Shein, a Chinese fashion retailer, has surged to cult status among Gen Z globally, boasting a valuation exceeding $15 billion. It's recognized as one of the fastest-growing and most secretive e-commerce giants, with revenues nearing $10 billion in 2020 and a consistent 100%+ growth annually (CB Insights). Shein has disrupted traditional fashion production methods while operating on an on-demand business model.

The company's popularity stems from its meager prices and swift adaptation to current fashion trends. Shein's approach involves frequent updates to its product offerings, reflecting the latest styles and contributing to its immense appeal among young consumers.

Fashion retailer data scraping plays a pivotal role in understanding Shein's strategy. Analysts can gather crucial insights into pricing strategies, inventory management, and trend forecasting by employing Shein data scraping. This data-driven approach allows Shein to stay ahead in the fast-paced fashion industry, adjusting its inventory dynamically to meet consumer demand and capitalize on emerging trends swiftly.

Shein's rapid growth underscores the importance of agility and data-driven decision-making in the competitive e-commerce landscape. Its ability to leverage e-commerce data scraping ensures it remains responsive to market shifts, maintaining its allure among fashion-forward consumers globally. As Shein continues to expand, its innovative business model and reliance on data analytics through scraping techniques will likely shape the future of fashion retailing.

Shein's Performance During the Pandemic

Shein Data Scraping depicts that during the COVID-19 pandemic, there was significant interest in how Shein, a prominent online fashion retailer, fared amidst global disruptions. Our e-commerce data scraping services, derived from transactional email receipts across 22 countries, analyzed Shein's performance.

Despite challenges posed by the pandemic, Shein exhibited resilience and adaptability. With its online-focused model and agile supply chain, Shein capitalized on increased online shopping trends during lockdowns. This strategy enabled the company to maintain robust revenue streams and continue its growth trajectory.

Our fashion retail data scraping services provided insights into consumer behavior and spending patterns during this period, highlighting Shein's ability to attract and retain customers amidst turbulent market conditions. As a result, Shein's performance during the pandemic underscored its agility and strategic positioning in the e-commerce landscape.

