Amazon, a leading e-commerce platform, offers various products across various categories. Identifying and analyzing top-selling items can be challenging due to the sheer volume of data. To streamline this process, we utilized e-commerce data scraping tools to collect detailed information about 279,748 products in the beauty and personal care category over one month. By scraping top-selling beauty products on Amazon, we gained valuable insights into their performance, trends, and sales dynamics. This approach provides a comprehensive view of top beauty products' performance, allowing businesses and analysts to make data-driven decisions and stay ahead in the competitive market. This blog will delve into the results of our scraping efforts, highlighting key findings and trends from the top sellers in the beauty category.

In-Depth Analysis of Amazon's Best-Selling Beauty Products Over a Month

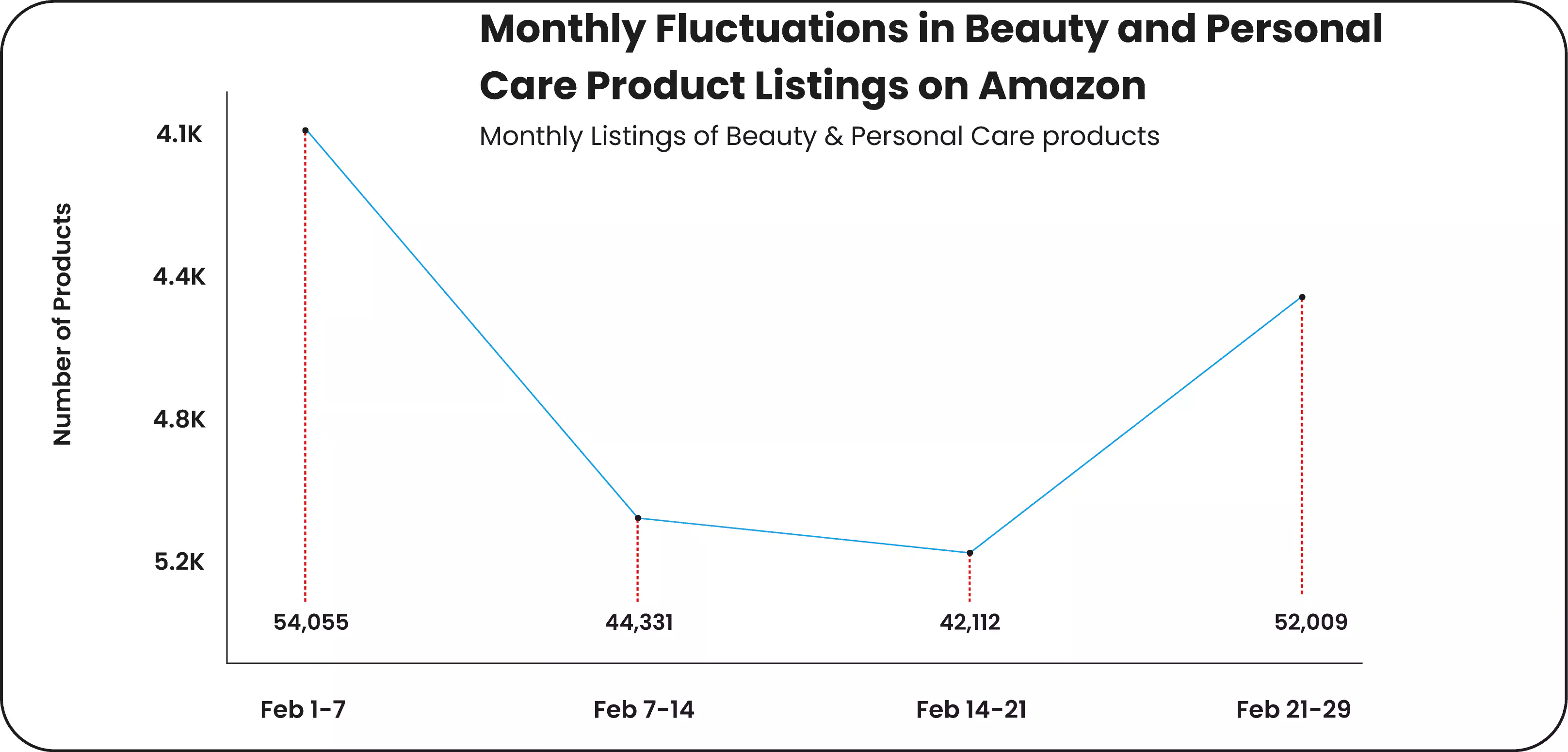

Our analysis of Amazon's best-selling beauty products starts with a detailed examination of product listings in the beauty and self-care category over one month. We extracted extensive data on nearly 288,000 products using the Amazon bestsellers scraper. This comprehensive dataset allows us to track variations in the number of products listed and observe trends in their performance over time. By analyzing this data, we can identify patterns of growth or decline within the category. Scraping Amazon Best-Selling Beauty Products provides valuable insights into market dynamics, helping to understand shifts in consumer preferences and the overall health of the beauty segment on Amazon. Through this detailed analysis, businesses can make informed decisions about inventory, marketing strategies, and competitive positioning.

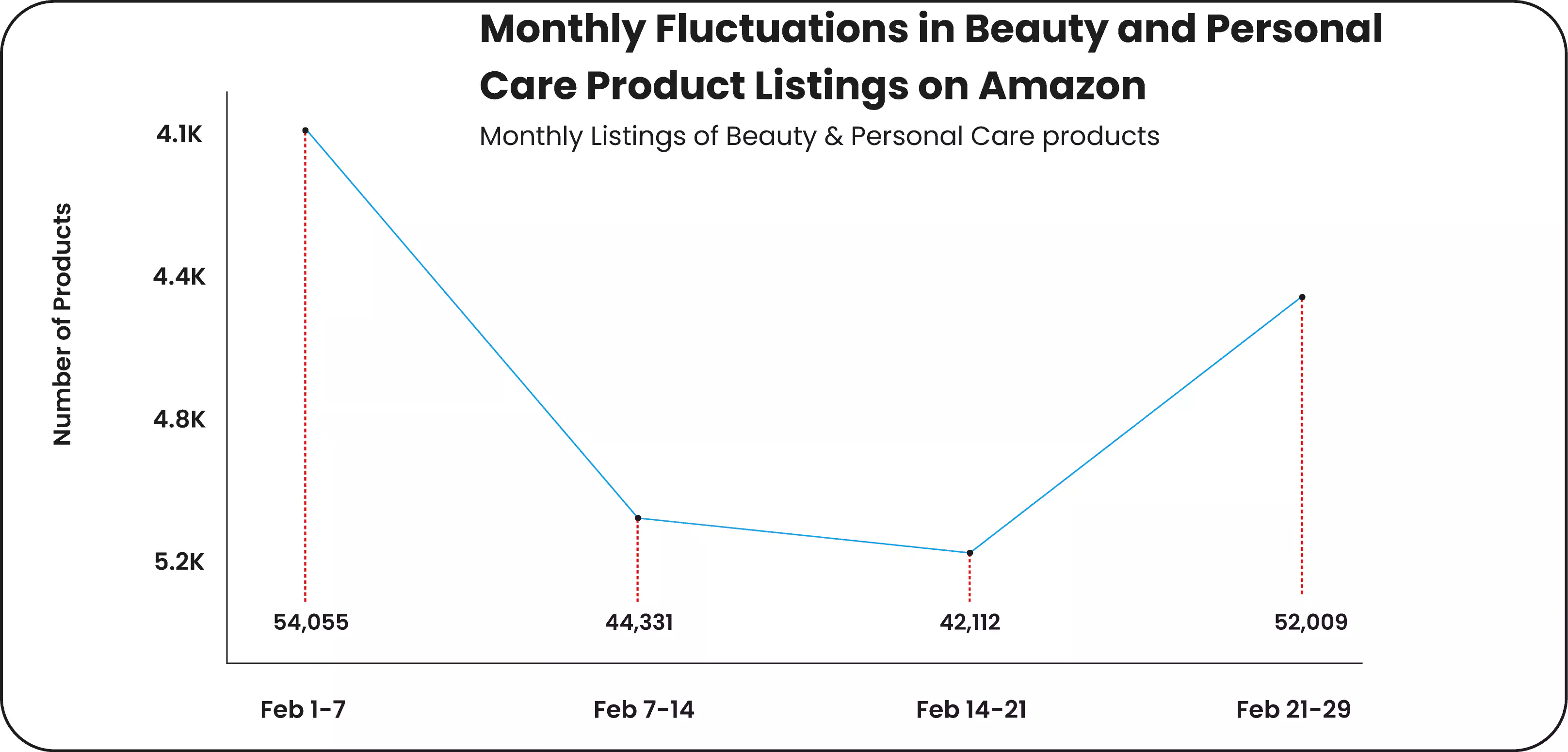

Our analysis, powered by advanced Amazon Beauty Products Price Scraping, reveals notable fluctuations in the total number of beauty and personal care products listed on Amazon throughout the month. The data indicates a strong start, with the highest number of product listings recorded in the first week. However, this trend was not sustained, as the volume of listings began to decrease significantly in the subsequent weeks. By the second week, the number of products listed fell to 44,331; by the third week, it dropped to 44,112. This decline suggests a temporary reduction in product availability or a shift in market focus during these weeks.

Using beauty products data scraper, we could capture and analyze these variations in real-time, providing valuable insights into market trends and inventory changes. This information is essential for businesses to understand shifts in product availability, adapt their strategies accordingly, and stay competitive in the evolving beauty and personal care market on Amazon.

