John Lewis is one of the UK's leading retailers, known for its commitment to quality,

customer service, and value. As a department store chain with many products, its pricing

strategy is critical in maintaining its competitive edge. In women's clothing, pricing decisions

are particularly significant, as the fashion industry is highly competitive and heavily driven

by consumer perception of value. Scrape John Lewis Women's Clothing Prices to help

businesses looking to analyze their market strategy.

This article delves deep into John Lewis's pricing strategy for women's clothing, exploring

various analytical approaches, including boxplot analysis, discount patterns, seasonal trends,

and competitive positioning. Retail analysts and data enthusiasts often Scrape John Lewis

Price Data to gain insights into how pricing evolves over time and across product categories.

By examining these aspects, we can better understand how John Lewis maintains its

position in the market while balancing profitability and customer loyalty. Web Scraping

John Lewis Fashion Prices allows companies to stay ahead of trends and adjust their

offerings to effectively meet consumer demands.

The Landscape of Women's Clothing Pricing

Women's fashion is a dynamic and competitive market where pricing is influenced by many

factors, including seasonal trends, brand positioning, consumer demand, and economic

conditions. At John Lewis, the pricing strategy is influenced by its commitment to offering

"Never Knowingly Undersold" products, a pledge to match the lowest prices found at

competitors. This is where John Lewis Clothing Data Extraction becomes vital for

understanding how their pricing compares across various segments.

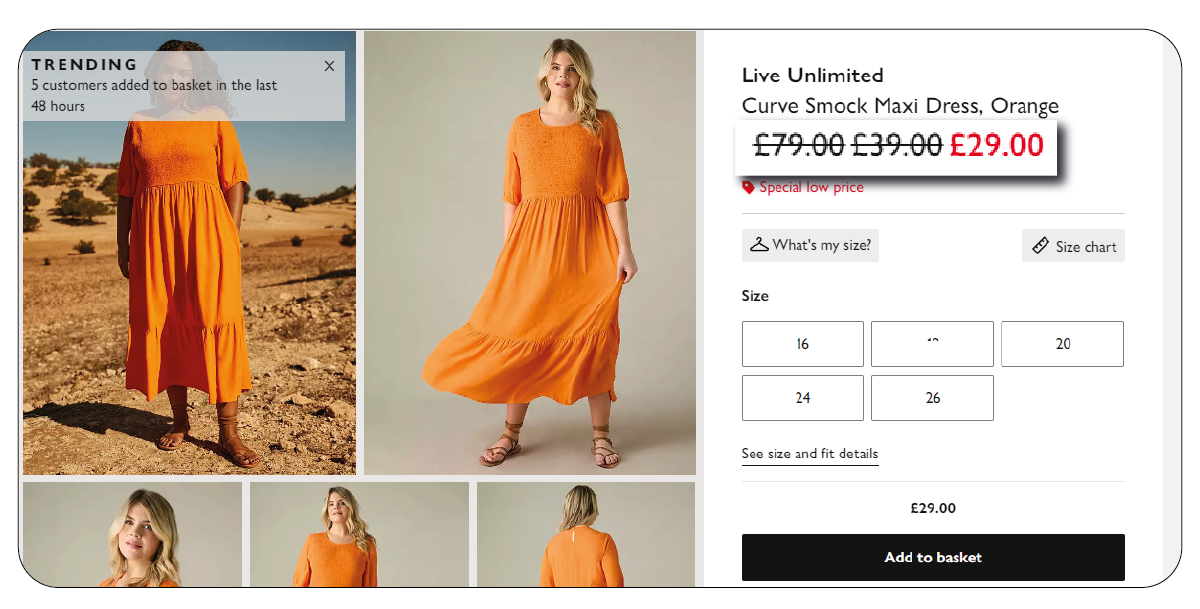

John Lewis caters to a wide demographic, from premium to mid-range clothing lines.

Women's clothing prices are highly variable, depending on the material, brand, design, and

seasonality factors. To fully appreciate the complexity of John Lewis's pricing strategy, it's

necessary to delve into detailed data analysis. Businesses that Scrape John Lewis Women's

Clothing Data can gain valuable insights into market trends and consumer behavior,

enabling more effective pricing and product strategies.

Boxplot Analysis of Pricing Distribution

One of the most effective ways to analyze the pricing of women's clothing at John Lewis is

through a boxplot analysis. A boxplot visually represents the price distribution by

summarizing the central tendency, variability, and any outliers in the data. It's beneficial

when comparing different product categories or brands. Web Scraping for Fashion Retailers

enables data gathering necessary for conducting such analyses effectively.

In this case, the boxplot analysis can help identify how the prices of women's clothing are

distributed across different brands and categories at John Lewis.

Example Insights from Boxplot Analysis:

1. Price Spread: The boxplot's interquartile range (IQR) helps identify how

concentrated prices are around the median. If the IQR is narrow, most clothing items

are priced similarly, which might indicate a more standardized pricing model.

Conversely, a wider IQR suggests more significant variability, possibly due to a range

of premium and budget brands. John Lewis Product Data Collection is crucial to

obtain this structured pricing information for analysis.

2. Outliers: Any outliers in the data (shown as dots outside the whiskers of the boxplot)

can provide insights into high-end premium products or particularly low-cost items.

For example, high-end brands like Phase Eight or Hobbs may create upper outliers,

while essential in-house brands or heavily discounted items may appear as lower

outliers.

3. Brand Comparisons: By comparing multiple boxplots across different brands or

categories (e.g., dresses, outerwear, or casual wear), it's possible to gain insights into

how John Lewis prices each category. A comparison between luxury brands like

Whistles and more affordable lines like Kin by John Lewis could reveal the pricing

strategy behind targeting different consumer segments. Utilizing a John Lewis Price

Comparison Tool helps businesses and consumers track and analyze these pricing

differences across product lines efficiently.