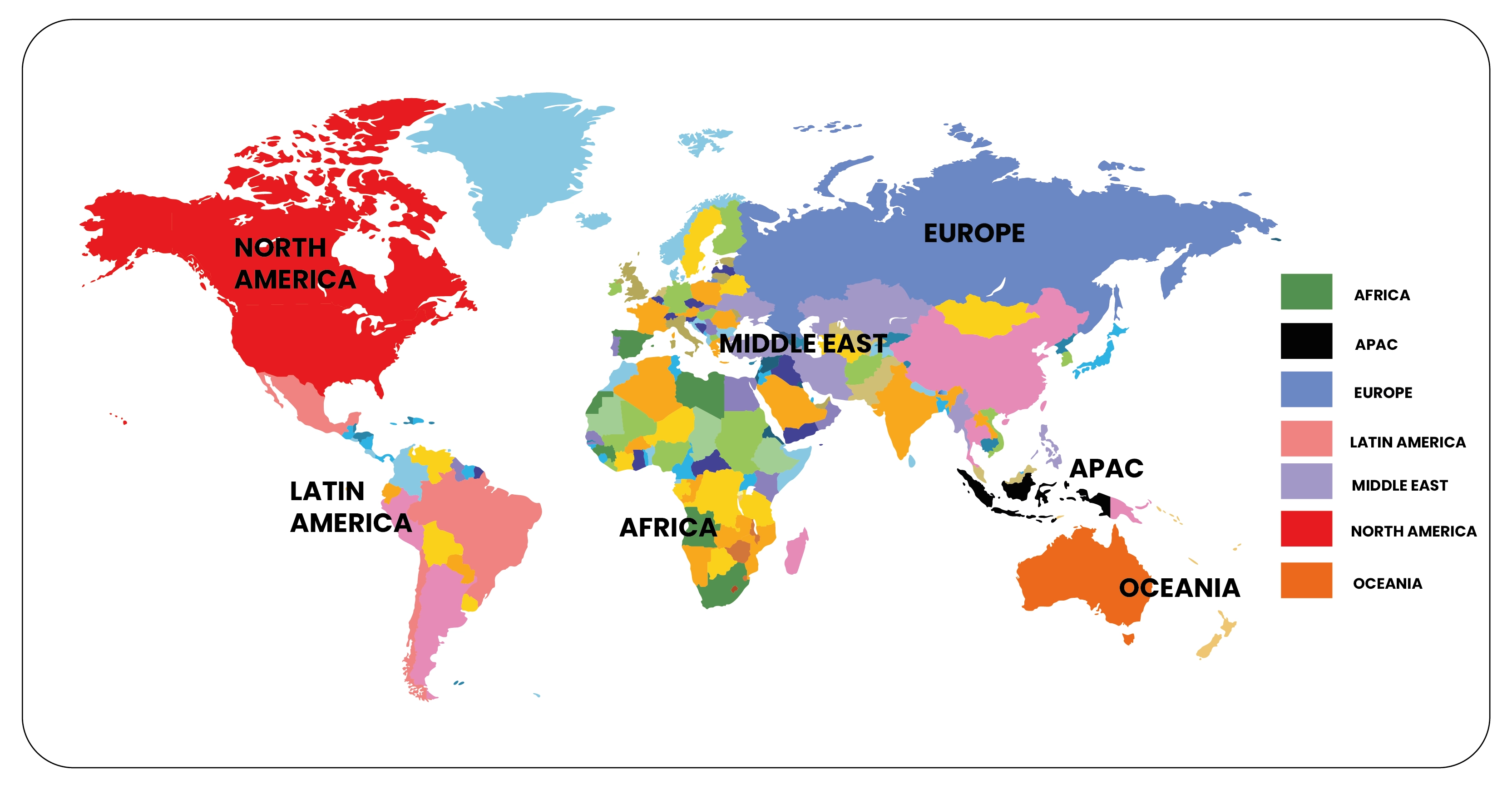

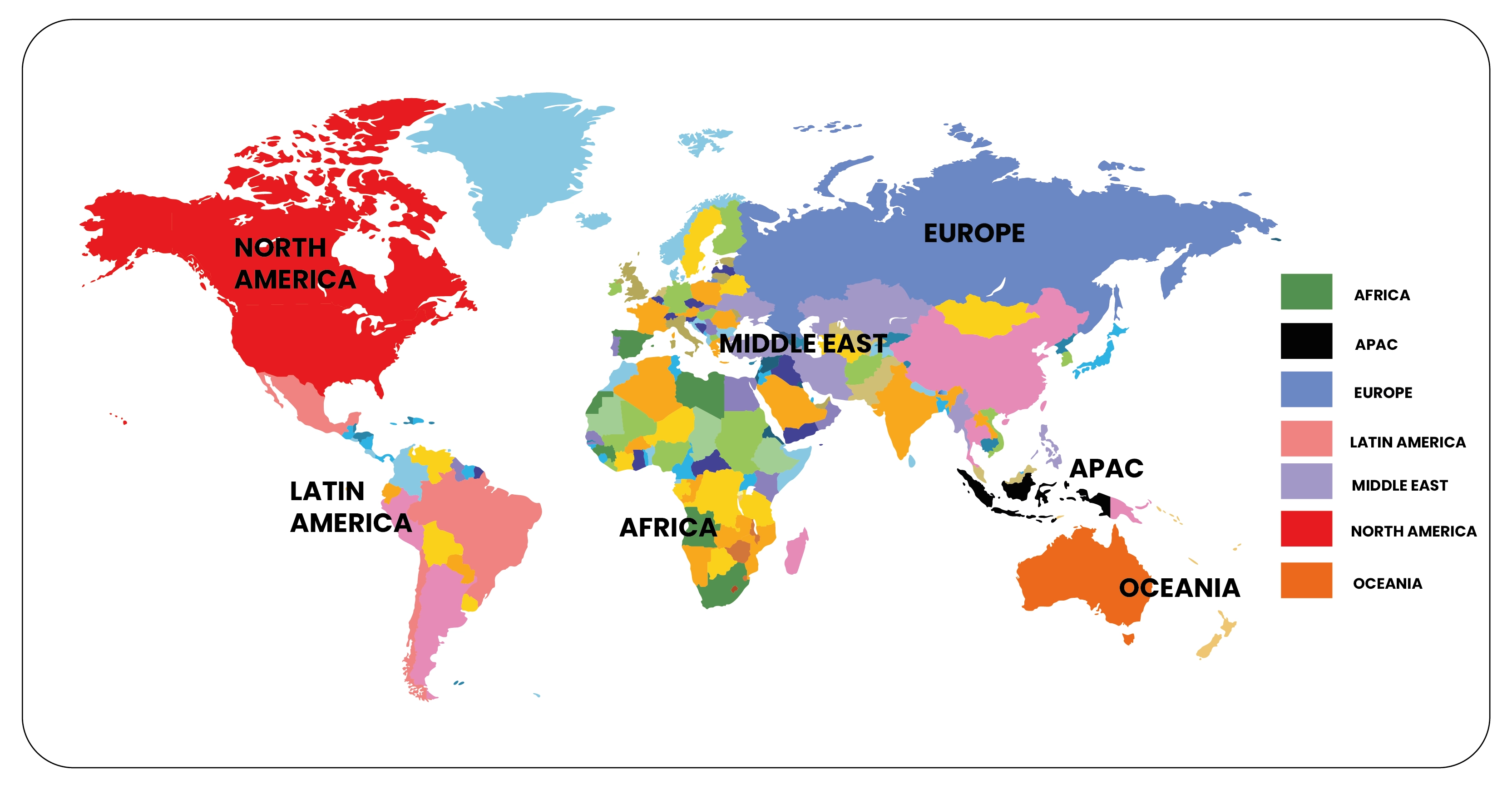

Shein's Global Distribution: Insights from Transactional Data

Shein's global distribution map, based on transactional email data across 22 markets, illustrates its extensive reach and popularity. This visual representation highlights Shein's broad consumer base and geographical penetration, showcasing its ability to attract customers globally. Scrape Ecommerce data to show the map that serves as a testament to Shein's effective international expansion strategy and its success in catering to diverse market preferences. Shein optimizes its operations and marketing efforts by leveraging transactional data insights to maintain a strong presence across continents, solidifying its position as a leading global fashion retailer.