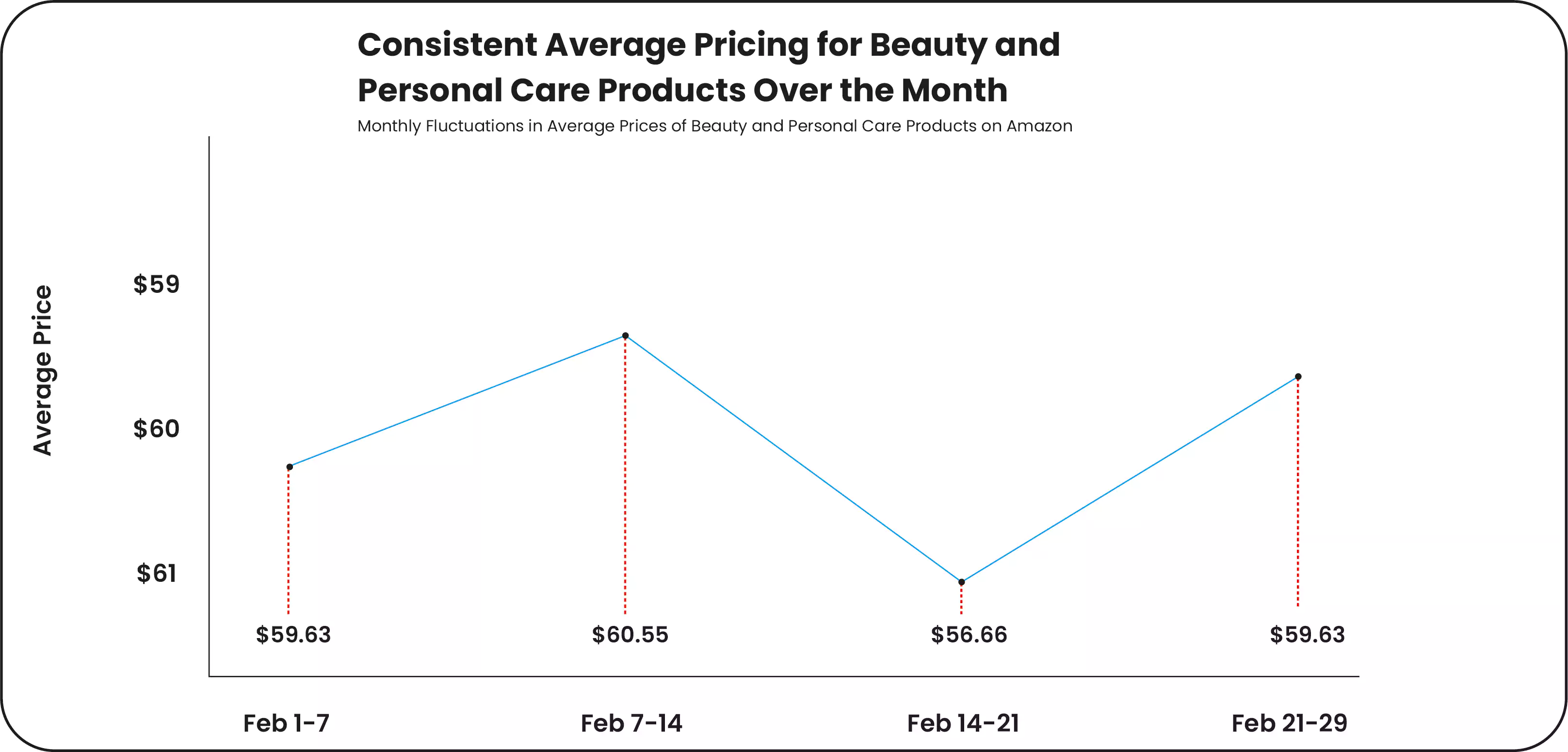

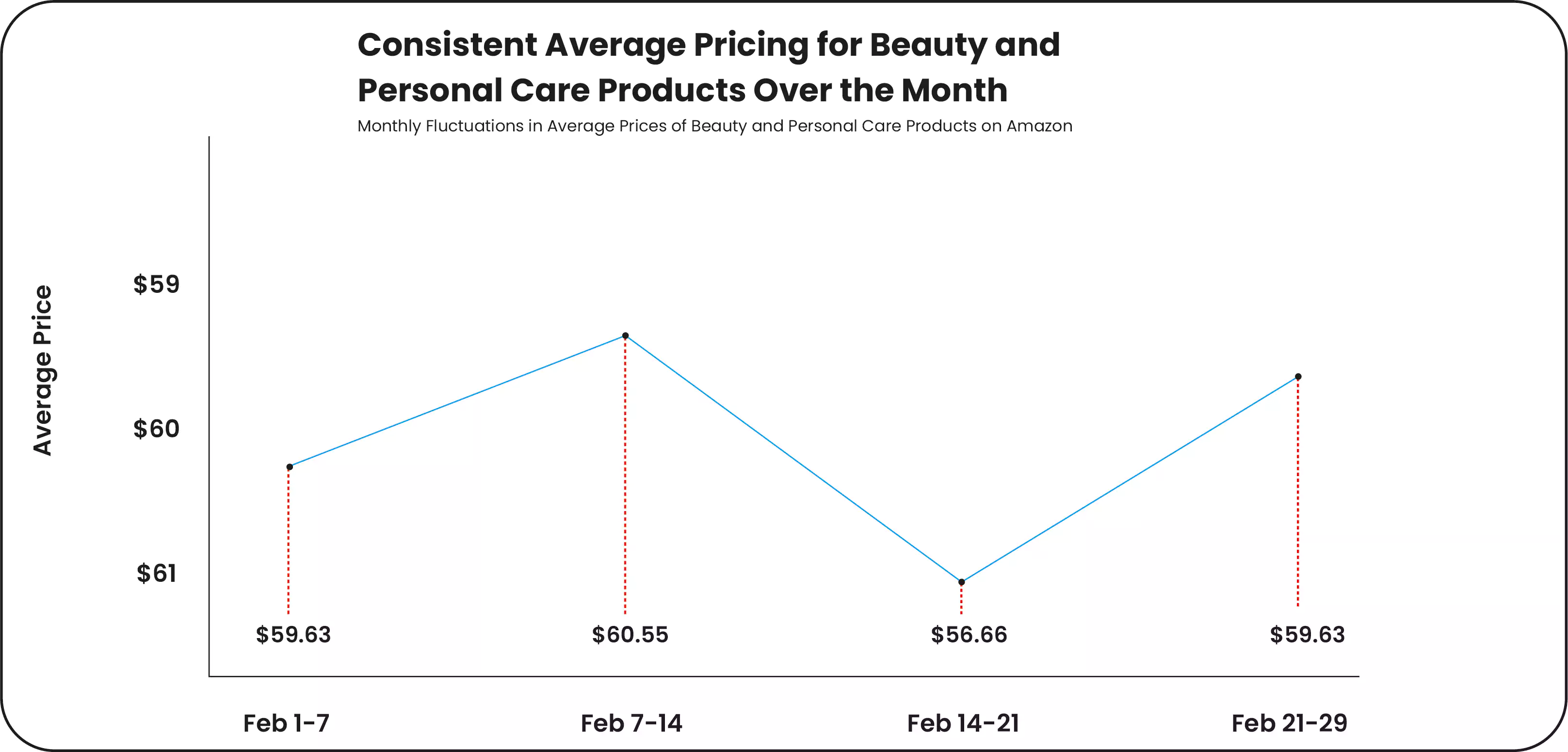

Amazon's average price of beauty and personal care products showed minimal fluctuation throughout the month. This stability contrasts with the variations in product listings, suggesting that while the volume of available products changed, pricing remained relatively consistent.

To gain deeper insights into the best-selling beauty products on Amazon, comparing these observations using Top Beauty Products Data Extraction on Amazon with average prices and sales figures from other months of the year is helpful. This comparative analysis can reveal whether specific product categories, such as skincare or makeup, influenced the fluctuations observed in listings.

Additionally, exploring sales trends and listing personal care products on Amazon can provide valuable context. Understanding these trends helps to identify which beauty products are popular and how they perform over time, offering strategic insights for businesses to refine their inventory and marketing strategies.

