In the realm of Indian e-commerce, Amazon and Flipkart reign supreme, dominating the fiercely competitive landscape. Flipkart, a native e-commerce giant, and Amazon's Indian division each command market shares exceeding 35% in the nation's online retail sector.

In this article, we delve into our transactional e-receipt consumer board in India to extract valuable consumer intelligence and actionable insights. Through e-commerce data scraping, we aim to uncover trends, preferences, and behaviors of Indian online shoppers. By analyzing this data, we can gain a deeper understanding of the Indian e-commerce market, including product preferences, pricing trends, and consumer demographics. This insight from Indian E-commerce Scraping About Amazon vs Flipkart War can help businesses make informed decisions regarding product offerings, marketing strategies, and competitive positioning in this dynamic and rapidly evolving market.

Unveiling Indian E-commerce Trends: Insights from MAI's Data Scraping Services

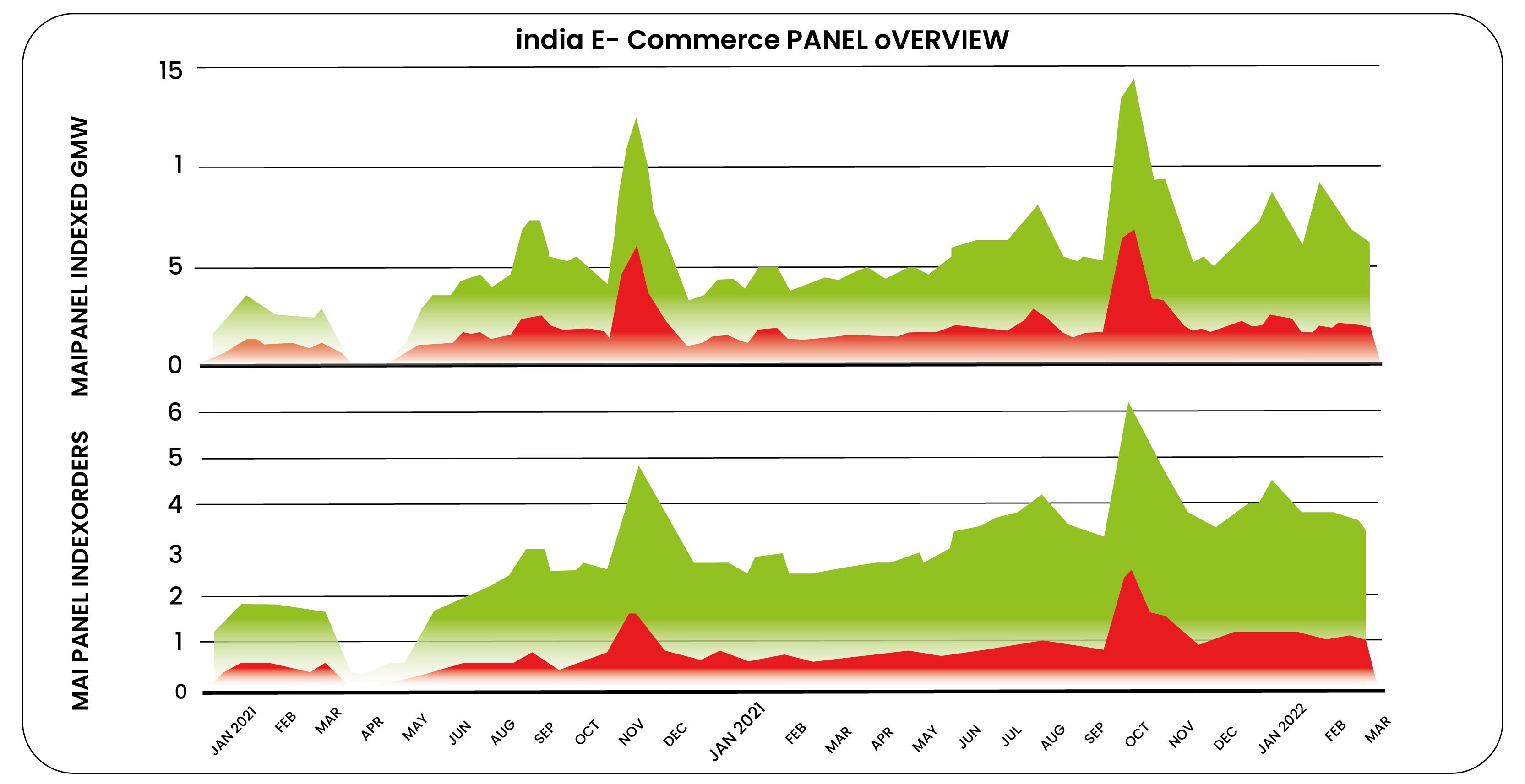

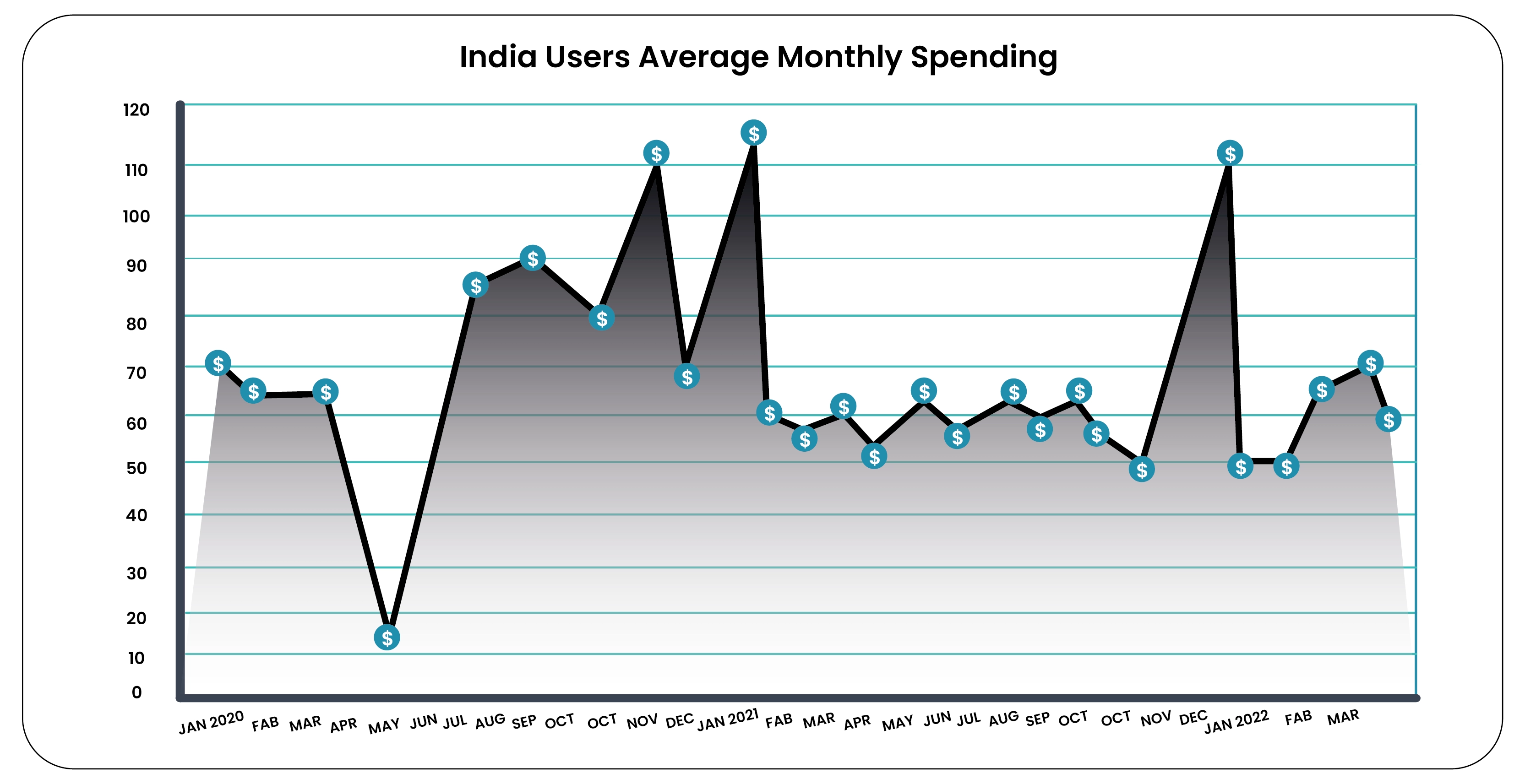

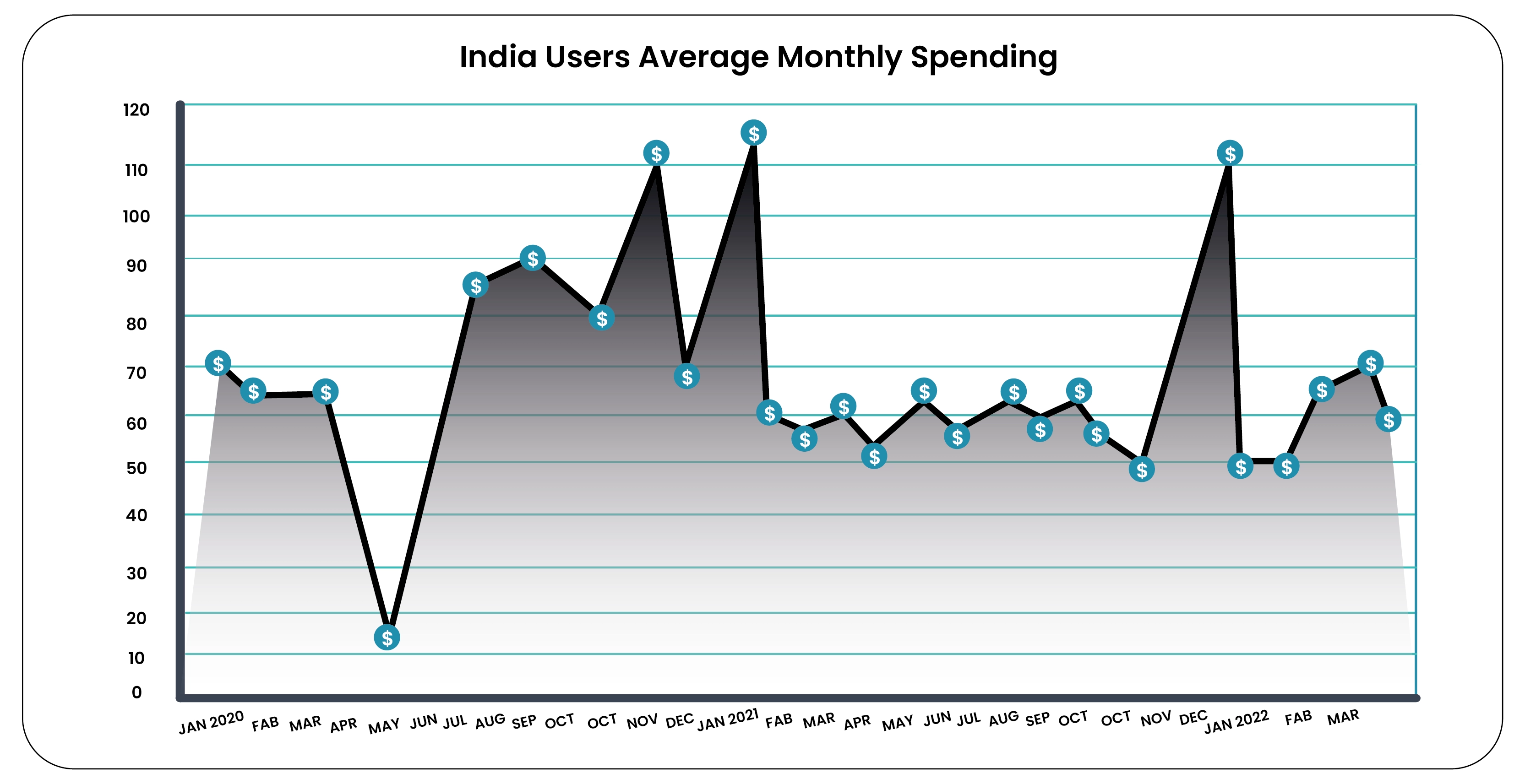

MAI's India eCommerce Panel offers a revealing snapshot of the average Indian consumer's spending habits. Through our unique consumer panel data, which includes email receipts from Amazon and Flipkart India, we estimate that the average monthly spend for Indian consumers on these platforms is approximately $75 USD.

