Introduction

India’s social commerce boom has made Meesho one of the fastest-growing marketplaces for budget-friendly and trend-driven products. For brands, sellers, and analysts, staying ahead now depends on data—not guesswork. This is why businesses increasingly rely on Scraping fast-selling categories From Meesho to understand which products gain traction, how demand shifts across regions, and what niches deliver the highest returns. Alongside this, access to a reliable Meesho E-commerce Product Dataset enables companies to build smarter strategies based on historical and real-time insights. Instead of reacting late to trends, decision-makers can now anticipate consumer behavior, optimize inventory, and launch products aligned with real demand. In 2026, success on Meesho is no longer about listing more products—it’s about listing the right products at the right time, powered by data intelligence.

Turning Category Trends into Business Intelligence

Brands today use Tracking fast-selling categories on Meesho using scraped data to convert raw listings into strategic market insights. By monitoring category-wise sales velocity, price ranges, and customer ratings, businesses can identify which segments deserve higher investment.

Between 2020 and 2026, Meesho’s fastest-growing categories shifted from basic apparel to home décor, beauty essentials, and budget electronics—reflecting changing consumer priorities.

Growth in top-performing categories (2020–2026):

| Year |

Fashion (%) |

Home & Living (%) |

Beauty (%) |

Electronics (%) |

| 2020 |

45% |

22% |

18% |

15% |

| 2022 |

41% |

27% |

20% |

12% |

| 2024 |

38% |

31% |

22% |

9% |

| 2026 |

34% |

35% |

24% |

7% |

With this level of visibility, brands no longer rely on intuition. They know which categories peak seasonally, which decline, and which are emerging. Scraped data helps sellers decide when to enter a niche, how to price competitively, and which products deserve promotional budgets—transforming category tracking into a powerful growth engine.

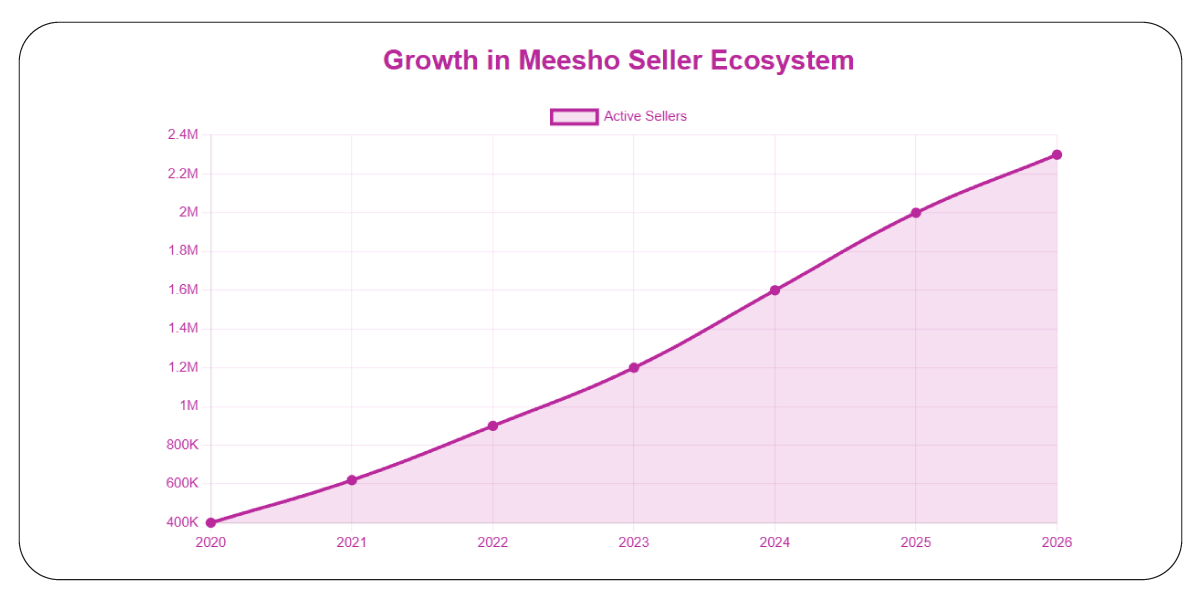

Understanding Seller Dynamics for Smarter Expansion

In addition to product trends, analyzing seller behavior is equally critical. Many brands now focus on Scraping Meesho Seller Data to understand market saturation, competition levels, and fulfillment performance. This allows businesses to identify underserved niches and regions where competition is still low.