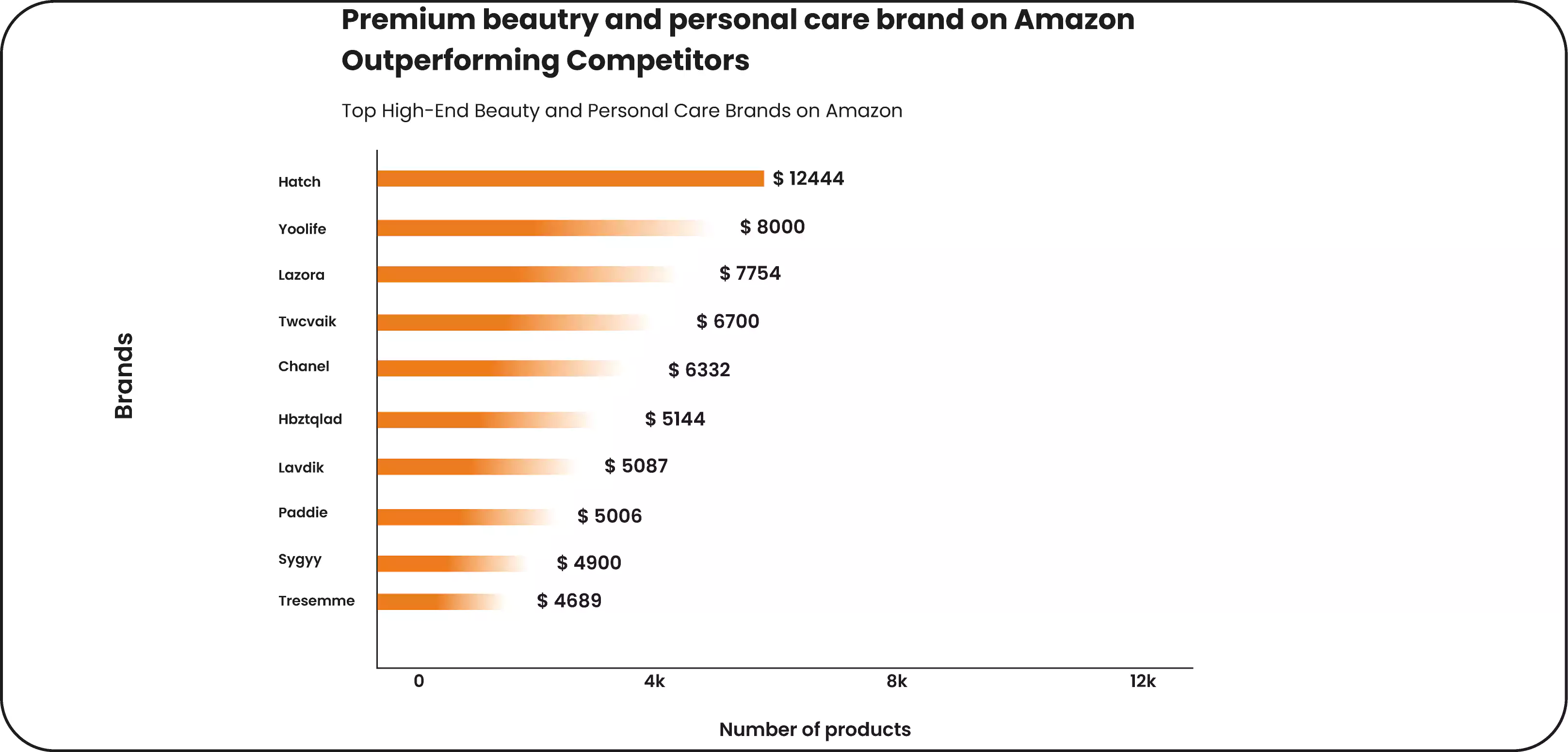

Most Expensive Beauty and Personal Care Brands on Amazon

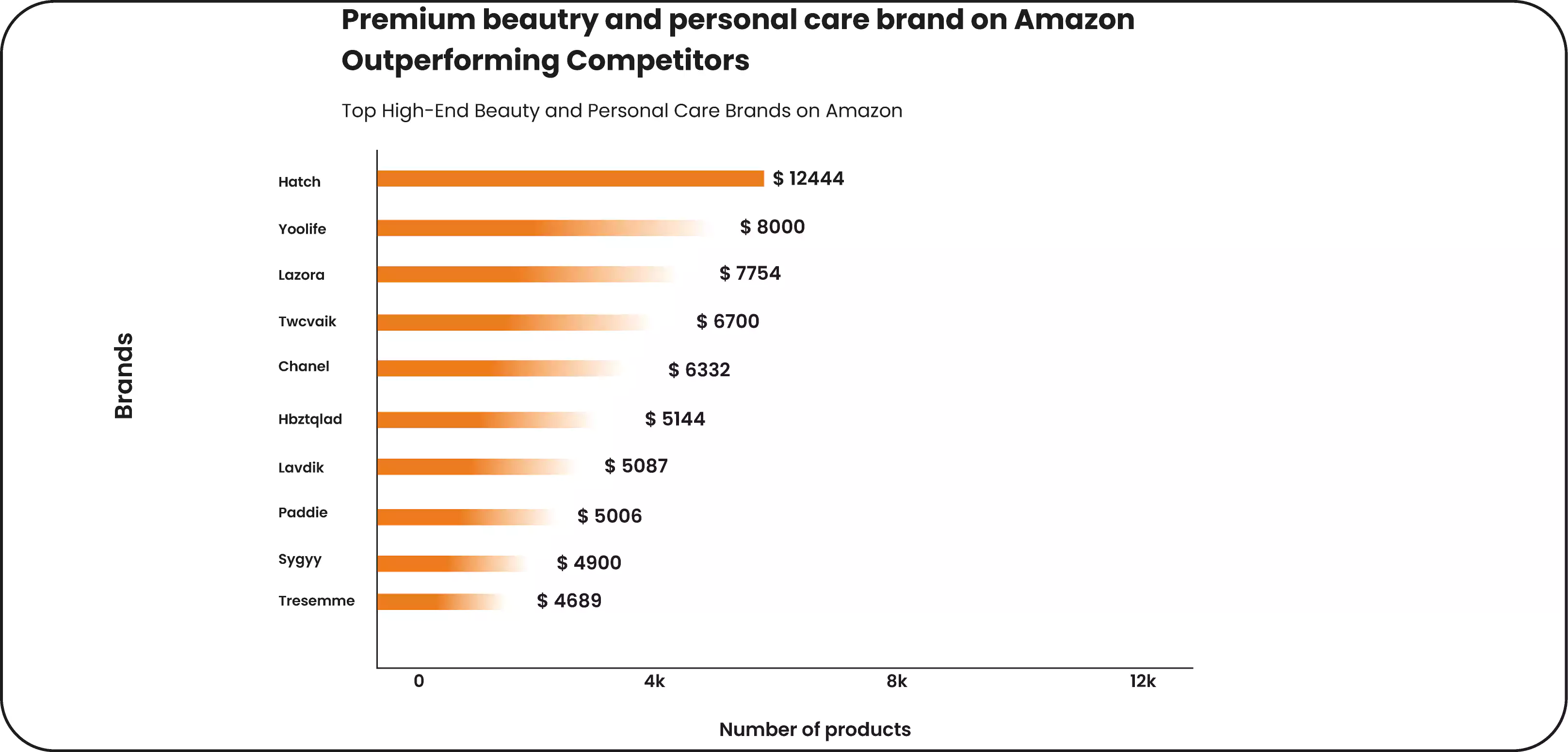

Some brands stand out for their premium pricing among the vast array of products. Scrape Top Beauty Products Data to identify the top ten most expensive beauty and personal care brands available on the platform. This detailed analysis provides insights into the luxury segment, highlighting brands that command higher prices and offering a glimpse into the high-end market landscape on Amazon.

During our Pricing Strategies analysis, Hatch emerged as the most expensive brand on Amazon, with an average price of $12444. Yoolife and Lazora followed closely, averaging $8000 and $7754, respectively. The substantial price difference between Hatch and the other brands highlights the premium nature of Hatch's offerings.

Luxury brands like Chanel and Lacoste are at the top of the list, underscoring Amazon's availability of high-end beauty and personal care products. However, it's important to note that this analysis focuses solely on the most expensive products from each brand. It does not represent the complete price range of their beauty and personal care items available on Amazon. This distinction is crucial for understanding these brands' full spectrum of pricing.

