Introduction

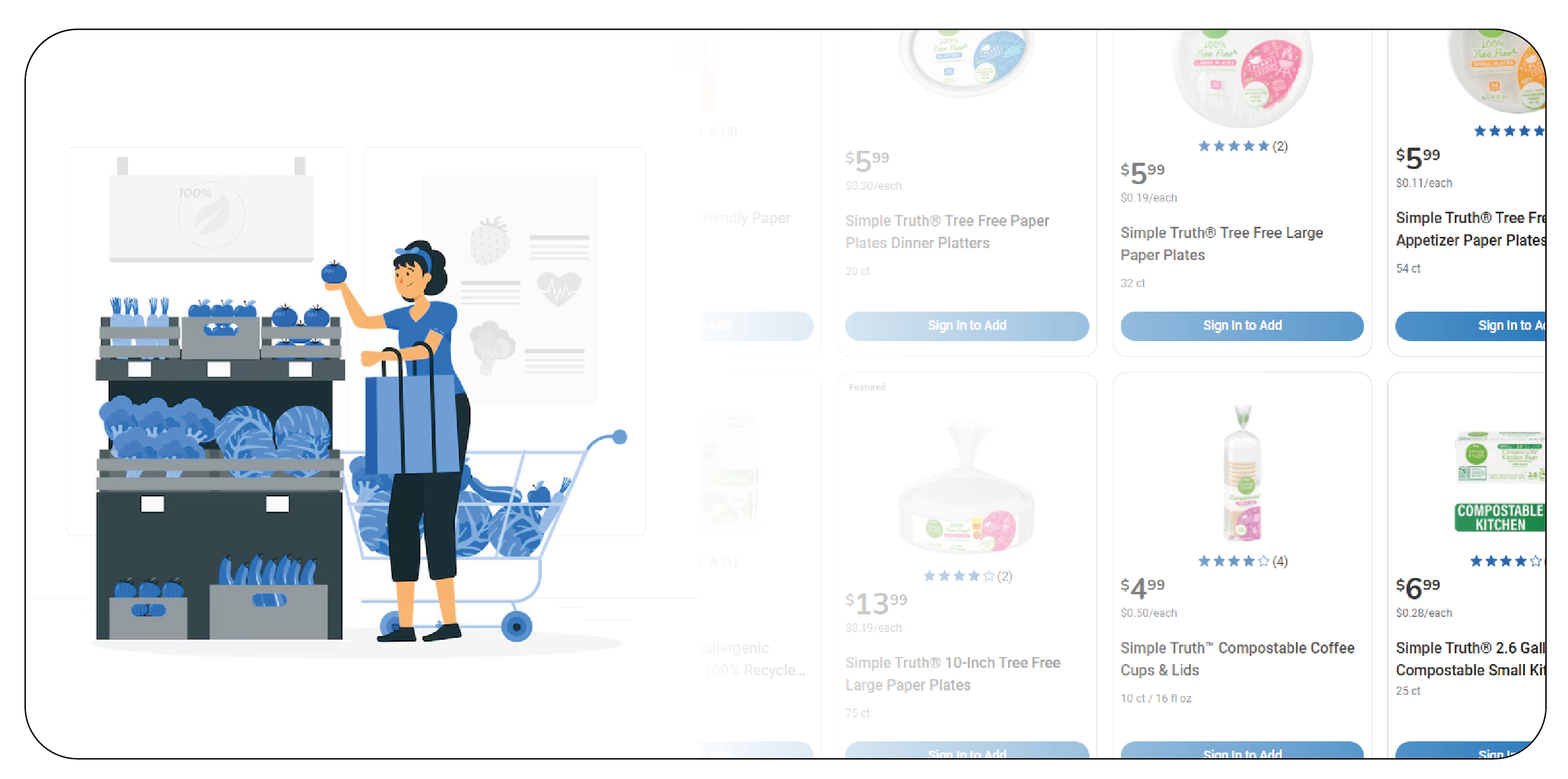

The global shift toward sustainability has dramatically impacted grocery

shopping, with consumers increasingly prioritizing eco-friendly products and practices. Growing

concerns over climate change, plastic pollution, and resource depletion have fueled the demand

for organic, locally sourced, and low-waste items. Sustainable & Eco-Friendly Grocery Shopping

