Introduction

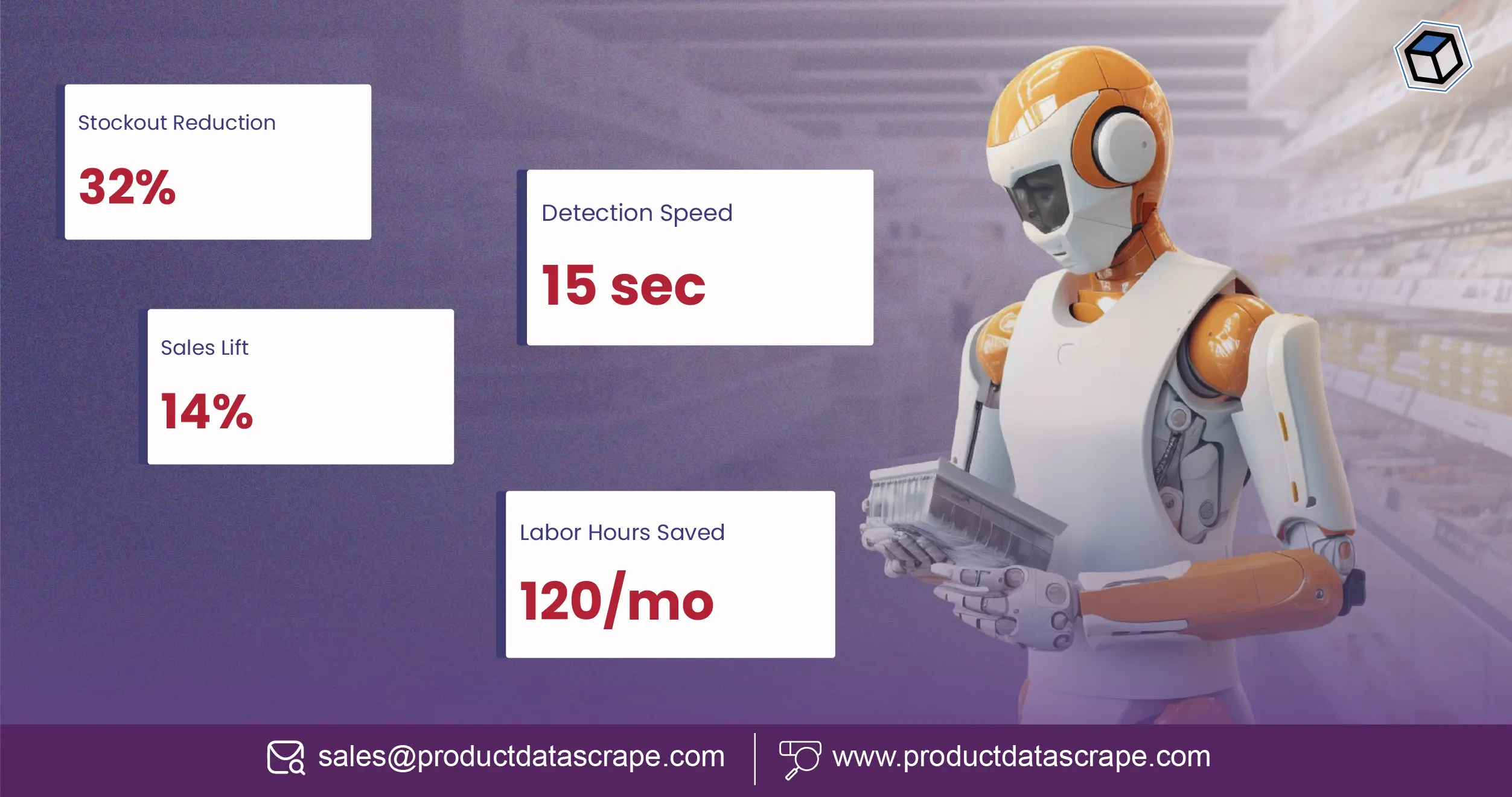

U.S. grocery retailers are under constant pressure to keep shelves full while minimizing excess inventory. Missed replenishment signals, demand volatility, and regional buying patterns often result in costly stockouts. This is where AI-Powered Shelf Analytics is transforming decision-making by turning shelf-level signals into real-time actions. Advanced data extraction and intelligence platforms now enable retailers to monitor assortment gaps, price changes, and availability fluctuations with precision.

