Introduction

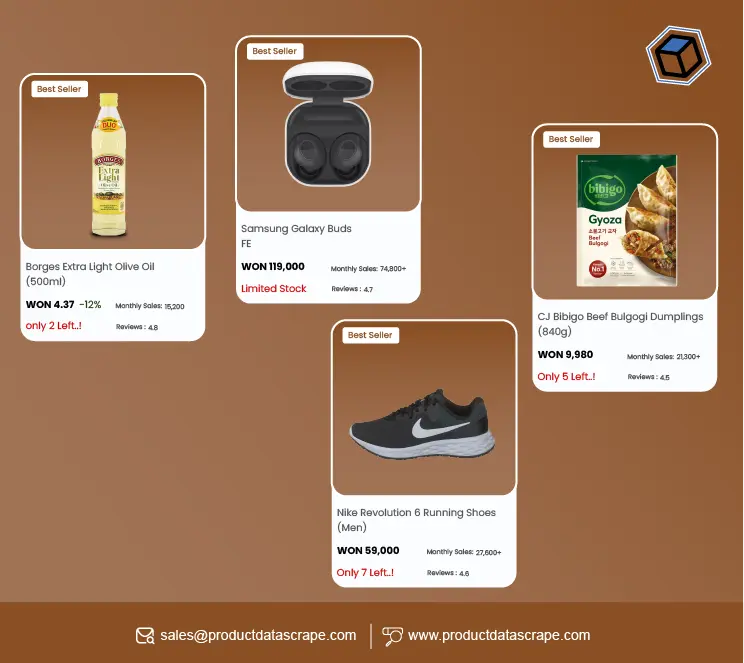

The grocery retail sector has significantly transformed from 2023 to 2025, driven by evolving consumer behaviors, technological advancements, and economic pressures. This report synthesizes key industry trends, supported by projections from 2023 to 2025, and analyzes their implications for retailers. Drawing from authoritative sources, including NielsenIQ, Statista, and McKinsey, the report highlights the shift toward value-driven shopping, sustainability, omnichannel experiences, private label growth, and technological integration. Two data tables are included to illustrate market dynamics and consumer preferences, offering actionable insights for grocery retailers navigating this competitive landscape. Businesses looking to Extract Grocery Retail Trends 2025 must be ready to align with fast-evolving demands. By choosing to Scrape Grocery Market Trends Data 2025, retailers and analysts gain critical foresight into customer behavior and pricing strategy. These analytics also enable firms to Extract Grocery Market Insights for 2025, helping to create data-backed strategies that boost competitiveness in a margin-sensitive market.

Key Grocery Retail Trends (2023–2025)

-01.webp)

