Introduction

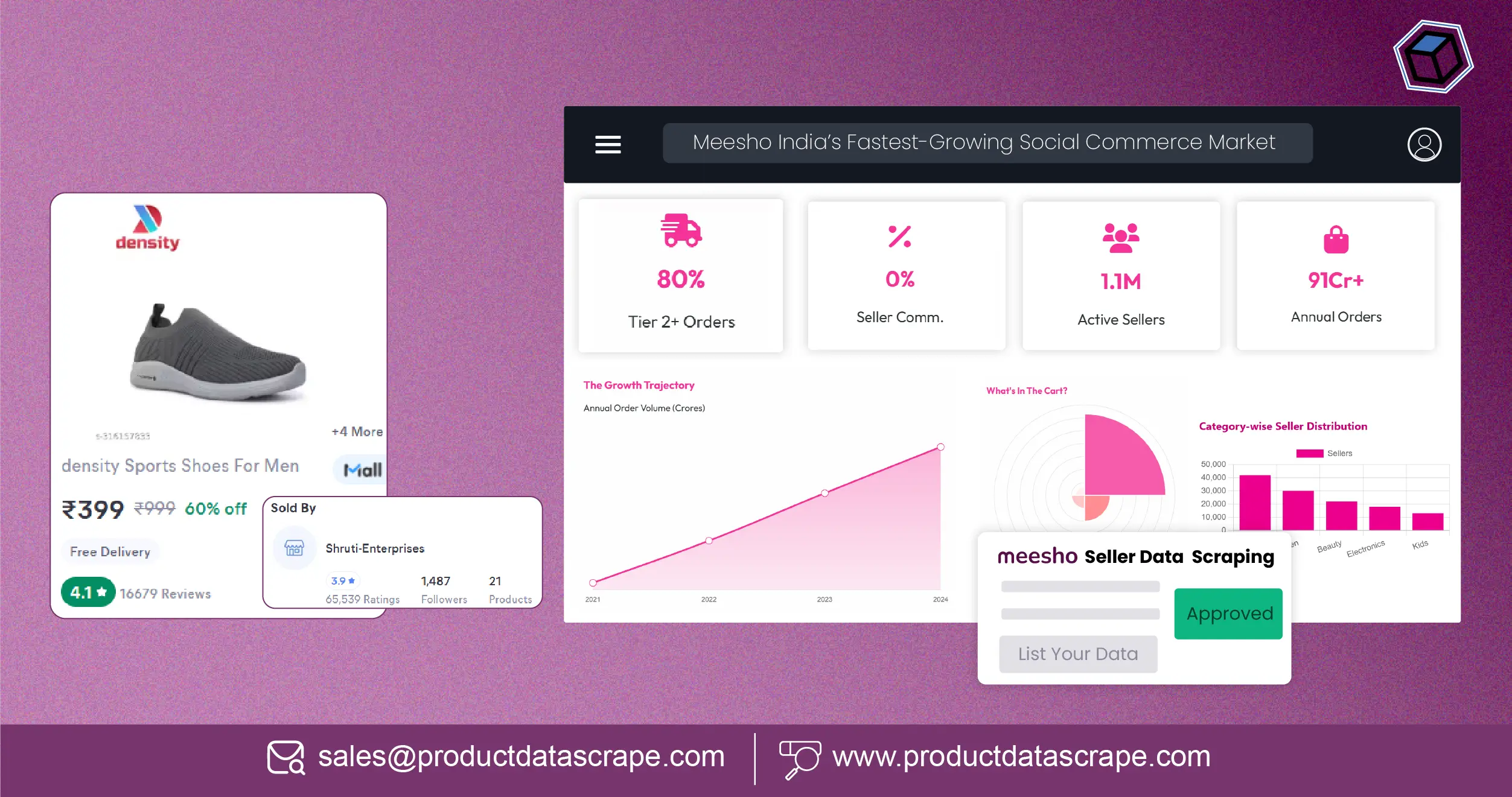

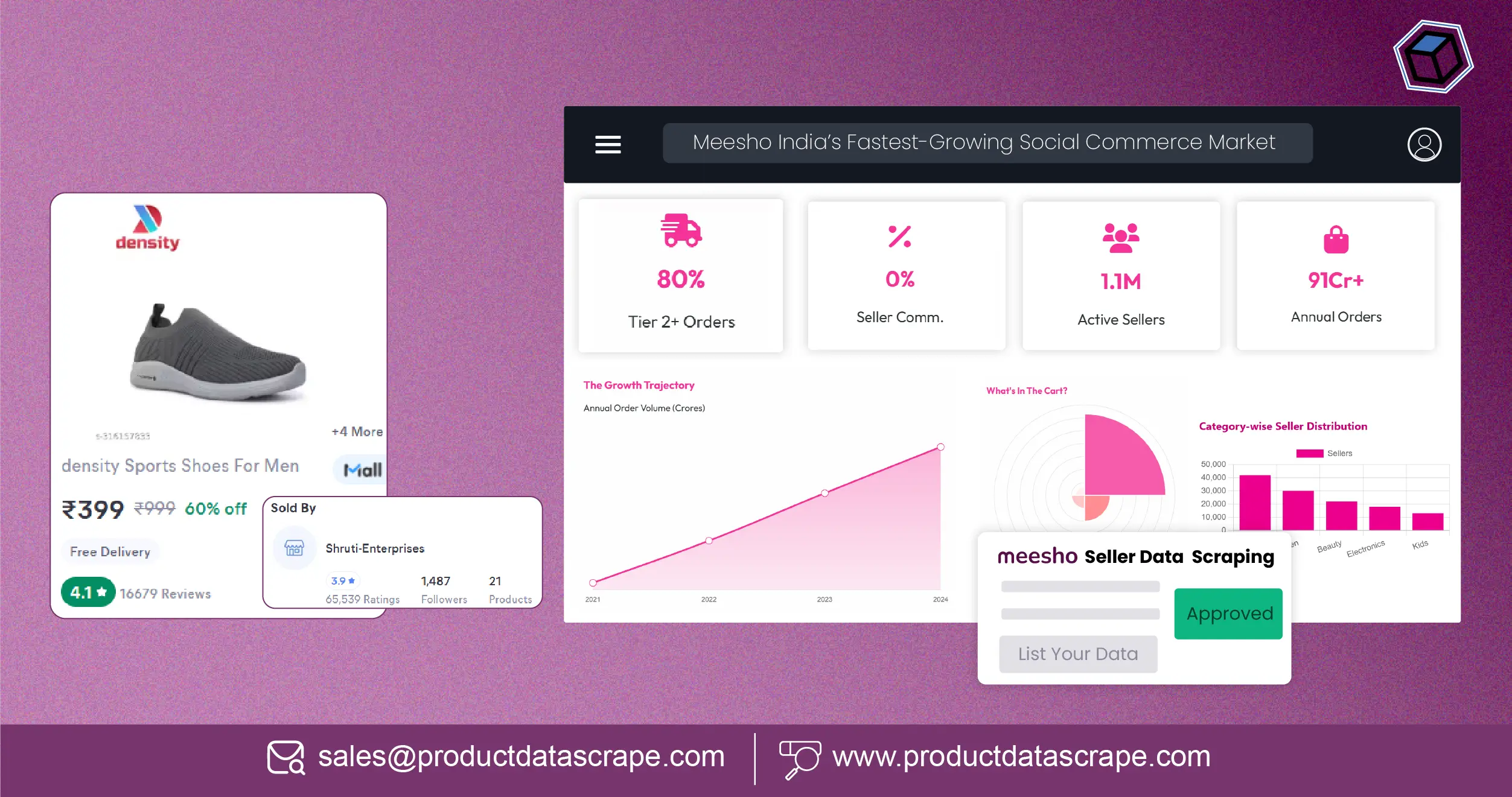

India’s social commerce ecosystem has witnessed explosive growth over the last five years, with Meesho emerging as one of the most influential platforms for small sellers and resellers. Through Scraping Meesho Seller Data, businesses can gain granular visibility into seller activity, pricing trends, catalog expansion, and regional demand patterns. From 2020 to 2025, Meesho’s seller base expanded from under 1 million to over 15 million active sellers, while listed products crossed 100 million SKUs across categories like fashion, home décor, electronics, and lifestyle. By using Extract Meesho E-Commerce Product Data, brands and analysts can track how average product prices declined by nearly 18% while order volumes grew annually at over 40%. These insights enable smarter pricing strategies, inventory forecasting, and competitive benchmarking in a market driven by affordability and reach. Data-driven intelligence has become essential to understand seller behavior, category saturation, and performance metrics within India’s rapidly evolving social commerce landscape.

Understanding Seller Growth and Catalog Expansion Trends

Between 2020 and 2025, Meesho experienced exponential seller onboarding, especially from Tier 2 and Tier 3 cities. In 2020, approximately 35% of sellers originated from non-metro regions; by 2025, this figure exceeded 65%. By Scrape Meesho seller product listings Data, businesses can analyze how seller catalogs expanded from an average of 25 products per seller in 2020 to nearly 140 products in 2025. Apparel and fashion accessories dominated listings with nearly 42% share, followed by home & kitchen at 27%. Average product pricing dropped from ₹520 in 2020 to ₹425 in 2025, reflecting aggressive price competition. Seller churn also reduced significantly, indicating platform maturity. Seasonal spikes around festivals increased listing volumes by nearly 30% year-over-year. These listing-level insights allow brands to identify fast-growing categories, track saturation points, and optimize their own catalog strategies in alignment with Meesho’s seller ecosystem evolution.