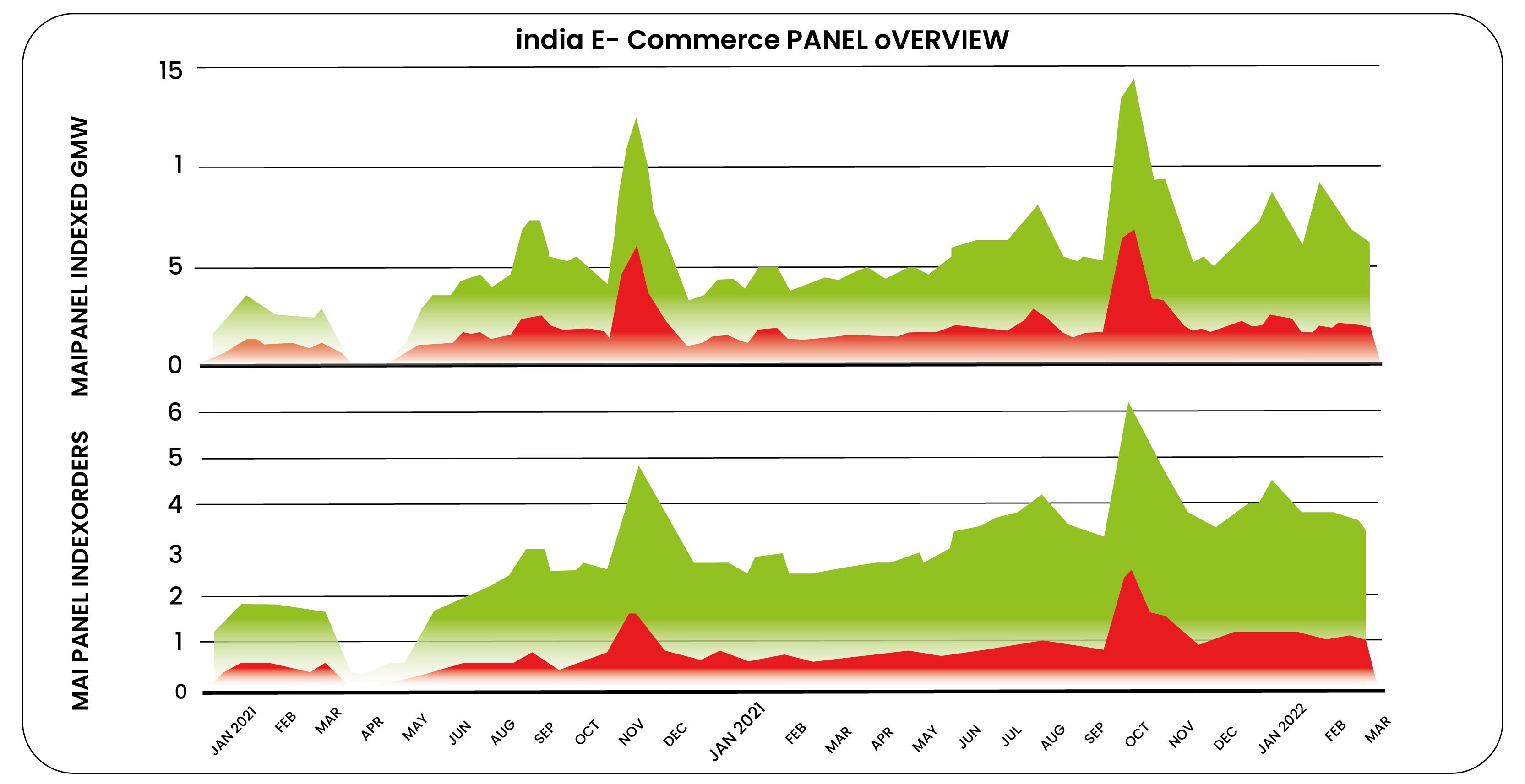

Delving deeper into our panel's Gross Merchandise Value (GMV) data, we observed that Amazon India consistently outperforms Flipkart in terms of sales. The spike in sales during the festive season in October, particularly in 2022 and 2023, is noteworthy. This surge aligns with India's festive season, during which Amazon and Flipkart engage in intense competition with their respective month-long sales events. Amazon hosts the "Great Indian Festival," while Flipkart runs its "Big Billion Days Sale."

The substantial increase in October 2021 can be attributed to both platforms extending the duration of their sales for the festive month. According to the India Brand Equity Foundation (IBEF), e-commerce sales in India during October 2021's festive season reached an impressive US$4.6 billion.

Conversely, the dip in April 2020 can be linked to the nationwide lockdown imposed in India at the end of March due to the COVID-19 pandemic. While brick-and-mortar stores were closed, online stores remained operational, albeit with logistical challenges. Following the sharp decline in April, online spending rebounded in May 2022.

Our analysis demonstrates the value of e-commerce data scraping services in providing valuable insights into consumer behavior, market trends, and competitive landscapes in the Indian e-commerce sector. By scraping data from Flipkart, businesses can make informed decisions to optimize their strategies and drive growth in this dynamic market.