Shein's Remarkable Growth Amidst Covid-19 Challenges

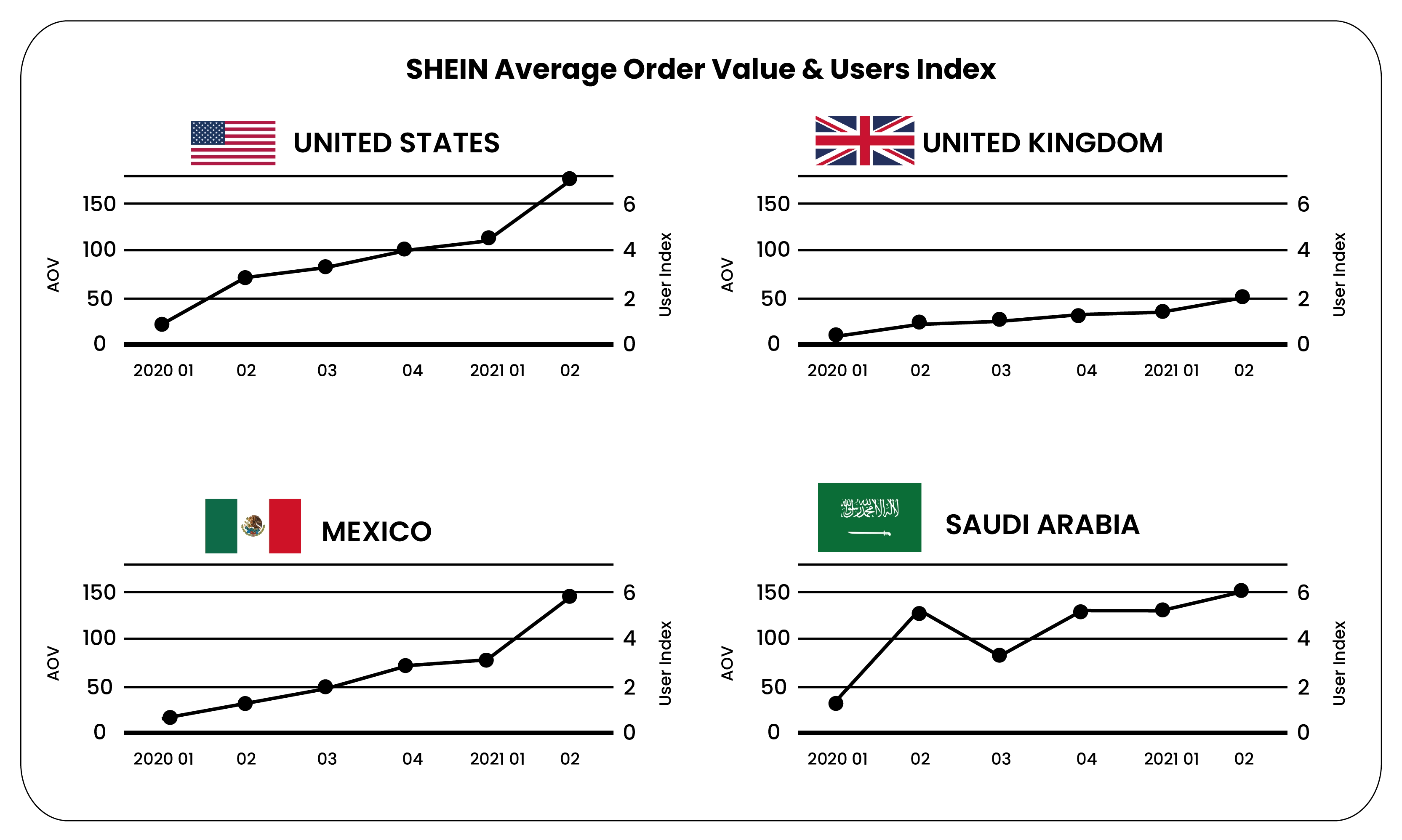

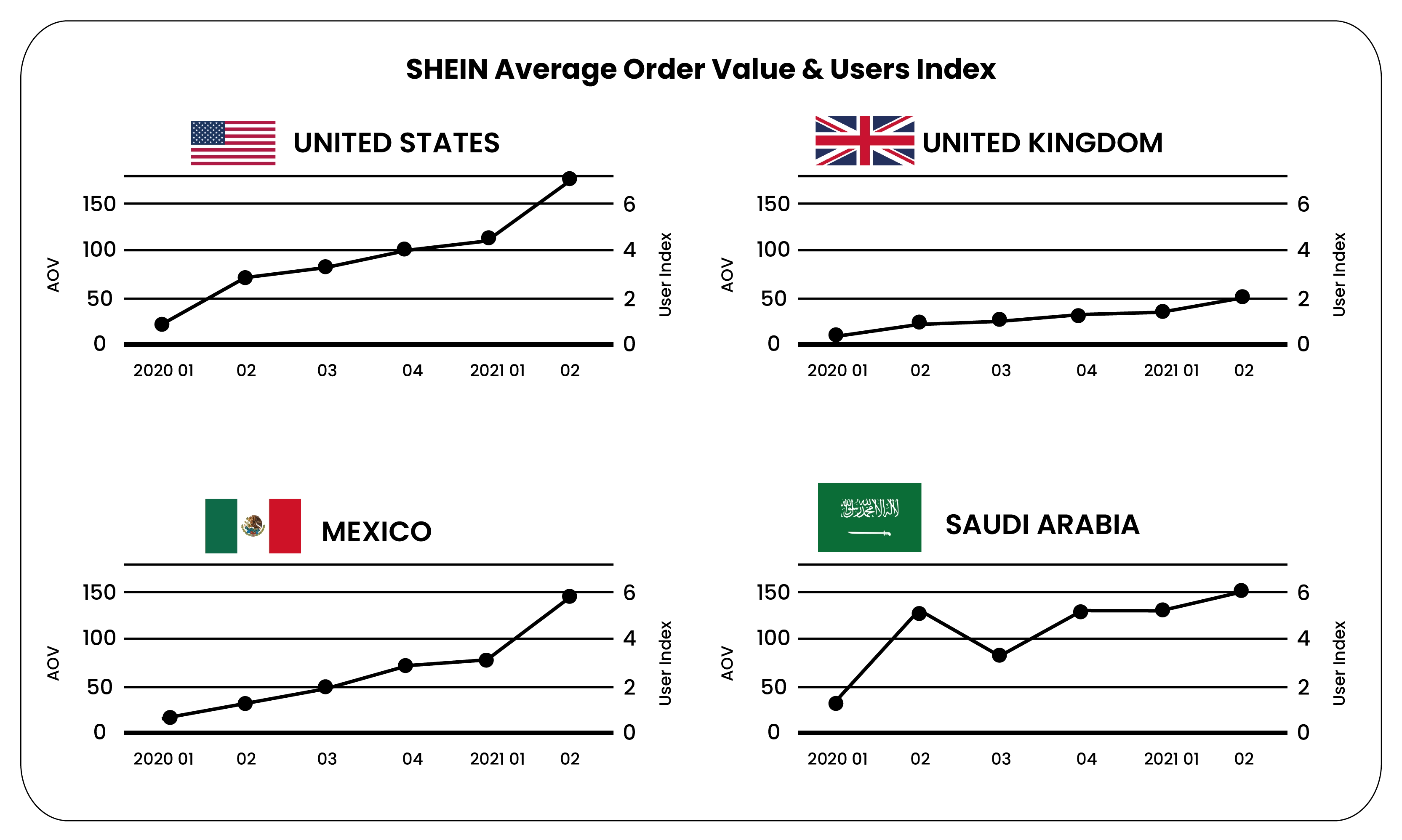

While many fashion brands struggled during the pandemic, facing bankruptcy and revenue declines, Shein defied the odds. According to insights from Shein Data Scraping transactional email receipt panel, Shein experienced a significant surge in sales starting in the second quarter of 2020, coinciding with the global spread of COVID-19 and subsequent lockdowns.

Analysis across critical markets, including the United States, United Kingdom, Mexico, and Saudi Arabia, reveals that Shein recovered and thrived during this period. The average order values in these countries reflect strong consumer engagement, with variations such as higher spending observed in Saudi Arabia, where shoppers prefer larger purchases.

Shein's ability to sustain momentum and grow amidst global economic uncertainties underscores its agility and appeal in e-commerce.

The shift to digital storefronts has become commonplace, with numerous fashion brands swiftly pivoting to online sales to sustain profitability. A McKinsey consumer sentiment survey in April highlighted a substantial decline in consumer purchasing intentions. The survey indicated a decrease in purchase intent by 70 to 80 percent for offline channels and 30 to 40 percent for online channels in Europe and North America, even in regions not under complete lockdown.

Similarly, 74 percent of Chinese consumers reported avoiding shopping malls in the weeks following store reopenings. This underscores the enduring impact of the pandemic on consumer behavior and the cementation of digital shopping as the predominant mode of retail engagement.