At the same time, scalable data solutions such as Scraper to Track Product Assortment Analytics for Planning empower merchandising and supply chain teams to align forecasting, replenishment, and promotions. By combining artificial intelligence with structured retail data, grocery chains can respond instantly to changing shelf conditions and consumer demand.

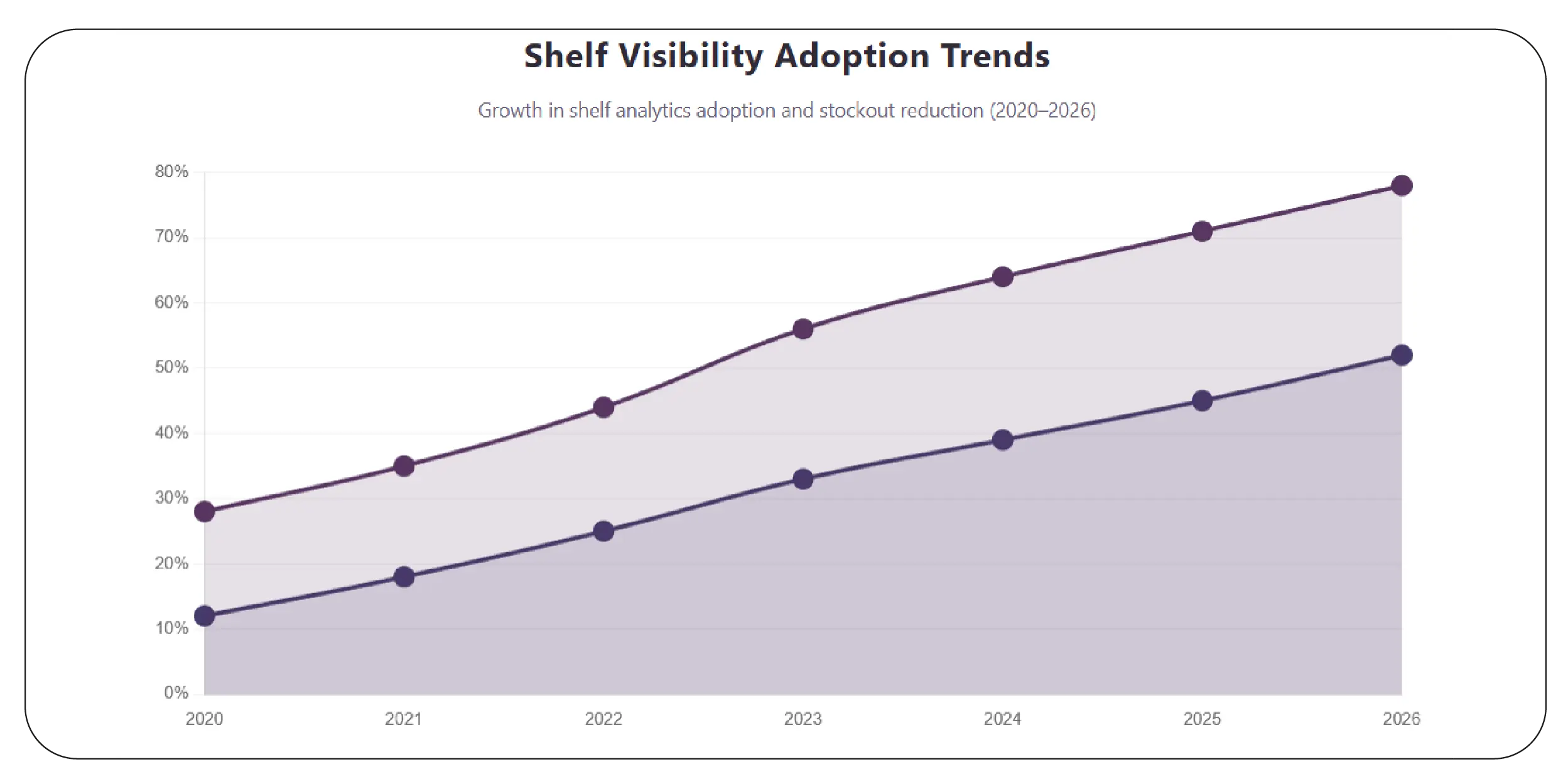

The Shift Toward Instant Shelf Visibility

Modern grocery operations rely heavily on Real-time shelf analytics for grocery retailers to identify empty shelves before customers notice. Shelf-level visibility helps teams respond dynamically to demand spikes, seasonal changes, and promotional impacts. Access to a structured Grocery store dataset allows retailers to compare on-shelf availability across regions, formats, and store sizes.