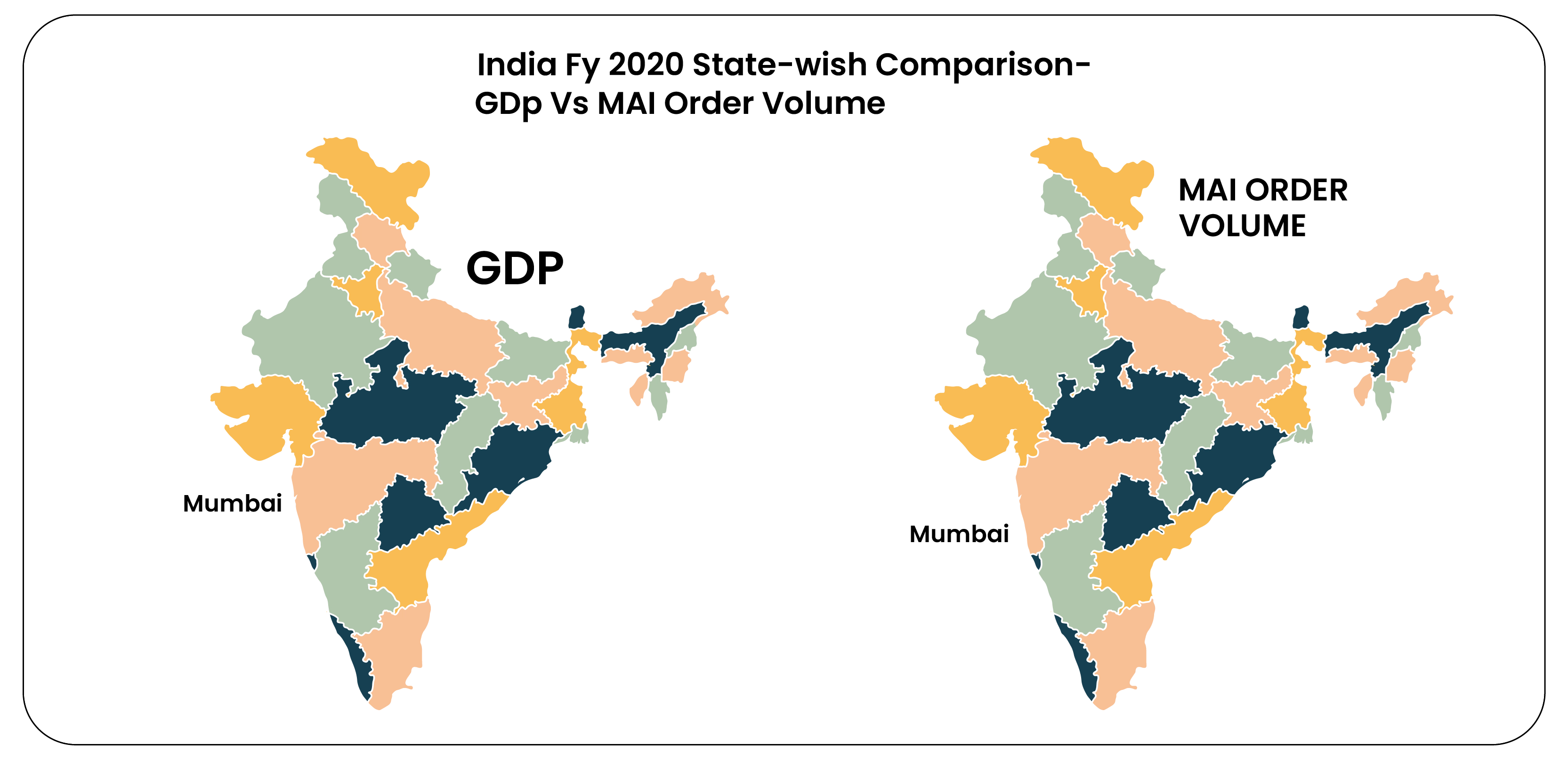

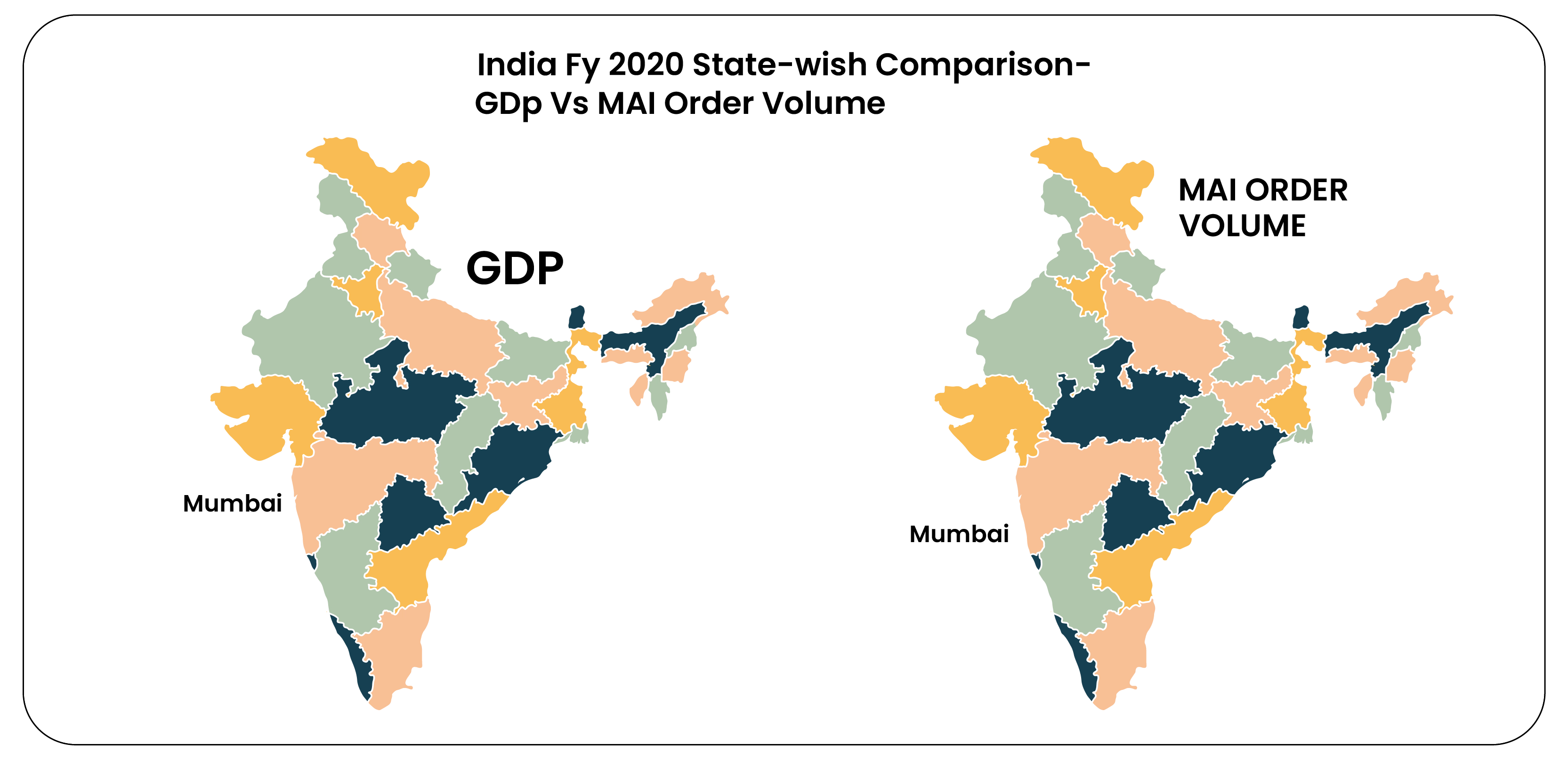

Mapping India's Economic Pulse: Correlating State GDP with MAI Order Volumes

In this study, we compared the GDP of Indian states with the order volumes revealed in our dataset to validate the reliability of our panel. As anticipated, states with higher GDPs showed a direct correlation with higher order volumes in our panel. This correlation underscores the significance of economic indicators in understanding consumer behavior and market dynamics. By aligning our data with macroeconomic factors like GDP, we provide valuable insights for businesses seeking to tailor their strategies to specific regional markets in India.

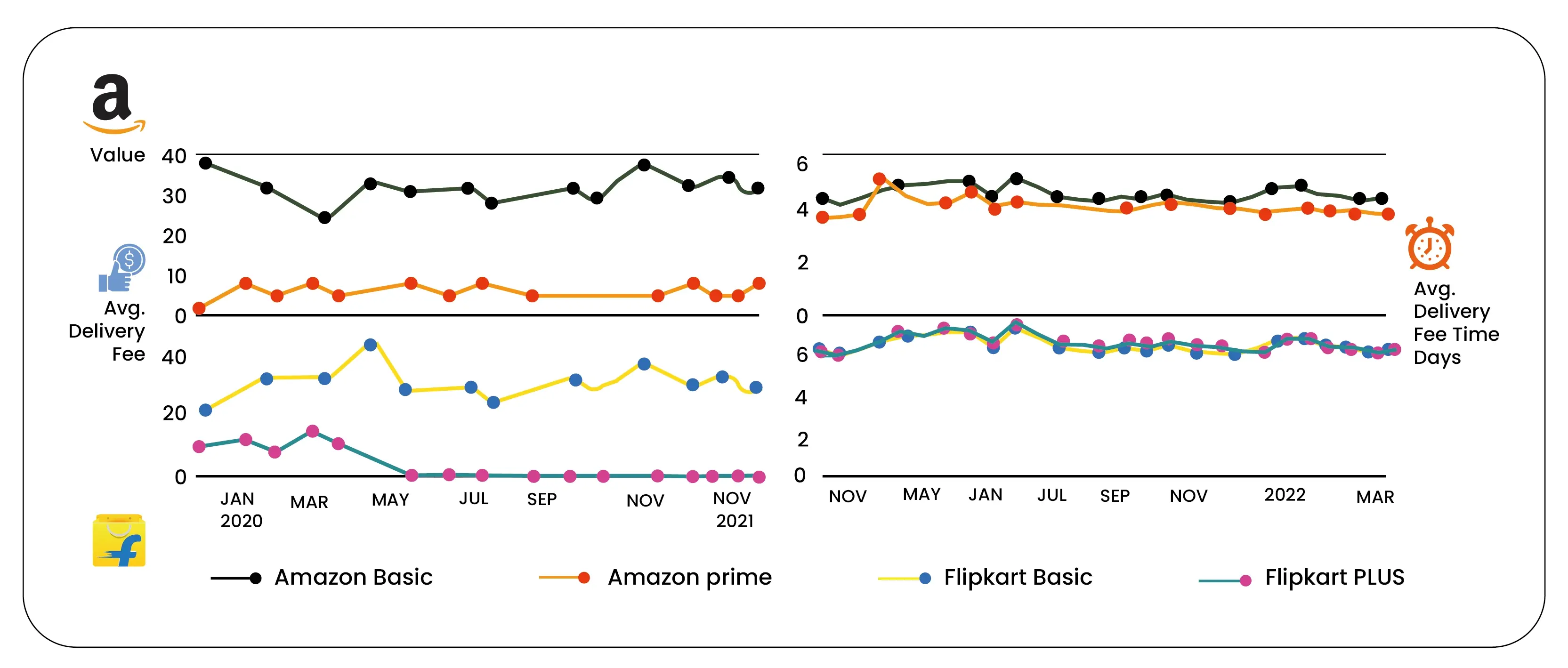

Premium User Insights: Amazon vs Flipkart

Our analysis of premium users on Amazon and Flipkart reveals intriguing patterns. According to our panel data, 20% of Amazon users subscribe to their Prime service, whereas nearly 55% of Flipkart users are enrolled in their premium package, Flipkart Plus.

Amazon Prime, a subscription-based service, offers members free delivery, along with access to Prime Video and Prime Music, for a monthly fee of Rs 829 (or a yearly offer at Rs 1549). On the other hand, Flipkart Plus is an earned loyalty program that comes with no subscription fee. It offers benefits such as special marketplace launch previews, free and fast delivery, prioritized customer support, Flipkart Pay Later options, and different benefits from ecosystem partners.