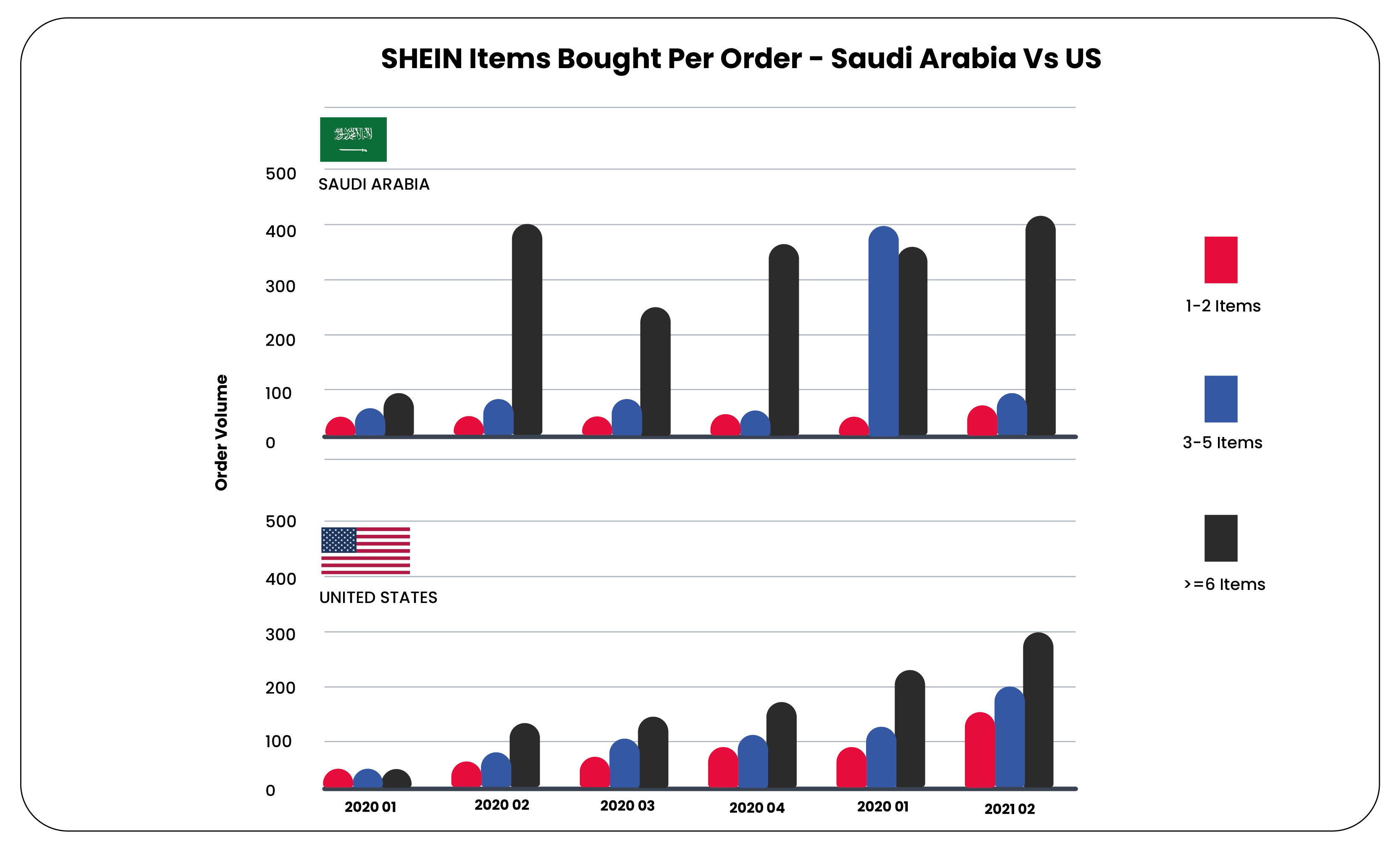

Which Country's Consumers Purchase the Most Items Per Order from Shein?