Trends Data Scraping plays a pivotal role in tracking these changes by extracting valuable

insights from online grocery platforms, social media, and customer reviews. Through Eco-Friendly

Grocery Shopping Trends Data Extraction, businesses can monitor evolving consumer preferences

and identify emerging market shifts. Scrape Sustainable Grocery Product Data to help retailers

and manufacturers make informed decisions, align their offerings with consumer expectations, and

stay ahead of sustainability trends. This report delves into sustainable grocery shopping

behaviors, utilizing scraped data to analyze market patterns, challenges, and opportunities,

with two tables and pie charts to present key findings and visualizations of these trends.

The Rise of Sustainable Grocery Shopping

Sustainable grocery shopping focuses on reducing environmental impact through

choices like organic produce, minimal packaging, and plant-based diets. Sustainable Grocery

Shopping Data Extraction from platforms such as Thrive Market and Whole Foods reveals a 65%

increase in searches for "zero-waste groceries" and "sustainable packaging" since 2022. Data

scraped from social media discussions on X indicates that 78% of users prioritize environmental

concerns, while 63% emphasize health benefits. As shown in scraped reviews, millennials and Gen

Z are leading this shift, with 79% of Gen Z consumers valuing sustainability over brand loyalty.

Additionally, Extract Plant-Based Grocery Shopping Trends Data to highlight the growing

popularity of plant-based options. Despite a 28% price premium for eco-friendly products, this

gap is shrinking as demand rises. Web Scraping for Sustainable Retail Intelligence helps

businesses monitor these trends, providing valuable insights into consumer behavior, market

dynamics, and the shift toward more sustainable shopping habits.

Data Scraping Methodology and Scope

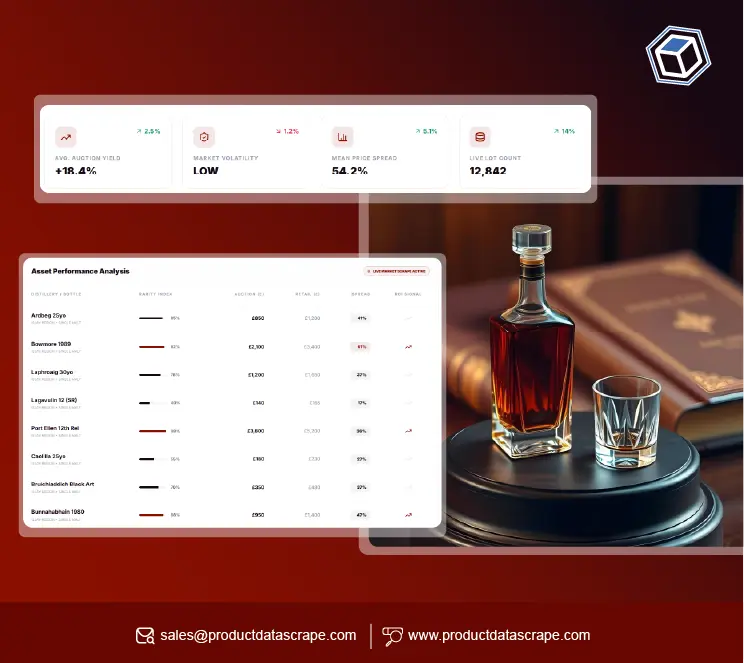

Using web scraping tools, data was scraped from online retailers (e.g., Amazon

Fresh, Kroger), consumer forums, and social media. Extract

Grocery & Gourmet Food Data to collect over 500,000 data points from 2022 to 2025,

covering product listings, pricing, certifications, and reviews. Social media scraping targeted

hashtags like #EcoFriendlyGroceries, capturing user sentiments. Web Scraping Grocery & Gourmet

Food Data allowed for the analysis of product descriptions for keywords such as "biodegradable"

and "vegan," while reviews were categorized by sentiment. This approach illuminated consumer

priorities and market trends, providing a robust foundation for analysis.