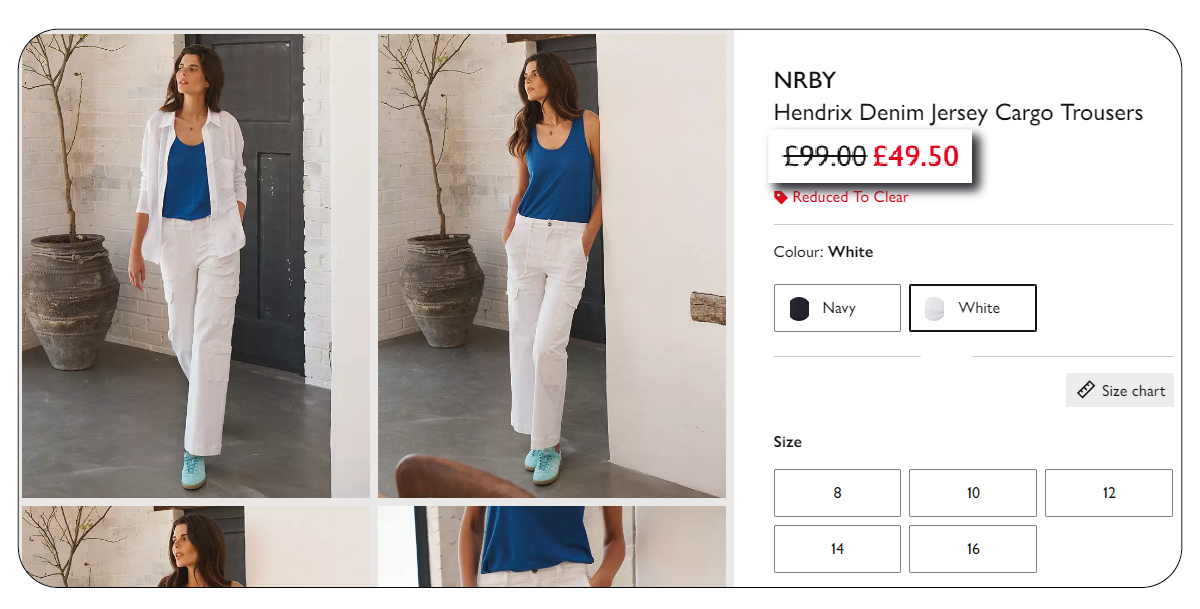

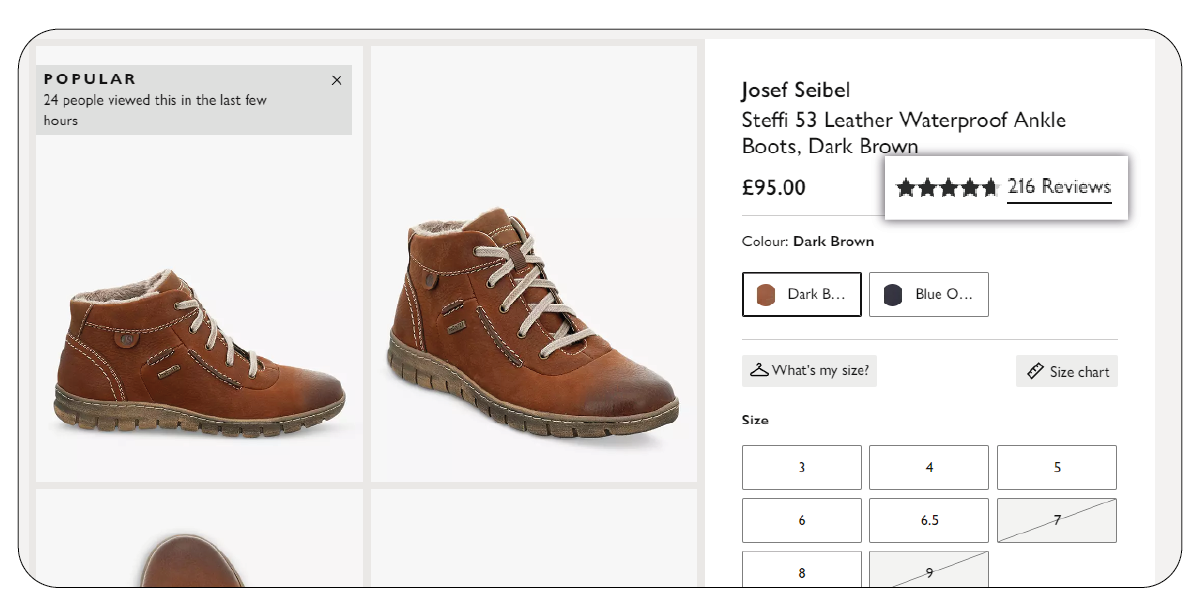

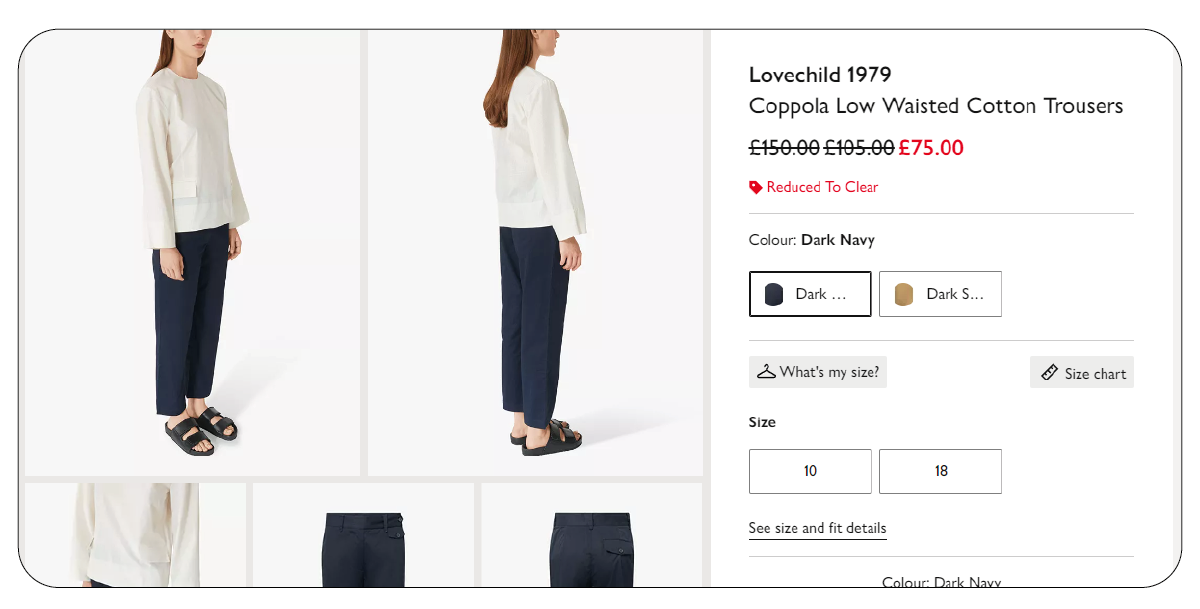

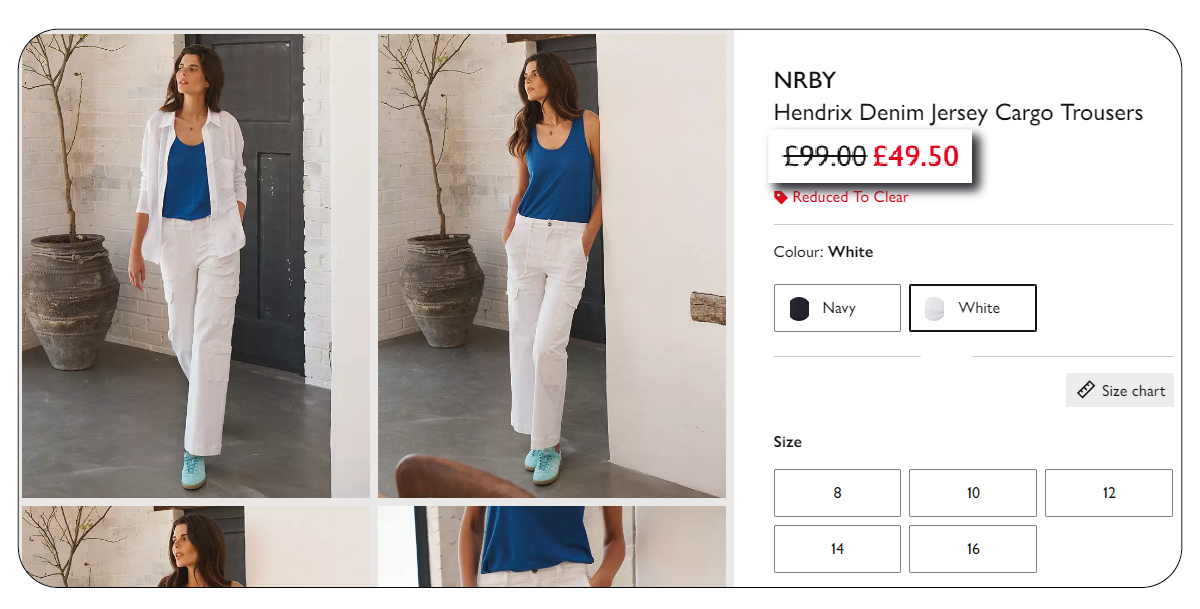

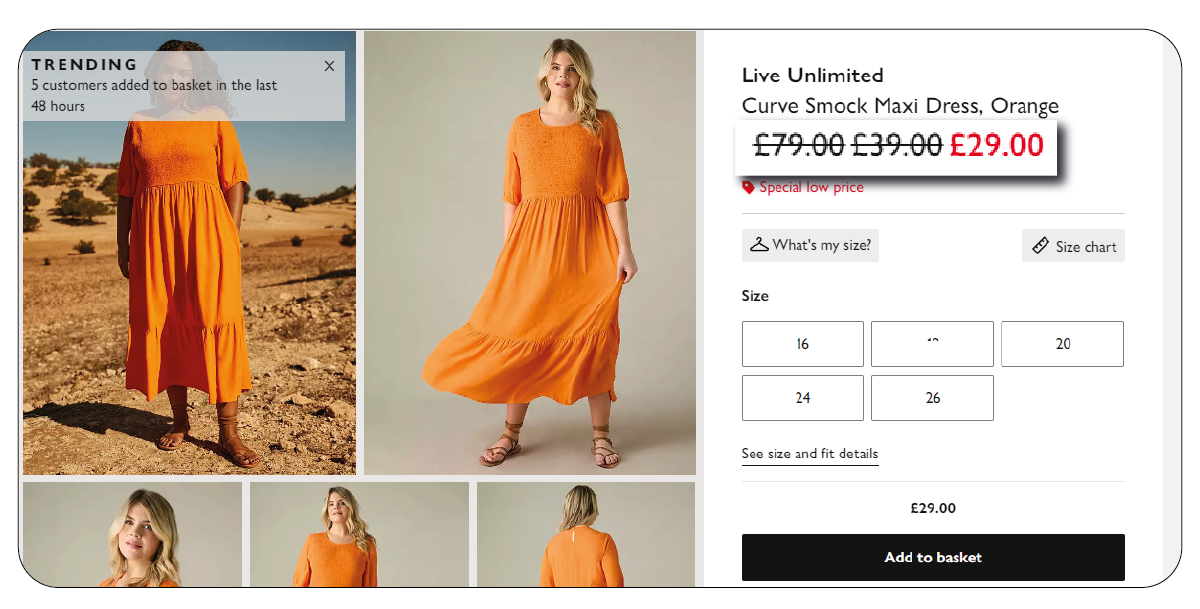

Analyzing Discount Patterns

Discounts and promotions are essential to any retailer's pricing strategy, and John Lewis is

no exception. Discounts not only help clear out inventory but also attract price-sensitive

consumers. However, the frequency and depth of discounts can significantly influence

consumer perception of the brand's pricing integrity. Women's Clothing Pricing Trends

Extraction from John Lewis can provide valuable insights into these promotional patterns.