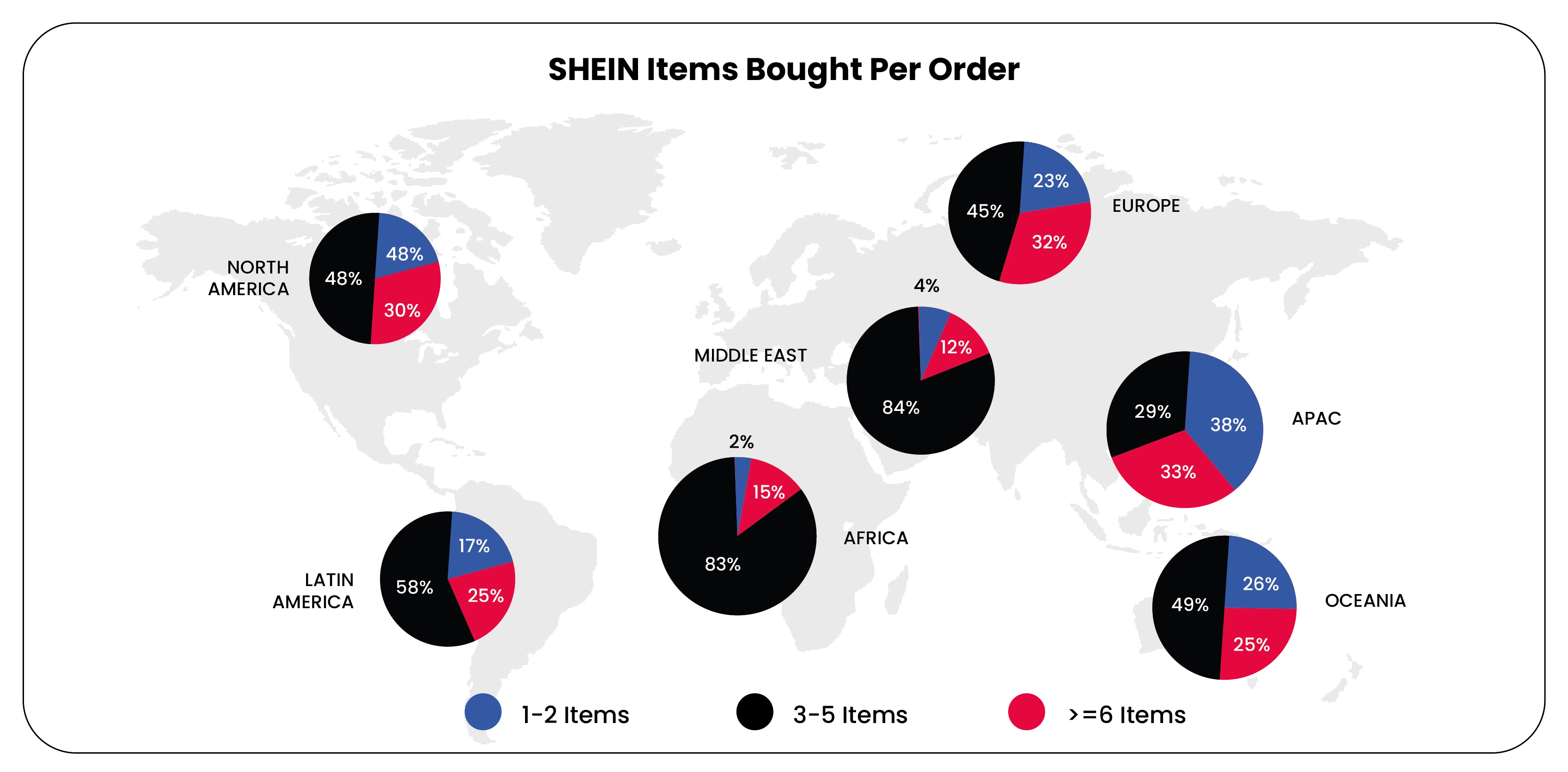

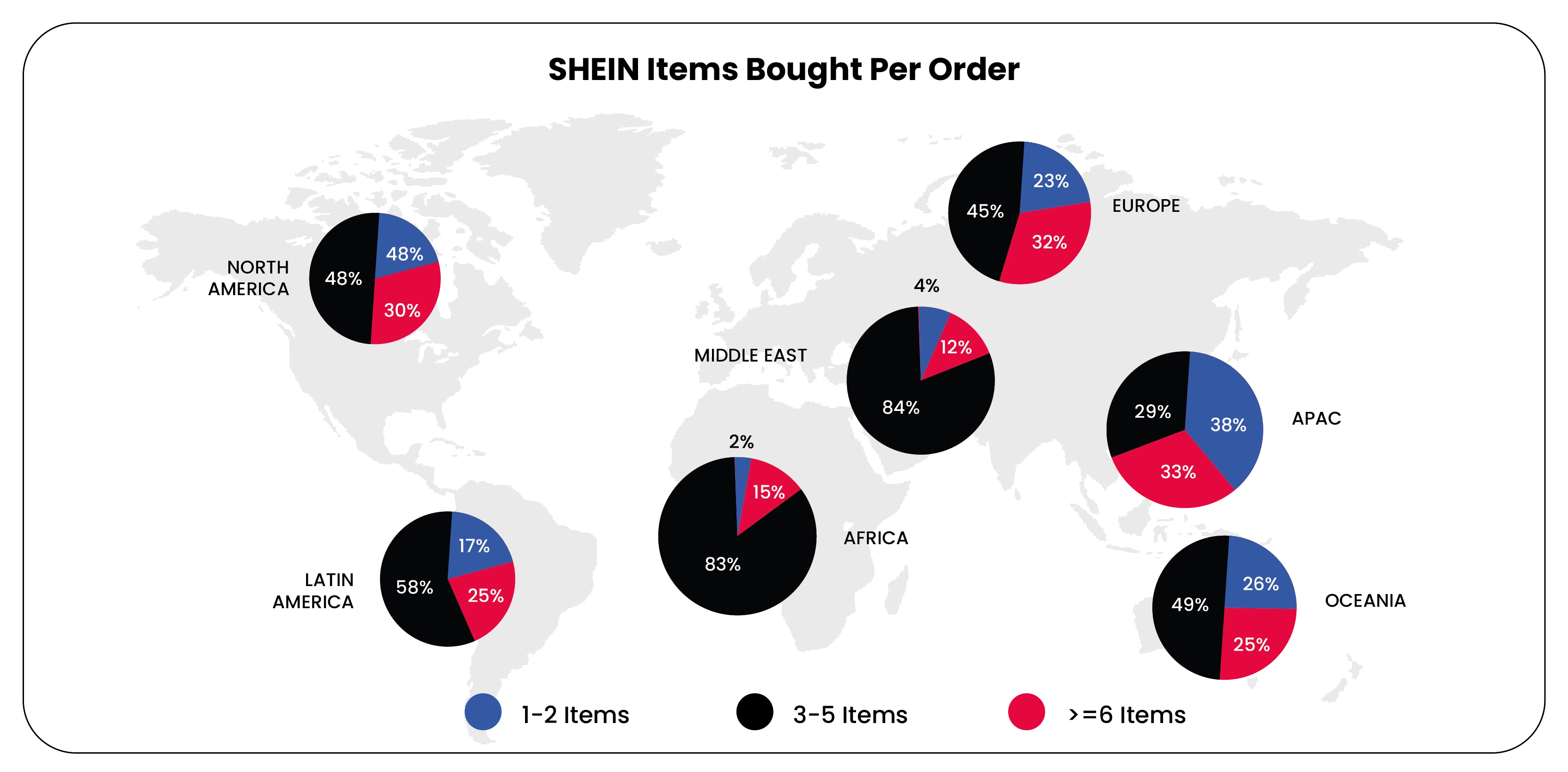

According to insights from our e-receipt data panel, consumers in emerging markets across the Middle East, Africa, and Latin America, typically associated with lower income levels, tend to purchase more items per transaction from Shein. This Ecommerce Dataset highlights a notable consumer behavior pattern where shoppers in these regions tend to place larger orders when shopping from Shein's online platform. This trend underscores Shein's appeal and accessibility in diverse global markets, where consumers capitalize on the affordability and variety offered by fast fashion retailers to maximize their shopping experience.