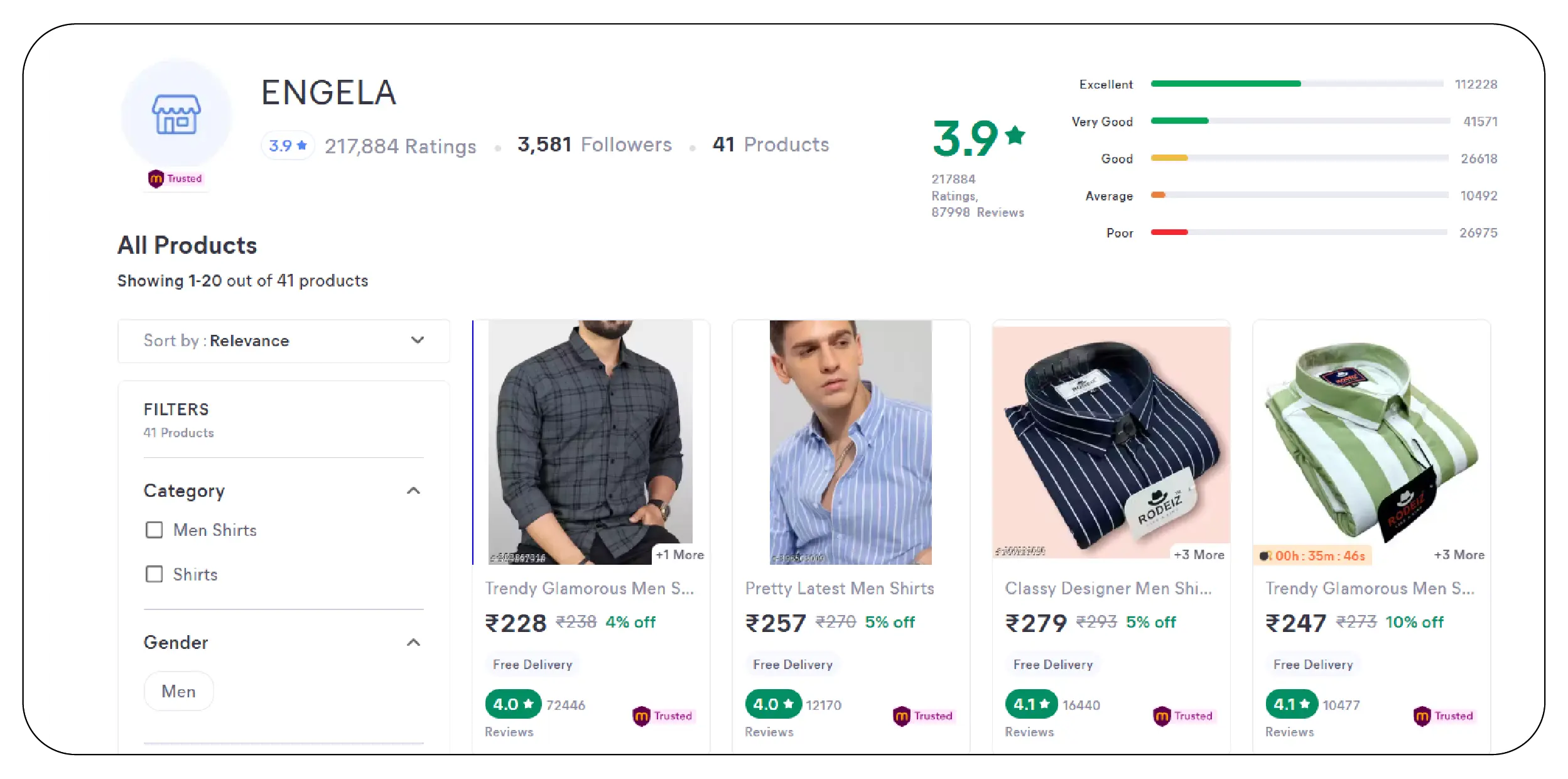

Tracking Price Dynamics and Automation Trends

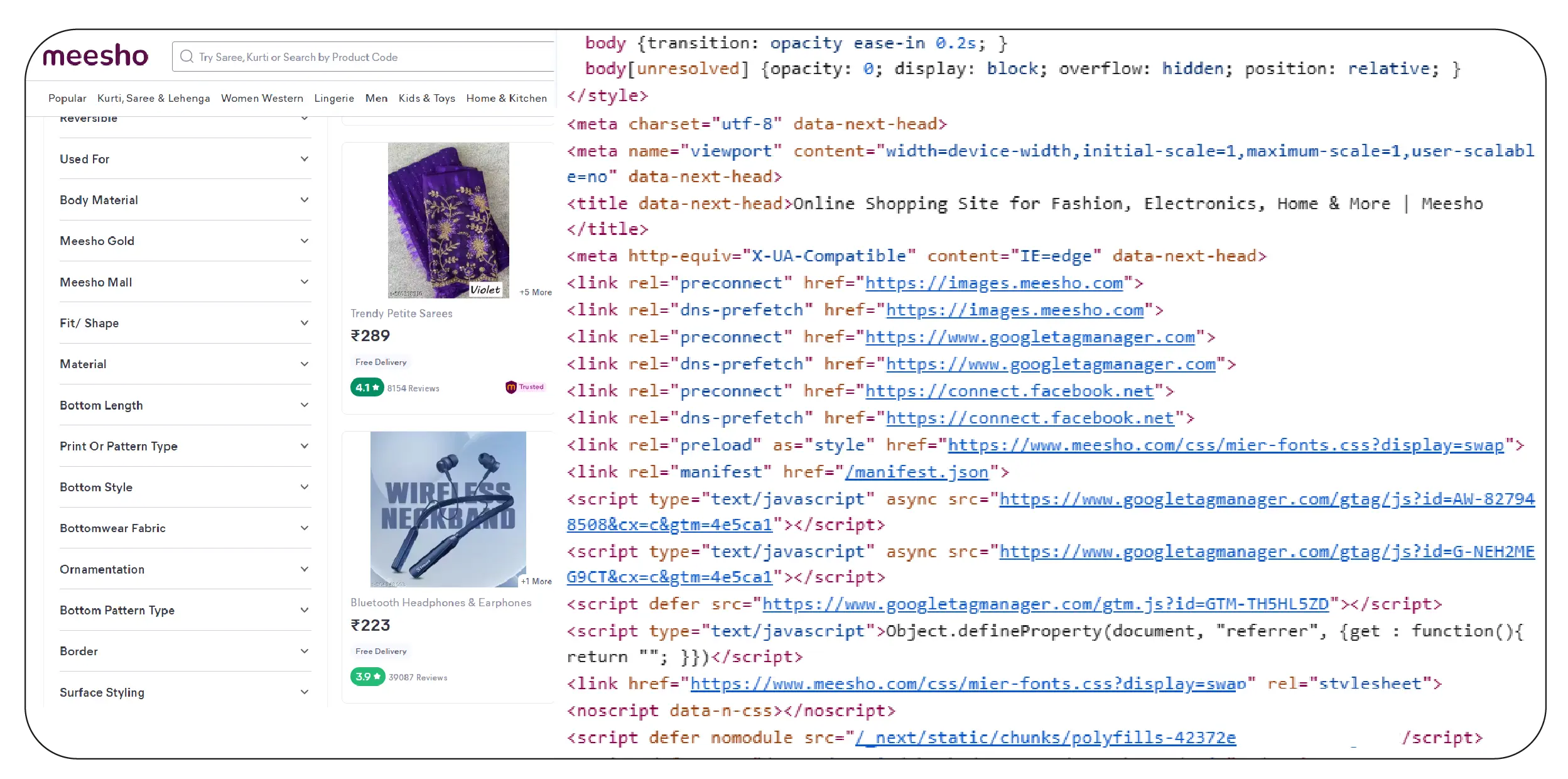

As Meesho scaled rapidly, pricing dynamics became increasingly volatile. From 2020 to 2025, daily price changes across popular SKUs increased by 3.5x, making manual tracking impossible. Using Scraping Meesho Product Data Using Python, analysts can automate extraction of price histories, discount patterns, and stock fluctuations. Data shows that flash discounts during sales events increased average conversion rates by 22%, while sellers who optimized pricing weekly saw 18% higher order volumes. Python-based scraping pipelines enabled structured tracking of over 500,000 price points daily across categories. Additionally, average discount depth rose from 12% in 2020 to nearly 28% in 2025. These insights help brands predict promotional behavior, understand competitive pricing elasticity, and optimize margins in a highly price-sensitive marketplace.