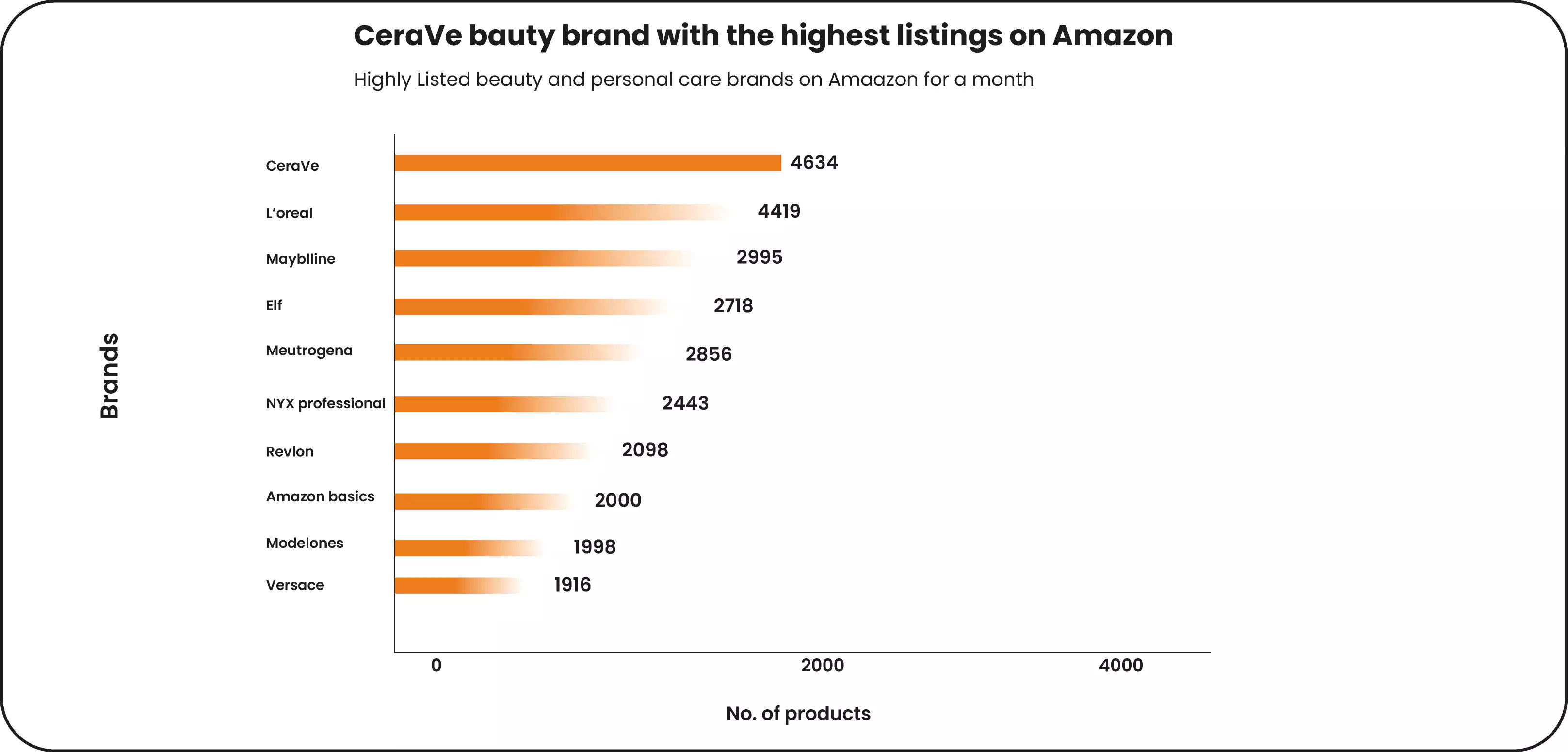

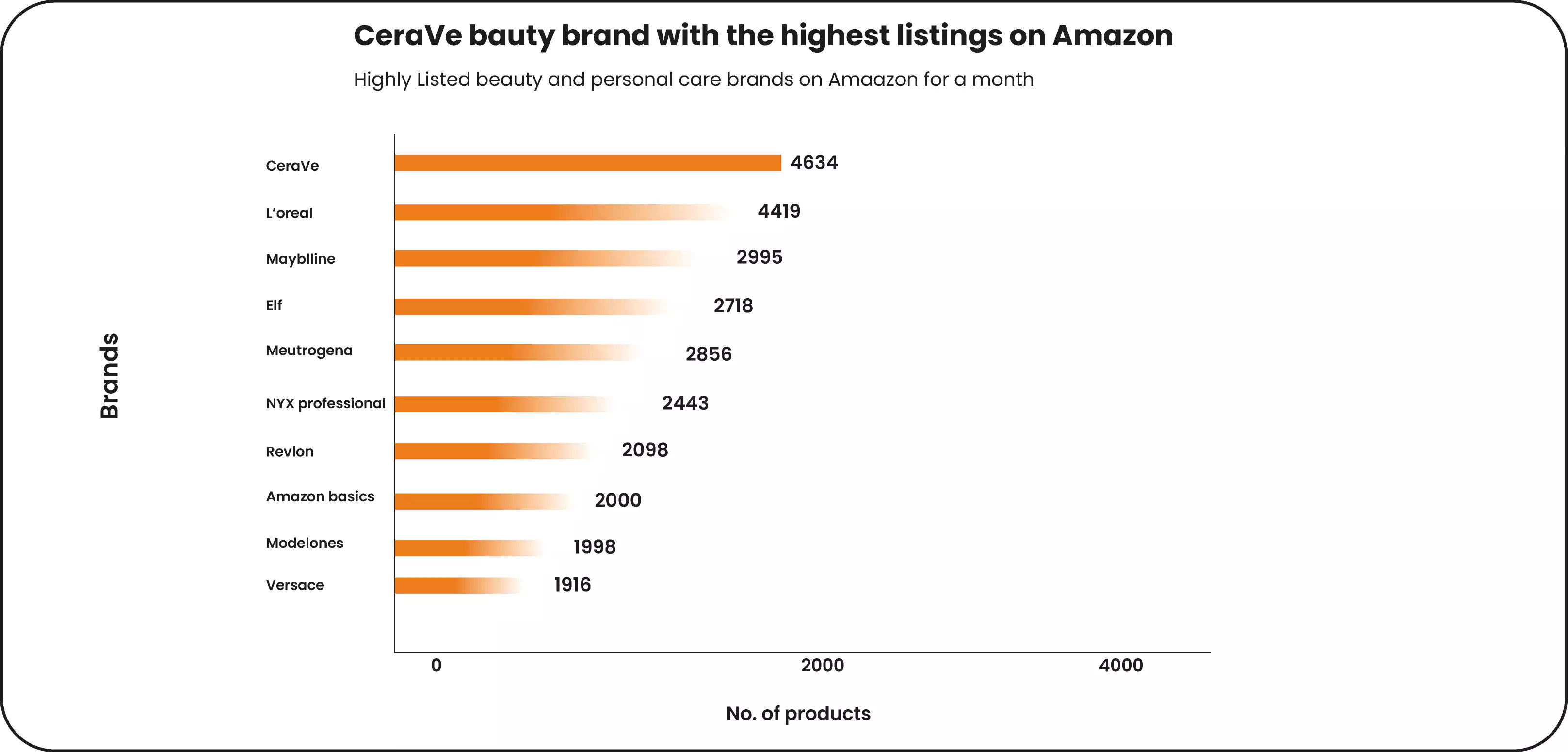

Top Beauty and Personal Care Brands with the Most Listings on Amazon

According to our analysis using E-Commerce Price Monitoring Services, CeraVe leads as the beauty and personal care brand with the highest number of products listed on Amazon, boasting 4,634 in February. L'Oreal Paris is the second top brand, with many products listed. Notably, the other brands on the list have significantly fewer listings compared to CeraVe and L'Oreal Paris. This observation highlights the dominance of these two brands in terms of product availability on Amazon.

Diverse Range of Brands and Categories in Amazon's Beauty and Personal Care

Our e-commerce data scraping on Amazon's beauty and personal care brands reveals a diverse mix in the top 10 list, including drugstore staples, luxury high-end brands, and professional makeup lines. This variety demonstrates that Amazon is a platform for both mainstream and niche beauty brands, enabling them to connect with a broad audience.