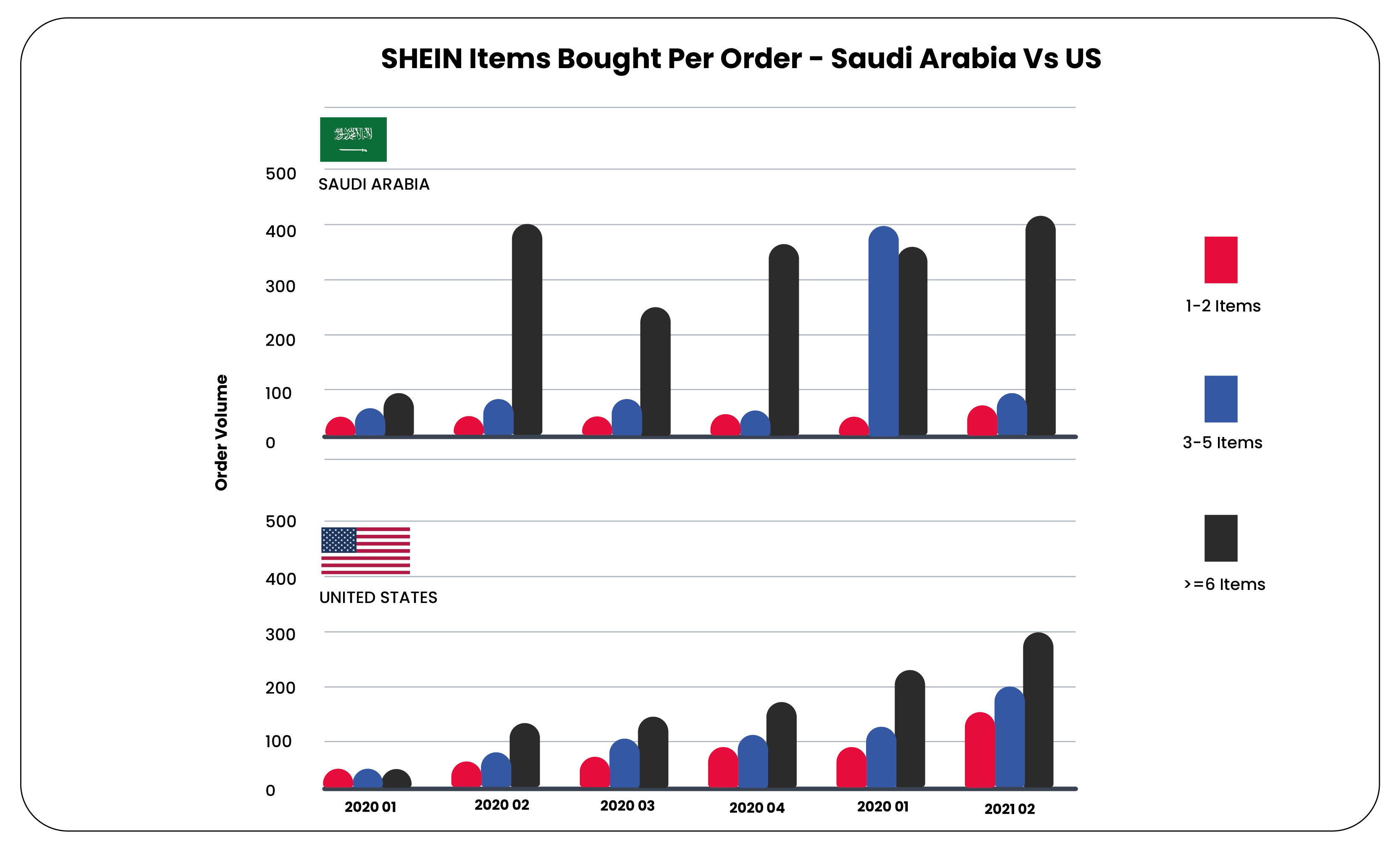

Saudi Arabia notably outperforms Shein's primary market, the United States. Data illustrates a significant contrast in the number of products purchased per customer order between the two countries, with Saudi Arabia showing a markedly higher average. This trend underscores the strong consumer engagement and preference for larger purchases among Shein's customer base in Saudi Arabia compared to the United States.