This comparison underscores the different approaches taken by Amazon and Flipkart in catering to premium users. By scraping data from Amazon and Flipkart, we were able to uncover these insights, highlighting the value of e-commerce data scraping in understanding user behavior and competitive strategies in the Indian e-commerce market.

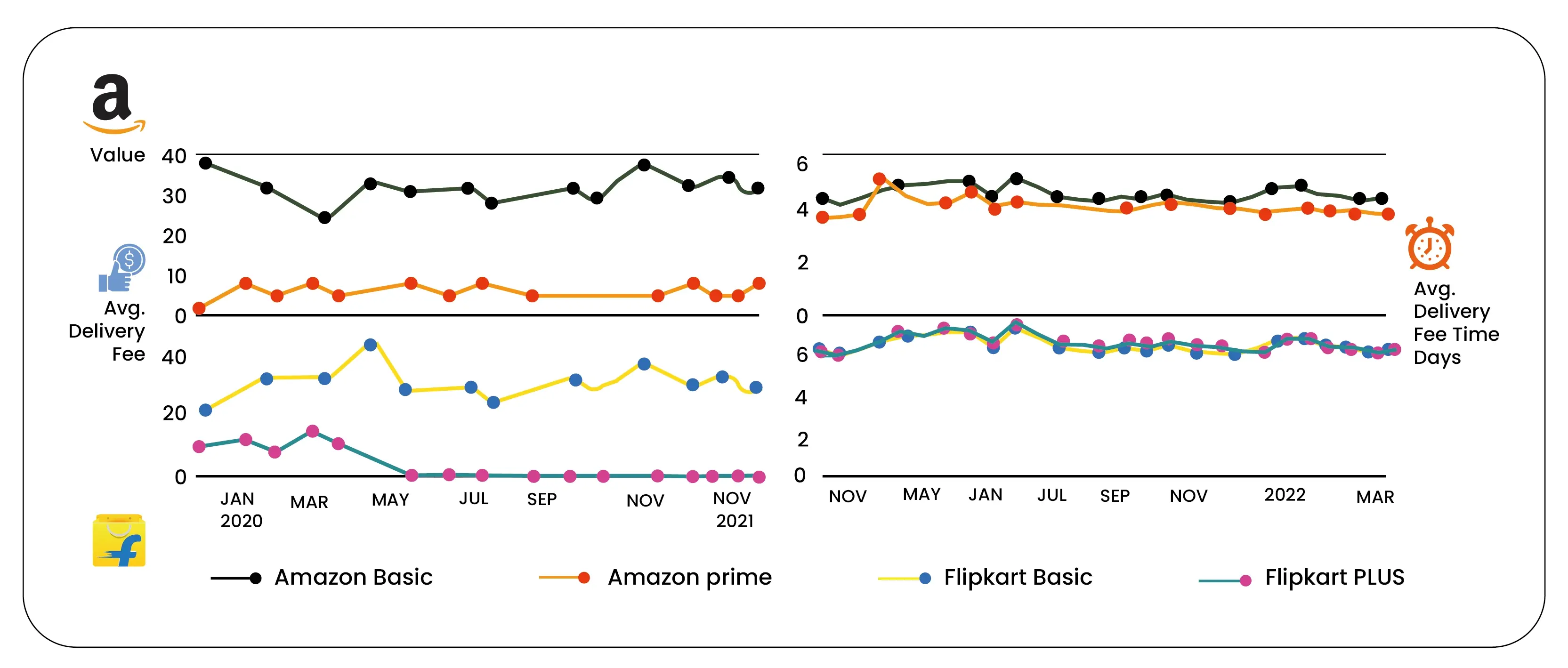

Delivery Fee and Shipment Time Analysis: Amazon vs Flipkart"

Our analysis of delivery fees and shipment times for Amazon and Flipkart reveals interesting trends. While both companies offer lower delivery fees to their premium members compared to regular users, Amazon's Prime members enjoy a lower delivery fee than Flipkart's Plus members. It's noteworthy that Flipkart has reduced its delivery fees and maintained them at a reduced rate since 2021.

In terms of delivery time, our Dunzo grocery data scraping estimated this variable in our e-receipt panel by calculating the date/time gap between the order confirmation email and the order delivered email to our panel members. For basic users of both companies, the delivery times appear to be similar. However, Amazon Prime members seem to experience slightly faster delivery times compared to Flipkart Plus members.

These insights were derived from our e-commerce data scraping services, highlighting the value of such services in understanding the competitive landscape and user experience in the e-commerce sector.

User Retention Analysis: Amazon vs Flipkart

In our study of consumer shopping behavior in India, we analyzed a cohort to observe changes in spending patterns after the October 2020 festive sales. Our data from competitor including Swiggy Instamart grocery data scraping indicates that basic members of both Amazon and Flipkart do not exhibit strong loyalty to either platform. Amazon had a 38% retention rate among basic users between the two October festive months in 2023 compared to 2022, while Flipkart had a 28% retention rate.

In contrast, premium members of both platforms showed higher retention rates. Amazon Prime and Flipkart Plus had retention rates of 74% and 80%, respectively. This suggests that premium services play a significant role in maintaining user loyalty. However, it's important to note that these users are likely already inclined towards online shopping. Additionally, India's preference for offline shopping remains strong, indicating that online platforms still have room for growth in user retention.

These insights were derived from our analysis using e-commerce data scraper, highlighting the value of such tools in understanding user behavior and retention strategies in the e-commerce sector.