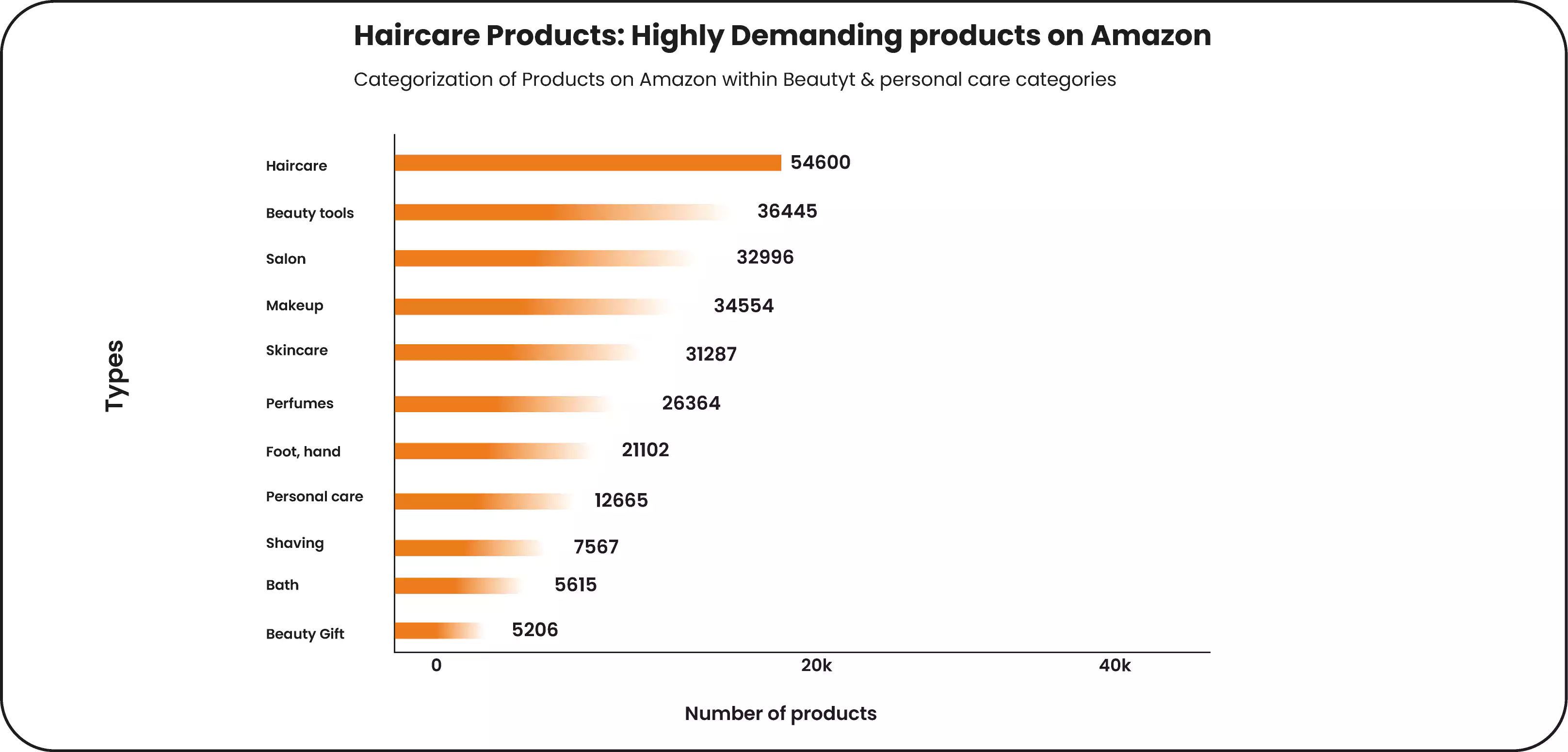

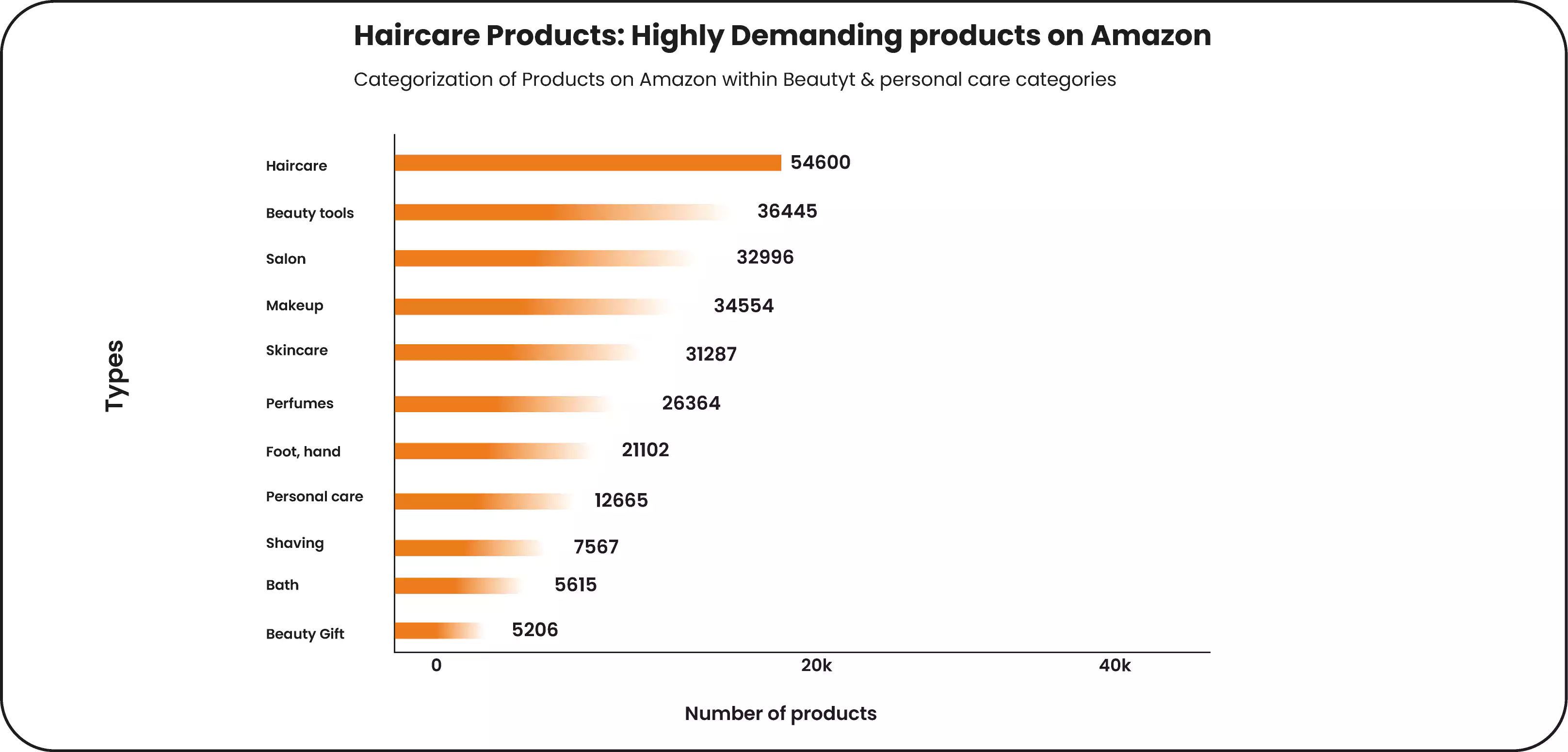

Categories Within Beauty and Personal Care Products

Amazon's beauty and personal care section encompasses a wide range of products aimed at personal grooming, hygiene, and enhancing appearance. Key categories include skincare, haircare, makeup, fragrances, nail care, and men's grooming. Each category caters to different aspects of personal care and beauty needs.

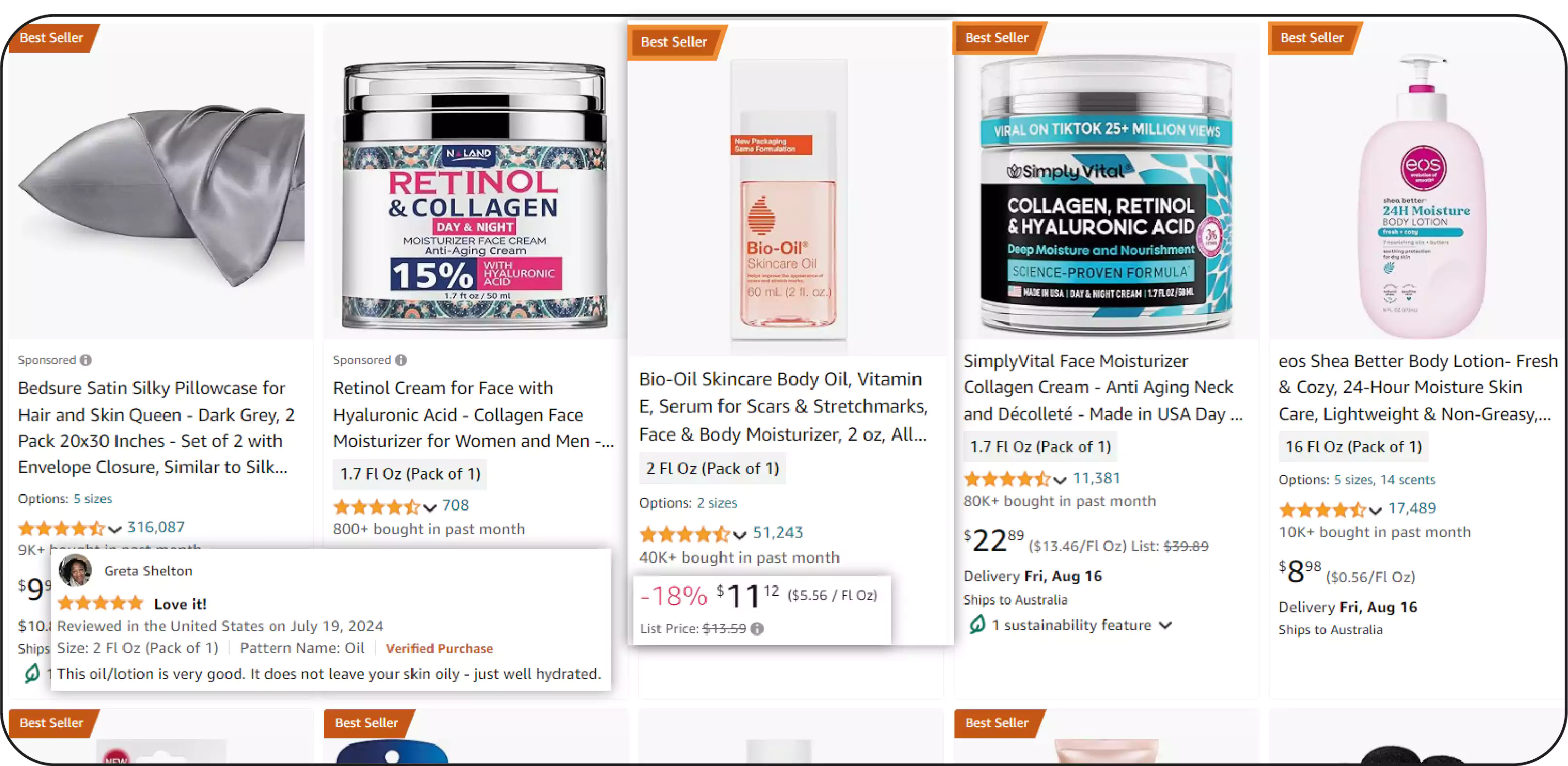

Top Products in the Beauty and Personal Care Category

The analysis of Amazon's best-selling beauty products for the month indicates that haircare items dominate the listings. The 54600 products were listed under haircare, making it the most popular category. In comparison, the second most listed category had approximately 18156 fewer products, highlighting the strong demand and wide variety of available haircare products on Amazon.

Comprehensive Overview of Beauty and Personal Care Products on Amazon

Scraping Top-Selling Beauty Products on Amazon demonstrates the extensive range of beauty and personal care products available on Amazon, reflecting the platform's role as a primary resource for consumers' grooming and beauty needs. The many products listed in each category indicate that many people rely on Amazon to fulfill their beauty and personal care requirements.

When analyzing Amazon's best-selling beauty products, seasonal trends must be considered. For instance, the demand for sun care products typically surges during summer, influencing category popularity throughout the year.