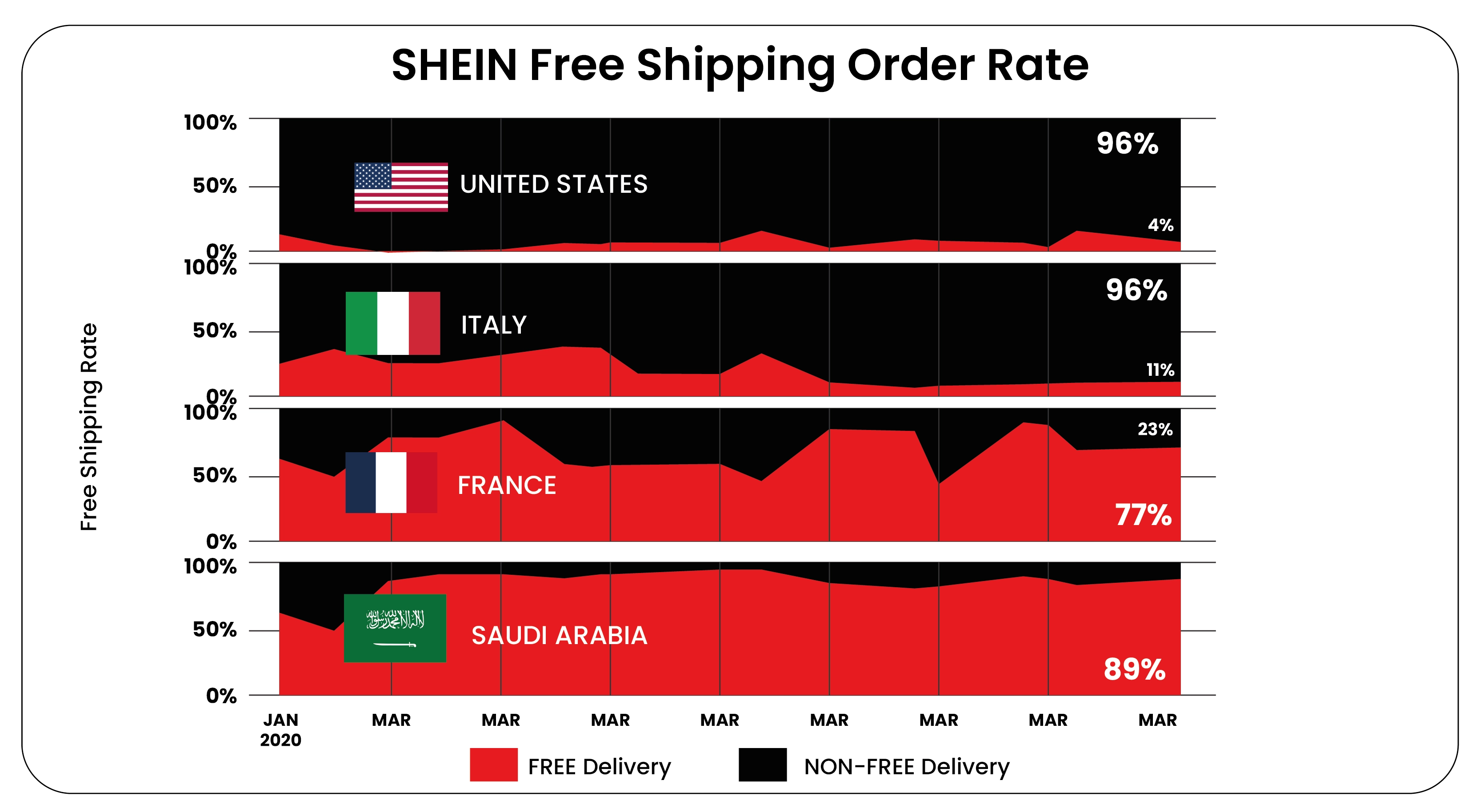

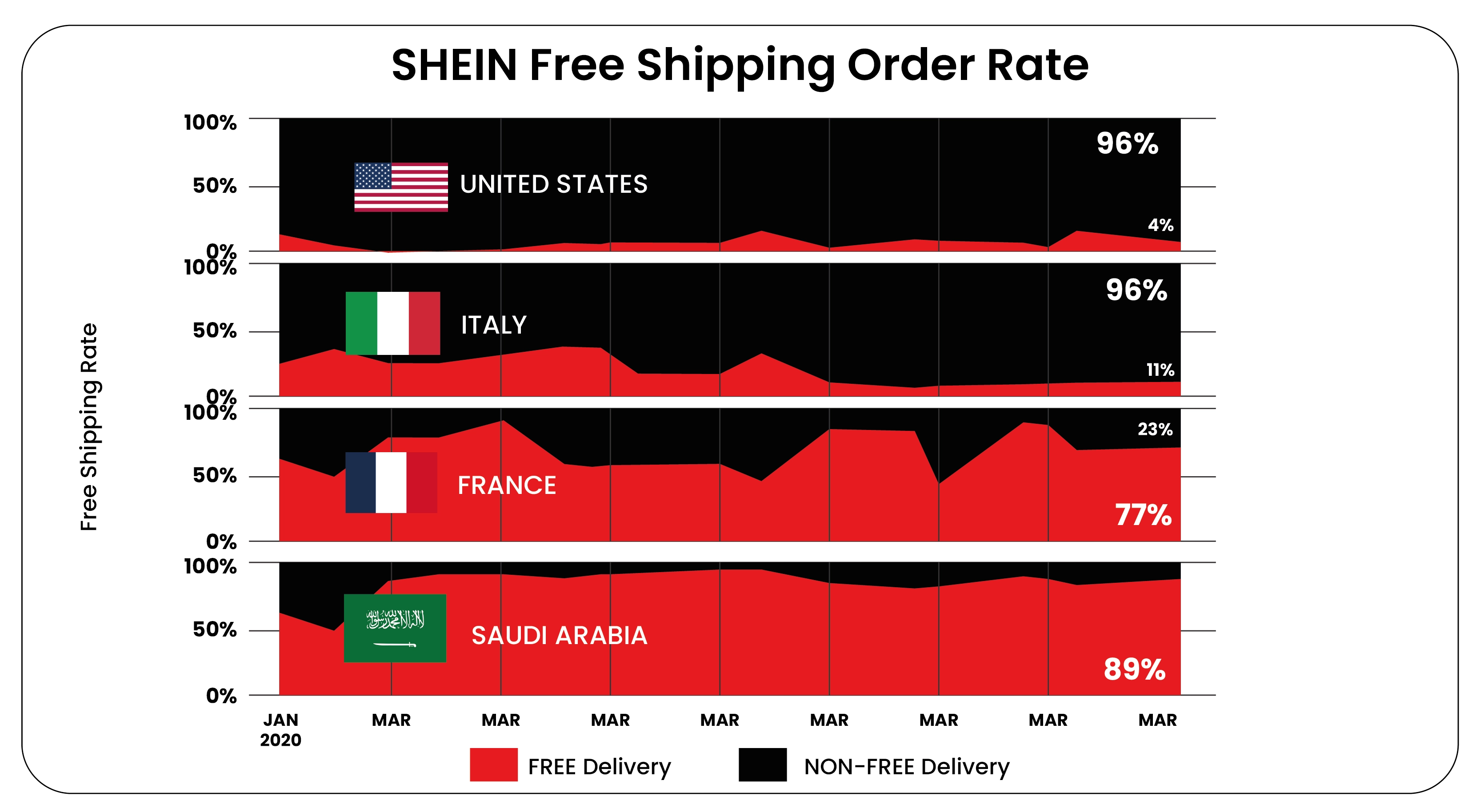

Could the surge in Shein online shopping by Saudi consumers be attributed to free shipping perks for larger orders? Our data strongly indicates this correlation.

