Introduction

India’s hyperlocal grocery ecosystem has evolved rapidly with the rise of quick-commerce platforms delivering essentials within minutes. Consumer expectations around speed, availability, and pricing consistency have intensified competition among platforms like Swiggy Instamart, BigBasket, and Flipkart Minutes. For brands and retailers, understanding these shifts requires continuous access to granular, real-time data. Analyzing Hyperlocal Grocery Trends enables businesses to decode purchasing behavior, demand spikes, and inventory volatility at a neighborhood level.

At the same time, pricing fluctuations across cities, pin codes, and platforms have made Hyperlocal Market Pricing Data Intelligence a critical capability for FMCG brands and retailers. Real-time data reveals how discounts, stock availability, and delivery promises influence conversion. By leveraging structured hyperlocal datasets from q-commerce platforms, decision-makers can forecast demand, optimize pricing, and respond faster to market changes in an increasingly time-sensitive grocery landscape.

Real-Time Visibility into Leading Grocery Marketplaces

Hyperlocal grocery platforms operate on razor-thin margins where pricing and stock visibility directly influence consumer choice. By Scrape BigBasket prices & stock in real time, brands gain immediate insights into how products are priced, discounted, and replenished across cities and fulfillment hubs. From 2020 to 2026, BigBasket expanded dark store coverage significantly, increasing the need for continuous price and inventory monitoring.

Real-time data shows that price changes on essential SKUs can occur multiple times a day during peak demand periods. Monitoring this volatility allows brands to benchmark pricing consistency and identify promotional windows.

| Year |

Avg Daily Price Changes |

Stock Availability (%) |

SKU Coverage |

| 2020 |

1.8 |

72% |

45,000 |

| 2022 |

2.4 |

78% |

62,000 |

| 2024 |

3.1 |

83% |

79,000 |

| 2026 |

3.8 |

88% |

95,000 |

This level of transparency enables brands to adjust pricing strategies dynamically while ensuring supply chain readiness in hyperlocal markets.

Capturing Ultra-Fast Commerce Pricing Signals

Quick-commerce models thrive on instant fulfillment and aggressive pricing strategies. Using Real-time pricing & availability from Flipkart Minutes, retailers can analyze how rapid delivery commitments impact product pricing and availability across pin codes. Flipkart Minutes has shown distinct pricing patterns compared to traditional grocery platforms, often prioritizing convenience-led pricing over bulk discounts.

Between 2020 and 2026, the average delivery promise window dropped below 20 minutes in metro areas, driving higher price sensitivity for impulse-driven categories. Real-time pricing intelligence highlights how availability constraints trigger temporary price increases or SKU substitutions.

| Year |

Avg Delivery Time (mins) |

Price Volatility Index |

Out-of-Stock Rate (%) |

| 2020 |

35 |

1.2 |

18% |

| 2022 |

28 |

1.6 |

14% |

| 2024 |

22 |

2.1 |

11% |

| 2026 |

18 |

2.6 |

8% |

These insights help brands align inventory planning with ultra-fast delivery models while maintaining competitive pricing.