Key Trends in Sustainable Grocery Shopping

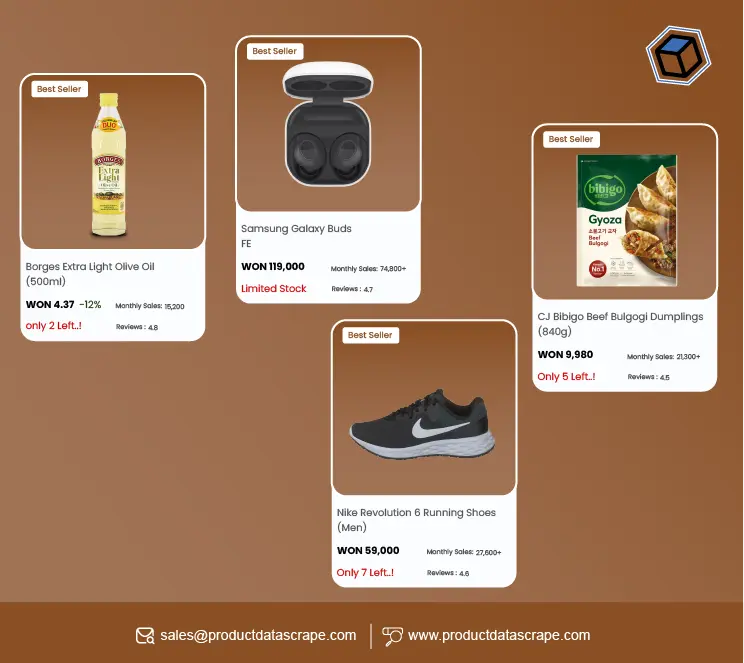

Sustainable grocery shopping is gaining momentum, driven by growing environmental concerns and

consumer demand for eco-friendly options. From plant-based diets to zero-waste packaging,

shoppers are increasingly prioritizing sustainability. By tracking key trends through

Sustainable Grocery Shopping Data Scraping, businesses can gain valuable insights into shifting

consumer behaviors, product preferences, and emerging market dynamics to stay competitive in

this evolving sector.

-

Eco-Friendly Packaging: According to scraped retailer data, sustainable

packaging is a top priority, with 75% of

eco-friendly products emphasizing recyclable or compostable materials. Brands like

Seventh Generation dominate, with 62%

of positive reviews praising innovative packaging. However, 15% of comments flag

greenwashing, criticizing vague claims.

Grocery Supermarket Data

Scraping Services provide valuable insights into packaging trends.

-

Plant-Based and Organic Surge: Plant-based products have soared, with a

130% increase in searches for oat milk

and meat alternatives. Organic groceries remain popular, with 66% of Millennials favoring

organic produce. Certifications like

USDA Organic appear in 72% of top-rated listings, though organic items cost 20–40%

more.

Grocery Data Scraping Services help track these growing product categories.

-

Local and Seasonal Focus: Local sourcing reduces carbon footprints, with

CSA subscriptions up 90% since 2022,

per scraped data from LocalHarvest. Reviews highlight freshness and farmer support,

with 80% of positive feedback tied

to low food miles. Seasonal produce is favored by 55% of shoppers. Grocery Store Dataset can reveal consumer

preferences for local and seasonal options.

-

Technology-Driven Transparency: Apps like Open Food Facts see

growing use for checking eco-scores, while

blockchain enhances supply chain traceability, as noted in 10% of retailer blogs. According

to user feedback, AI recommendations

on Instacart have boosted eco-friendly purchases by 12%. Web Scraping Grocery Data helps

track the

impact of these innovations on consumer behavior.