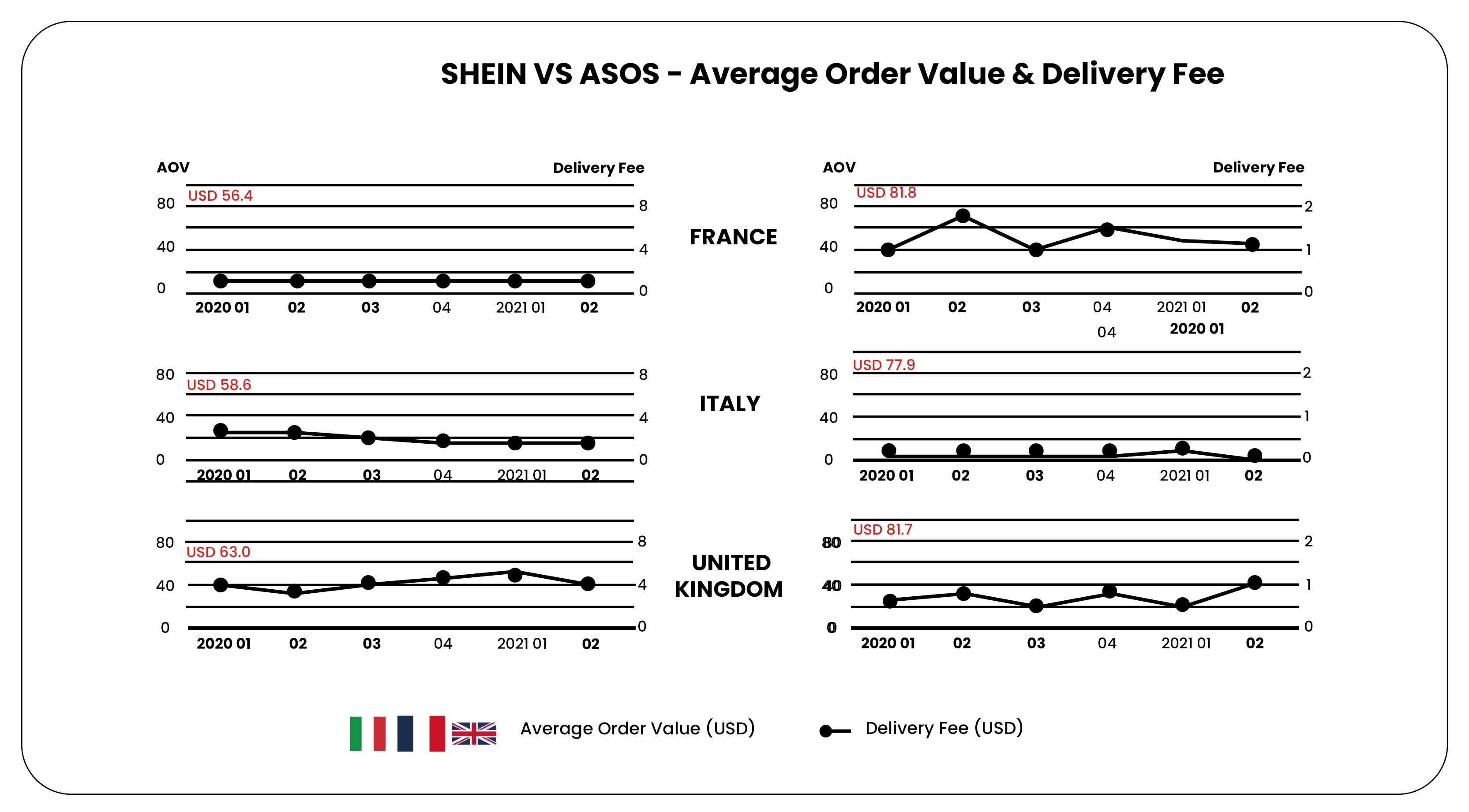

Shein vs. ASOS: Fast Fashion's Teenage Titans

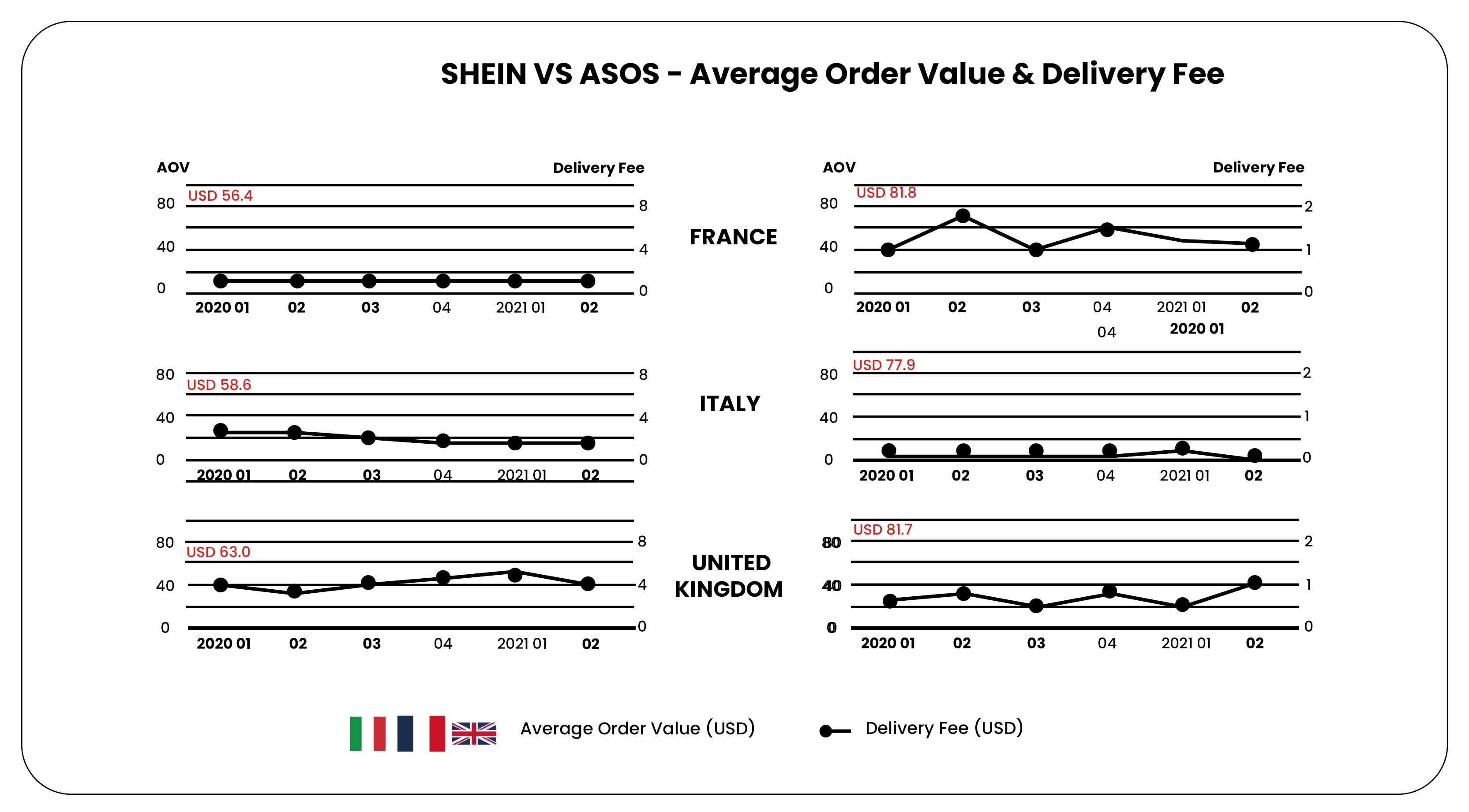

Over the past two decades, British brand ASOS has maintained its position as a premier fast-fashion destination for young adults. However, with Shein's rapid growth trajectory, there is speculation that it could surpass ASOS as the fastest-growing fast-fashion brand globally among teenagers.

In comparing Shein to ASOS, ASOS still maintains a higher average order value, approximately 40% higher. This disparity can be attributed to ASOS's pricing structure, which includes higher item costs but potentially lower delivery fees than Shein. Despite these differences, Shein's appeal lies in its competitive pricing and extensive range of trendy apparel, which resonates strongly with younger demographics globally. As Shein continues to expand and innovate in e-commerce, its ability to capture market share from established players like ASOS highlights its potential to dominate the fast fashion market among teenagers shortly.

Shein's Ethical Accountability

Shein presents itself as an inclusive fashion brand where everyone can affordably access trends. However, scrutiny reveals significant ethical concerns across its operations. Environmental impact is a crucial issue, with Shein accused of contributing to pollution by using hazardous chemicals and generating carbon emissions. Its fast-paced 'on-demand' production model exacerbates concerns about sustainability and fosters a throwaway fashion culture.

Labor conditions at Shein facilities have also come under fire, with reports indicating long working hours exceeding 75 hours per week for some employees, mainly migrants, who are often paid based on piecework. This setup can incentivize excessive labor without adequate compensation, raising ethical questions about fair labor practices and potential exploitation.

Shein's stance regarding animal welfare remains contentious. While the company has launched campaigns like "Shein Cares" and pledged donations to animal welfare organizations, skepticism persists about the depth of its commitment and practices within its supply chain.

Despite Shein's efforts to enhance its image through initiatives and marketing campaigns, the brand continues to be under the microscope. Its ethical standards in environmental sustainability, labor rights, and animal welfare are still subject to scrutiny and criticism, highlighting the need for ongoing evaluation and improvement.

Conclusion: At Product Data Scrape, ethical principles are central to our operations. Whether it's Competitor Price Monitoring Services or Mobile App Data Scraping, transparency and integrity define our approach. With offices spanning multiple locations, we offer customized solutions, striving to surpass client expectations and foster success in data analytics.

.webp)