Introduction

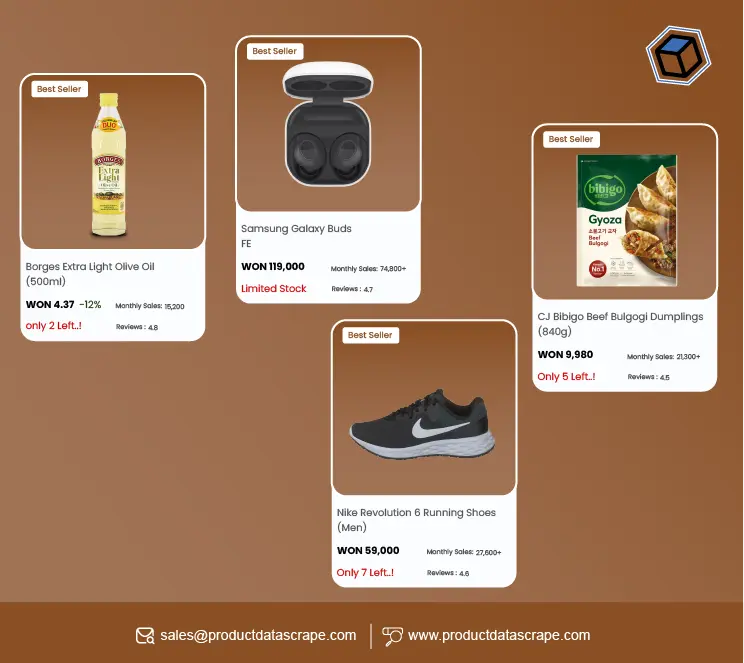

The Indian beauty and personal care market has witnessed exponential growth,

projected to reach a gross merchandise value of $30 billion by 2027, driven by rising disposable

incomes, increasing beauty consciousness, and the proliferation of e-commerce platforms. Among

the leading players, Nykaa and Purplle have emerged as dominant online marketplaces, catering to

diverse consumer segments with extensive product ranges. Scrape Beauty Product Prices from Nykaa

and Purplle to compare how these platforms strategically position their offerings in response to

market demand.