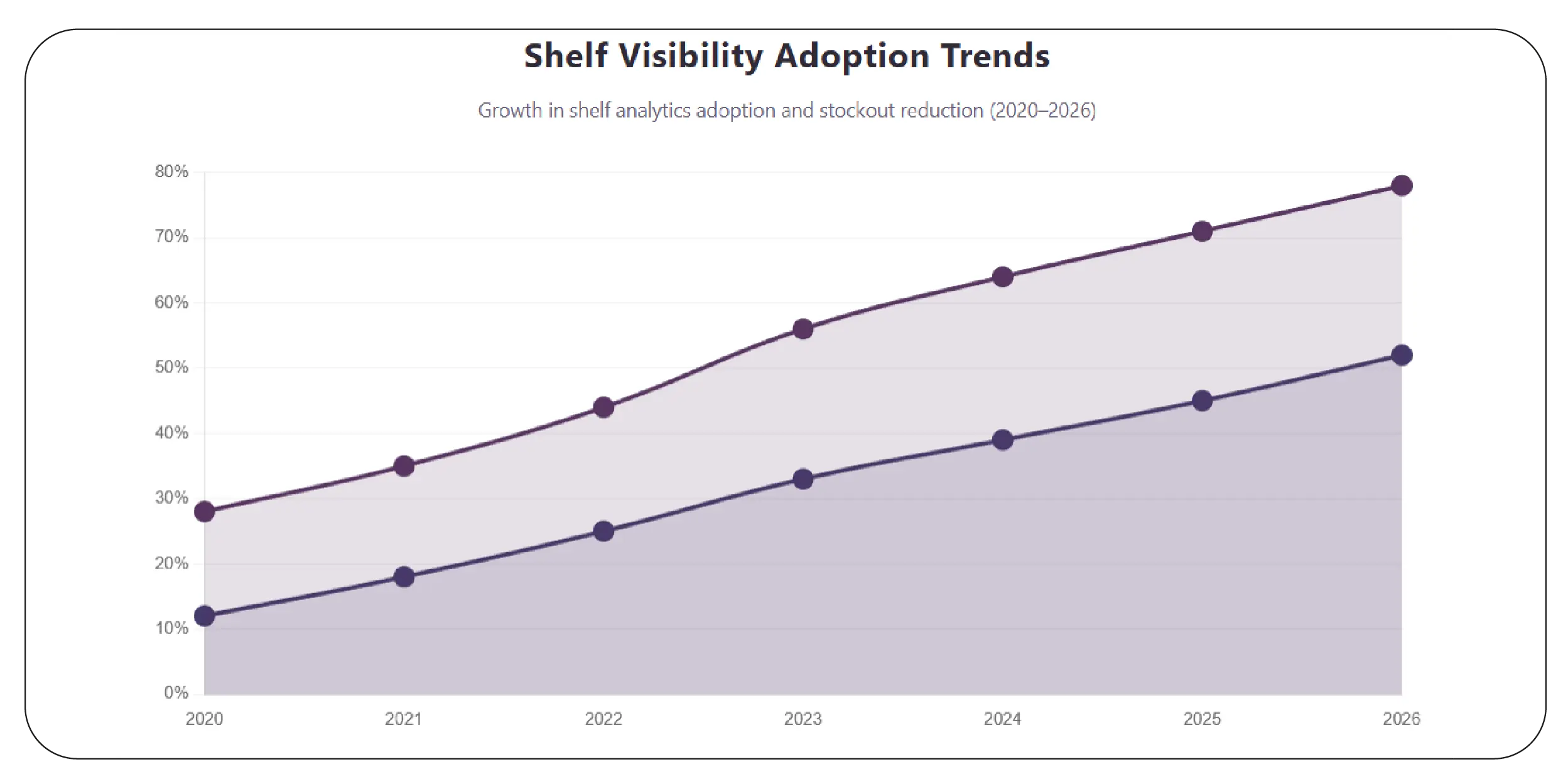

Between 2020 and 2026, U.S. grocers significantly increased investment in shelf analytics to combat pandemic-driven disruptions and long-term labor shortages.

