The fashion industry is currently undergoing a phase of stabilization following

a series of significant disruptions in recent years. Fashion retailers face the challenge of

adapting to changing consumer preferences and addressing issues stemming from inflation and the

enduring supply chain disruptions caused by the COVID-19 pandemic.

Inflation has emerged as a critical concern, leading to an imbalance between

supply and demand in the market as per data available from web scraping e-commerce data. As

consumers curtail their spending due to rising prices, fashion retailers grapple with several

issues. First, there is an excess of inventory, which can be costly to store and manage.

Additionally, these retailers are experiencing reduced profit margins due to decreased sales

volume.

Consequently, these market dynamics have forced fashion retailers to reevaluate

their pricing strategies, resulting in significant fluctuations in pricing and competitiveness

across different periods, subcategories, and individual retail brands.

To effectively address these challenges, fashion retailers are increasingly

adopting a data-driven approach to scrape fashion ecommerce data that relies on competitive and

market insights. This approach allows them to implement agile and adaptable pricing strategies

and use pricing intelligence that supports advanced pricing and assortment management. By

comprehensively understanding their market position and competitive landscape, retailers can

navigate the hurdles of reduced consumer demand and inflationary pressures without sacrificing

their top-line revenue and overall profitability.

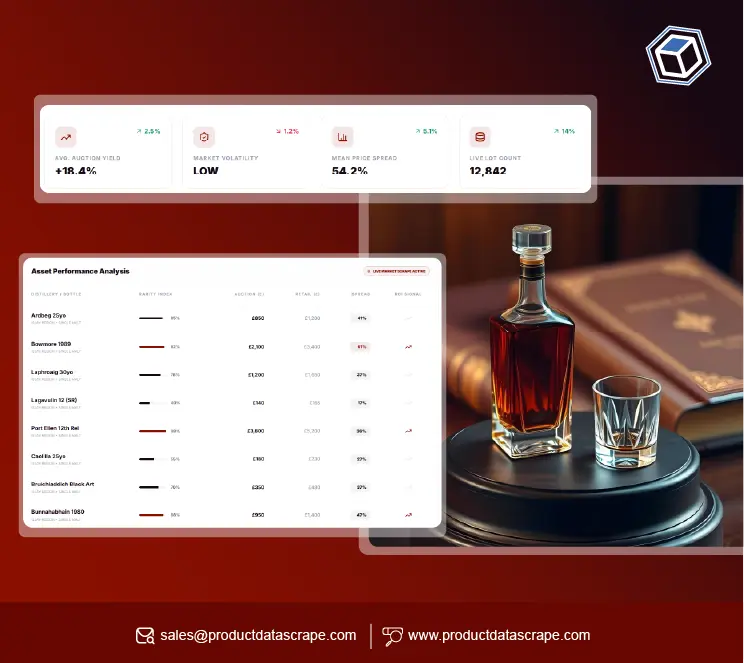

At Product Data Scrape, we've harnessed the capabilities of our proprietary

data aggregation and analysis platform to monitor and analyze the pricing strategies of

prominent fashion retailers. We aim to unearth unique insights into their price competitiveness

over the past year. Moreover, we seek to understand how these pricing strategies have evolved

across various subcategories within the fashion industry.

Steps to Scrape Fashion Product Data

Here are the steps to extract data from fashion websites and integrate it into

online stores:

- Complete the order form to request sample data.

- Provide feedback on the sample file for data refinement and formatting.

- Incorporate the gathered data into your shopping cart for seamless integration.

Enhance Competitive and Pricing Intelligence

- Take charge of your online reputation with real-time updates on user comments and reviews.

- Optimize product distribution and positioning through detailed, up-to-the-minute inventory

assessments, anticipating supply challenges.

- Leverage Precise Competitor Pricing Data for Market Share Growth.

- In a competitive market, pricing plays a pivotal role. Setting the correct prices can attract

more customers, significantly expanding market share. Let's delve into how businesses can

achieve this.

- Price monitoring is crucial to competitive intelligence, utilizing advanced tools to track

competitor pricing.

Companies can access essential pricing data through a data-as-a-service provider, transcending organizational barriers.

This service helps evaluate market pricing ranges by extracting e-commerce data from leading websites like Amazon.

Methodology:

For this comprehensive analysis, we meticulously tracked changes in average prices among the top US fashion retailers over 12 months. Our primary objective was to gain insights into how pricing strategies evolved across various fashion subcategories in response to various factors, including supply chain disruptions, inflationary pressures, seasonal fluctuations, and shifts in consumer preferences.

Sample:

We compiled data from over 88,000 SKUs (Stock Keeping Units) sourced from five prominent US retailers. These retailers included industry giants like Amazon, Walmart, Target, Macy's, and Zappos.