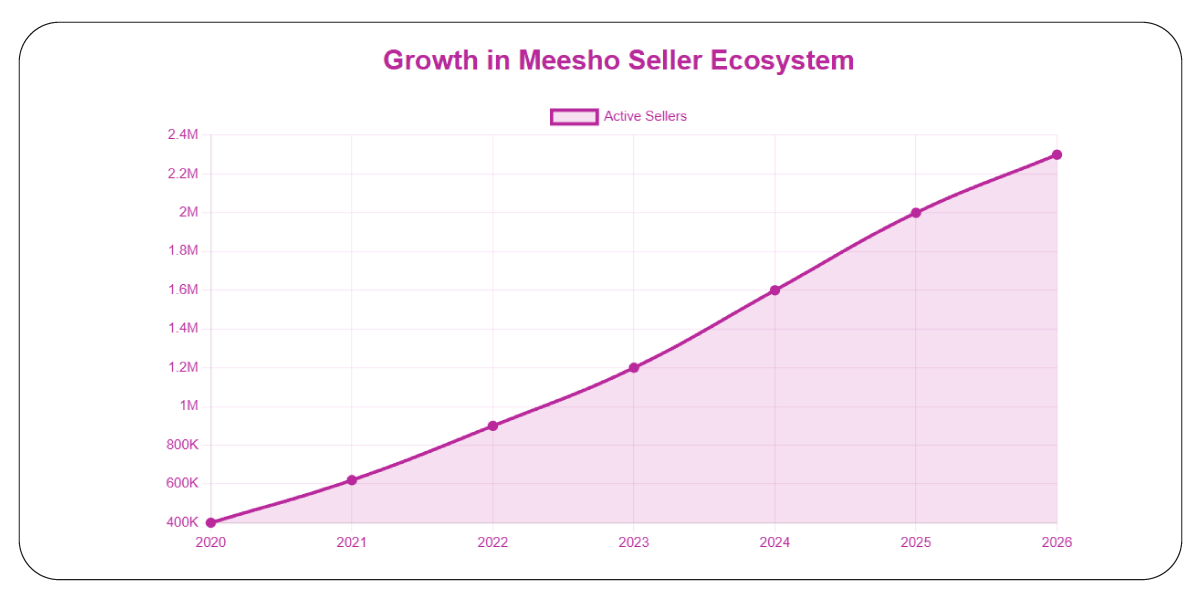

From 2020 to 2026, the number of active sellers on Meesho grew nearly fourfold, making seller intelligence a key differentiator for success.

Growth in Meesho seller ecosystem:

| Year |

Active Sellers |

| 2020 |

400,000 |

| 2021 |

620,000 |

| 2022 |

900,000 |

| 2023 |

1.2M |

| 2024 |

1.6M |

| 2025 |

2.0M |

| 2026 |

2.3M |

By analyzing seller ratings, delivery speed, and pricing strategies, brands can benchmark their own performance and find opportunities to outperform competitors. This intelligence supports expansion planning—helping sellers decide where to invest, which products to scale, and how to differentiate in crowded categories.

Building Data-Driven Category Playbooks

With the rise of analytics-first strategies, many enterprises rely on popular and fast-selling categories on Meesho Datasets to create long-term growth playbooks. These datasets provide historical sales trends, product performance metrics, and customer engagement patterns across years.

From 2020 to 2026, companies using category-level datasets improved product launch success rates by over 35%. Instead of trial-and-error launches, brands test demand virtually before investing in inventory.

Impact of category datasets on product success:

| Year |

Launch Success Rate (%) |

| 2020 |

48% |

| 2021 |

52% |

| 2022 |

57% |

| 2023 |

63% |

| 2024 |

69% |

| 2025 |

73% |

| 2026 |

78% |

These datasets also support forecasting—helping businesses predict which categories will peak during festive seasons and which will slow down. The result is optimized stock planning, reduced dead inventory, and higher return on investment for every product launch.