Key Discount Metrics:

1. Discount Frequency: By analyzing the frequency of discounts on women's clothing,

we can determine whether John Lewis leans towards regular promotions or

occasional deep discounts. High-frequency discounts might suggest maintaining

competitive pricing, especially during sale periods such as Black Friday, January Sales,

and mid-season promotions. Lower frequency but more significant discounts may

indicate a premium pricing strategy with occasional clearance sales. Real-time John

Lewis Price Extraction can track the shifts in these pricing patterns to give businesses

an edge in understanding the strategy.

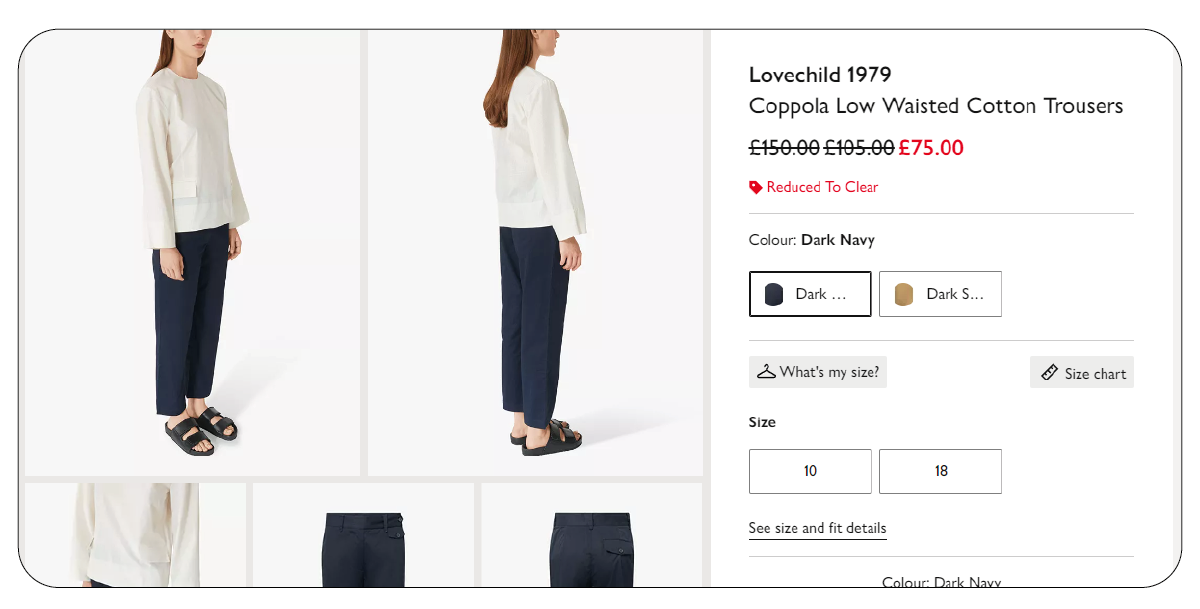

2. Average Discount Depth: The discount depth refers to the percentage reduction

from the original price. John Lewis might apply different discount depths based on

seasonality, product age, and inventory levels. For example, end-of-season clothing

might see deeper discounts, while newer collections may have shallower discounts

or no promotions. We can gauge the retailer's promotional aggressiveness by

calculating the average discount depth across different categories.

3. Timing of Discounts: Seasonal fluctuations play a significant role in discounting

women's clothing. Data analysis can track when John Lewis offers the highest or

most frequent discounts. Typically, late winter and summer see higher discounting

as stores prepare for new collections. Understanding the timing of discounts is

essential for determining consumer buying behavior—whether customers wait for

sales or purchase at the total price. Using tools to Analyze John Lewis Women's

Fashion Pricing helps businesses optimize their inventory and marketing strategies

around these discount cycles.

Example Analysis of Discount Patterns:

Early Discounts vs. End-of-Season Sales: Analyzing how early in the season John

Lewis applies discounts can show whether the retailer prefers early markdowns to

stimulate demand or deep end-of-season cuts to clear out inventory.

Brand-Specific Discounts: Some brands may experience more frequent or deeper

discounts, especially if they are less in demand. Analyzing which brands or product

categories are subject to frequent promotions may suggest areas where John Lewis

seeks to boost sales through discounting.