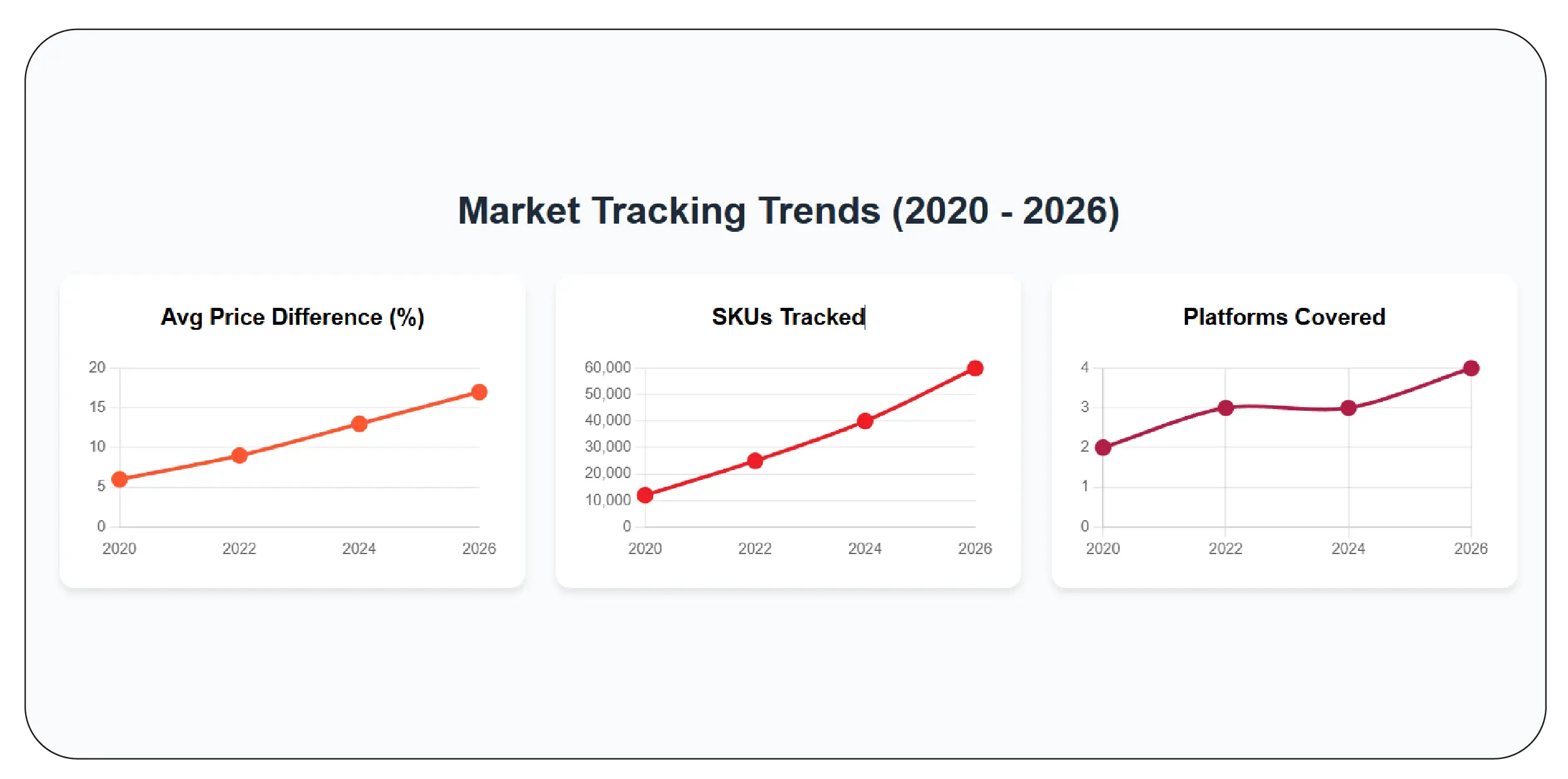

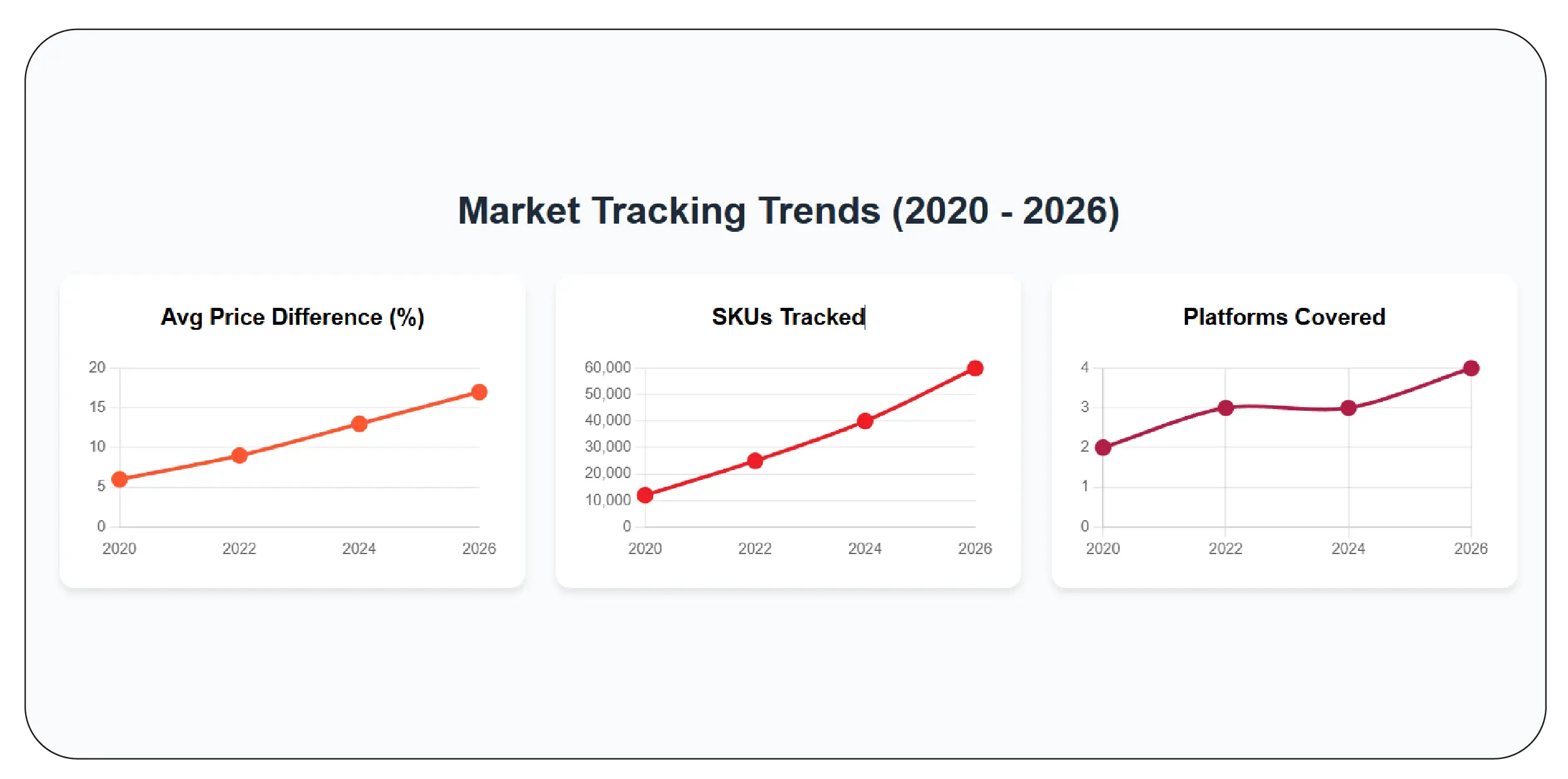

Building Cross-Platform SKU-Level Intelligence

Consumers frequently compare prices across apps before placing orders, making cross-platform visibility essential. By Track SKU-level prices across Indian q-commerce platforms, brands can analyze how the same product behaves across Swiggy Instamart, BigBasket, and Flipkart Minutes. This comparison uncovers pricing gaps, discount overlaps, and regional inconsistencies.

From 2020 to 2026, SKU-level price dispersion across platforms widened, particularly for packaged foods and daily essentials. Data-driven brands used this intelligence to minimize channel conflict and optimize promotional calendars.

| Year |

Avg Price Difference (%) |

SKUs Tracked |

Platforms Covered |

| 2020 |

6% |

12,000 |

2 |

| 2022 |

9% |

25,000 |

3 |

| 2024 |

13% |

40,000 |

3 |

| 2026 |

17% |

60,000 |

4 |

SKU-level analytics empower brands to maintain price parity while responding faster to competitor moves in hyperlocal ecosystems.

Decoding Demand Patterns in 10-Minute Delivery Models

Swiggy Instamart has reshaped grocery buying by encouraging frequent, small-basket purchases. With Swiggy Instamart SKU-Level Data Extraction, brands gain access to granular data on demand frequency, stock rotation, and consumer preferences at a micro-market level.