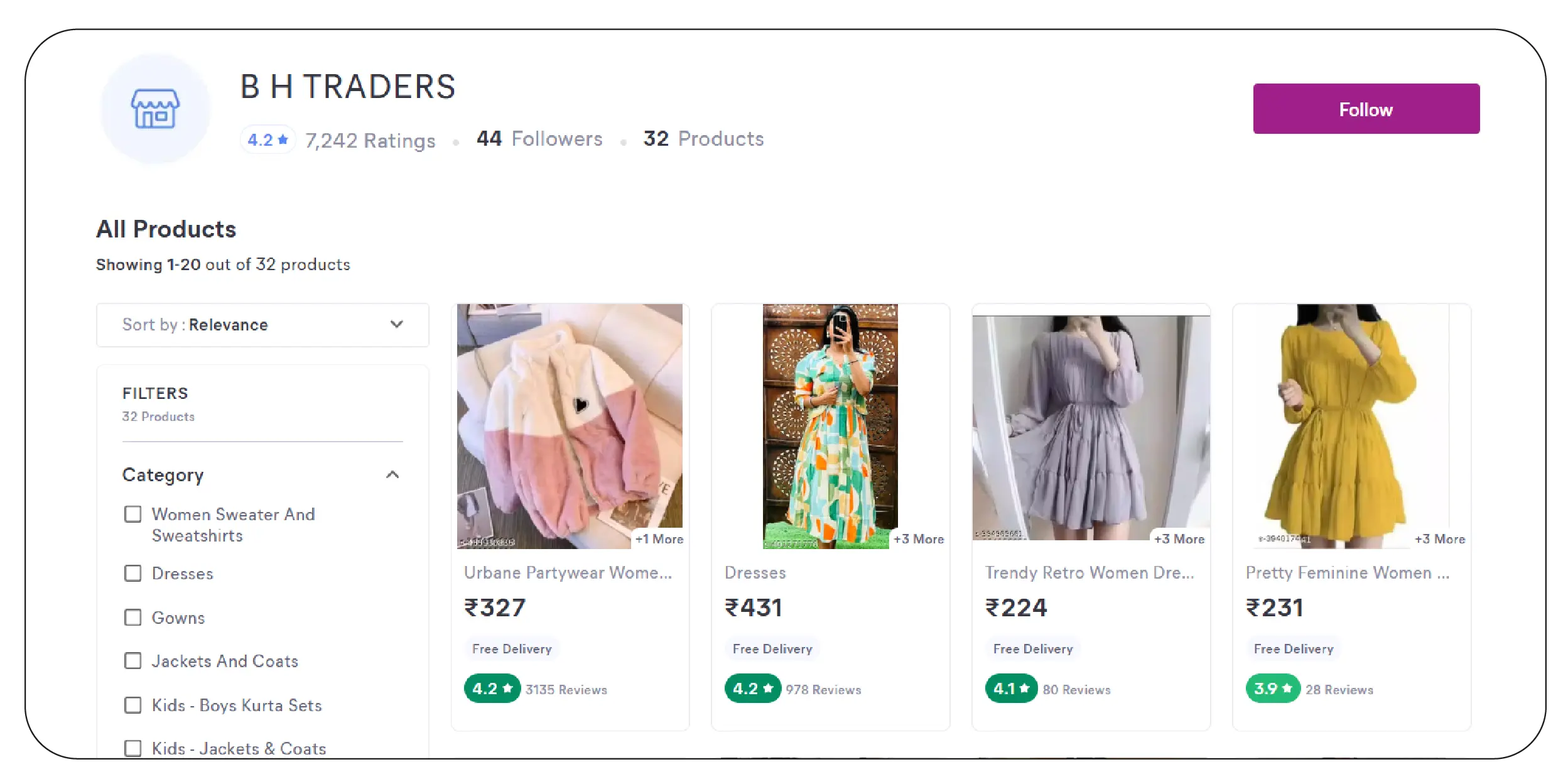

Seller Profiling and Market Penetration Insights

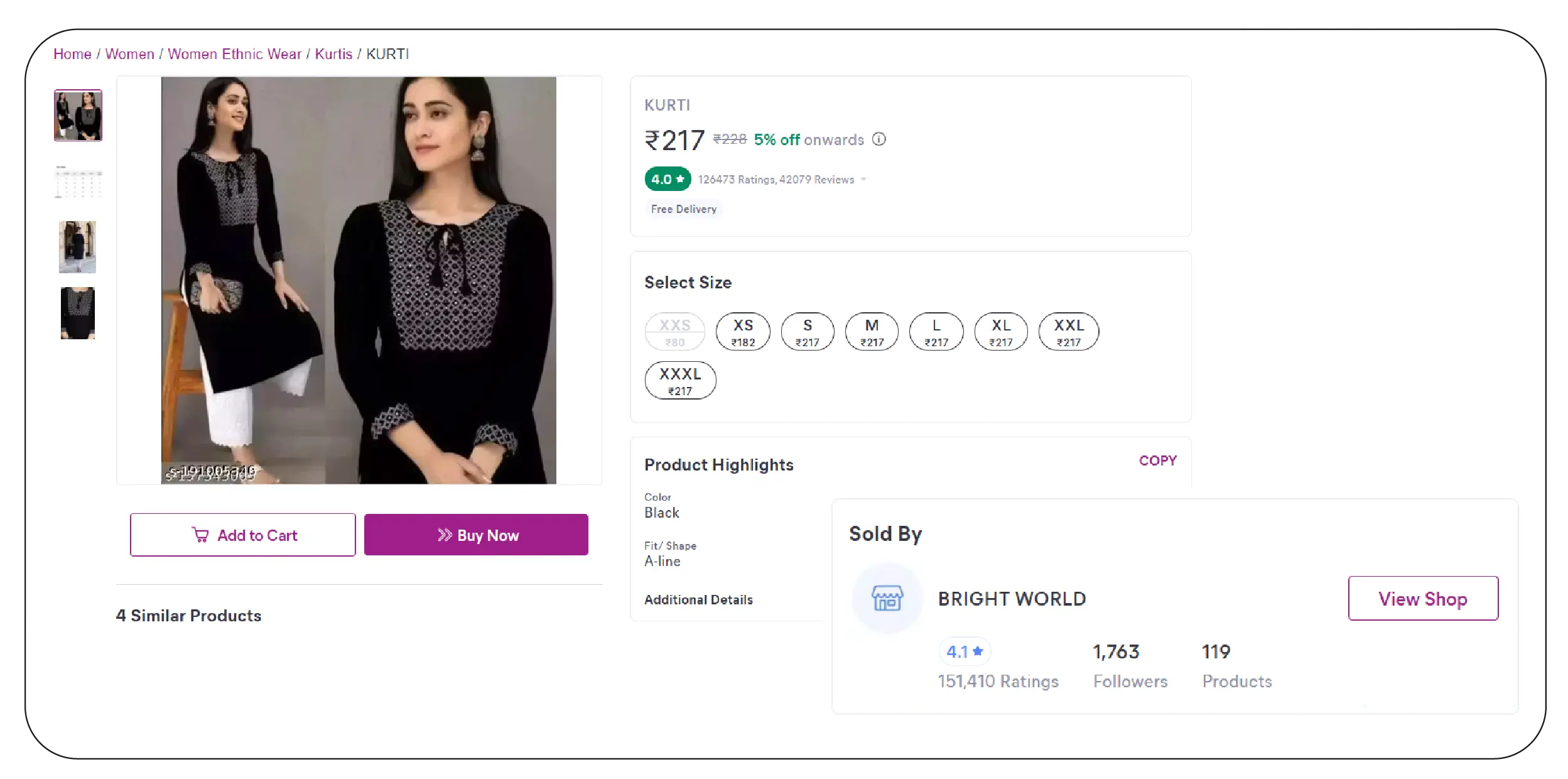

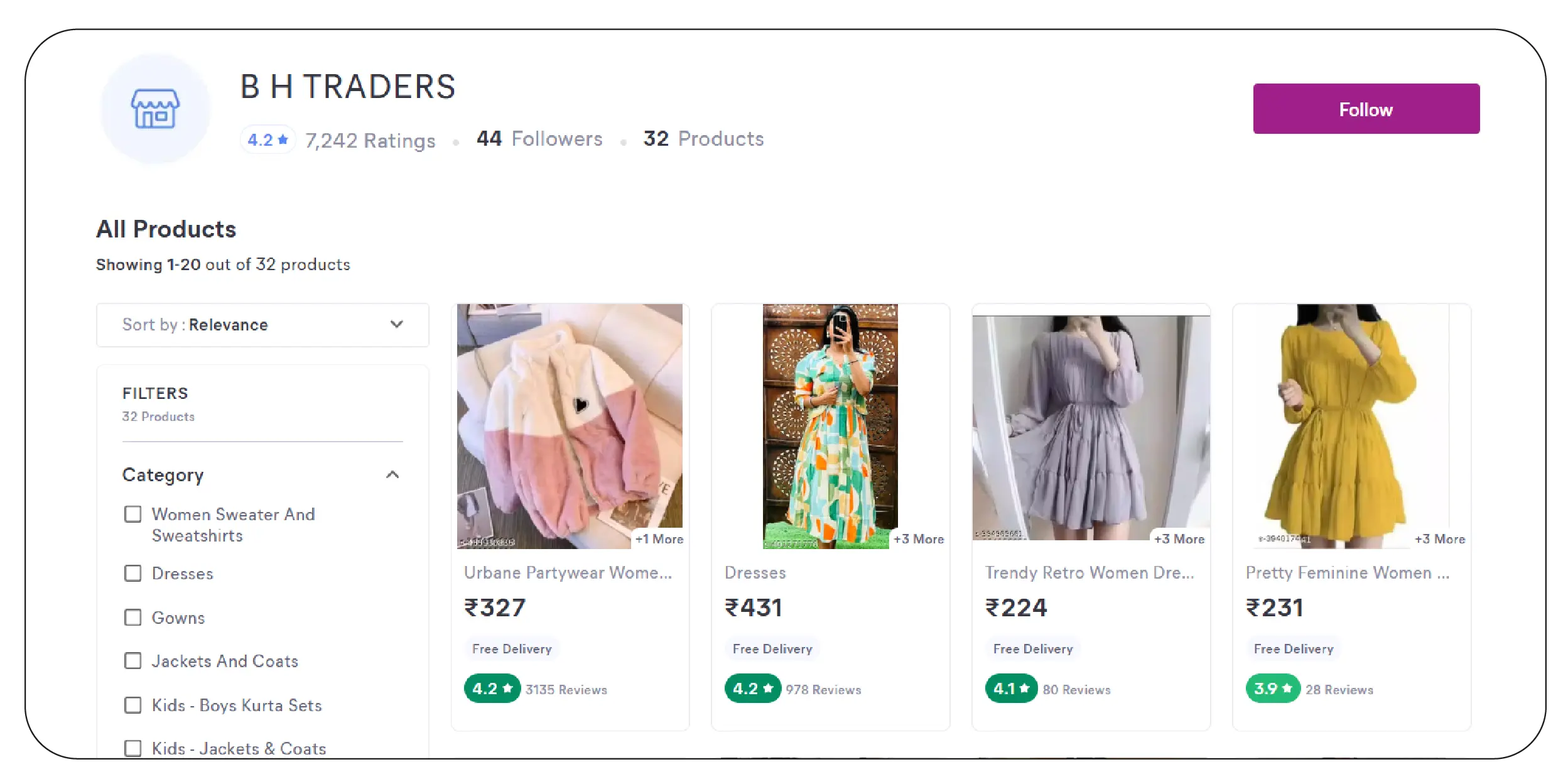

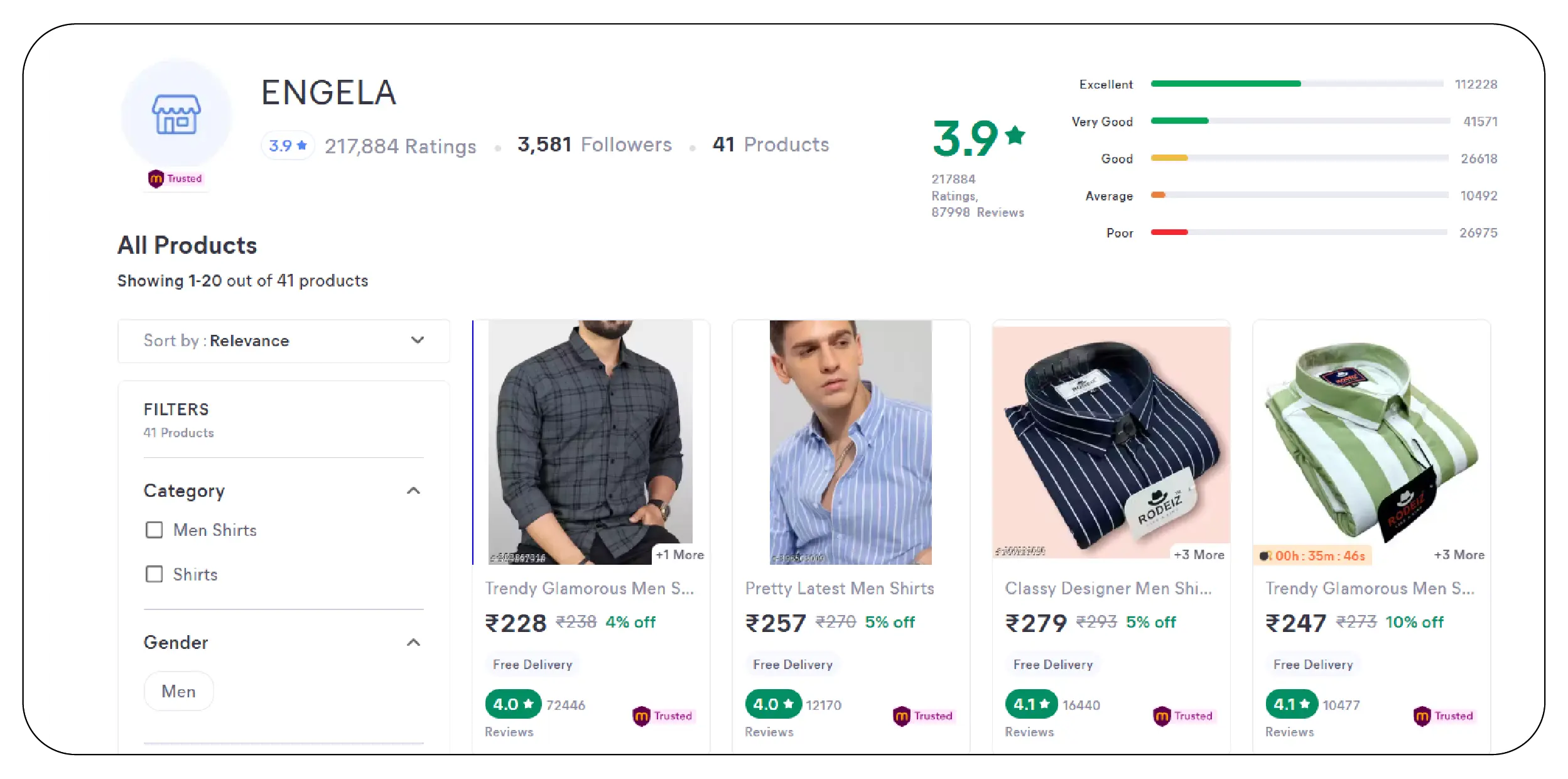

Seller identity and operational data play a critical role in social commerce intelligence. With an Automated Meesho seller information extractor, businesses can map seller locations, onboarding timelines, catalog sizes, and fulfillment ratings. From 2020 to 2025, sellers from Gujarat, Rajasthan, and Uttar Pradesh accounted for over 48% of total active sellers. Average seller ratings improved from 3.8 to 4.2, signaling platform trust growth. Data also shows sellers with complete profiles and higher response rates achieved 1.6x higher sales velocity. Tracking seller tenure reveals that sellers active for more than 18 months contribute nearly 70% of GMV. These insights support vendor discovery, partnership evaluation, and regional expansion strategies for brands looking to collaborate or benchmark against top-performing Meesho sellers.

API-Driven Data Structuring and Scalability

As data volumes surged, scalability became critical. Using a Meesho Product Data Scraper integrated with the Meesho Product Data Scraping API, enterprises structured millions of data points into standardized datasets. From 2020 to 2025, SKU-level data extraction increased from thousands to millions of records monthly. Structured outputs included product titles, category paths, pricing history, seller IDs, and stock indicators. Businesses using API-driven extraction reported 92% data accuracy and reduced processing time by 65%. This approach enabled long-term trend analysis, cross-category comparisons, and integration with BI dashboards. API-based scraping ensured consistency despite frequent platform UI changes, allowing organizations to maintain uninterrupted intelligence pipelines across years of marketplace evolution.

