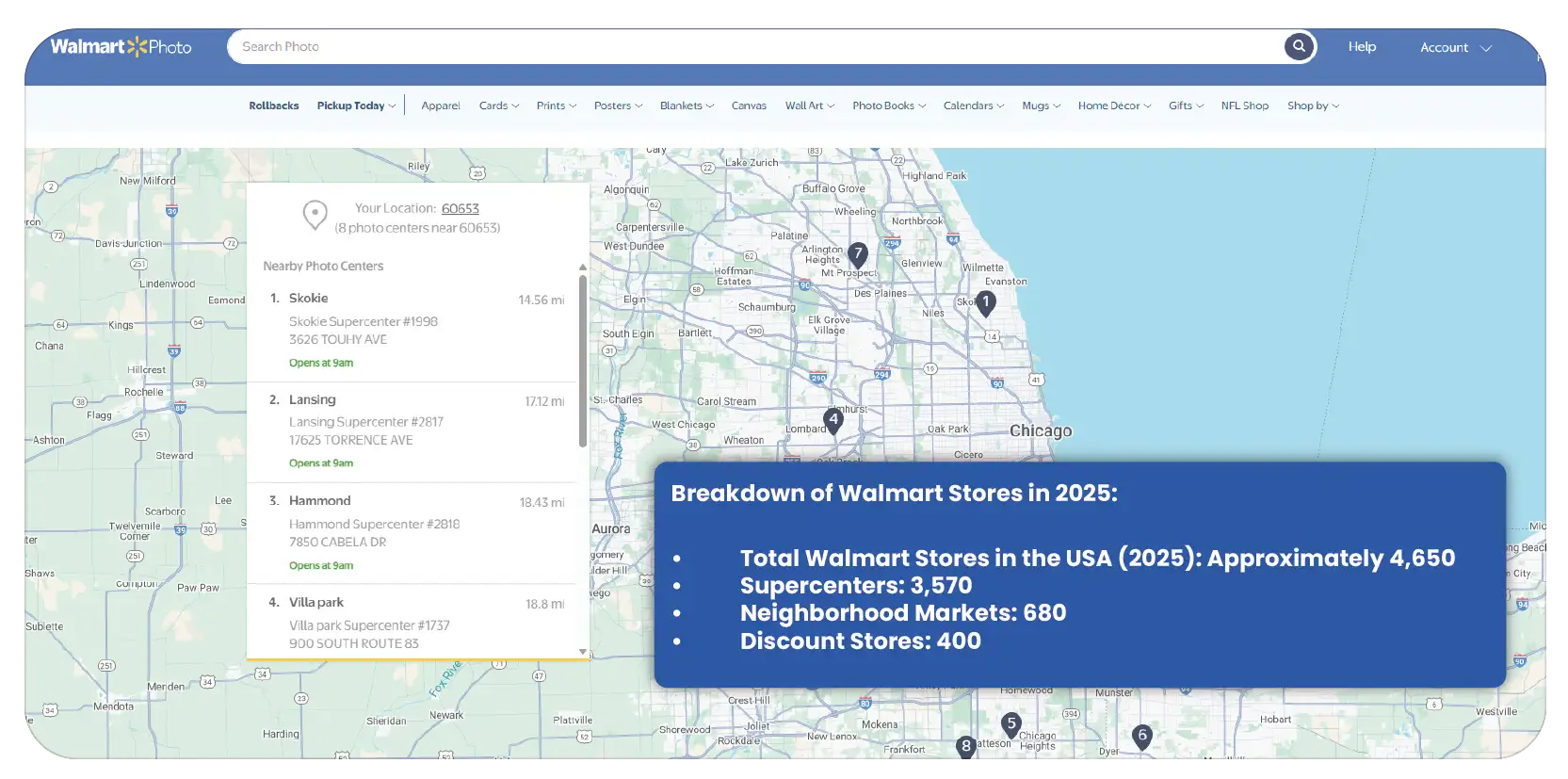

Breakdown of Walmart Stores in 2025

The following figures represent the estimated store count for Walmart in the USA in 2025:

- Total Walmart Stores in the USA (2025): Approximately 4,650

- Supercenters: 3,570

- Neighborhood Markets: 680

- Discount Stores: 400

Year-over-Year Comparison

A comparative analysis of Walmart's store count over previous years provides valuable insights into its growth trajectory, expansion strategies, and evolving retail landscape. By leveraging grocery app data scraping services, businesses can extract essential data on Walmart's store locations, store types, and operational changes. This real-time data helps industry analysts, logistics companies, and competitors track market trends, store openings, and closures efficiently.