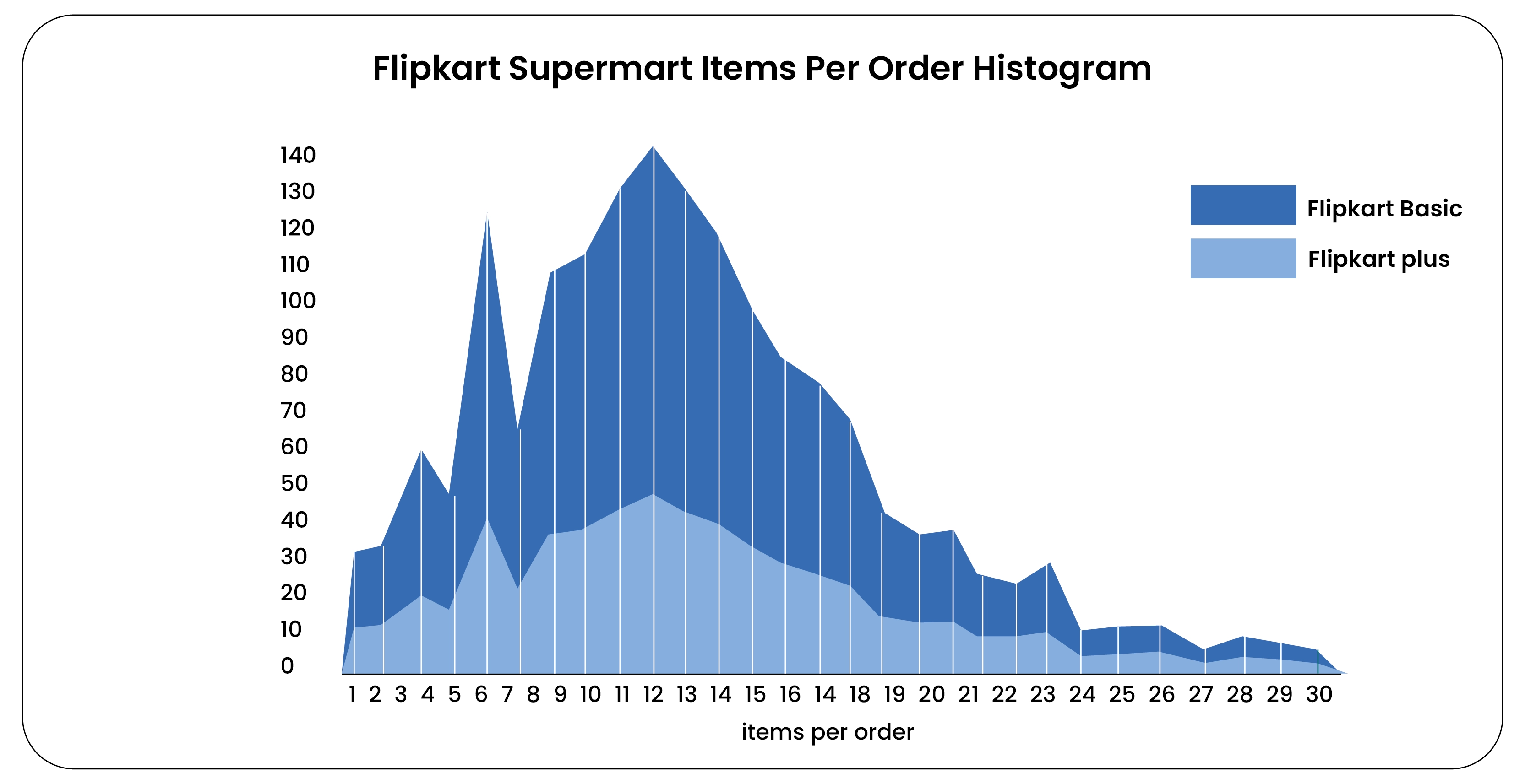

Exploring Flipkart's Supermart Grocery Basket: Insights from Grocery Data Scraping