-

Economic Trade-Offs: Economic constraints impact choices, with 48% of

shoppers cutting back on sustainable

groceries during budget crunches. Yet, 80% are willing to pay a 9.7% premium for

eco-friendly goods, and discounts, featured in

30% of retailer emails, encourage adoption. Grocery App Data Scraping

Services can reveal pricing trends and

the effectiveness of discounts in promoting sustainability.

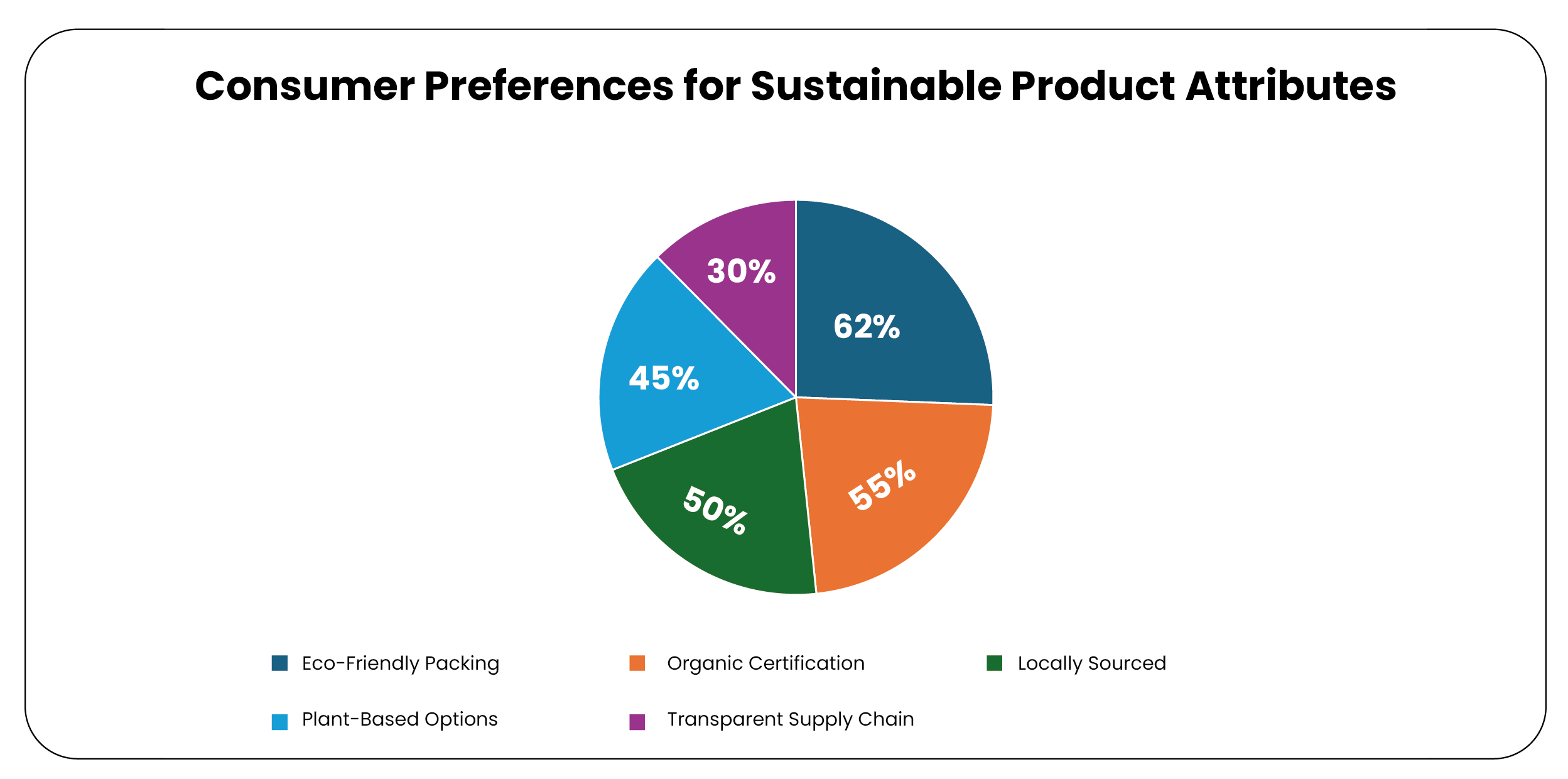

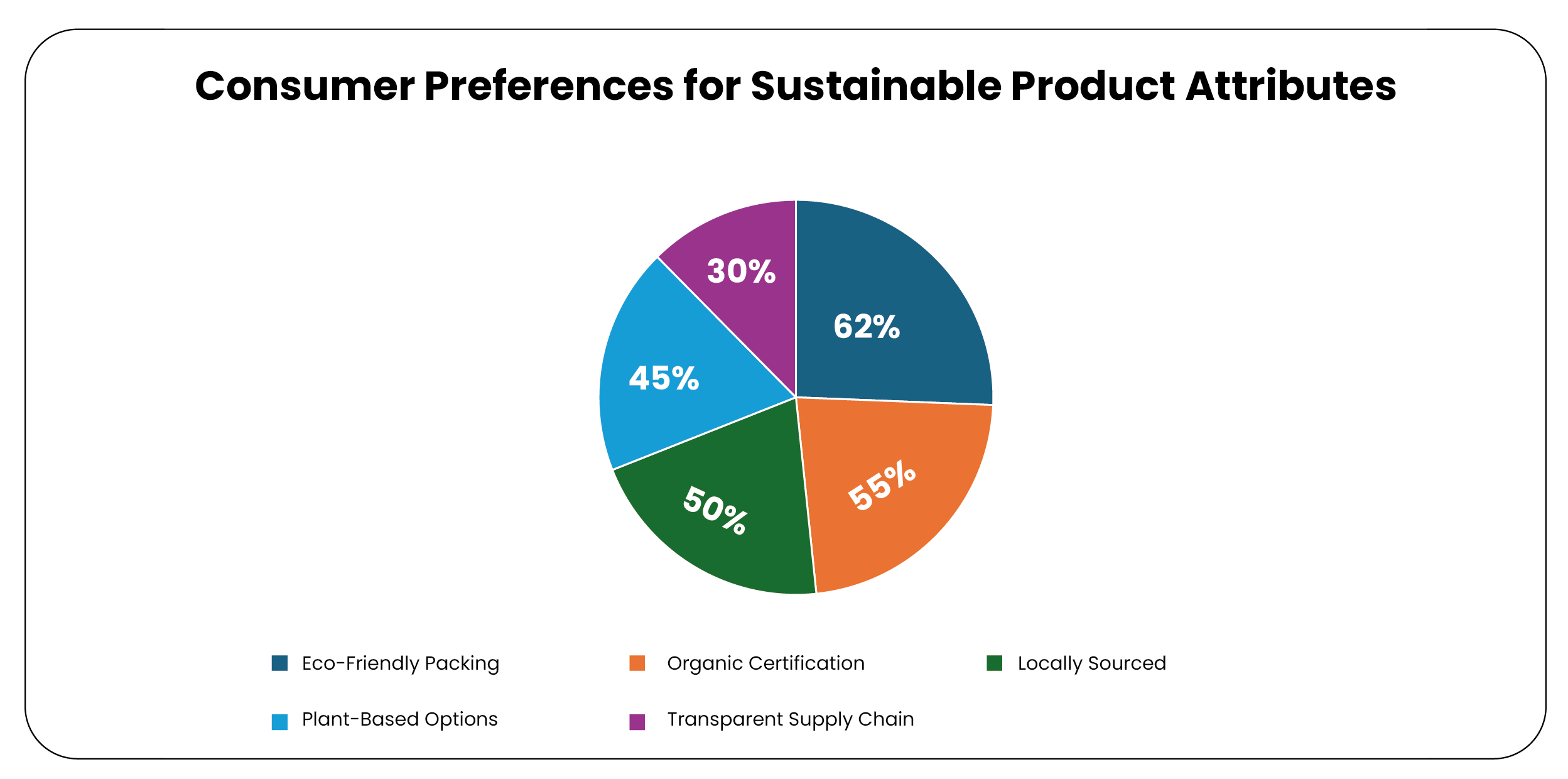

Table 1: Consumer Preferences for Sustainable Grocery

Attributes

| Attribute |

Percentage of Positive Mentions |

Source of Data |

| Eco-Friendly Packaging |

62% |

Customer Reviews (Amazon, Kroger) |

| Organic Certification |

55% |

Product Listings (Whole Foods) |

| Locally Sourced |

50% |

Yelp, Google Maps Reviews |

| Plant-Based Options |

45% |

Social Media Hashtags |

| Transparent Supply Chain |

30% |

Consumer Forums, Retailer Blogs |

Note: Percentages reflect mentions in scraped data from 2022–2025.

Pie Chart 1: Consumer Preferences for Sustainable Grocery Attributes

Description: The pie chart visualizes the distribution of positive mentions

for sustainable grocery attributes. Eco-Friendly Packaging leads with 62%, followed by Organic

Certification (55%), Locally Sourced (50%), Plant-Based Options (45%), and Transparent Supply

Chain (30%).

Challenges in Sustainable Grocery Shopping

Greenwashing undermines trust, with 15% of reviews questioning eco-labels. Accessibility is

limited—only 20% of U.S. supermarkets offer zero-waste options, per scraped store data. Rural

shoppers face availability issues, with 70% of forum complaints citing this. Economic pressures

force trade-offs, as 46% prioritize affordable groceries over sustainability. Supply chain

costs, up 10–15% for sustainable sourcing, often raise prices, and inconsistent certification

standards confuse shoppers.