The study further evaluates the role of data-driven insights in strategic decision-making, enabling businesses to optimize supply chain logistics, identify emerging trends, and stay ahead in the competitive retail sector.

| Year |

Total Stores |

Supercenters |

Neighborhood Markets |

Discount Stores |

| 2023 |

4,720 |

3,600 |

700 |

420 |

| 2024 |

4,680 |

3,580 |

690 |

410 |

| 2025 |

4,650 |

3,570 |

680 |

400 |

Store Count by Region in 2025

The following table provides a detailed overview of Walmart’s regional store distribution across the U.S. in 2025. Understanding Walmart’s geographic presence is crucial for retailers, analysts, and logistics companies aiming to track market trends and expansion strategies. By leveraging grocery store datasets, businesses can analyze store locations, consumer demand, and regional market penetration.

Additionally, web scraping grocery & gourmet food data allows for real-time tracking of Walmart’s grocery offerings, pricing trends, and store performance. This data-driven approach helps businesses optimize supply chain logistics, assess competitive landscapes, and make informed decisions in the evolving U.S. retail and grocery sector.

| Region |

Total Stores |

Supercenters |

Neighborhood Markets |

Discount Stores |

| Northeast |

720 |

540 |

120 |

60 |

| Midwest |

950 |

780 |

120 |

50 |

| South |

1,850 |

1,500 |

250 |

100 |

| West |

1,130 |

750 |

190 |

190 |

- The overall store count has slightly decreased from 2023 to 2025, reflecting Walmart’s shift towards digital transformation and e-commerce.

- The number of Supercenters has reduced, indicating potential closures of underperforming locations or consolidation strategies.

- The decline in Neighborhood Markets and Discount Stores suggests Walmart’s focus on larger, high-traffic stores and online sales growth.

Key Insights

E-commerce Growth Impact

- Walmart’s investment in online retail and same-day delivery services has reduced reliance on physical stores.

- The company’s acquisition of digital platforms and partnerships with delivery services indicates a strategic shift.

Regional Store Distribution Trends

- The Southern and Midwestern states continue to have the highest number of Walmart stores.

- Urban areas see fewer store openings due to high operational costs and increased online shopping preferences.

Competitive Landscape

- Walmart faces competition from Amazon, Target, and grocery chains that are also expanding their digital presence.

- The retailer has introduced more automation and AI-driven inventory management to optimize store efficiency.

Store Closures and Strategic Openings

- Some underperforming stores in rural or low-traffic areas have been shut down.

- New store openings are focused on high-growth regions with strong consumer demand.

Conclusion

Scraping the number of Walmart stores in the USA for 2025 offers crucial insights into the company’s retail strategy and shifting market trends. The slight decline in physical store count reflects Walmart’s focus on digital expansion and changing consumer preferences. By utilizing advanced web scraping techniques, businesses can extract grocery & gourmet food data to analyze store distribution, product availability, and pricing trends. Data analytics enables investors, retailers, and logistics companies to track market dynamics, optimize supply chains, and strengthen competitive positioning. Access to real-time insights supports strategic decision-making in an increasingly digital and data-driven retail environment.

At Product Data Scrape, we strongly emphasize ethical practices across all our services, including Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to transparency and integrity is at the heart of everything we do. With a global presence and a focus on personalized solutions, we aim to exceed client expectations and drive success in data analytics. Our dedication to ethical principles ensures that our operations are both responsible and effective.