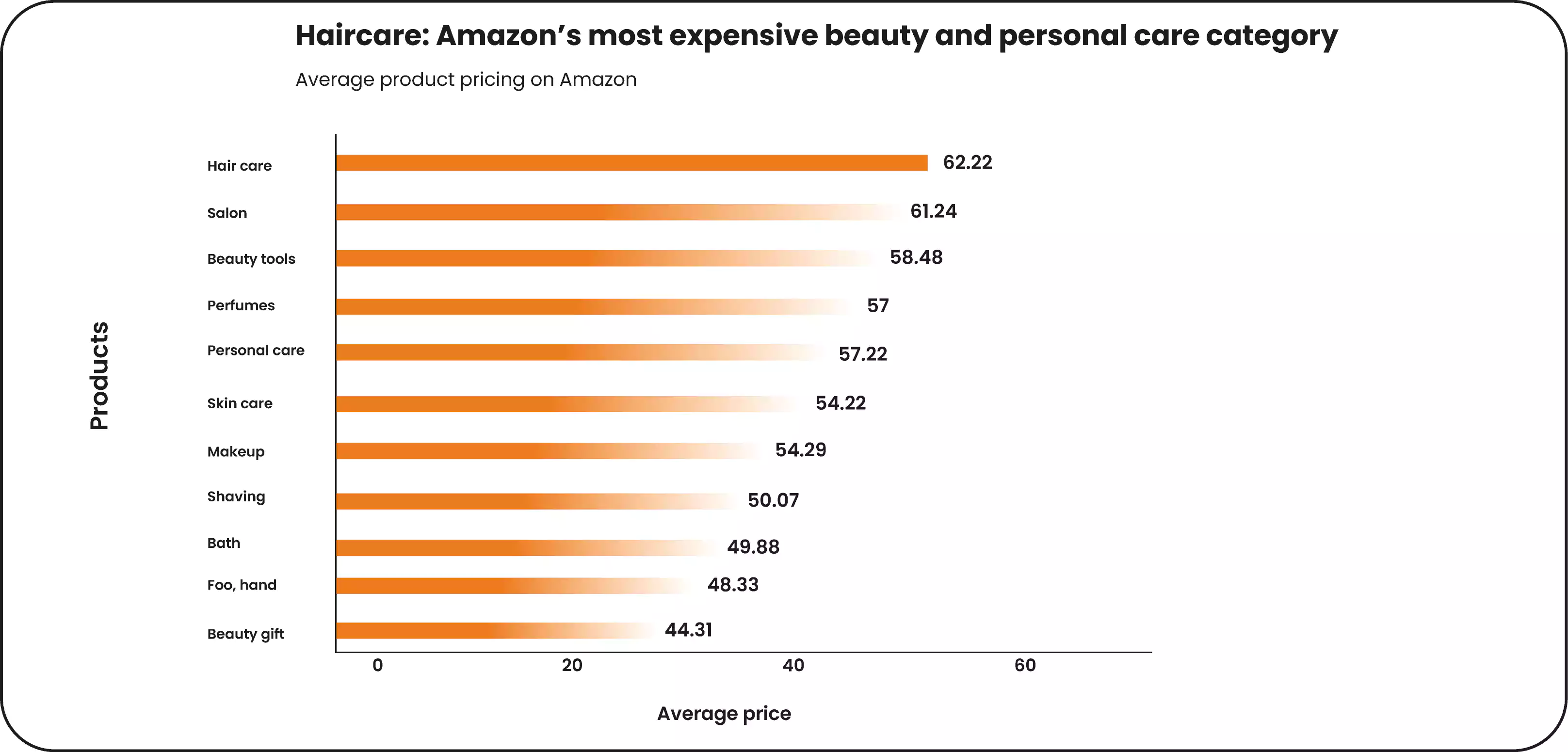

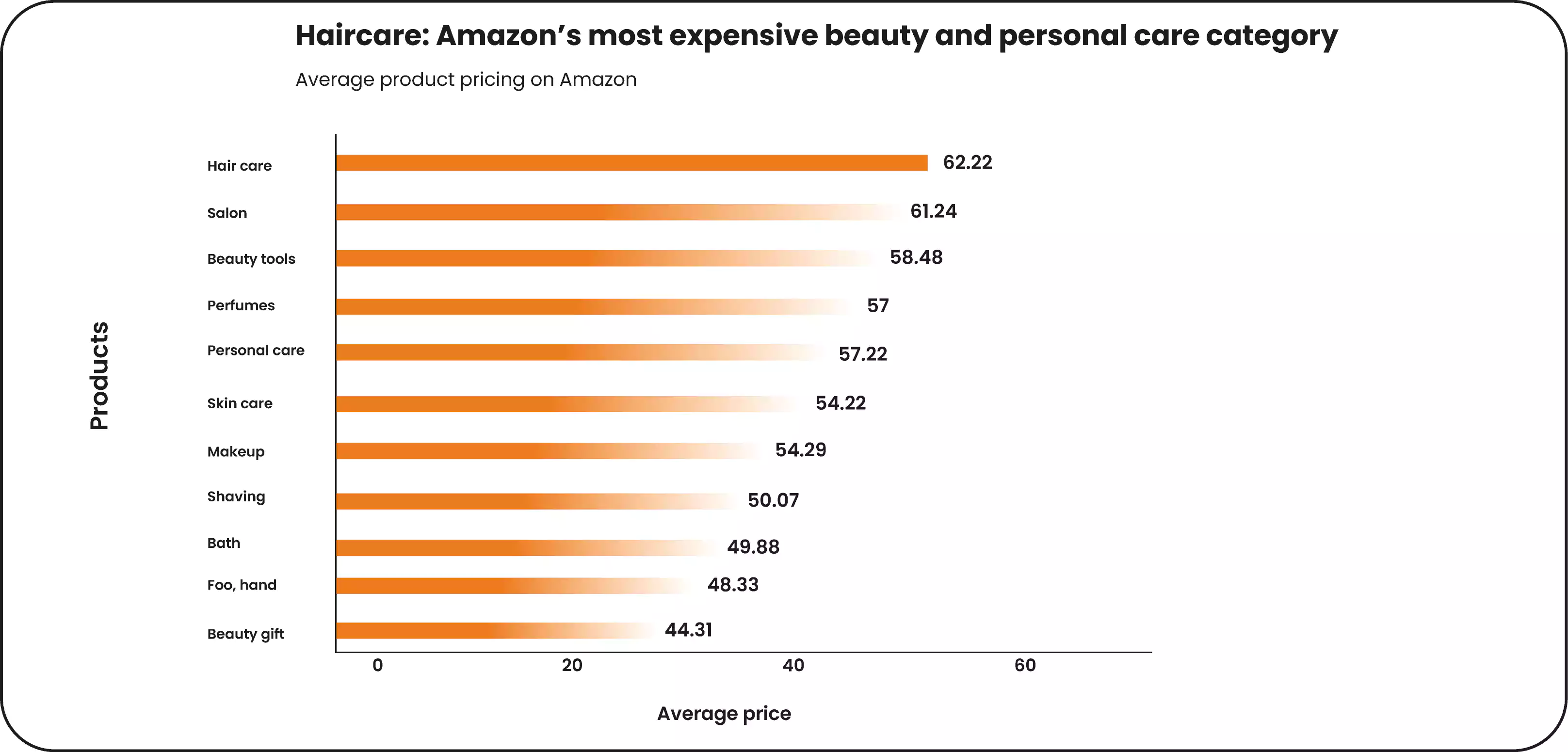

Average Pricing in the Beauty and Personal Care Category

Our examination of the average prices for top-selling beauty items reveals that haircare products are the priciest category, averaging $62.22. Other relatively expensive categories include Salon and spa Equipment, with an average price of $61.24, and Beauty Tools and accessories, averaging $58.48. These figures highlight the premium nature of certain beauty products and their impact on overall category pricing.

Best-Selling Beauty Products on Amazon: Focus on Haircare

Haircare products have stood out as the most frequently listed and among the most expensive categories in the best-selling beauty products on Amazon. This prominence highlights their significant role in the beauty market.

