Introduction

In today’s competitive grocery landscape, data-driven decisions are essential for pricing, promotions, and assortment planning. Scraping Coles & Aldi Citrus Listings Data helps retailers, brands, and analysts understand how citrus products perform across leading Australian supermarkets. By leveraging Extract Grocery & Gourmet Food Data, businesses can evaluate pack sizes, price per kg, seasonal fluctuations, and promotional intensity. This blog explores how structured grocery data collected from 2020 to 2026 enables accurate comparisons between Coles and Aldi, revealing actionable insights for smarter retail strategies, optimized margins, and better consumer value.

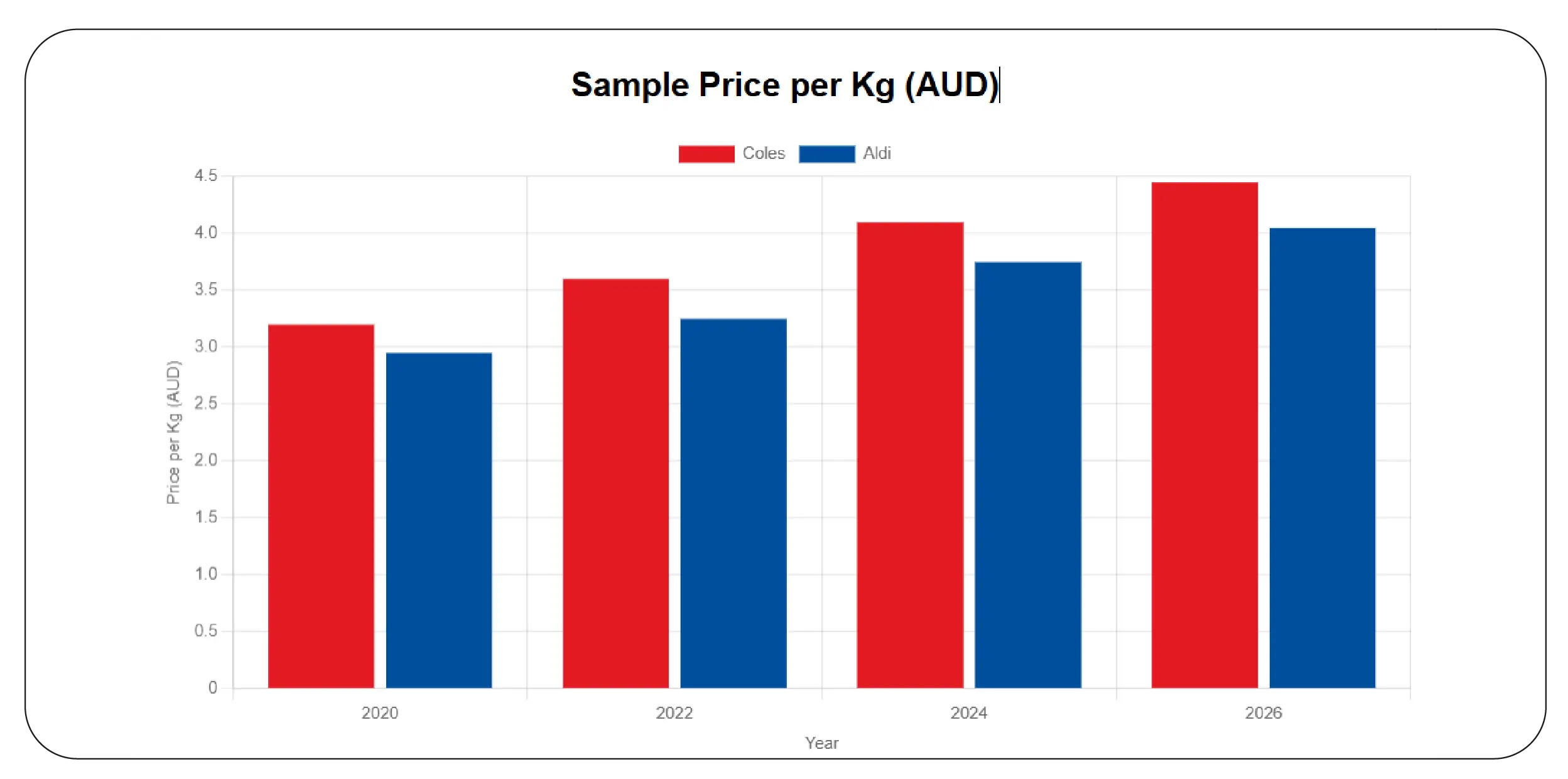

Market Signals from Citrus Pricing Trends

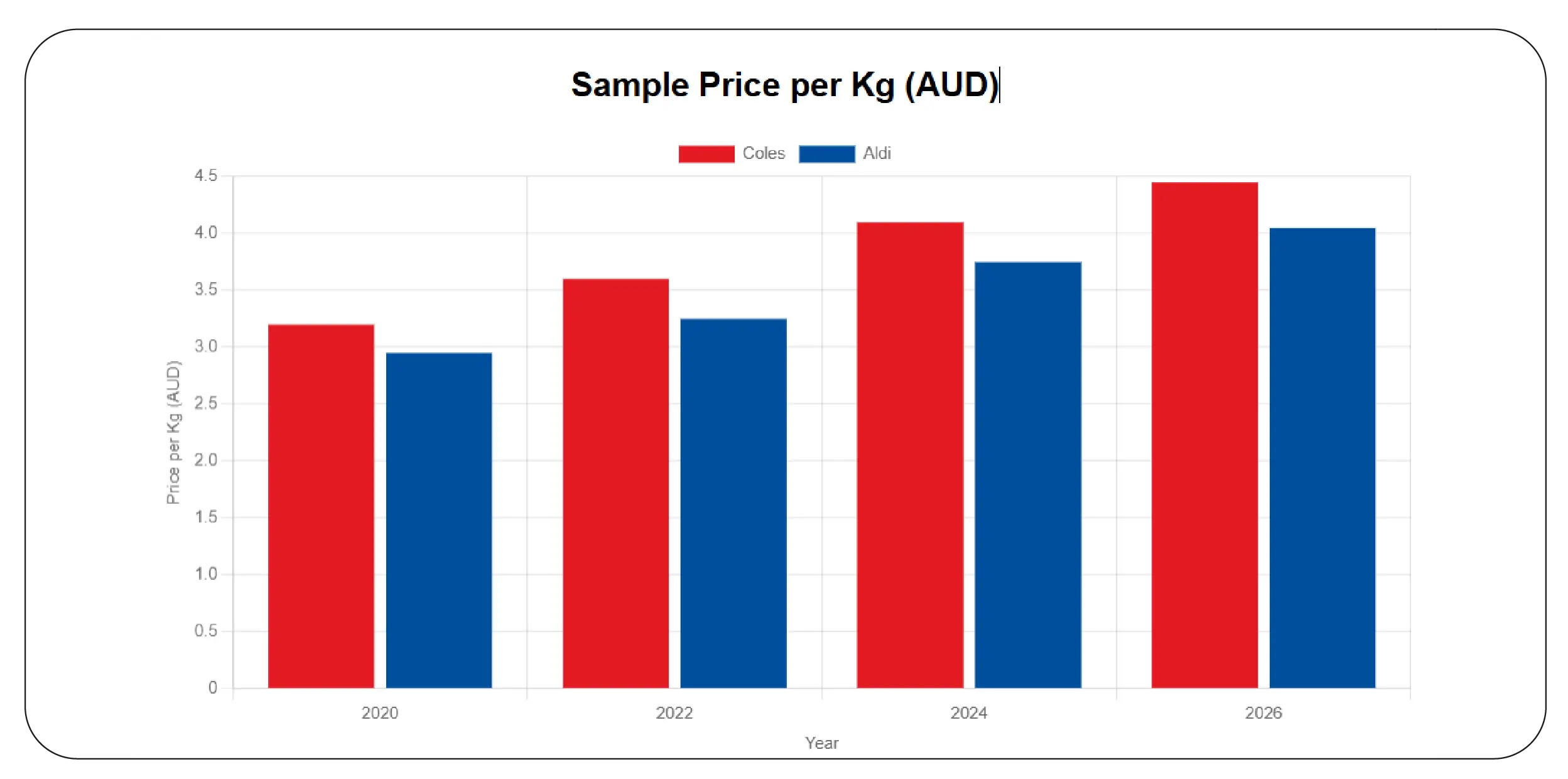

Understanding citrus pricing over time reveals how retailers respond to supply, demand, and inflation. Using scraping coles and aldi citrus price data, analysts can track how oranges, lemons, and mandarins changed in price from 2020 to 2026. Data shows steady increases post-2022 due to logistics and climate impacts, with Aldi consistently pricing 8–12% lower per kg.