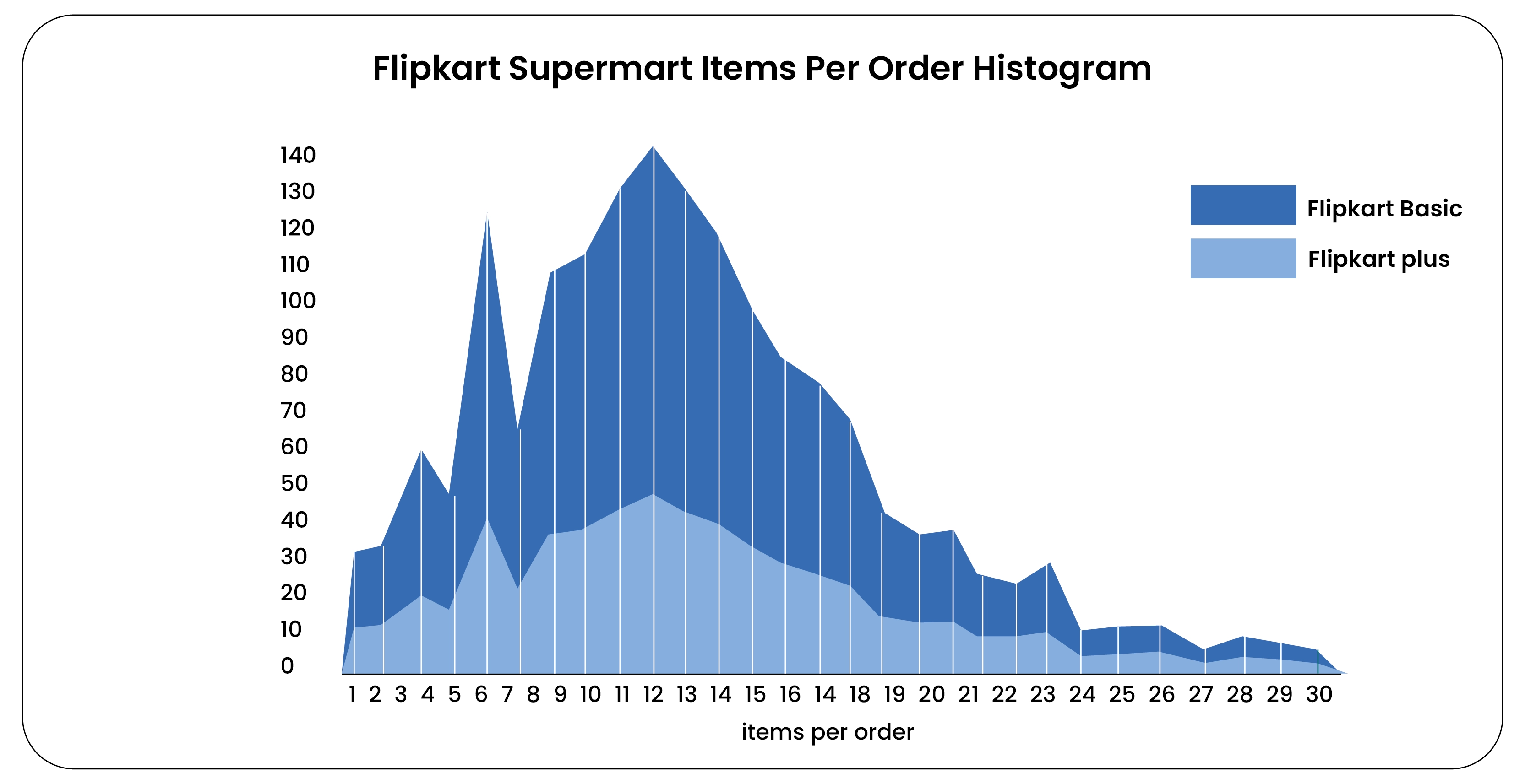

Supermart, Flipkart's e-grocery arm, offers next-day delivery and collaborates with Ninjacart for its supply chain. Recently, they reduced their 90-minute delivery to 45 minutes, aligning with competitors like Blinkit, Zepto, Swiggy's Instamart, and RIL-backed Dunzo striving for ultra-fast deliveries within 15-20 minutes. Our grocery data scraping revealed that the average number of items in a Flipkart user's basket is 10 for basic and Plus members. Interestingly, only Flipkart Plus members tend to order more, averaging over 27 items per basket. For details on average basket orders for Zepto grocery data scraping, please contact us for further insights. India, compared to 8% in China and 4% in Europe.

Delving into our e-receipt panel, our Blinkit grocery data scraping found interesting insights into the most popular items ordered by Indian households on Flipkart. The top spot goes to Pillsbury chakki fresh atta, indicating a high consumption of chapatis. Following closely are Parry's white label sugar, Maggi Masala instant noodles, Happilo 100% natural premium Californian almonds, and Ananda Ghee, highlighting common items used in Indian households.

The Evolving E-commerce Landscape of India: A Deep Dive

India's e-commerce sector has experienced rapid growth, doubling between 2017 and 2023, driven by increasing internet adoption. Despite being the second most populous country globally, India's internet penetration stands at around 45%, leading to the majority of retail sales still occurring offline. However, the sheer population size contributes to a massive e-commerce industry.

Projections by the India Brand Equity Foundation (IBEF) estimate India's e-commerce market to reach US$119billion by 2025 and US$220 billion by 2026. In 2022, India's e-commerce turnover was $55 billion, making it the eighth-largest e-commerce market, surpassing Canada and trailing France. With 144 million online shoppers, India ranks third globally, behind the US and China.

The sector's growth is driven by increased internet and smartphone penetration, supported by the "Digital India" program. As of July 2023, India had 790.59 million internet connections, with urban areas accounting for about 61%, predominantly wireless. Projections suggest India's internet users will reach 900 million by 2025, growing at a CAGR of 48% from 2023. RedSeer forecasts the e-retail market's Gross Merchandise Value (GMV) to reach $350 billion by 2030, indicating substantial growth opportunities in India's e-commerce sector.

Conclusion: India's e-commerce market is witnessing exponential growth, fueled by increasing internet penetration and smartphone usage. Despite lower internet penetration rates compared to its population, India's e-commerce sector has seen significant expansion, with projections indicating continued growth. The sector's potential is underscored by its sheer population size and the ongoing "Digital India" initiative. As internet and smartphone penetration continue to rise, India's e-commerce market is poised for further expansion, offering vast opportunities for businesses. With a projected e-commerce market size of US$119 billion by 2025 and US$220 billion by 2026, India remains a key player in the global e-commerce landscape

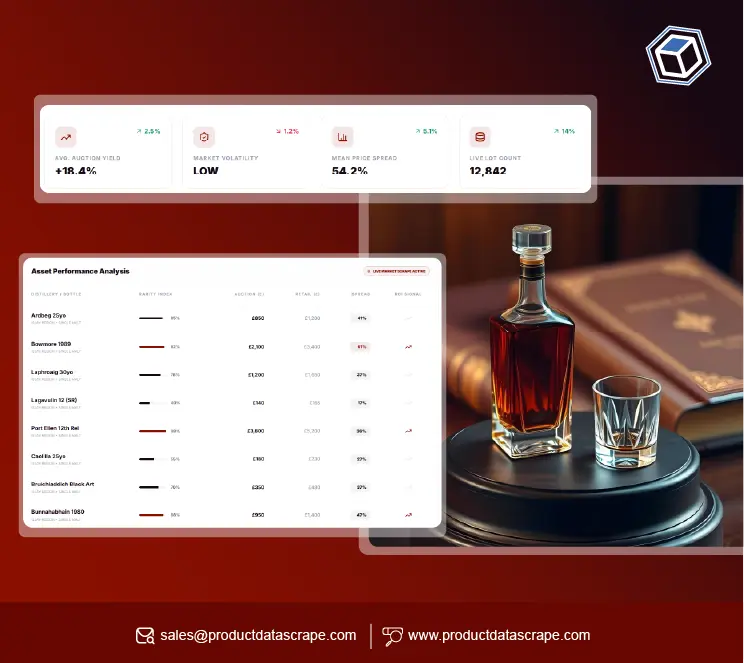

At Product Data Scrape, ethical principles are central to our operations. Whether it's Competitor Price Monitoring Services or Mobile App Data Scraping, transparency and integrity define our approach. With offices spanning multiple locations, we offer customized solutions, striving to surpass client expectations and foster success in data analytics.

.webp)