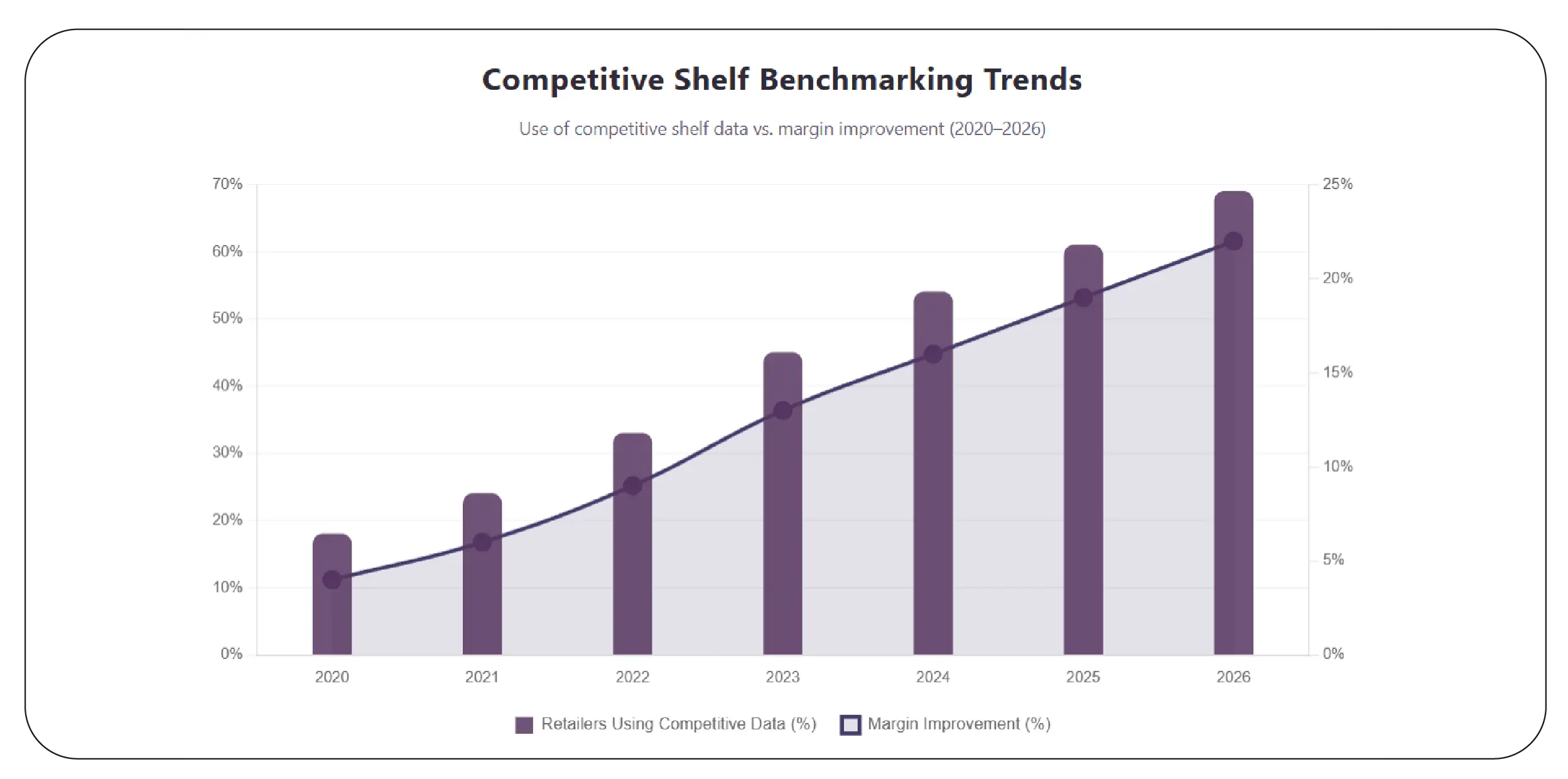

Shelf Visibility Adoption Trends (2020–2026)

| Year |

Stores Using Shelf Analytics (%) |

Avg. Stockout Reduction (%) |

| 2020 |

28% |

12% |

| 2021 |

35% |

18% |

| 2022 |

44% |

25% |

| 2023 |

56% |

33% |

| 2024 |

64% |

39% |

| 2025 |

71% |

45% |

| 2026 |

78% |

52% |

With accurate shelf data, retailers can prioritize high-velocity SKUs, optimize planograms, and ensure consistent product availability across locations.

Smarter Forecasting Through Intelligent Signals

Data-driven forecasting is evolving through AI-driven grocery inventory intelligence, which processes millions of shelf observations to predict future demand. These systems analyze historical sales, shelf gaps, promotions, and regional buying behavior to generate actionable insights.