Sample Price per Kg (AUD)

| Year |

Coles |

Aldi |

| 2020 |

3.20 |

2.95 |

| 2022 |

3.60 |

3.25 |

| 2024 |

4.10 |

3.75 |

| 2026 |

4.45 |

4.05 |

These insights help retailers benchmark pricing strategies, anticipate consumer sensitivity, and adjust pack sizes. Long-term citrus pricing data also supports forecasting models and supplier negotiations by highlighting sustained gaps between premium and value-focused chains.

Turning Data into Retail Advantage

Retailers increasingly rely on grocery pricing intelligence for retailers to remain competitive. Citrus data from 2020–2026 shows that dynamic pricing and private-label focus strongly influence Aldi’s lower average prices, while Coles leverages broader assortments and promotions.

Promotion Frequency (%)

| Year |

Coles |

Aldi |

| 2020 |

18% |

10% |

| 2023 |

26% |

14% |

| 2026 |

30% |

18% |

This intelligence enables retailers to identify optimal discount windows, assess competitor reactions, and balance margins with volume. By converting raw listings into structured intelligence, grocery teams can optimize shelf pricing, regional strategies, and promotional depth based on historical performance and competitive benchmarks.

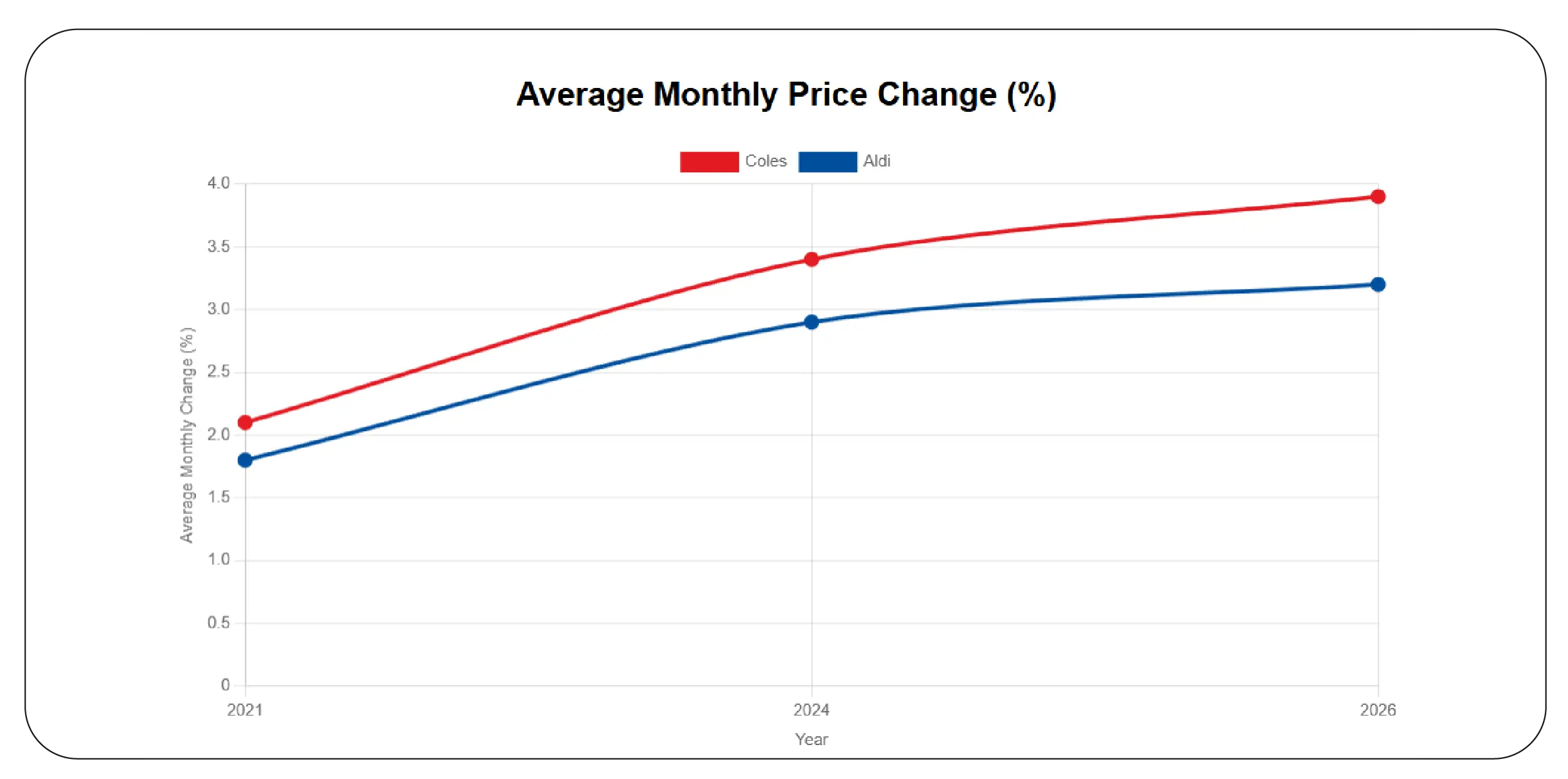

Always-On Price Visibility Across Markets

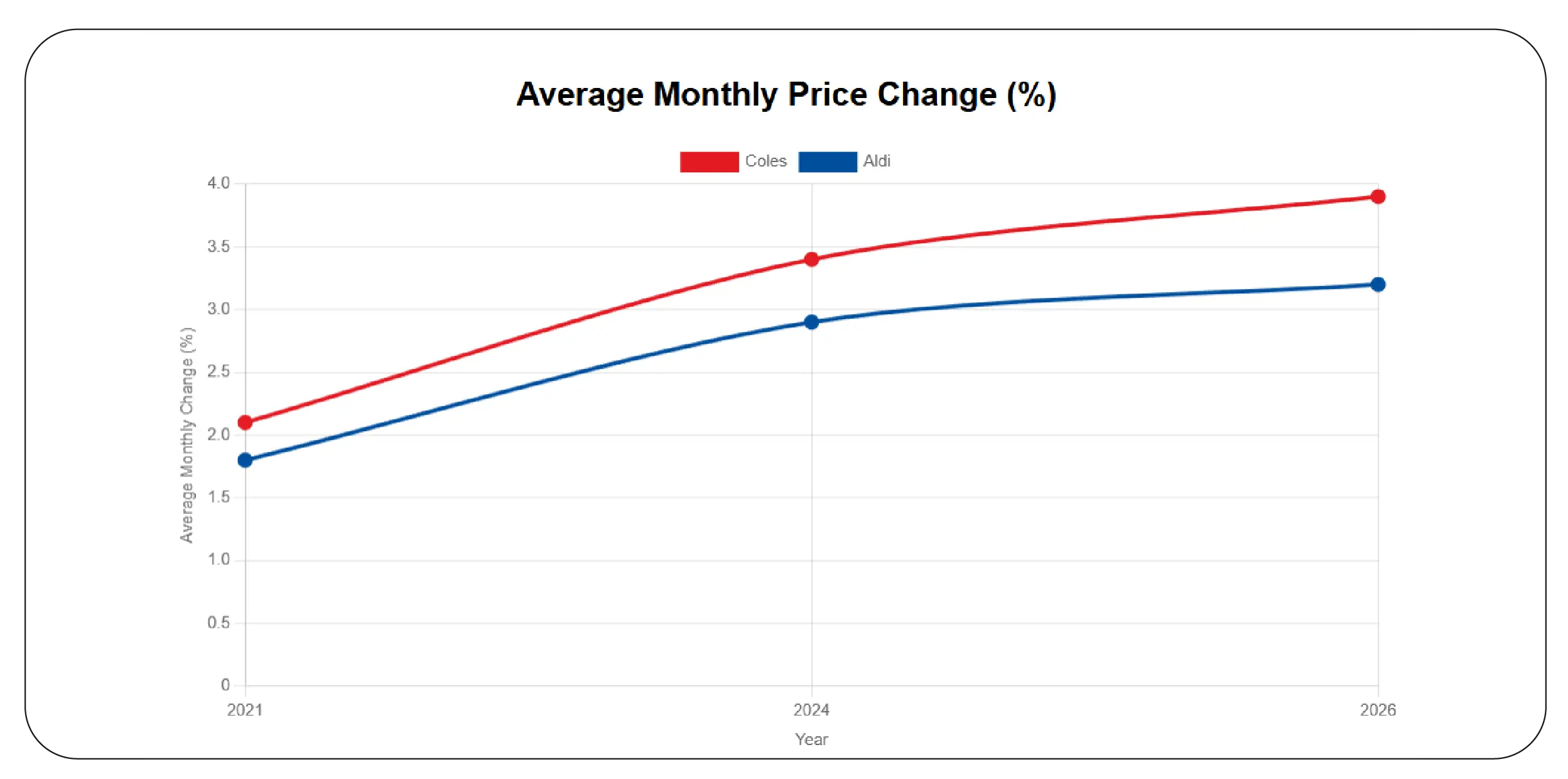

Modern retailers require continuous access to pricing changes. A Real-Time Grocery Price Monitoring API for Aldi and Walmart ensures citrus pricing updates are captured instantly, supporting rapid decision-making. Between 2020 and 2026, real-time feeds showed price volatility spikes during seasonal shortages.

Average Monthly Price Change (%)

| Year |

Coles |

Aldi |

| 2021 |

2.1 |

1.8 |

| 2024 |

3.4 |

2.9 |

| 2026 |

3.9 |

3.2 |

Such monitoring enables proactive pricing adjustments, automated alerts, and faster responses to competitor moves. Retailers benefit from reduced lag between market change and action, improving profitability and customer trust.

Evaluating True Value for Consumers

To understand real affordability, analysts often compare price per kg citrus coles vs aldi rather than shelf price alone. From 2020–2026, Aldi maintained smaller pack sizes but lower per-kg costs, while Coles offered bulk options at competitive unit pricing during promotions.

Mandarins Price per Kg (AUD)

| Year |

Coles |

Aldi |

| 2020 |

3.50 |

3.10 |

| 2023 |

4.00 |

3.55 |

| 2026 |

4.60 |

4.15 |

These comparisons help retailers refine pack-size strategies and help brands position products more effectively for value-conscious shoppers.

Leveraging Structured Supermarket Data

A reliable Coles Supermarket Grocery Store Dataset offers long-term visibility into citrus assortment, pricing tiers, and promotional cadence. From 2020 to 2026, data highlights Coles’ shift toward premium citrus varieties alongside aggressive seasonal discounts.

SKU Count Growth

| Year |

Citrus SKUs |

| 2020 |

42 |

| 2023 |

55 |

| 2026 |

63 |

Such datasets support assortment planning, private-label expansion, and category performance analysis. Structured supermarket data enables better collaboration between suppliers and retailers through shared, transparent insights.