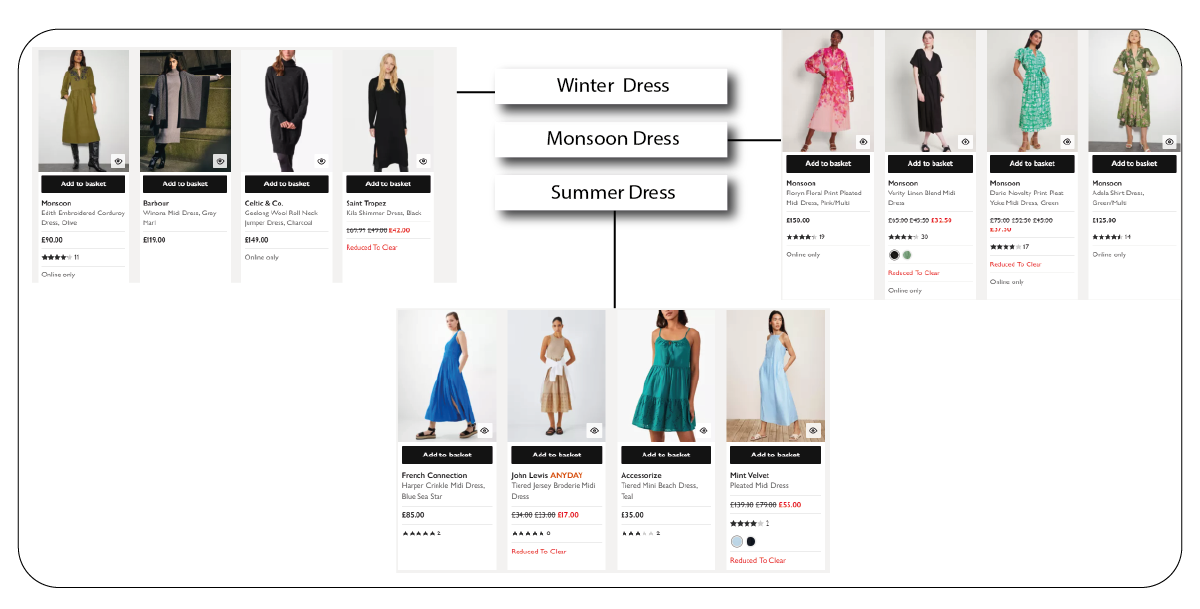

Seasonal Pricing Trends

Seasonal pricing trends play a huge role in the pricing of women's clothing at John Lewis.

Different seasons bring varied demand for certain types of clothing, and John Lewis's pricing

strategy must reflect these shifts in consumer preferences. Businesses can use tools to

scrape JohnLewis.com Product Data effectively to gain deeper insights.