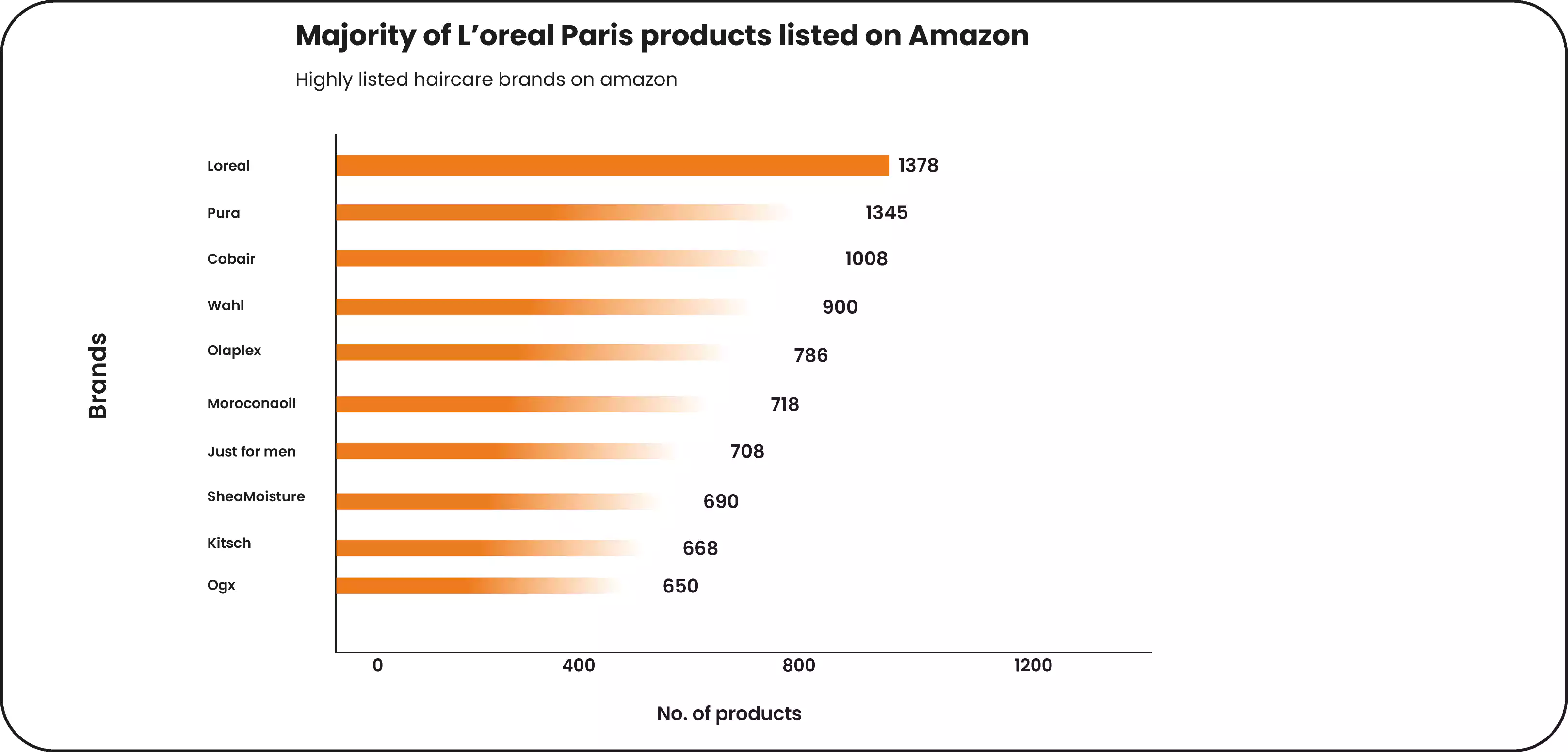

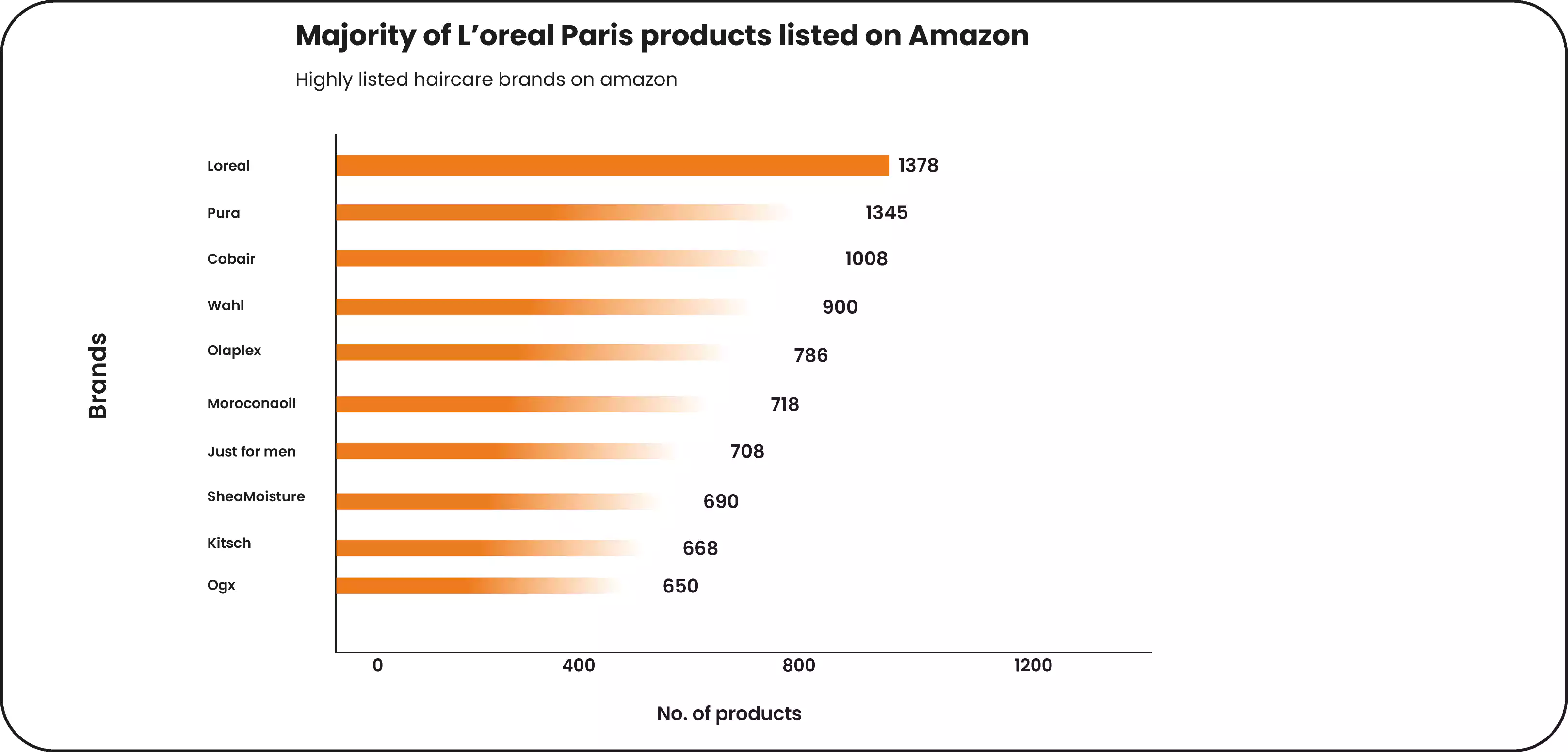

Top-Selling Haircare Brands on Amazon

Leading the haircare category on Amazon are L'Oreal Paris and PURA D'OR, with 1,378 and 1,345 products listed, respectively. Their high ranking is likely due to their strong market presence, which is driven by an extensive product range and widespread consumer appeal. These brands' extensive listings reflect their popularity and influence in the haircare segment.

Competitive Landscape of Haircare Brands on Amazon

Brands like SheaMoisture, Kitsch, and Ogx are prominent in the haircare category, each listing around 600 to 700 products. Their close competition reflects their significant presence and appeal within the market.

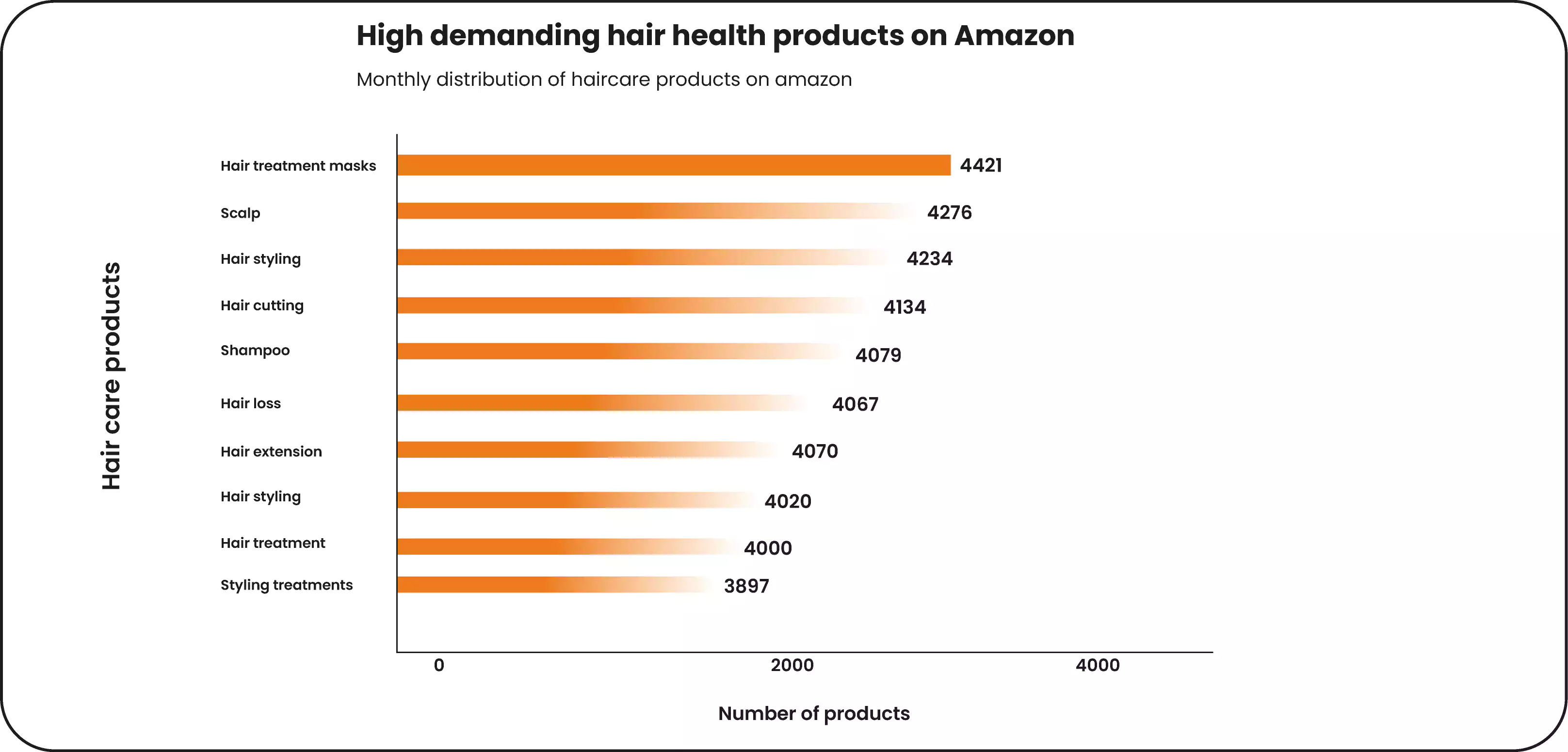

Comparative Availability of Haircare Product Categories on Amazon

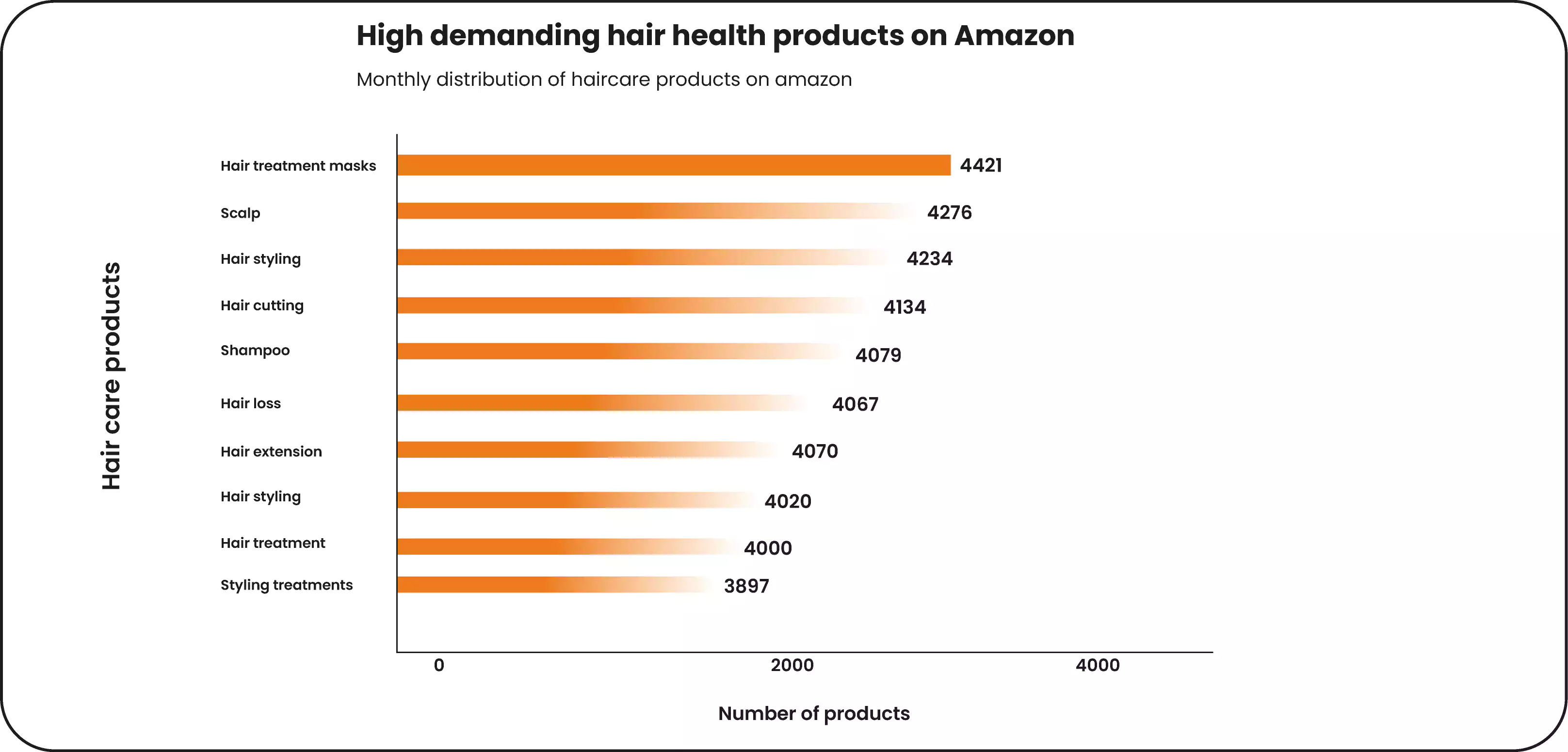

Regarding product availability, Hair Treatment Masks lead the category with 4,421 listings, indicating either a high demand or a broad selection in this segment. Other haircare categories, including Styling Tools & Appliances and various treatment products, also feature substantial numbers, each with over 4234 products. This wide range of options highlights the diverse and competitive nature of Amazon's hair care market.