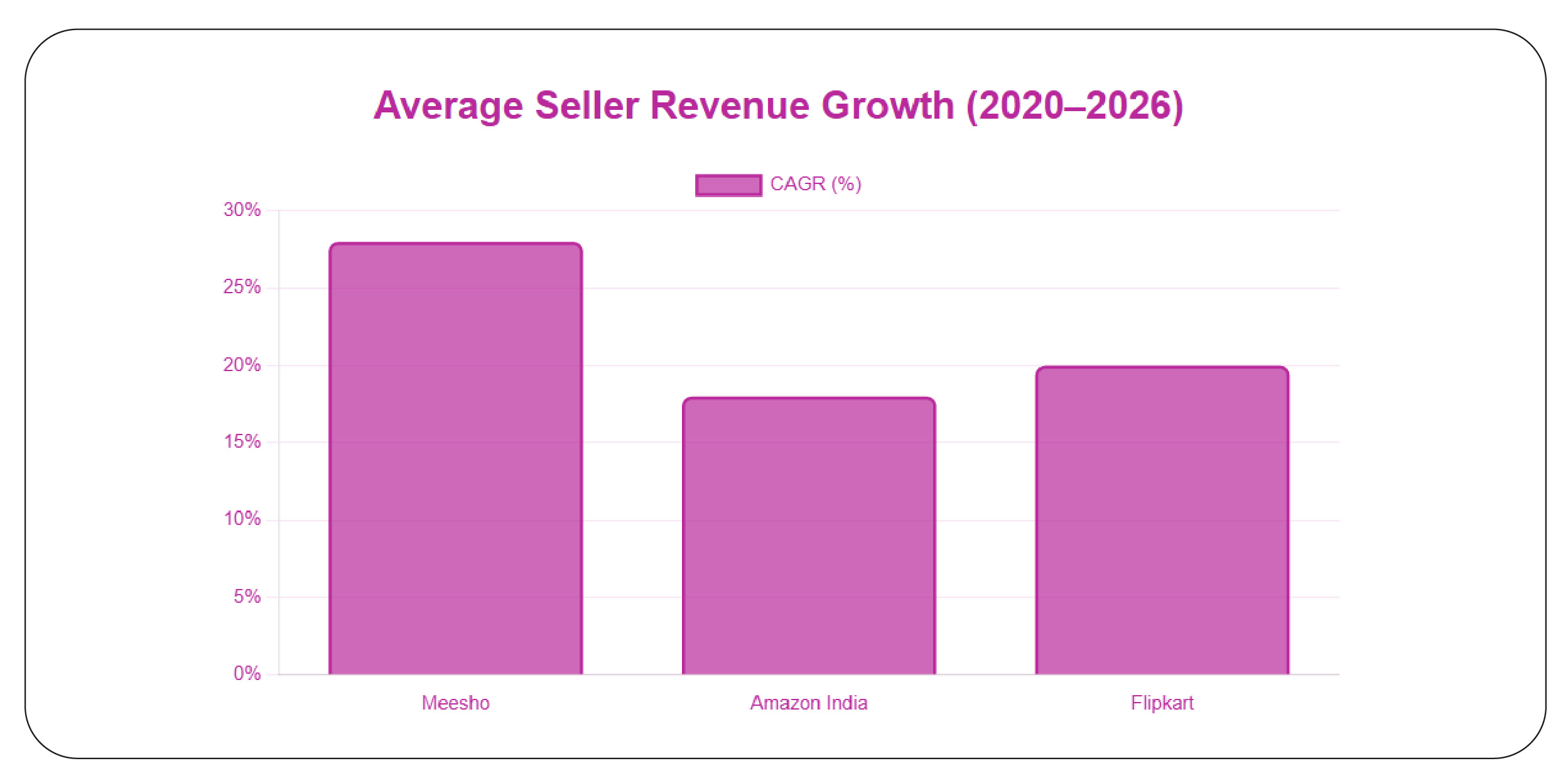

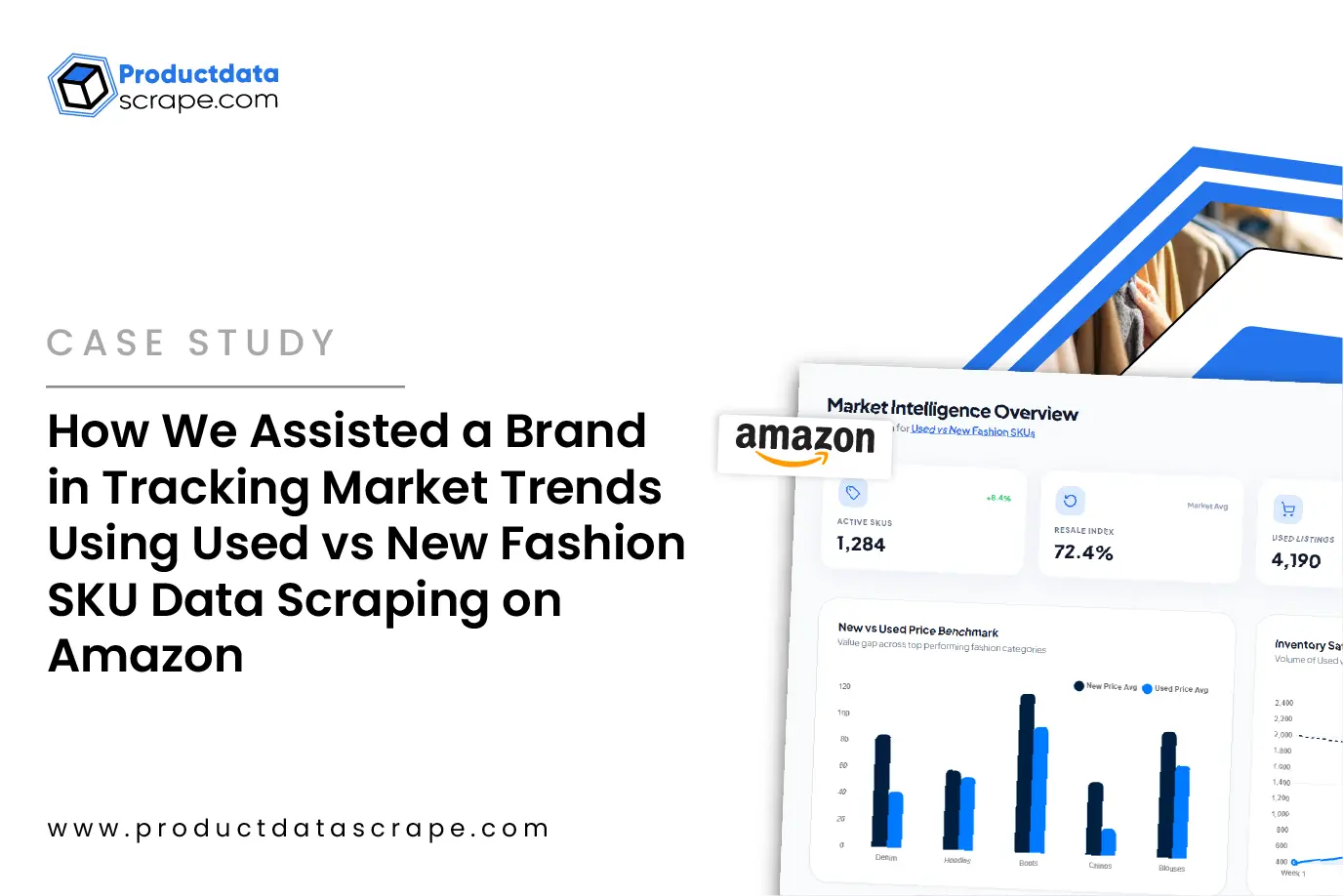

Why Meesho Sellers Are Winning the Growth Race

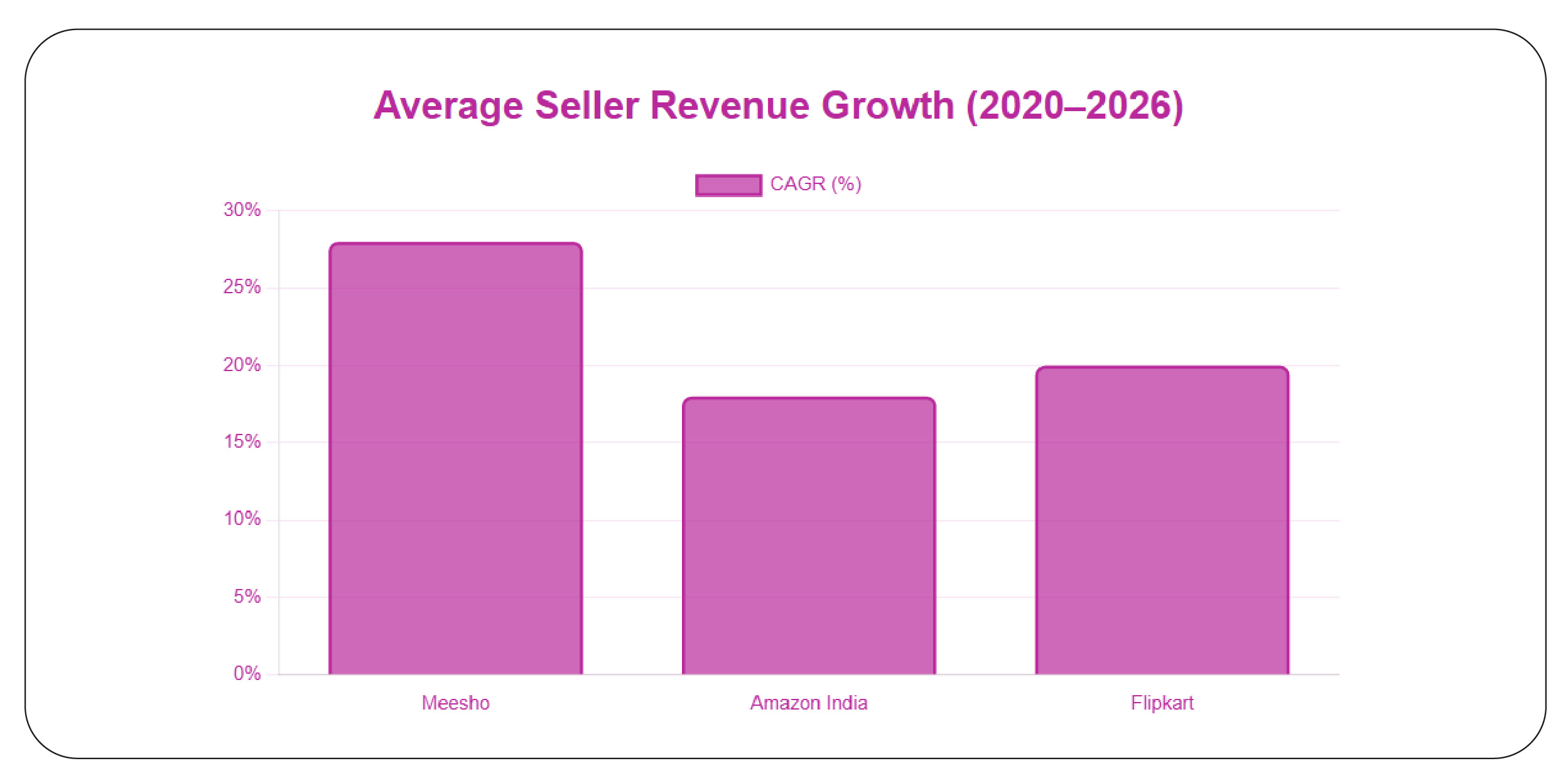

A notable trend shaping Indian eCommerce is that Meesho Sellers Are Growing Faster Than Amazon Sellers in several budget-focused segments. This growth is driven by Meesho’s social commerce model, low entry barriers, and strong penetration in Tier 2 and Tier 3 cities.

Between 2020 and 2026, Meesho seller revenue growth outpaced Amazon India in categories like women’s apparel, kitchenware, and accessories.

Average seller revenue growth (2020–2026):

| Platform |

CAGR (%) |

| Meesho |

28% |

| Amazon India |

18% |

| Flipkart |

20% |

This shift has made Meesho a priority platform for emerging brands and D2C sellers. Data-driven category insights further amplify this advantage—helping sellers position themselves in fast-moving niches while avoiding overcrowded segments. For growth-focused brands, Meesho is no longer just an alternative marketplace—it’s a primary channel for scalable expansion.