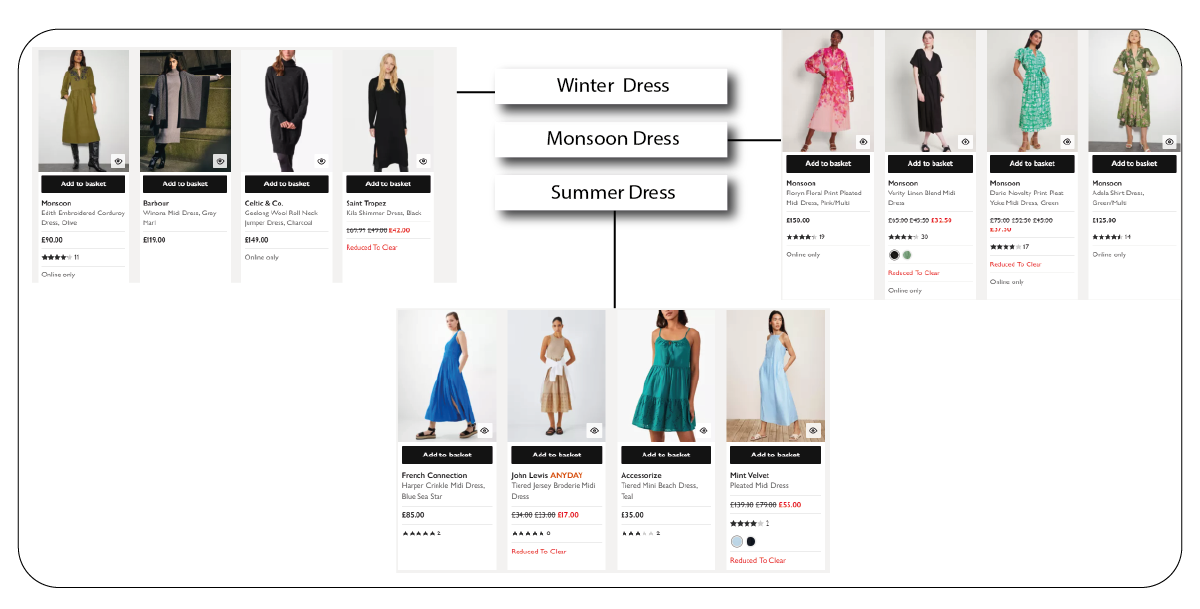

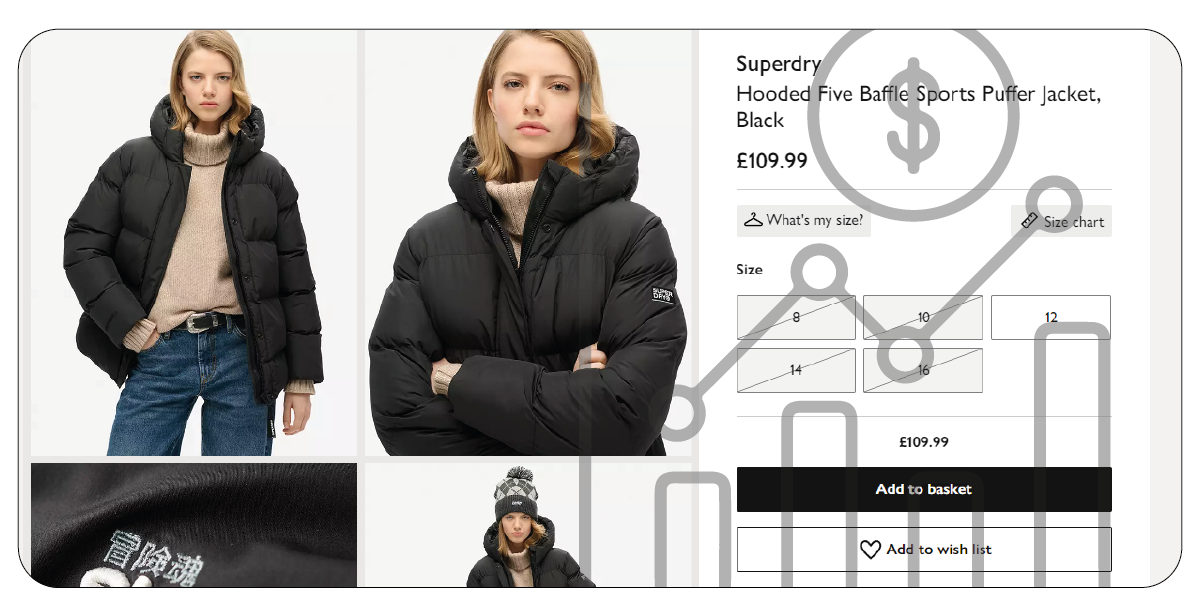

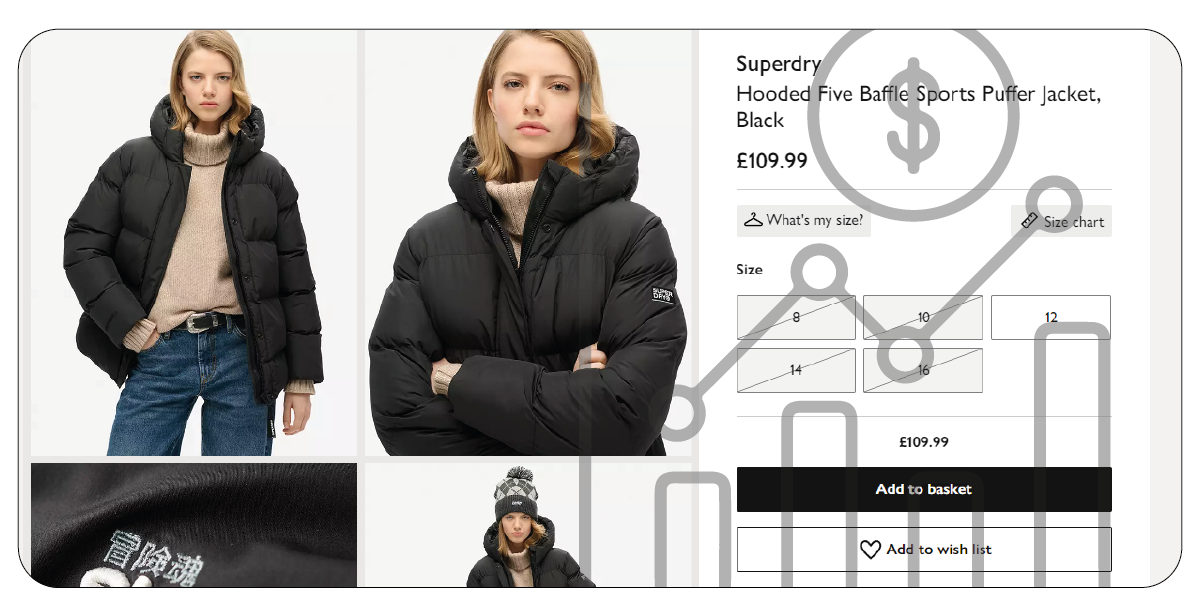

1. Winter vs. Summer Apparel: Winter clothing such as coats, knitwear, and boots is

typically priced higher than summer clothing like dresses and sandals due to material

costs and the complexity of the designs. However, winter apparel may also see more

aggressive discounting after the holiday season to clear stock. Understanding these

pricing dynamics can help retailers refine their inventory strategies.

2. Holiday Promotions: John Lewis often runs promotions around significant shopping

events, including Black Friday, Christmas, and the New Year. These periods can

significantly influence pricing patterns, with discounts and special offers creating

temporary fluctuations. Analyzing these seasonal pricing patterns can help identify

key moments when prices are more competitive. The John Lewis Dataset can

provide valuable information to track these trends.

3. New Collection Pricing: New arrivals typically enter the market at total price, and the

pricing strategy here involves positioning them as desirable, premium products.

Analyzing how long it takes for new collections to be discounted or whether specific

categories maintain full pricing longer can reveal John Lewis's approach to product

lifecycle management. Utilizing eCommerce Product Data Scraping Services can

enhance data collection efforts to monitor these trends in real time.