From 2020 to 2026, grocery chains using AI-based inventory intelligence saw measurable improvements in replenishment accuracy and reduced waste.

Inventory Forecast Accuracy Improvements (2020–2026)

| Year |

Forecast Accuracy (%) |

Inventory Waste Reduction (%) |

| 2020 |

68% |

8% |

| 2021 |

72% |

12% |

| 2022 |

77% |

17% |

| 2023 |

82% |

22% |

| 2024 |

86% |

26% |

| 2025 |

89% |

30% |

| 2026 |

92% |

35% |

By continuously learning from shelf-level data, AI models help grocery retailers move from reactive replenishment to proactive inventory planning.

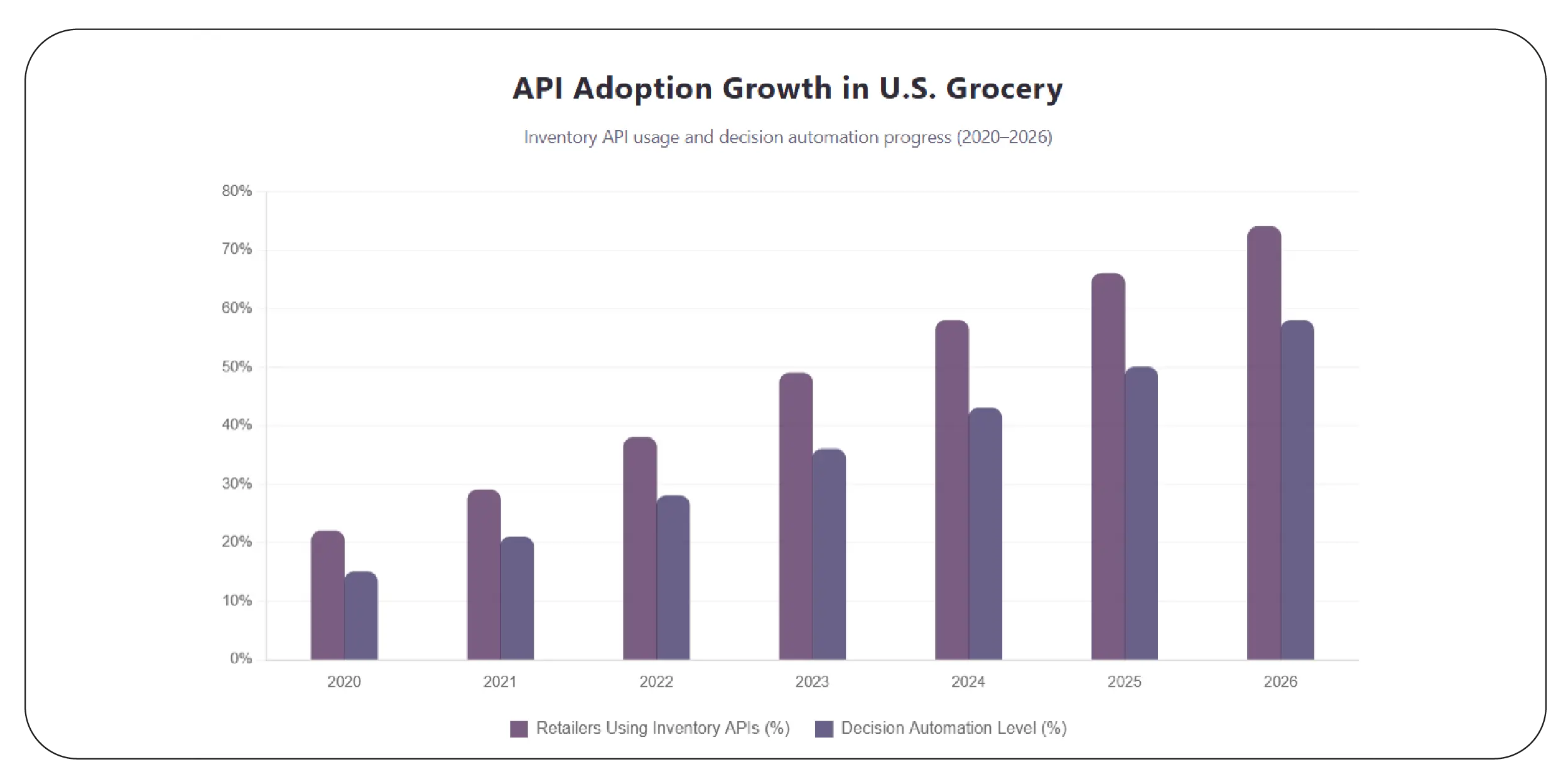

Connecting Shelf Insights With Enterprise Systems

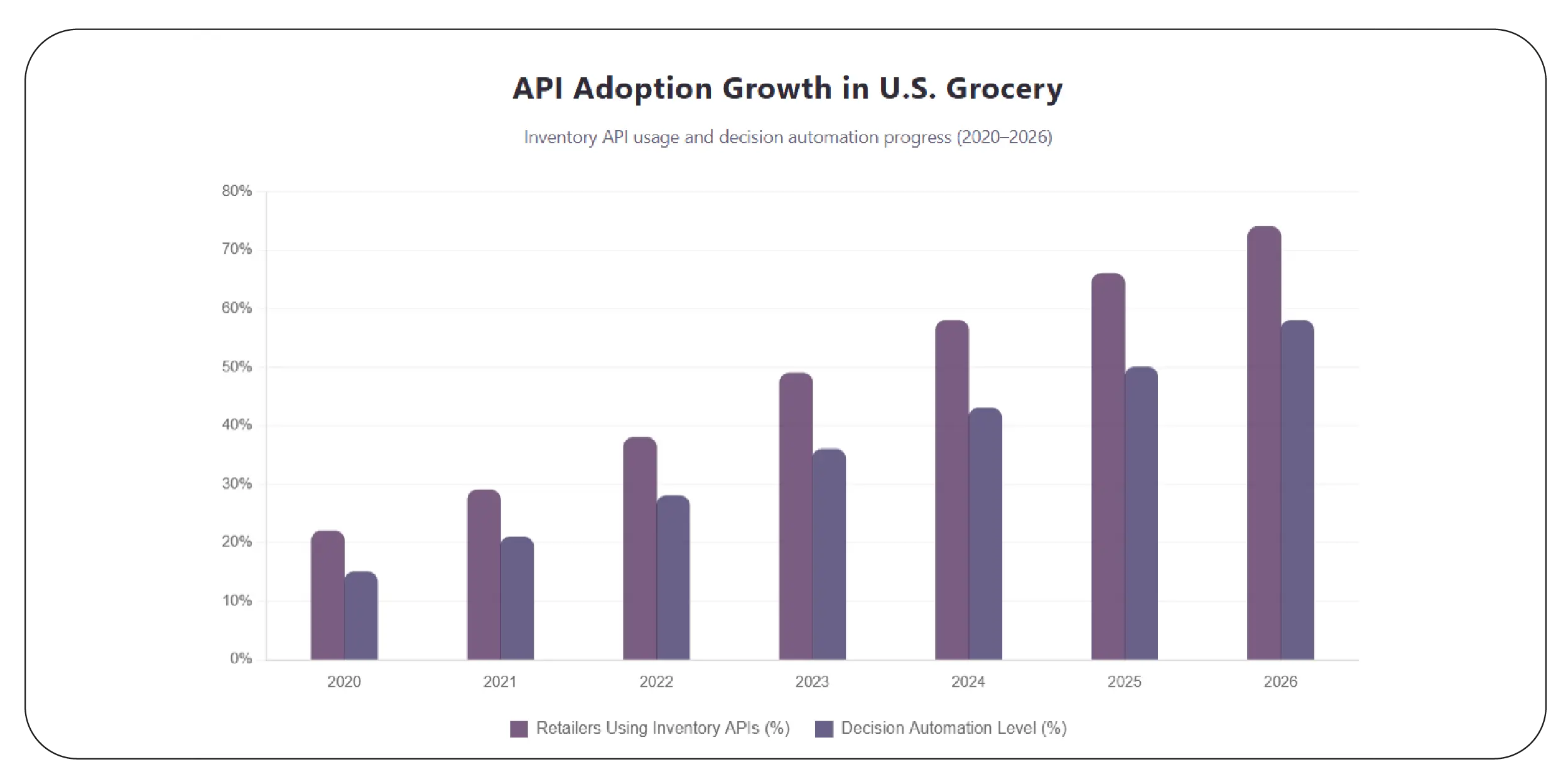

To operationalize insights, retailers increasingly rely on a Retail inventory intelligence API that integrates shelf data into ERP, demand planning, and replenishment platforms. APIs allow seamless data flow across merchandising, supply chain, and analytics teams.