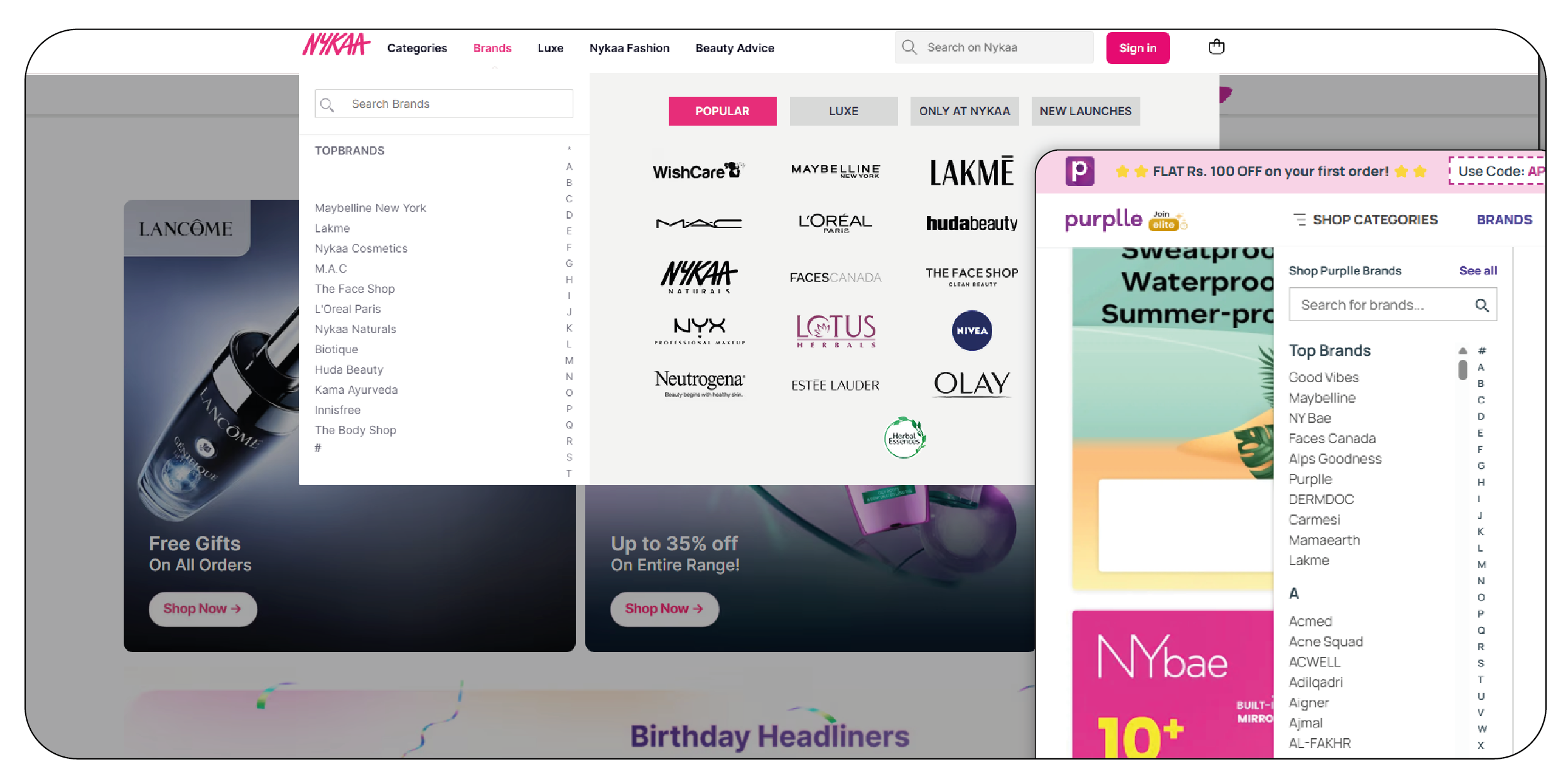

Nykaa, established in 2012 by Falguni Nayar, is renowned for its premium and luxury offerings.

Purplle, founded in 2012 by Manish Taneja and others, focuses on affordability and

accessibility, particularly in Tier 2 and 3 cities. This report analyzes and compares beauty

product prices on Nykaa and Purplle across key categories—skincare, makeup, and haircare—to

understand their pricing strategies, target demographics, and competitive positioning. Nykaa vs.

Purplle Price Scraping Services enables an in-depth look at their distinct approaches to product

pricing.

The analysis draws on scraped pricing data to provide insights into market dynamics and consumer

value propositions. Platforms like Nykaa and Purplle leverage this data to refine their

strategies and provide the best deals for customer segments. As part of this evaluation, we will

also explore how to Scrape Makeup and Skincare Prices from Nykaa and Purplle to inform consumer

decision-making and shape purchasing behavior.