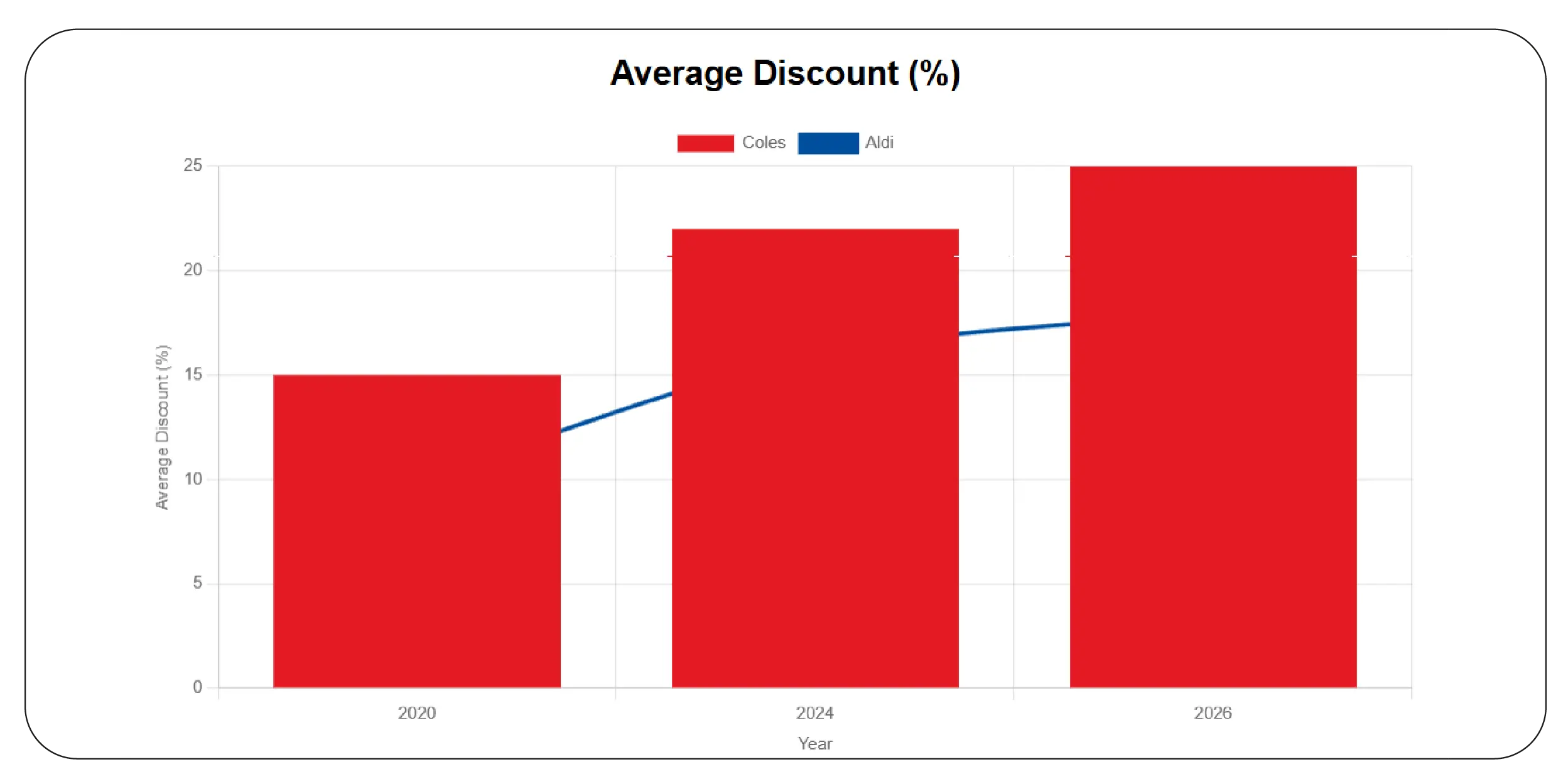

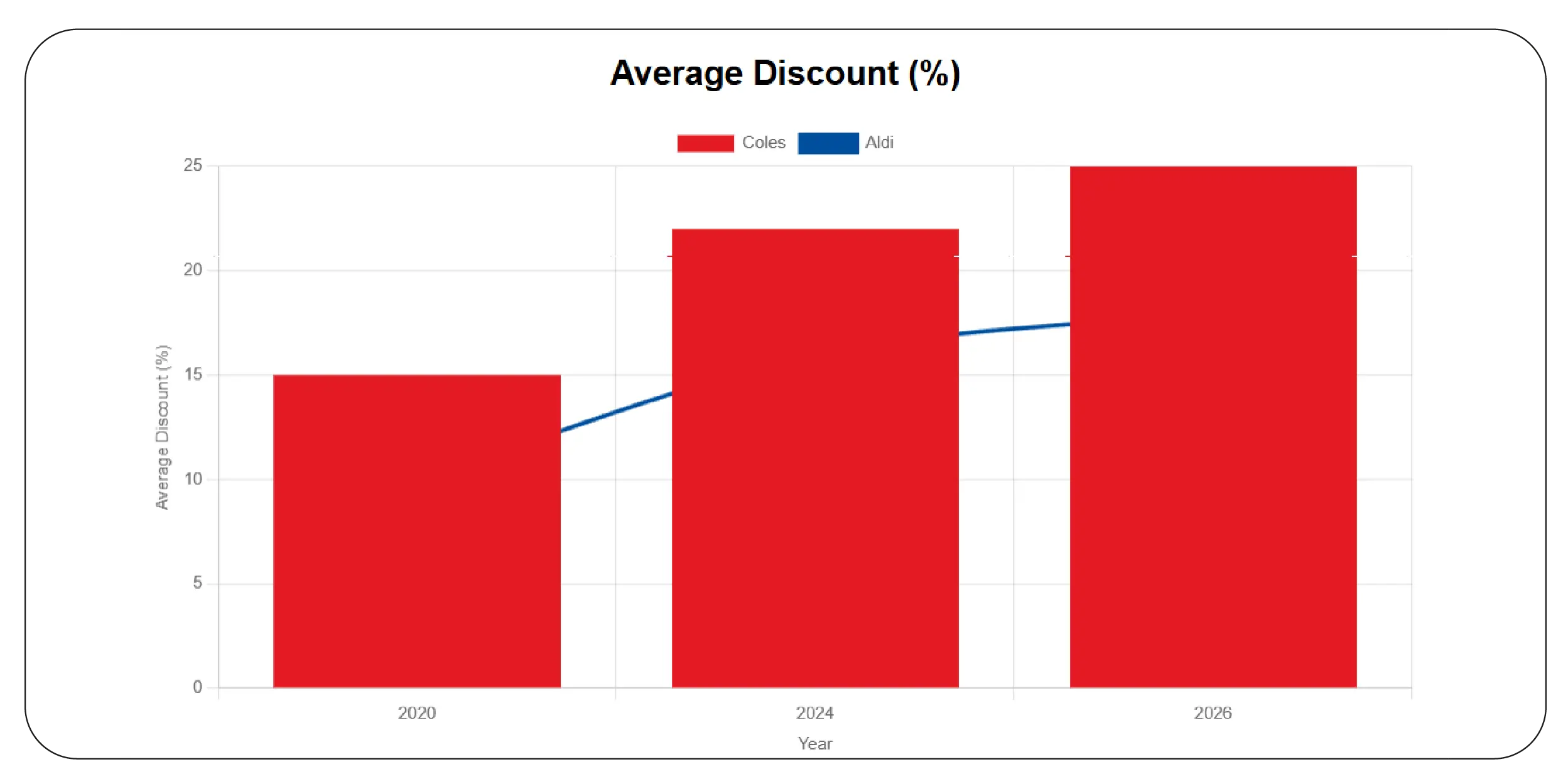

Capturing Promotional Opportunities at Scale

Retailers aiming to track supermarket fruit offers using scraping gain a clear view of discount timing and depth. From 2020–2026, citrus promotions increased during peak harvest months, driving volume spikes of up to 22%.

Average Discount (%)

| Year |

Coles |

Aldi |

| 2020 |

15% |

10% |

| 2024 |

22% |

16% |

| 2026 |

25% |

18% |

This data empowers teams to synchronize promotions, forecast demand surges, and align supply chains with marketing campaigns for maximum impact.

Why Choose Product Data Scrape?

Product Data Scrape delivers accurate, scalable grocery intelligence tailored for modern retail needs. By combining Promotions Using Coles Grocery Dataset for Australia with automated extraction workflows, businesses gain consistent visibility into pricing, availability, and offers. The platform also supports Extract Coles Grocery & Gourmet Food Data for deep category analysis across time periods. With reliable historical and real-time datasets, retailers, brands, and analysts can reduce manual effort, improve forecasting accuracy, and confidently execute data-driven pricing and promotional strategies.

Conclusion

Citrus pricing intelligence is no longer optional in a competitive grocery environment. Structured datasets enable a stronger retail pricing strategy using grocery datasets, helping businesses compare pack sizes, price per kg, and promotional effectiveness across Coles and Aldi. With accurate, long-term insights from 2020 to 2026, decision-makers can respond faster to market shifts and consumer expectations.

Unlock smarter grocery insights today by partnering with Product Data Scrape and transform raw supermarket data into measurable retail growth.

FAQs

1. How does citrus pricing data help retailers?

Citrus pricing data reveals long-term trends, competitive gaps, and promotion timing, helping retailers adjust pricing, margins, and assortment strategies using Product Data Scrape.

2. Can historical grocery data support forecasting?

Yes, multi-year datasets from 2020–2026 enable accurate demand forecasting, seasonality analysis, and supplier negotiations.

3. Why compare price per kg instead of shelf price?

Price per kg reflects true value, allowing fair comparisons across different pack sizes and promotional formats.

4. How often should grocery prices be monitored?

Daily or real-time monitoring ensures rapid response to competitor changes and market volatility.

5. Is scraped grocery data scalable for enterprises?

Yes, automated extraction pipelines support large-scale data needs across regions, categories, and timeframes.

.webp)