From 2020 to 2026, API-driven data adoption accelerated as retailers sought scalable, real-time integrations.

API Adoption Growth in U.S. Grocery (2020–2026)

| Year |

Retailers Using Inventory APIs (%) |

Decision Automation Level (%) |

| 2020 |

22% |

15% |

| 2021 |

29% |

21% |

| 2022 |

38% |

28% |

| 2023 |

49% |

36% |

| 2024 |

58% |

43% |

| 2025 |

66% |

50% |

| 2026 |

74% |

58% |

APIs ensure that shelf insights are not siloed but actively drive replenishment decisions in near real time.

Continuous Shelf Awareness at Scale

Large grocery chains benefit from Real-Time Grocery Shelf Monitoring API solutions that deliver live alerts when products go out of stock. These tools provide store-level, category-level, and SKU-level visibility without manual audits.

Between 2020 and 2026, real-time monitoring significantly reduced lost sales due to delayed shelf checks.

Impact of Real-Time Shelf Monitoring (2020–2026)

| Year |

Avg. Out-of-Stock Duration (Hours) |

Lost Sales Reduction (%) |

| 2020 |

14.2 |

10% |

| 2021 |

12.8 |

16% |

| 2022 |

10.5 |

23% |

| 2023 |

8.9 |

31% |

| 2024 |

7.4 |

38% |

| 2025 |

6.2 |

44% |

| 2026 |

5.1 |

50% |

Such monitoring enables store managers and supply chain teams to act before shelves remain empty for extended periods.

Regional Intelligence for Competitive Advantage

Access to US Supermarket Shelf Data Intelligence allows retailers and brands to benchmark availability, pricing, and assortment strategies across competitors. This intelligence supports data-backed negotiations with suppliers and more effective category management.