Market Context and Significance

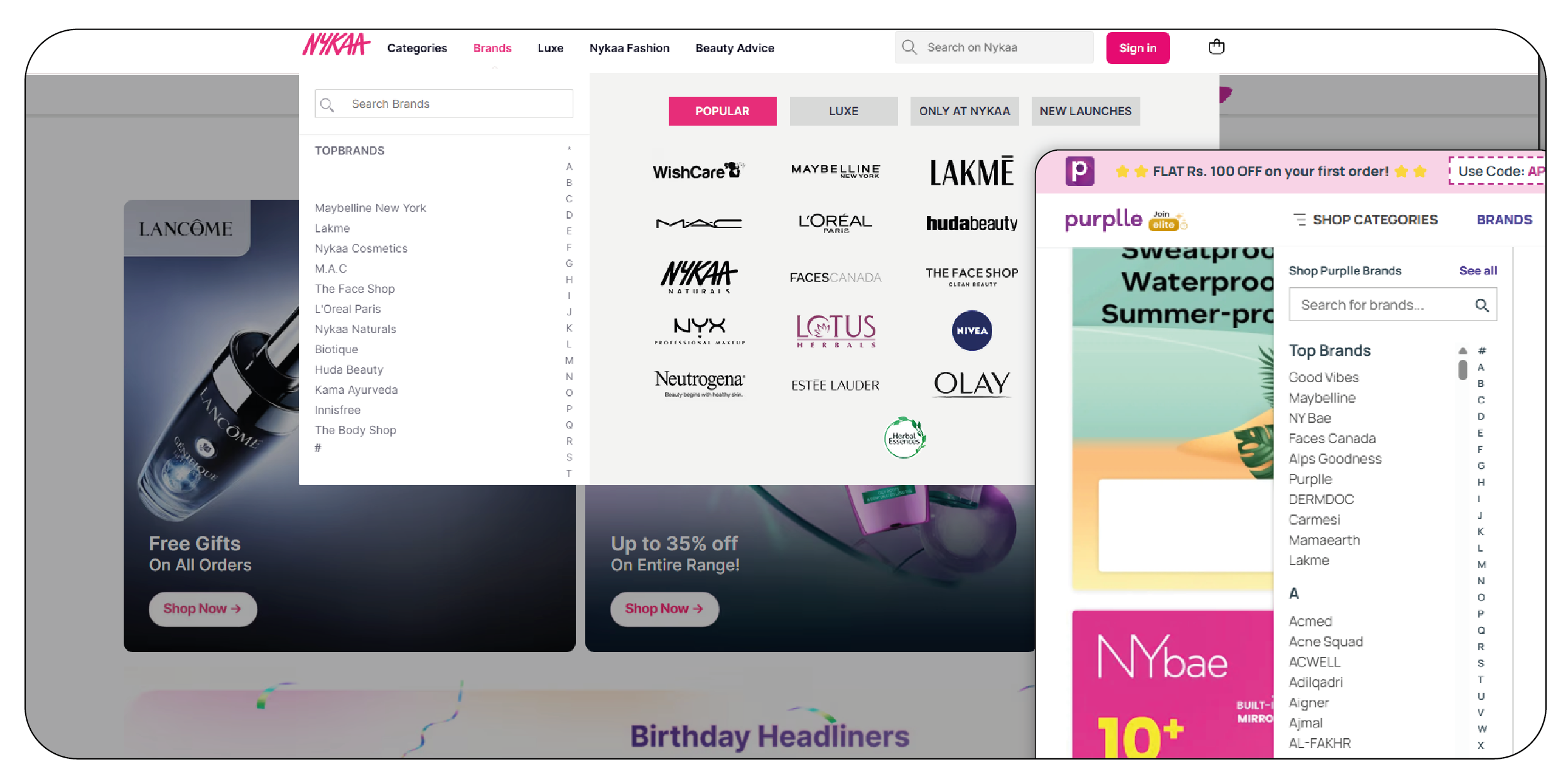

The Indian beauty market is characterized by a blend of traditional preferences

and modern aspirations, with e-commerce platforms bridging the gap between urban and rural

consumers. Nykaa has positioned itself as a premium beauty destination, offering over 2,000

brands, including international names like Huda Beauty and Charlotte Tilbury, alongside its

in-house Nykaa Cosmetics line. Web Scraping Beauty Products from Nykaa & Purplle allows for an

accurate comparison of the diverse offerings available on each platform, helping businesses

understand market trends.

Purplle, with over 1,000 brands, emphasizes budget-friendly options and private

labels like Good Vibes, appealing to cost-conscious buyers. Price is a critical factor

influencing consumer decisions, especially in a market where disposable income varies widely.

Extract Beauty Product Pricing Data from Nykaa and Purplle to identify key pricing trends and

how each platform adapts to consumer demands. Comparing prices on these platforms reveals how

each caters to different economic segments while competing for market share in a rapidly growing

industry. With the right tools, such as a Nykaa and Purplle Product Scraper for Price

Monitoring, businesses can track and analyze real-time price changes to stay competitive.