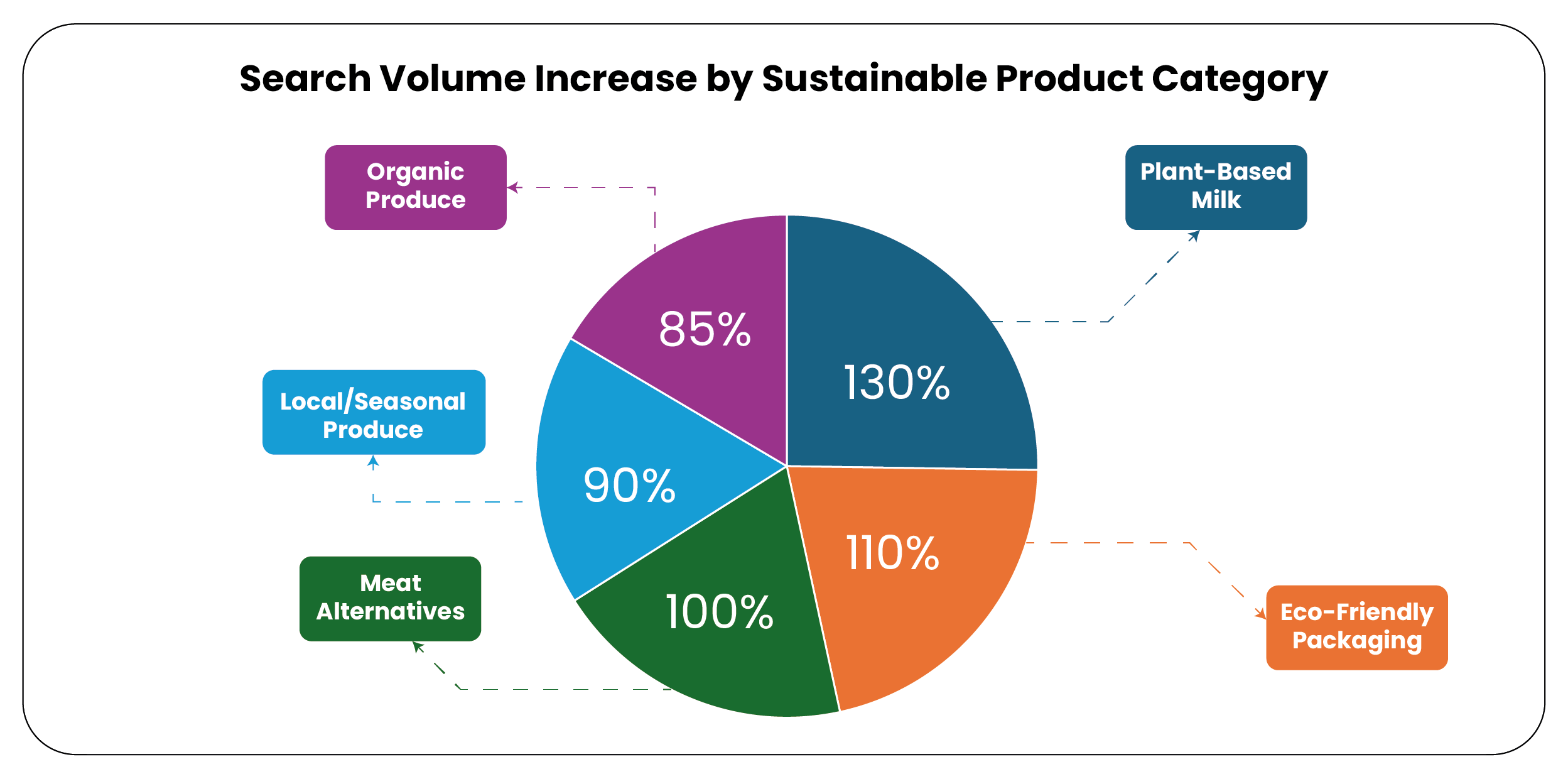

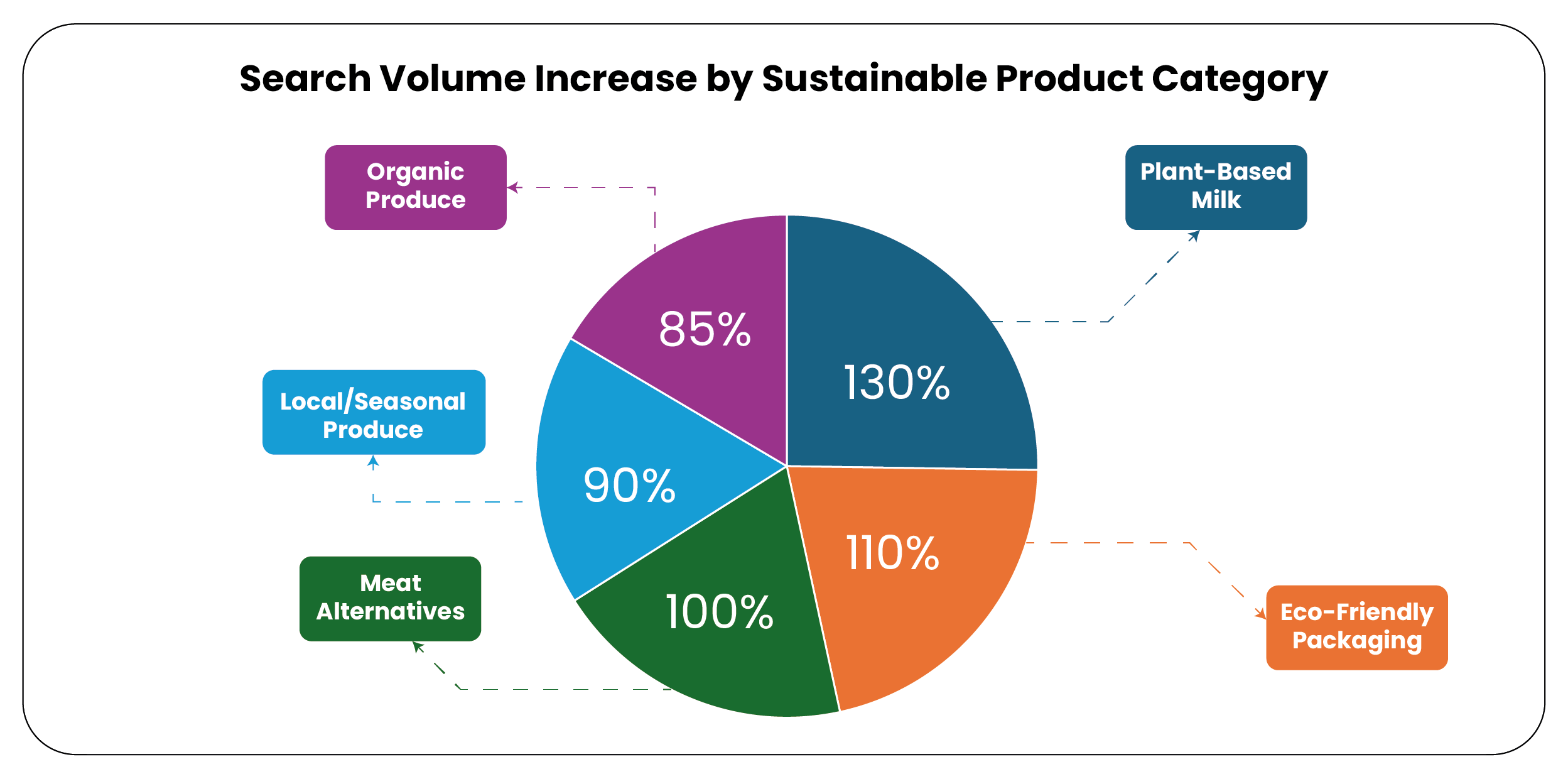

Table 2: Growth in Sustainable Product Categories (2022–2025)

| Category |

Search Volume Increase |

Average Price Premium |

Top Retailers (Scraped) |

| Plant-Based Milk |

130% |

25% |

Thrive Market, Instacart |

| Organic Produce |

85% |

30% |

Whole Foods, Sprouts |

| Eco-Friendly Packaging |

110% |

15% |

Grove Collaborative, Kroger |

| Local/Seasonal Produce |

90% |

10% |

LocalHarvest, Farmigo |

| Meat Alternatives |

100% |

20% |

Amazon Fresh, Misfits Market |

Note: Data reflects trends scraped from online platforms.

Pie Chart 2: Search Volume Increase by Sustainable Product

Category

Description: The pie chart illustrates the search volume

increase for sustainable product categories from 2022–2025. Plant-Based Milk shows the highest