Between 2020 and 2026, Instamart’s average order frequency per user increased sharply, highlighting the importance of continuous SKU availability. Real-time data reveals how weather, festivals, and time-of-day influence SKU demand.

| Year |

Avg Orders per User / Month |

Top SKU Turnover (Days) |

Availability (%) |

| 2020 |

4.2 |

9.5 |

70% |

| 2022 |

6.8 |

7.2 |

78% |

| 2024 |

9.6 |

5.4 |

85% |

| 2026 |

12.3 |

4.1 |

90% |

Such insights allow brands to prioritize fast-moving SKUs and tailor assortments for hyperlocal demand spikes.

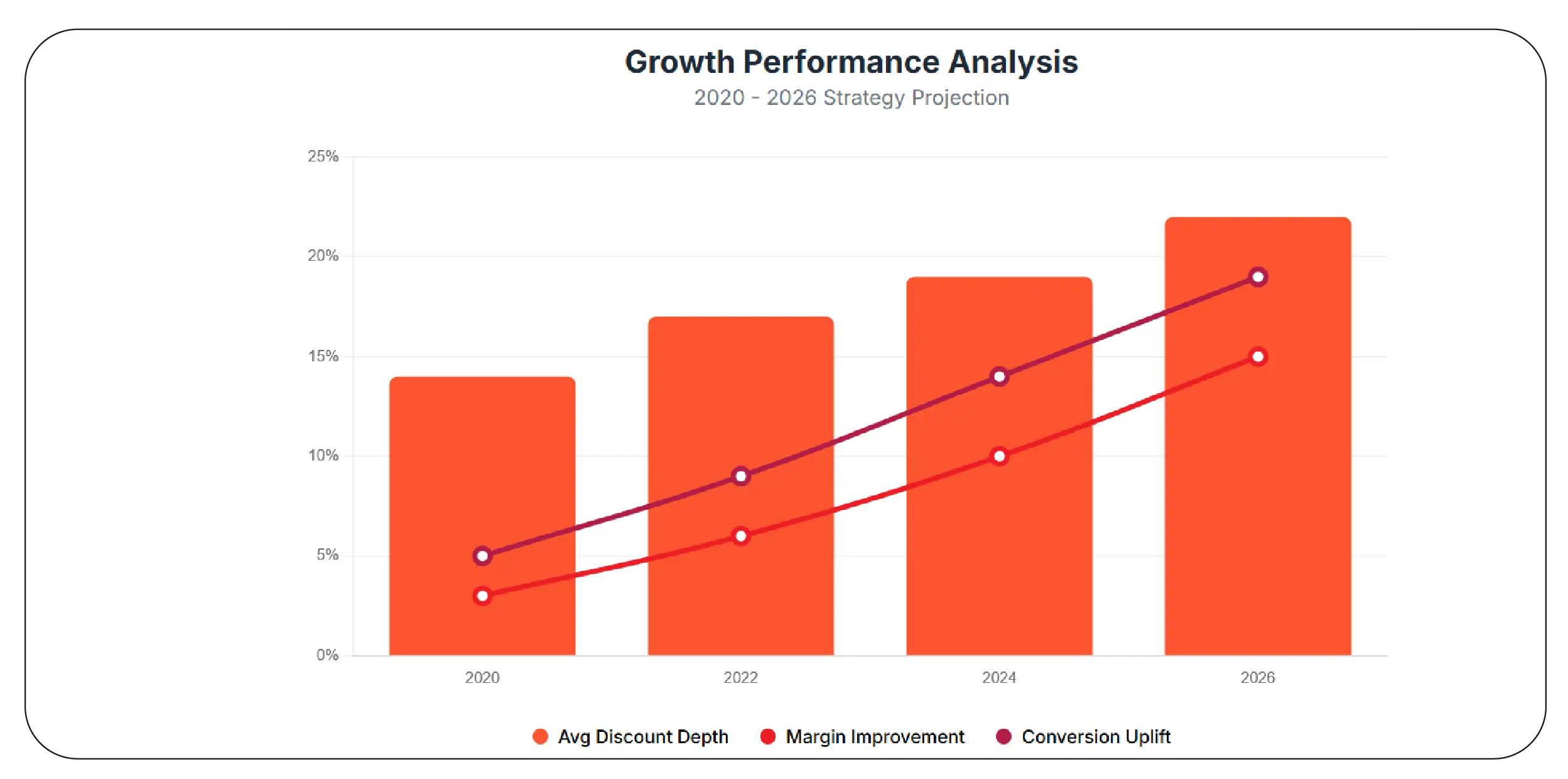

Turning Hyperlocal Data into Competitive Advantage

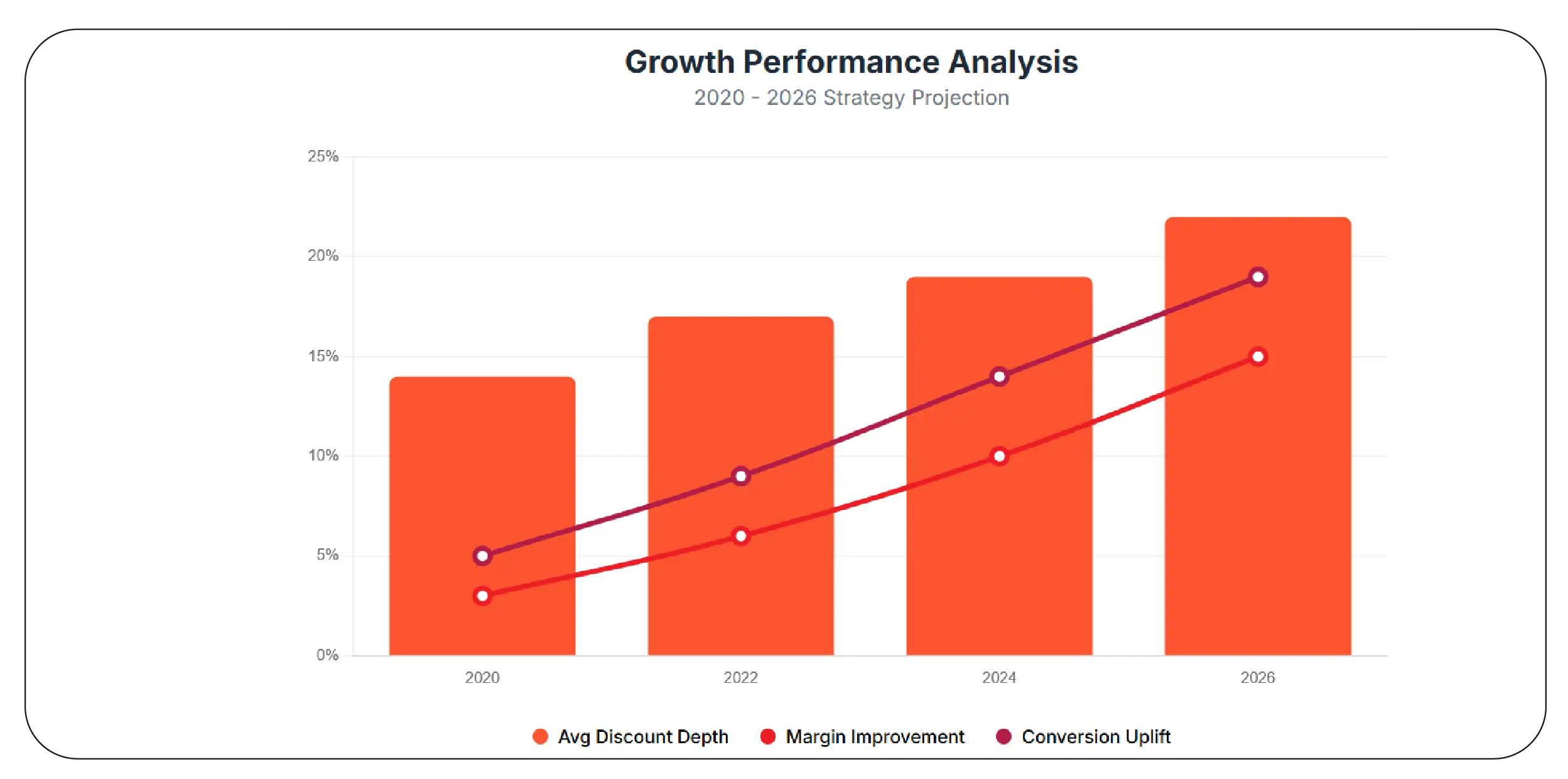

Pricing intelligence has become a decisive lever for FMCG brands operating in q-commerce. Through Q-Commerce Pricing Intelligence for FMCG Brands, companies can analyze how price elasticity varies across cities, platforms, and delivery models. Hyperlocal pricing data reveals which SKUs are most sensitive to discounts and which sustain premium positioning.