Methodology Overview

This report is based on an analysis of beauty product prices collected from

Nykaa and Purplle’s websites for products listed in February 2025. The data spans three

categories: skincare (moisturizers and serums), makeup (lipsticks and foundations), and haircare

(shampoos and conditioners). A sample of 20 popular products per category was selected, focusing

on identical or comparable items on both platforms. Extract Nykaa Health & Beauty Data for an

accurate price comparison across categories.

Prices were recorded in Indian Rupees (INR), excluding promotional discounts

unless consistently applied, to ensure a fair comparison. The analysis considers regularly

listed prices, product availability, and brand positioning. For the most precise and up-to-date

data, Web Scraping Nykaa Health & Beauty Data gathers the necessary information. The tables

summarize the findings, comparing average prices and specific product examples.

Comparative Analysis

Pricing Strategies: Nykaa’s pricing reflects its focus on premium and luxury segments. The

platform offers a wide range of high-end brands, which naturally command higher prices, but it

also includes mid-range and drugstore options to appeal to a broader audience. Its average order

value (AOV) is approximately ₹400, indicating a skew toward higher-priced products. Nykaa’s

inventory-led model ensures authenticity, which justifies a slight premium for specific brands.

Frequent sales, such as the Pink Friday Sale, make luxury products more accessible, but regular

prices remain competitive for premium offerings. To gain deeper insights, businesses can Extract

Purplle Health & Beauty Data to analyze Nykaa’s competitive pricing dynamics.

Purplle, conversely, prioritizes affordability, with an AOV of around ₹200. Its pricing strategy

targets price-sensitive consumers, particularly in Tier 2 and 3 cities, where disposable incomes

are lower. Purplle’s private labels, such as Good Vibes and NY Bae, are priced significantly

lower than comparable branded products, enhancing cost-effectiveness. The platform’s bundle

deals and regular price drops further reinforce its value-driven positioning. However, Purplle’s

selection of luxury brands is more limited, reflecting its focus on mass and mid-range markets.

For a comprehensive analysis, Web Scraping Purplle Health & Beauty Data helps track pricing

trends on these budget-friendly offerings.

Skincare Pricing: Skincare is a high-demand category, with moisturizers and serums being top

sellers. Nykaa’s skincare offerings include premium brands like Estée Lauder and Clinique

alongside affordable options like The Ordinary. PURPLLE Product and Review Dataset provides

valuable data for comparing Purplle’s skincare selection, including popular natural beauty

brands like Mamaearth and Plum, which cater to the clean beauty trend at lower price points.

Meanwhile, the NYKAA Product and Review Dataset offers a robust analysis of high-end skincare

options for more discerning consumers.

Table 1: Skincare Price Comparison (Average Prices in INR)