Automating Market Intelligence with APIs

As data volumes grow, automation becomes essential. Businesses increasingly adopt the Meesho eCommerce Website Data Extraction API to streamline access to product listings, prices, and category performance metrics.

From 2020 to 2026, brands using automated extraction reduced manual data collection costs by more than 60%, while improving update frequency from weekly to real time.

Efficiency gains from API-driven data access:

| Year |

Manual Tracking (hrs/week) |

API Automation (hrs/week) |

| 2020 |

15 |

8 |

| 2022 |

14 |

6 |

| 2024 |

13 |

5 |

| 2026 |

12 |

4 |

With automation in place, teams can focus on insights instead of operations—testing new pricing strategies, monitoring category shifts, and launching products faster than competitors.

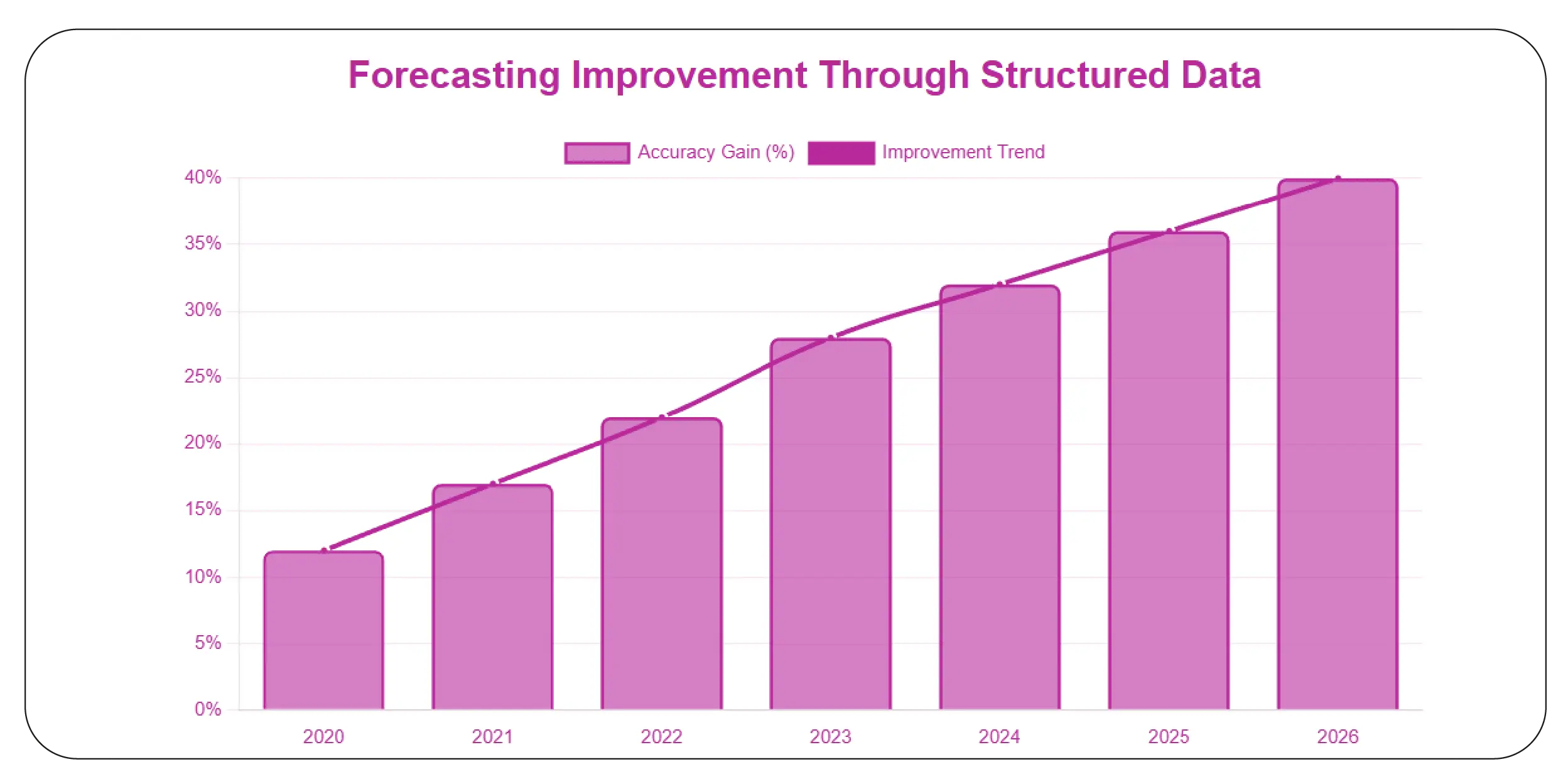

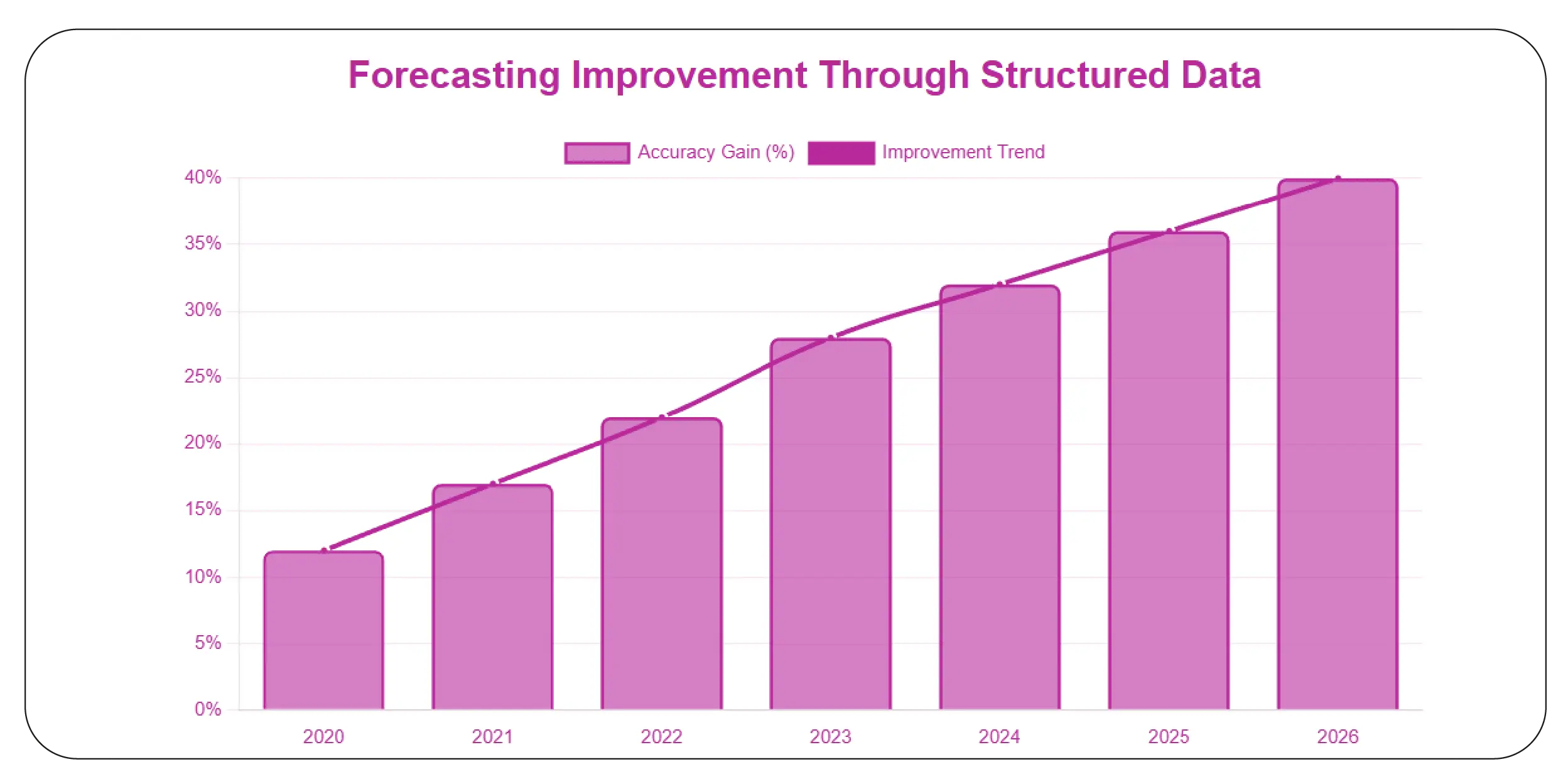

From Raw Data to Strategic Advantage

The real power of scraping lies in the ability to extract structured data for in-depth analysis. Clean, organized datasets enable advanced use cases such as demand forecasting, competitor benchmarking, and customer sentiment analysis.