Haircare Product Listings by Category on Amazon

Interestingly, Amazon's number of products listed across different haircare categories shows slight variation. The category with the fewest listings is Styling Tools and Appliances, at 3,936 products, while Hair Treatment Masks lead with 4,320 products. This close range suggests a balanced distribution of product types within the haircare market on Amazon, reflecting a well-rounded selection for consumers.

Distribution and Pricing of Haircare Products on Amazon

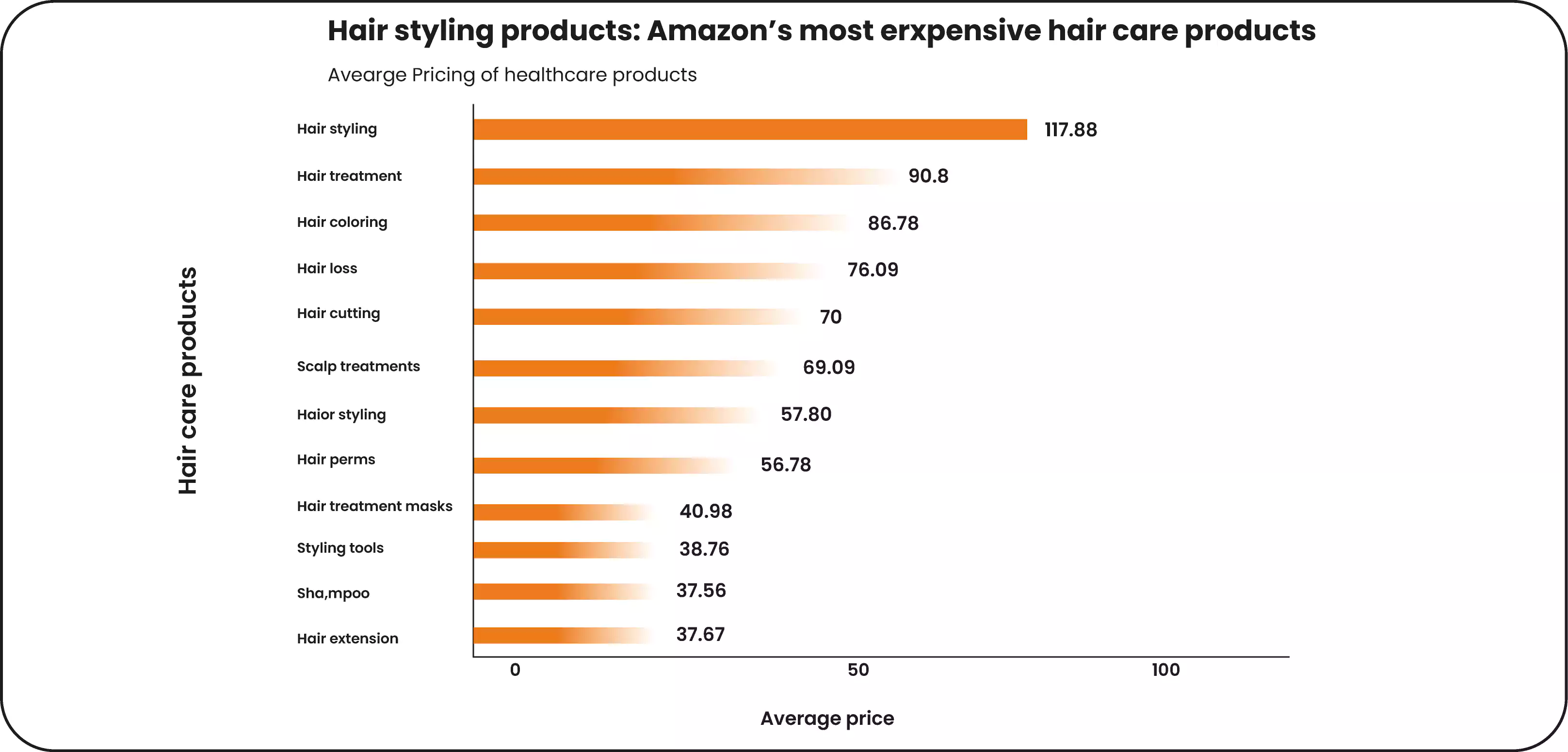

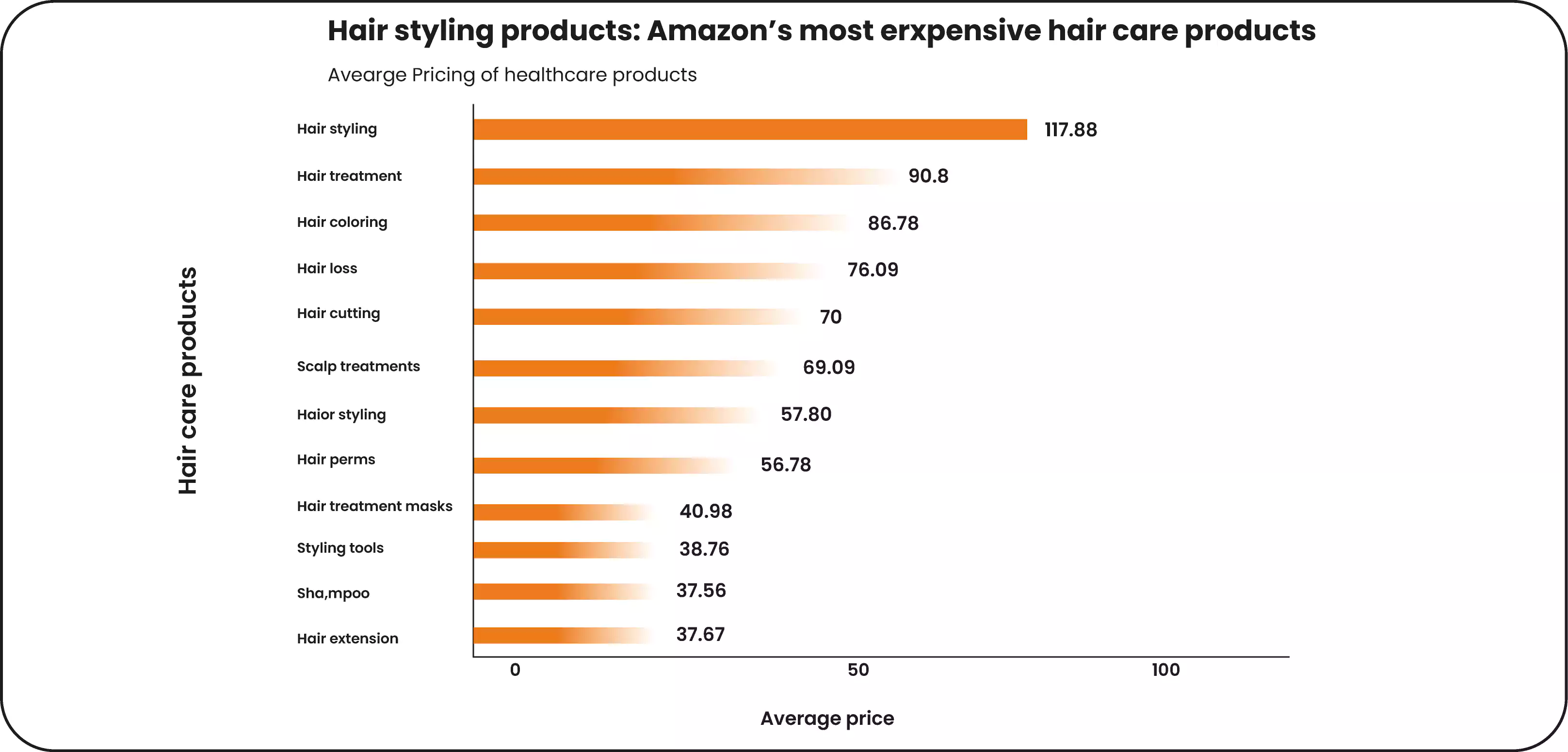

Pricing Trends Across Haircare Product Categories on Amazon

Hair Styling Products top the list with the highest average price at $117.88, suggesting that they often include premium or professional-grade items. Following are Hair Treatment Oils and Hair Coloring Products, with average prices of $90.8 and $86.78, respectively.

On the more affordable side, Shampoo and conditioner, Hair Extensions, Wigs, and accessories have the lowest average prices at around $37. These categories represent everyday essentials with a wide range of budget-friendly options.

Final Insights on Amazon’s Best-Selling Beauty Products

Analyzing best-selling beauty products on Amazon, a platform of such extensive scale, demands significant data. Manual review of the site is labor-intensive and time-consuming.

Our detailed analysis was conducted using the Amazon Best Sellers Scraper. This tool enabled us to collect data across a broad spectrum of products efficiently.

The results reveal Amazon’s crucial role in the beauty and personal care market, showcasing various offerings from luxury brands to famous, frequently listed items. Amazon is a comprehensive marketplace that addresses varied beauty needs and consumer preferences.

Conclusion: At Product Data Scrape, ethical principles are central to our operations. Whether it's Competitor Price Monitoring Services or Mobile App Data Scraping, transparency and integrity define our approach. With offices spanning multiple locations, we offer customized solutions, striving to surpass client expectations and foster success in data analytics.

.webp)

.webp)

.webp)

.webp)