| Product Type |

Nykaa (INR) |

Purplle (INR) |

Price Difference (%) |

| Moisturizers |

1,250 |

850 |

32% (Nykaa higher) |

| Serums |

2,100 |

1,400 |

33% (Nykaa higher) |

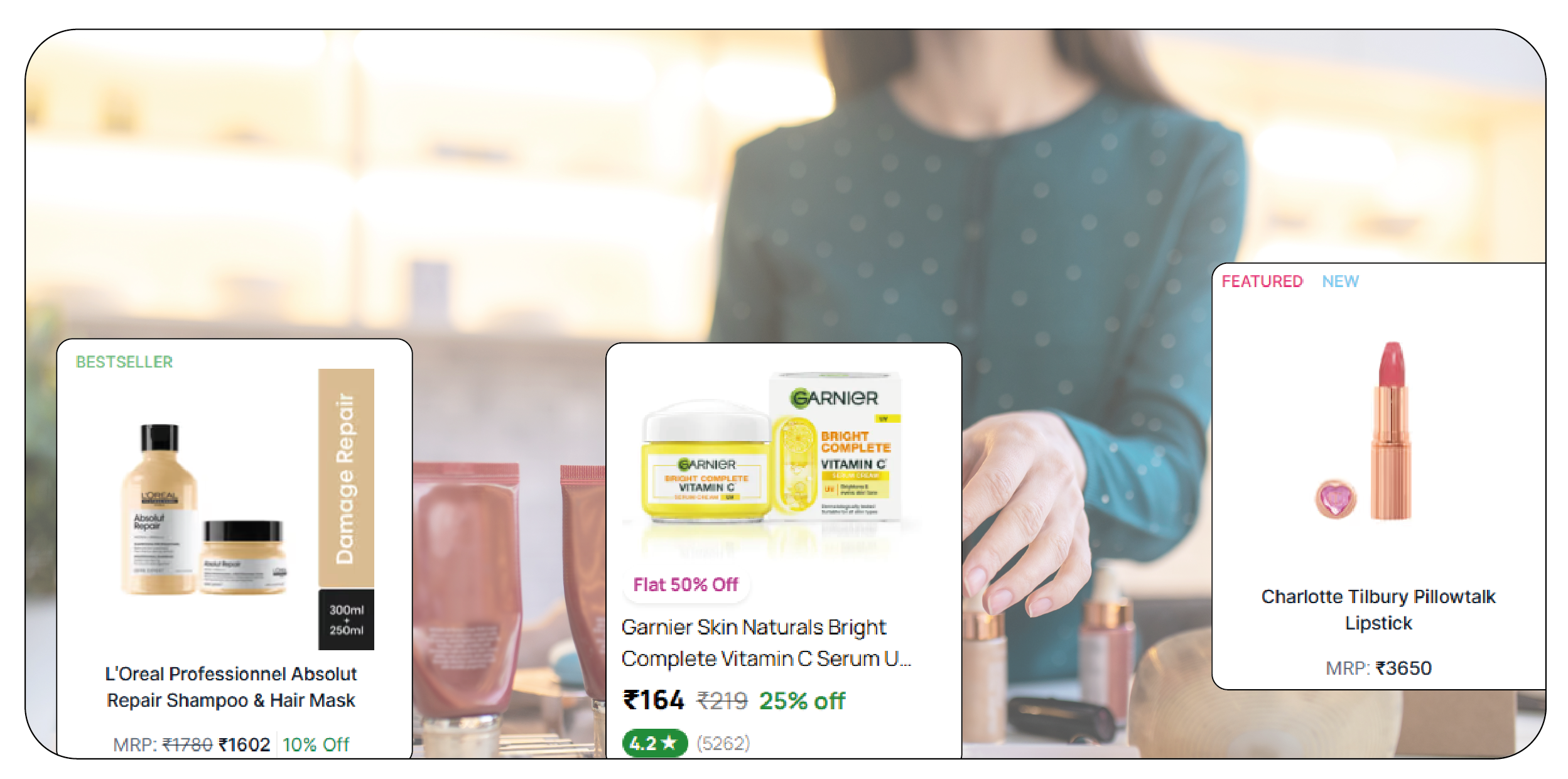

Nykaa’s moisturizers, such as the Clinique Moisture Surge (₹2,950 for 50ml), are priced higher

than Purplle’s equivalents, like the Mamaearth Vitamin C Moisturizer (₹599 for 80ml). For

serums, Nykaa’s The Ordinary Hyaluronic Acid 2% + B5 (₹1,650 for 30ml) contrasts with Purplle’s

Minimalist 2% Hyaluronic Acid (₹599 for 30ml). Nykaa’s higher prices reflect its premium brand

portfolio, while Purplle’s affordability appeals to budget-conscious shoppers seeking functional

products.