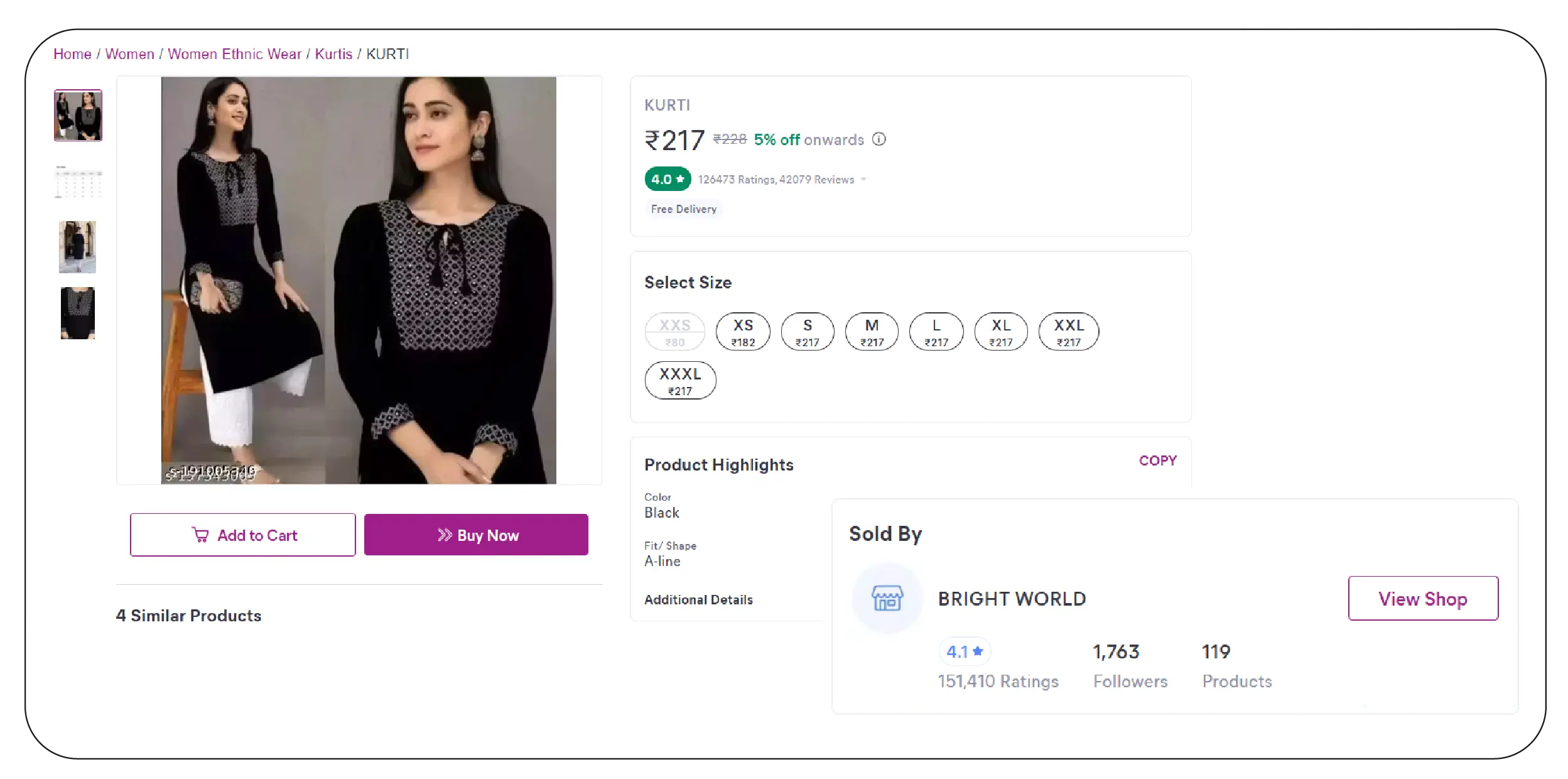

Measuring Seller Reputation and Customer Sentiment

Customer trust is the backbone of social commerce. By Scrape Meesho seller performance & reviews, analysts tracked how review volumes increased from an average of 12 reviews per product in 2020 to over 85 reviews in 2025. Products with ratings above 4.3 experienced 2.1x higher repeat purchases. Negative feedback trends highlighted common issues such as sizing inconsistencies and delayed deliveries, which declined significantly after 2023 due to improved logistics. Seller response rates to customer queries also rose from 54% to 81%, correlating strongly with higher seller rankings. Review sentiment analysis helped brands identify quality gaps, optimize product descriptions, and improve customer satisfaction benchmarks across categories.

SKU-Level Intelligence for Competitive Benchmarking

Granular SKU-level insights are critical for operational optimization. A Meesho seller SKU-level data scraper enables tracking of individual product lifecycle performance. Between 2020 and 2025, top-performing SKUs showed an average lifespan of 14 months compared to 6 months for underperforming items. Price drops within the first 60 days increased conversion probability by 35%. SKU-level analysis revealed that sellers updating images and descriptions quarterly saw 28% higher visibility. Brands leveraging SKU intelligence optimized assortment planning, eliminated low-performing items faster, and aligned launches with demand trends. This level of detail supports data-backed merchandising decisions in a hyper-competitive social commerce environment.

Why Choose Product Data Scrape?

Product Data Scrape delivers reliable, scalable, and compliant data solutions tailored for social commerce intelligence. With access to the Meesho E-commerce Product Dataset, businesses receive structured, validated, and analysis-ready data across sellers, SKUs, pricing, and reviews. Our solutions support historical tracking from 2020 to 2025, enabling long-term trend analysis and forecasting. Advanced automation ensures high accuracy, rapid updates, and seamless integration with analytics platforms. Whether for competitive benchmarking, pricing intelligence, or seller discovery, Product Data Scrape empowers organizations to convert raw marketplace data into actionable business insights with confidence.

Conclusion

Meesho’s rapid rise has reshaped India’s e-commerce landscape, making seller-level intelligence more important than ever. By leveraging a Real-time Meesho seller data monitoring API, businesses can track pricing shifts, seller performance, SKU trends, and customer sentiment with precision. From category expansion to competitive benchmarking, structured data enables smarter, faster decisions.

Unlock actionable Meesho insights today—partner with Product Data Scrape to access real-time, scalable, and reliable seller intelligence that drives growth.

FAQs

1. What data can be extracted from Meesho sellers?

Seller profiles, product listings, pricing history, stock availability, reviews, ratings, and SKU-level performance metrics can be extracted efficiently.

2. How often can Meesho seller data be updated?

Data can be refreshed daily or near real-time depending on business requirements and monitoring frequency.

3. Is historical Meesho data available?

Yes, structured datasets can cover multi-year periods, including trends from 2020 to 2025.

4. Can this data support pricing intelligence?

Absolutely, seller and SKU-level pricing data supports competitive analysis and dynamic pricing strategies.

5. How does Product Data Scrape ensure data accuracy?

Product Data Scrape uses automated validation, adaptive scraping logic, and structured pipelines to maintain high data accuracy and reliability.

.webp)