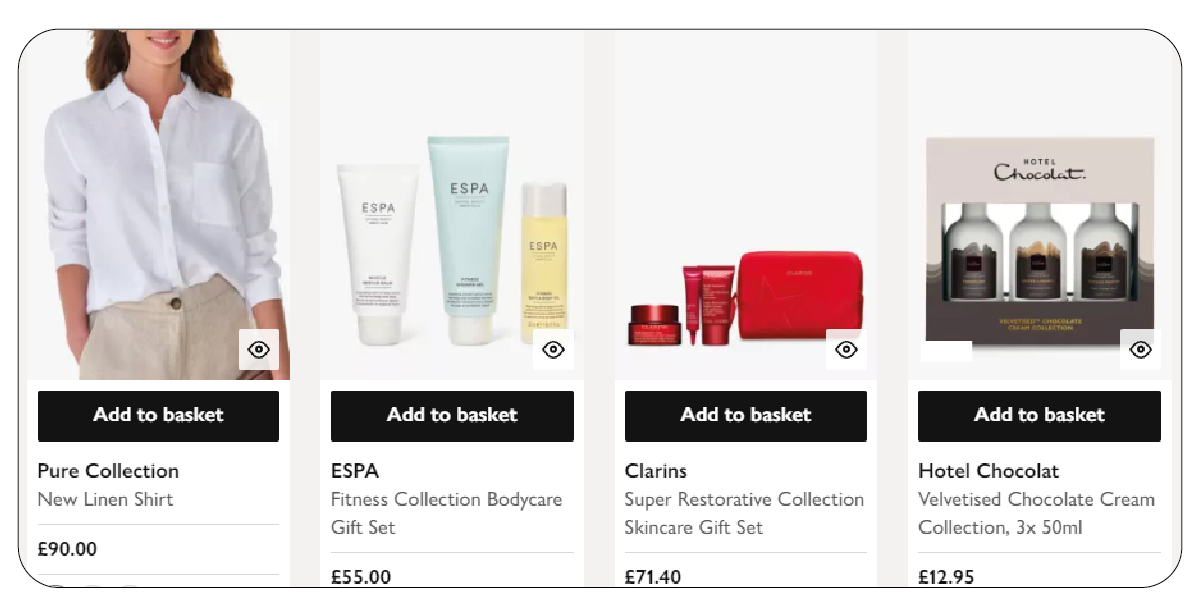

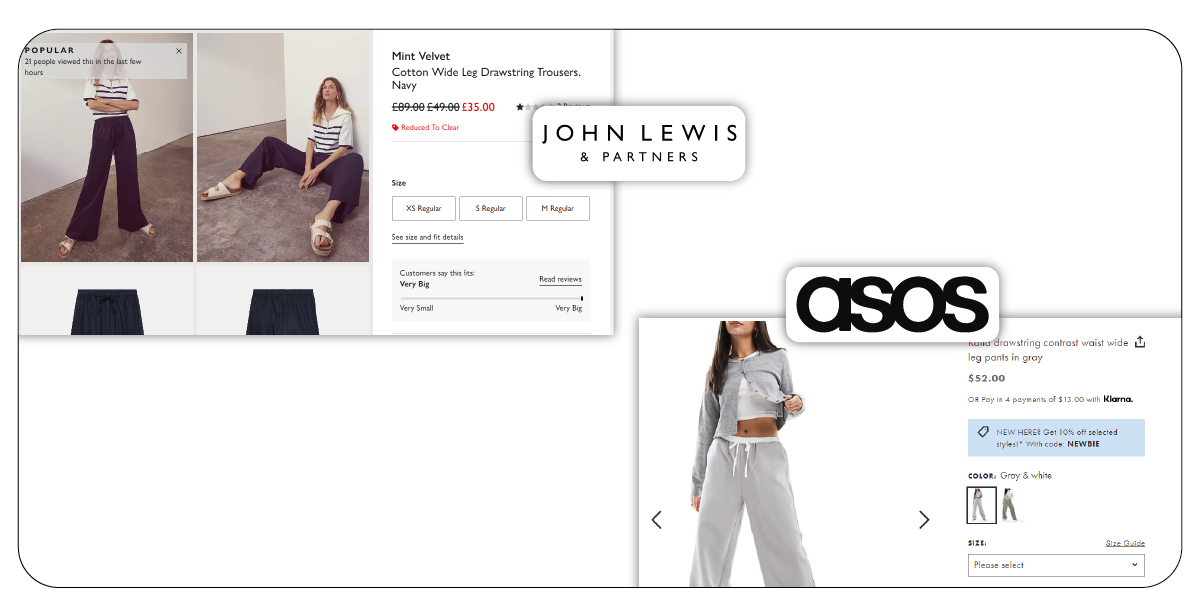

Competitive Pricing Analysis

John Lewis operates in a highly competitive market where pricing is critical in consumer

decision-making. Understanding how John Lewis positions itself against competitors like

Marks & Spencer, Debenhams, or online retailers such as ASOS and Next is essential in

evaluating its Pricing Strategy.

Key Competitive Pricing Strategies

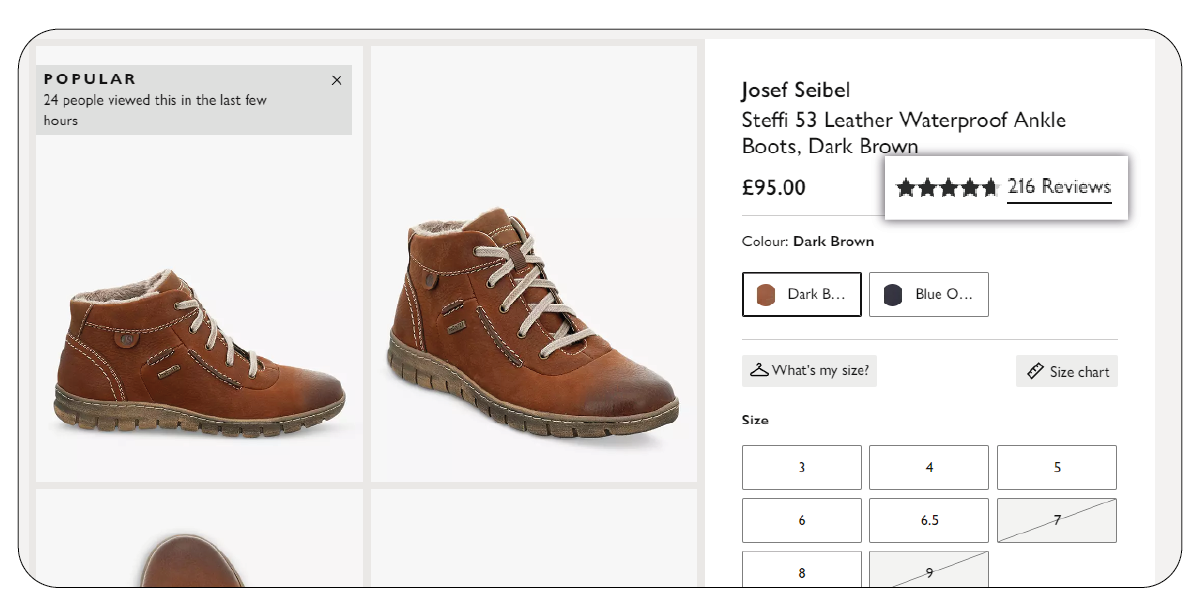

1. Price Matching: As part of its "Never Knowingly Undersold" policy, John Lewis offers

price matching for products found cheaper at other major retailers. This strategy

ensures that John Lewis remains competitive on critical items, but it also means that

the retailer must continually monitor its competitors' prices. By analyzing which

items are most frequently subject to price matching, we can infer which products are

considered high-priority in maintaining competitiveness. Utilizing Price Monitoring

Services can enhance this analysis by providing real-time data on competitor pricing.