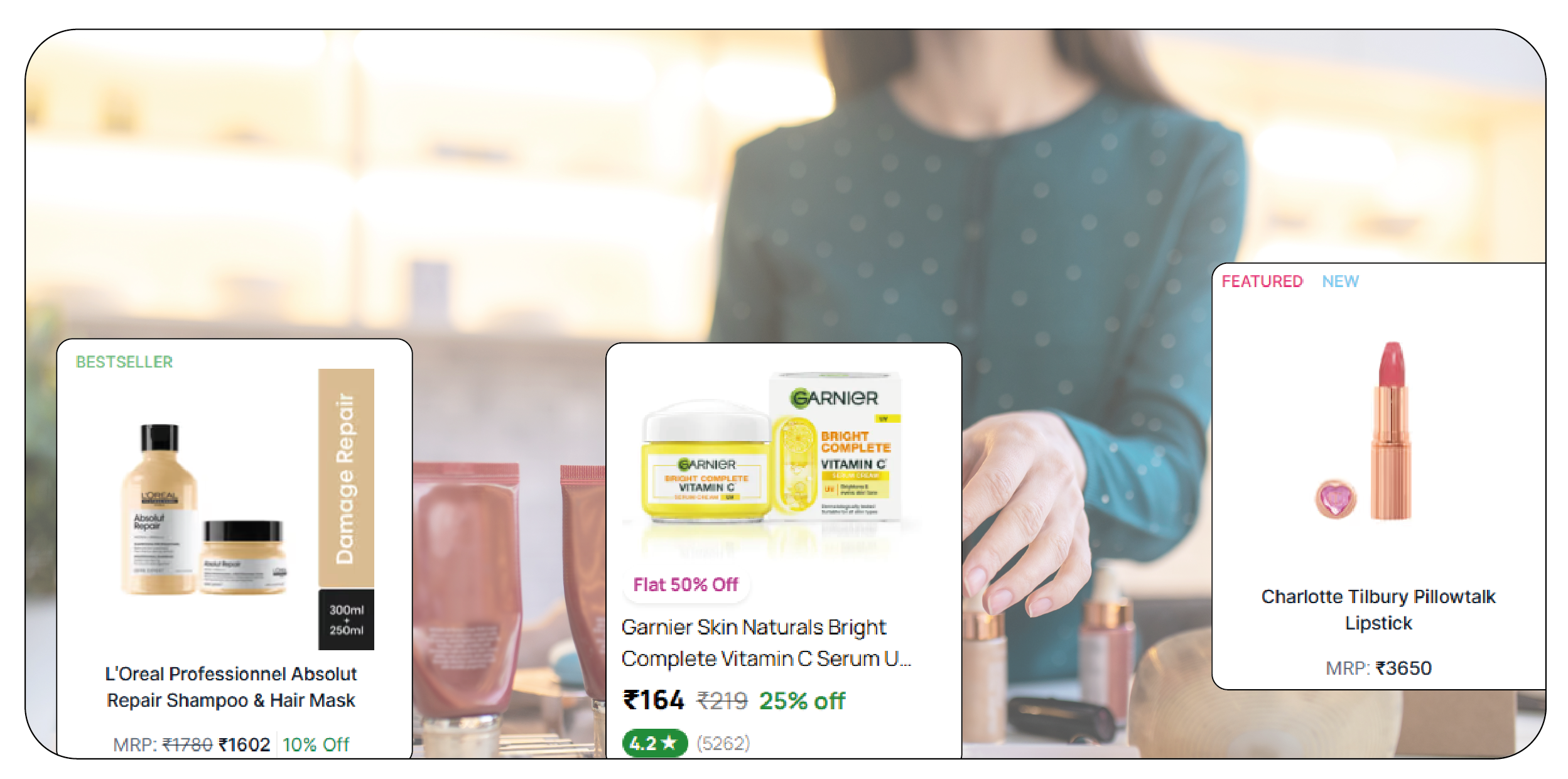

Makeup Pricing

Makeup, particularly lipsticks and foundations, drives significant revenue for both platforms.

Nykaa dominates in luxury makeup, offering brands like MAC and Fenty Beauty, while Purplle

excels in affordable options like Maybelline and Lakmé.

Table 2: Makeup and Haircare Price Comparison (Sample Products in INR)

| Product |

Nykaa (INR) |

Purplle (INR) |

Price Difference (%) |

| Maybelline Superstay Lipstick |

599 |

549 |

8% (Nykaa higher) |

| L’Oréal True Match Foundation |

999 |

899 |

11% (Nykaa higher) |

| L’Oréal Elvive Shampoo (400ml) |

499 |

449 |

11% (Nykaa higher) |

| Tresemmé Conditioner (190ml) |

299 |

279 |

7% (Nykaa higher) |

For lipsticks, Nykaa’s MAC Retro Matte (₹2,100 for 3g) is pricier than

Purplle’s NY Bae Liquid Lipstick (₹249 for 3ml). Foundations follow a similar trend, with

Nykaa’s Estée Lauder Double Wear (₹4,100 for 30ml) contrasting Purplle’s Lakmé Absolute (₹750

for 30ml). Purplle’s lower prices cater to younger consumers experimenting with makeup, while

Nykaa targets those seeking premium finishes.