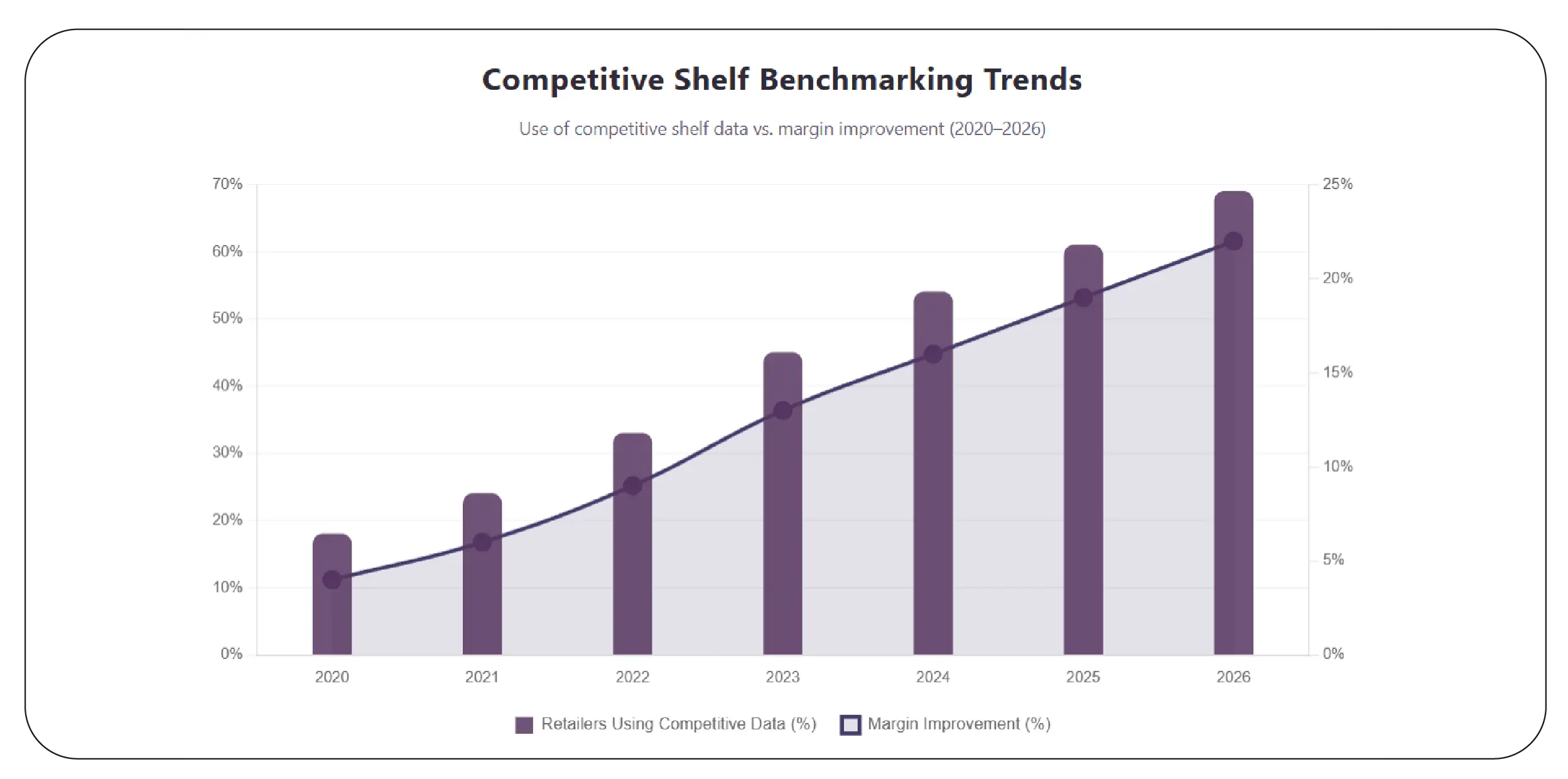

From 2020 to 2026, competitive shelf intelligence became a strategic differentiator.

Competitive Shelf Benchmarking Trends (2020–2026)

| Year |

Retailers Using Competitive Data (%) |

Margin Improvement (%) |

| 2020 |

18% |

4% |

| 2021 |

24% |

6% |

| 2022 |

33% |

9% |

| 2023 |

45% |

13% |

| 2024 |

54% |

16% |

| 2025 |

61% |

19% |

| 2026 |

69% |

22% |

This intelligence helps retailers identify assortment gaps and capitalize on regional demand variations.

Turning Availability Data Into Action

The ability to Scrape Real-Time Availability Data For U.S. Supermarkets gives retailers immediate insight into shelf conditions across thousands of stores. Availability data supports faster replenishment, better promotion execution, and improved customer satisfaction.

From 2020 to 2026, real-time availability scraping became critical for omnichannel grocery strategies.

Availability Data Utilization (2020–2026)

| Year |

Stores Tracked in Real Time |

Online Order Fulfillment Accuracy (%) |

| 2020 |

8,000 |

84% |

| 2021 |

12,500 |

87% |

| 2022 |

18,000 |

90% |

| 2023 |

24,000 |

93% |

| 2024 |

30,500 |

95% |

| 2025 |

36,000 |

97% |

| 2026 |

42,000 |

98% |

Availability intelligence bridges the gap between digital demand and physical shelf execution.

Why Choose Product Data Scrape?

Retailers choose Product Data Scrape for its ability to deliver accurate, scalable, and compliant retail intelligence. Our solutions help businesses Extract Grocery & Gourmet Food Data across multiple U.S. grocery chains with high frequency and precision. We also enable brands and analysts to Extract Top 10 Largest Grocery Chains in USA 2025 to gain comprehensive market visibility and competitive insights. With robust infrastructure, customizable data feeds, and enterprise-ready APIs, we support smarter planning, faster decisions, and improved shelf performance across the entire retail ecosystem.

Conclusion

In an increasingly competitive grocery landscape, shelf-level visibility is no longer optional. Real-time analytics, intelligent APIs, and availability intelligence empower U.S. grocery chains to prevent stockouts, protect revenue, and enhance customer trust. By leveraging advanced data extraction and analytics, retailers can move from reactive operations to predictive, insight-driven strategies.

Partner with us today to unlock real-time shelf intelligence and transform your grocery supply chain performance.

FAQs

1. How does shelf analytics reduce stockouts?

Shelf analytics identifies availability gaps instantly, allowing faster replenishment and better demand forecasting across stores.

2. Is real-time shelf data useful for online grocery fulfillment?

Yes, accurate shelf data improves order accuracy, substitution rates, and customer satisfaction.

3. Can APIs integrate shelf data with existing systems?

Modern retail APIs seamlessly connect shelf insights with ERP, planning, and replenishment tools.

4. How often should grocery shelf data be updated?

High-frequency updates, hourly or daily, ensure accurate decision-making and faster response times.

5. Which provider supports scalable grocery data extraction?

Product Data Scrape offers enterprise-grade solutions for large-scale grocery and retail data intelligence.

.webp)