Key Subcategories:

Our analysis focused on several key fashion subcategories: Coats, Boots, Denim, Bottoms, Flats, Heels, Kids' apparel, and Jackets.

Timeline:

Our analysis encompassed a timeline spanning from April 2022 to April 2023.

Analysis Findings:

In an environment where prices have generally been rising across various industry sectors, notably in groceries, due to inflationary pressures, the fashion sector presented a contrasting picture. Our e-commerce data scraping services recorded average prices within the fashion industry remained relatively stable, with occasional price decreases. In fact, by April 2023, average fashion prices had declined by 1.2% compared to April 2022.

The primary driver behind this trend is the shifting consumer behavior in response to economic uncertainties. Consumers have become increasingly cautious about discretionary spending on fashion items, choosing to prioritize essential needs. This shift in consumer behavior has resulted in lower demand for fashion products and, in turn, an overstocking challenge retailers face.

A noteworthy statistic is that, during the first quarter of 2022, clothing accounted for only 3.9% of the total expenditure by US consumers, a decrease from the 4.3% recorded in 2019 before the pandemic. It indicates a reduced allocation of household budgets to fashion-related expenses.

Furthermore, as of March 2023, a significant 60% of fashion retailers in the US still had surplus inventory, comprising nearly 20% of their total stock. Fashion retailers have implemented various strategies to address this surplus and adapt to lower demand. These include offering freebies with purchases, bundling products together, distributing unwanted items as incentives, and reducing prices to entice consumers.

Subcategory Analysis:

Our detailed subcategory-level analysis uncovered intriguing trends within the fashion industry. In winter 2022, we observed significant price spikes ranging from 6% to 11% in subcategories like coats, boots, and jackets. These price increases were primarily driven by seasonal demand, reflecting consumers' inclination towards winter attire. However, it's noteworthy that these price surges were relatively short-lived.

As we moved into 2023, several key factors came into play. Firstly, raw material costs stabilized, alleviating some of the pricing pressure on fashion items. Secondly, the ongoing decline in demand for nonessential apparel and fashion accessories played a pivotal role. Consumers prioritized essential needs over discretionary spending in the wake of economic uncertainties.

It's important to highlight that these trends exhibited variations among retailers. Each retailer faced unique challenges and responded in distinct ways to the evolving market dynamics. Our data indicates that certain retailers opted to raise their prices starting from the third quarter of 2022. This strategic move was likely motivated by the need to protect profit margins amidst growing pressures. Conversely, other retailers chose to reduce their prices further, a response to the challenge of managing increasing inventory levels.

Capability Spotlight:

Matching products accurately across competitor websites is crucial for tracking competitive prices and conducting price leadership analyses. In the realm of fashion, achieving precise product matching is particularly challenging. Fashion websites present many product variants, encompassing differences in size, color, material, and more, often needing more standardized representations. This complexity frequently leads to unusable pricing insights due to inaccurate and incomplete product matching.

Our cutting-edge product-matching algorithm addresses this challenge effectively. It identifies and utilizes numerous product attributes extracted from product titles, descriptions, and images, achieving a remarkably high level of accuracy and coverage in product matching. Moreover, our platform can match similar products based on various parameters, providing our customers with a comprehensive view of their competitive landscape.

Case Example:

In August, Target reported a significant 90% drop in profits during the second quarter of 2022. This decline is due to shoppers' concerns about inflation, which led to reduced spending on nonessential items. Target's attempts to combat this with price cuts yielded different results, resulting in a 1.5% increase in inventory compared to the previous three months. Consequently, we observed a spike in Target's average fashion prices in August 2022, which have remained relatively stable. Walmart faced similar challenges and raised its prices in October 2022.

Conversely, during the same period in August 2022, Macy's adopted a different strategy by announcing increased discounts to clear out excess inventory ahead of the holiday shopping season. Macy's highlighted how the rising cost of groceries, marked by double-digit increases, impacted consumer budgets, altered buying behaviors, and increased the demand for discounts. Our data mirrors this approach, reflecting a significant price drop from October 2022 to January 2023.

In January 2023, Macy's successfully reduced its inventory levels from $6.4 billion in October 2022 to $4.3 billion, subsequently initiating a rise in average prices. It demonstrates how different retailers employ unique strategies to navigate challenges in inventory management and pricing dynamics.

In contemporary fashion retail, striking a delicate equilibrium between expansion objectives and maintaining profitability is a paramount challenge. It necessitates a continuous and thorough scrutiny of competitive dynamics and market insights. This ongoing assessment is essential to counter competitive pressures and successfully navigate the complexities of the present-day retail environment.

Product Data Scrape is committed to upholding the utmost standards of ethical

conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations.

With a global presence across multiple offices, we meet our customers' diverse needs with

excellence and integrity.

.webp)