2. Premium Positioning: While John Lewis matches competitors' prices on certain

items, it still maintains a premium image in the market. Analyzing pricing for high-

end brands or exclusive designer collaborations can reveal how John Lewis positions

itself as a premium retailer, even within the mid-range pricing spectrum. This could

involve maintaining higher prices on certain luxury items or focusing on full-price

strategies for limited-edition collections.

3. Competitive Differentiation by Category: John Lewis may use different pricing

tactics for various categories in the competitive landscape. For example, casual wear

might be priced to compete directly with fast fashion retailers. In contrast, evening

wear or formal attire could maintain higher prices to differentiate based on quality

and exclusivity. Leveraging an Ecommerce Data Collection Service can provide

detailed insights into category-specific pricing trends and consumer behavior, further

informing John Lewis's strategic decisions.

Markdown Efficiency and Stock Turnover

Markdowns are a crucial part of any retailer's strategy, but they can also signal inefficiency if

applied too frequently or heavily. Analyzing the efficiency of markdowns can provide

insights into how well John Lewis manages its inventory and demand forecasting.

Markdown Efficiency Metrics:

1. Speed of Markdowns: How quickly does John Lewis resort to markdowns after

introducing a product? If markdowns occur soon after launch, it may suggest an

overestimating demand or mispricing.

2. Stock Turnover Rate: High stock turnover rates indicate that products are sold at a

healthy pace, often at or near the total price. A low turnover rate, particularly for

high-ticket items, may lead to heavy discounting and lower profit margins.

3. Impact of Discounts on Sales Volume: It's crucial to analyze whether discounts lead

to a significant spike in sales. A successful markdown strategy should clear inventory

and boost overall sales volume. By examining the relationship between discount

depth and sales velocity, it's possible to measure the effectiveness of markdowns.

Price Elasticity and Consumer Behavior

Price elasticity refers to how sensitive customers are to changes in price. In women's

clothing, consumer behavior is often heavily influenced by perceptions of value and fashion

trends. Understanding the price elasticity of demand for different clothing categories at

John Lewis can help identify the optimal price points for maximizing revenue.

Measuring Price Elasticity:

1. Elastic vs. Inelastic Products: Some products, particularly high-end or exclusive

items, may be inelastic, meaning that demand remains strong even if prices are high.

Conversely, everyday wear or seasonal products may exhibit more elastic demand,

where small price changes lead to significant shifts in consumer behavior.

2. Impact of Promotions: Promotions and discounts are critical drivers of demand for

elastic products. Analyzing how price changes affect sales, especially during

promotional periods, can provide valuable insights into consumer behavior and price

sensitivity.

3. Seasonal Elasticity: The price elasticity of women's clothing at John Lewis may vary

seasonally. For example, during the holiday season, consumers may be more willing

to pay premium prices for gifts, while post-holiday shopping behavior could be more

price-sensitive due to seasonal discounts.

Conclusion

John Lewis's pricing strategy for women's clothing is carefully balanced, considering market

competition, seasonal trends, consumer behavior, and brand positioning. Through detailed

analyses such as boxplot analyses of price distributions, discount patterns, competitive

positioning, and price elasticity, it becomes evident that John Lewis employs a multi-faceted

strategy to maintain profitability while offering value to its customers.

By leveraging tools like discount depth, markdown efficiency, and seasonal pricing analysis,

John Lewis adapts to the dynamic fashion retail landscape while staying true to its

commitment to quality and customer satisfaction. Understanding the complexities of this

strategy provides valuable insights not only into John Lewis's operations but also into the

broader retail landscape.

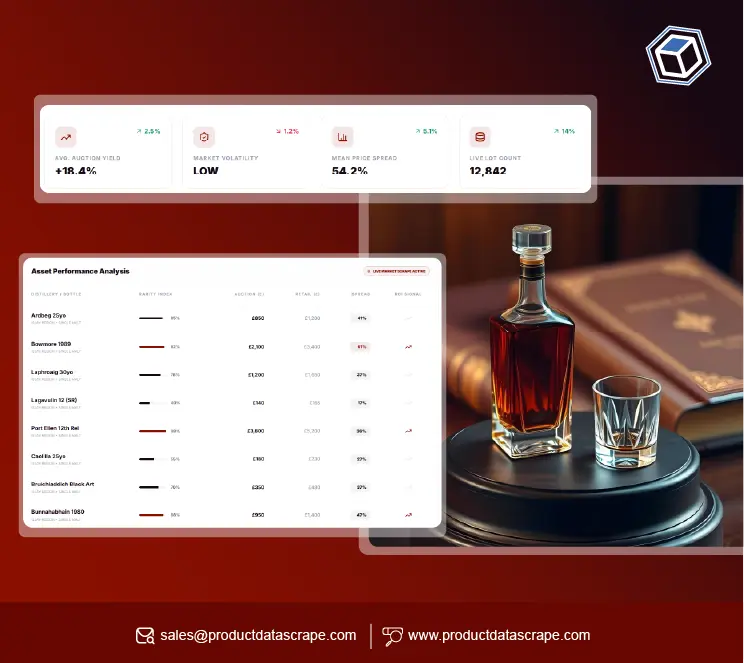

At Product Data Scrape, we strongly emphasize ethical practices across all our services, including

Competitor Price Monitoring and Mobile App Data Scraping. Our commitment to transparency and

integrity is at the heart of everything we do. With a global presence and a focus on personalized

solutions, we aim to exceed client expectations and drive success in data analytics. Our dedication to

ethical principles ensures that our operations are both responsible and effective.

.webp)