From 2020 to 2026, brands leveraging pricing intelligence achieved improved margin control despite intense competition. Data-driven pricing strategies enabled targeted promotions instead of blanket discounts.

| Year |

Avg Discount Depth (%) |

Margin Improvement (%) |

Conversion Uplift (%) |

| 2020 |

14% |

3% |

5% |

| 2022 |

17% |

6% |

9% |

| 2024 |

19% |

10% |

14% |

| 2026 |

22% |

15% |

19% |

This approach transforms hyperlocal data into actionable pricing decisions that balance growth and profitability.

Powering Real-Time Decision Making with APIs

APIs enable seamless, scalable access to live hyperlocal grocery data. By using Swiggy Instamart Grocery Data Scraping API, businesses can automate data ingestion for pricing, availability, and SKU performance across thousands of locations. APIs ensure data freshness while eliminating manual tracking challenges.

Between 2020 and 2026, API-driven data pipelines reduced latency in decision-making and improved forecasting accuracy. Brands integrated real-time feeds directly into dashboards, enabling instant response to stockouts and competitor pricing shifts.

| Year |

Data Refresh Frequency |

Locations Covered |

Forecast Accuracy (%) |

| 2020 |

Daily |

120 |

68% |

| 2022 |

Hourly |

300 |

74% |

| 2024 |

Near Real-Time |

650 |

82% |

| 2026 |

Real-Time |

1,200 |

89% |

API-led intelligence ensures brands remain agile in a rapidly evolving q-commerce environment.

Why Choose Product Data Scrape?

Product Data Scrape delivers scalable, compliant solutions tailored for hyperlocal grocery intelligence. With access to structured datasets like BigBasket Grocery Store Dataset, brands can analyze pricing, availability, and demand patterns with precision. The platform specializes in Analyzing Hyperlocal Grocery Trends by offering real-time feeds, historical datasets, and customizable extraction pipelines. Businesses benefit from automation, high accuracy, and seamless integration with analytics systems—allowing teams to focus on insights instead of data collection complexities.

Conclusion

Hyperlocal grocery markets demand speed, precision, and continuous visibility. Real-time data from Swiggy Instamart, BigBasket, and Flipkart Minutes empowers brands to stay ahead of shifting consumer behavior and competitive pricing dynamics. With the right data strategy, hyperlocal volatility becomes a source of opportunity rather than risk.

Organizations looking to unlock real-time insights can accelerate outcomes using Flipkart Minutes Quick Commerce Scraper.

Partner with Product Data Scrape today to transform hyperlocal grocery data into actionable growth intelligence.

FAQs

1. How does real-time grocery data support pricing decisions?

Real-time grocery data reveals instant price changes, discount patterns, and competitor moves, helping brands optimize pricing strategies while maintaining competitiveness across hyperlocal platforms.

2. Can hyperlocal data improve inventory planning?

Yes, real-time availability and SKU demand trends enable brands to anticipate stockouts, prioritize fast-moving products, and improve replenishment cycles.

3. Which platforms are covered in hyperlocal grocery analysis?

Major platforms include Swiggy Instamart, BigBasket, Flipkart Minutes, and other emerging q-commerce marketplaces across Indian cities.

4. Is SKU-level tracking important for FMCG brands?

SKU-level tracking ensures visibility into individual product performance, enabling accurate benchmarking, targeted promotions, and assortment optimization.

5. How does Product Data Scrape support hyperlocal intelligence?

Product Data Scrape provides automated, real-time data extraction, APIs, and custom datasets designed for scalable hyperlocal grocery analytics.

.webp)