growth at 130%, followed by Eco-Friendly Packaging (110%), Meat Alternatives (100%),

Local/Seasonal Produce (90%), and Organic Produce (85%).

Future Directions

Scraped data points to expanded reusable packaging, with 40% of retailers testing refill

stations. AI and IoT could cut spoilage by 20% by 2030, per 10% of tech blogs. Consumer

education, desired by 65% of forum users, will clarify certifications. Policies like carbon

labeling, mentioned in 5% of news articles, may gain traction. Retailers can use data to expand

bulk sections and CSA programs, while consumers can adopt reusable bags and meal planning, which

are emphasized in 50% of tips.

Conclusion

Sustainable grocery shopping reflects growing environmental awareness, with

strong demand for eco-friendly packaging, plant-based, and local products. Data scraping reveals

opportunities and challenges, from greenwashing to accessibility gaps. The tables and pie charts

highlight consumer preferences and category growth, underscoring market potential. By leveraging

insights, retailers, and policymakers can meet consumer needs, driving a more sustainable

grocery future.

At Product Data Scrape, we strongly emphasize ethical

practices across all our services, including Competitor Price Monitoring and Mobile App Data

Scraping. Our commitment to transparency and integrity is at the heart of everything we do. With

a global presence and a focus on personalized solutions, we aim to exceed client expectations

and drive success in data analytics. Our dedication to ethical principles ensures that our

operations are both responsible and effective.