Haircare Pricing: Haircare products like shampoos and

conditioners appeal to a broad audience. Nykaa’s haircare range includes high-end options like

Moroccanoil, while Purplle focuses on brands like Tresemmé and Wow Skin Science. As shown in

Table 2, Nykaa’s prices are consistently higher, though the gap narrows for mass-market brands.

For instance, Nykaa’s Moroccanoil Shampoo (₹2,250 for 250ml) far exceeds Purplle’s Wow Skin

Science Onion Shampoo (₹499 for 300ml). Purplle’s focus on natural and sulfate-free options at

lower prices resonates with health-conscious buyers.

Consumer Implications: Nykaa’s higher prices align with its

brand image as a curator of luxury and authenticity, appealing to urban consumers with higher

purchasing power. Its loyalty program, Nykaa Prive, offers perks like free shipping and

exclusive discounts, adding value for frequent shoppers. However, its premium focus may alienate

price-sensitive consumers in smaller cities.

Purplle’s affordability makes it a preferred choice for Tier 2 and 3 city

residents, where e-commerce penetration is growing. The Purplle Elite program provides free

shipping and loyalty points, enhancing its appeal for budget shoppers. However, its limited

luxury offerings may deter consumers from seeking high-end brands.

Competitive Positioning: Nykaa’s strength lies in its

omnichannel presence, with over 200 offline stores complementing its online platform. This

allows it to build brand trust and cater to consumers who prefer in-store experiences. Its

extensive inventory and exclusive partnerships with global brands give it a competitive edge in

the premium segment. However, competitors like Reliance’s Tira and quick-commerce platforms like

Blinkit challenge its dominance by offering faster delivery and deeper discounts. Nykaa can

benefit from Ecommerce Data Scraping Services by staying ahead by monitoring market trends and

competitor strategies.

Purplle’s competitive advantage is its focus on affordability and regional expansion. Targeting

underserved markets and leveraging private labels captures a growing segment of value-conscious

consumers. Its recent ₹1,500 crore funding round signals ambitions for further growth,

potentially including an IPO by 2026. Yet, its reliance on budget brands limits its appeal to

luxury shoppers. To enhance its market analysis, Purplle could Extract Popular E-Commerce

Website Data to gain valuable insights into pricing trends and consumer preferences across

different segments.

Conclusion

The price comparison reveals distinct strategies: Nykaa caters to aspirational and premium consumers with higher prices and a diverse brand portfolio. Purplle targets budget-conscious buyers with affordable options and private labels. Skincare and makeup prices on Nykaa are 7-33% higher than Purplle’s, reflecting its luxury focus, though the gap narrows for mass-market haircare products. To further analyze this pricing trend, leveraging an Ecommerce Product & Review Dataset can provide insights into product performance across various categories.

Both platforms serve critical roles in India’s beauty market, with Nykaa dominating urban and premium segments and Purplle excelling in affordability and regional reach. Web Scraping E-commerce Websites allow for real-time tracking of their pricing dynamics, providing a clear picture of how both platforms are evolving in response to market pressures. Consumers benefit from this competition, accessing diverse products tailored to their budgets and preferences. Future growth will depend on how each platform balances price, quality, and accessibility in an increasingly crowded market. The ability to Extract E-commerce Data will be crucial for understanding consumer trends and making data-driven decisions in the industry.

At Product Data Scrape, we strongly emphasize ethical

practices across all our services, including Competitor Price Monitoring and Mobile App Data

Scraping. Our commitment to transparency and integrity is at the heart of everything we do. With

a global presence and a focus on personalized solutions, we aim to exceed client expectations

and drive success in data analytics. Our dedication to ethical principles ensures that our

operations are both responsible and effective.