Between 2020 and 2026, brands using structured data pipelines improved forecasting accuracy by nearly 40%, enabling better alignment between sales, marketing, and supply chain teams.

Forecasting improvement through structured data:

| Year |

Accuracy Gain (%) |

| 2020 |

12% |

| 2021 |

17% |

| 2022 |

22% |

| 2023 |

28% |

| 2024 |

32% |

| 2025 |

36% |

| 2026 |

40% |

This transformation turns scraping from a tactical tool into a strategic capability—helping organizations build sustainable, data-driven growth models.

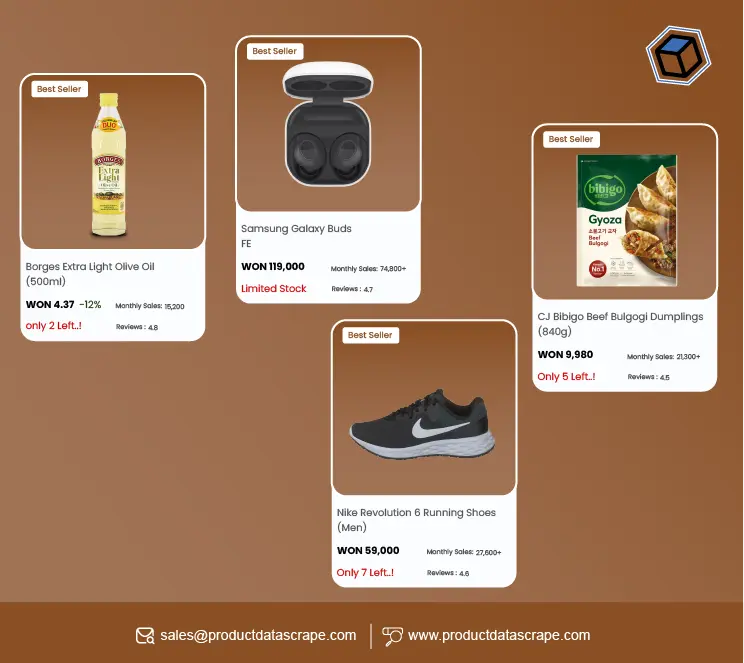

Why Choose Product Data Scrape?

At Product Data Scrape, we specialize in delivering scalable, reliable solutions powered by the Meesho Product Data Scraping API. Our technology ensures high-frequency data collection, structured outputs, and seamless integration with your analytics systems. From tracking category trends to monitoring seller performance, we provide end-to-end intelligence that helps brands move faster, smarter, and more confidently in the competitive Meesho ecosystem.

Conclusion

In 2026, winning on Meesho is about acting on insights before trends peak. Brands that invest in real time meesho trending data scraping gain the agility to identify fast-selling categories, enter high-demand niches early, and capitalize on sales opportunities as they emerge. With accurate, structured, and automated data, businesses no longer chase the market—they lead it.

Ready to unlock smarter growth on Meesho? Partner with us today and turn real-time category intelligence into your competitive advantage!

FAQs

1. How does scraping help identify fast-selling categories on Meesho?

Scraping collects live data on product rankings, prices, and reviews, helping brands spot demand surges early and align inventory with trending categories.

2. Is Meesho data useful for long-term business planning?

Yes, historical Meesho data reveals seasonal patterns and growth trends, enabling smarter forecasting and category expansion strategies.

3. Can small sellers benefit from data scraping?

Absolutely. Even small sellers can use scraped insights to choose profitable niches and compete effectively with larger brands.

4. How often should Meesho data be updated?

For best results, updates should happen daily or in real time to capture fast-changing trends and competitive movements.

5. Why should businesses choose Product Data Scrape for Meesho insights?

Product Data Scrape delivers reliable, scalable data solutions that help brands turn Meesho marketplace intelligence into actionable growth strategies.

.webp)