1. Rise of Value-Driven Shopping

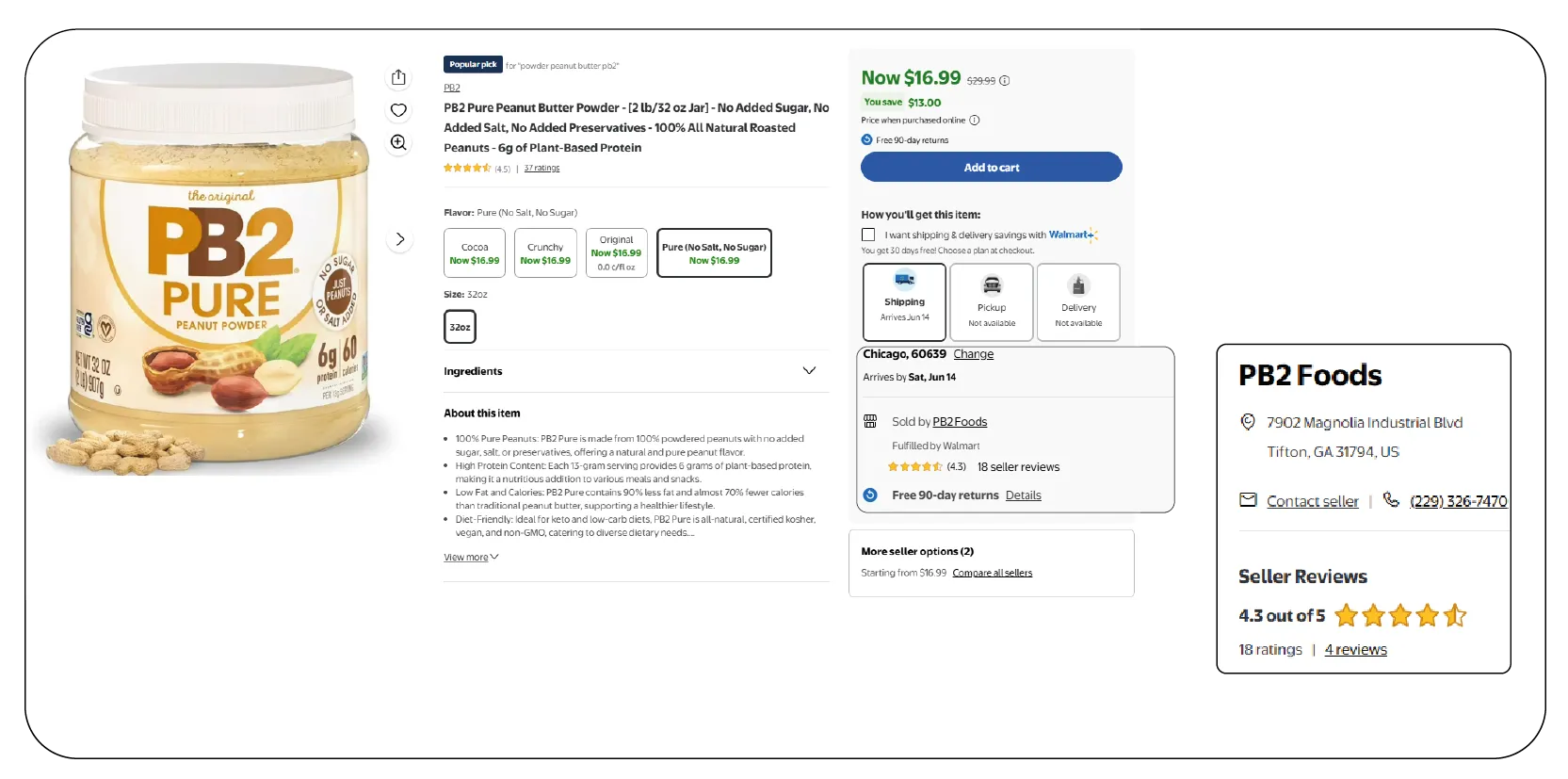

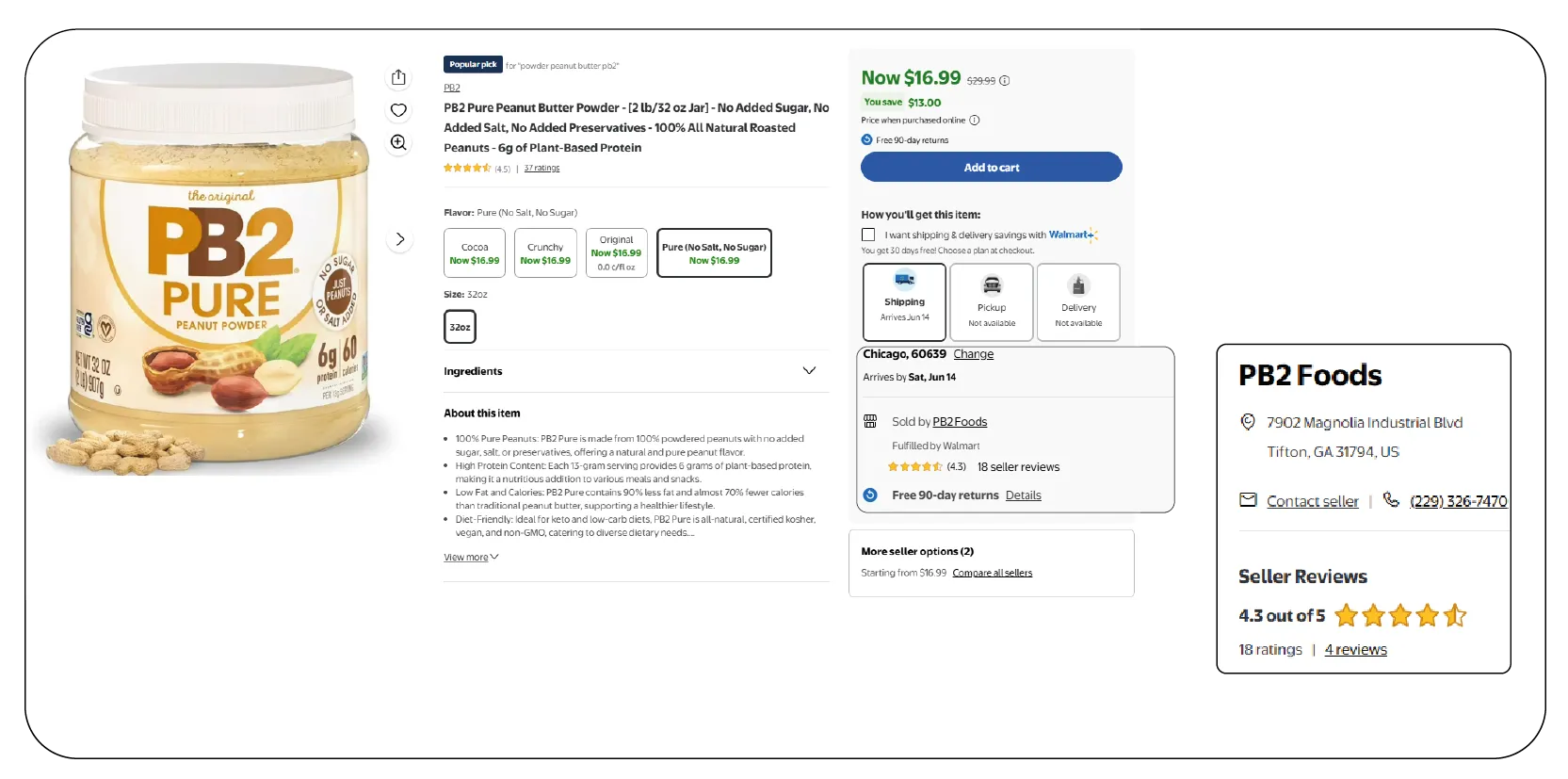

Economic pressures, particularly inflation, have significantly influenced consumer behavior. In 2023, U.S. food prices were 25% higher than in January 2020, with 70% of shoppers citing food prices as a top concern in February 2024, down slightly from 75% in 2023. Despite inflation easing to 2.3% in 2024, consumers continued prioritizing cost-effectiveness. Average unit price increases slowed from 4–8% in 2023 to 1.7% in 2024, yet many shoppers traded for budget-friendly options. In 2025, food-at-home prices will rise by 2.1%, below the 20-year historical average of 2.6%, encouraging deal-seeking behavior. Retailers have responded by expanding private label offerings, which accounted for 19% of total grocery revenue in 2023, a 5% year-over-year increase. In 2024, private label growth continued, with retailers like Walmart launching trendy lines like Bettergoods to cater to value-conscious consumers seeking quality. This value-seeking behavior fuels interest in Web Scraping Grocery Retail Trends 2025 to uncover how price sensitivity shapes retail strategies.

2. Sustainability and Health-Conscious Choices

The environmental, social, and governance (ESG) movement has reshaped grocery lists. In 2023, Mintel reported that 27% of U.S. shoppers reduced meat consumption and 17% cut dairy intake, reflecting a shift toward healthier and ethically sourced foods. A 2024 NielsenIQ survey found that 95% of U.S. consumers aimed to integrate sustainable living into their purchases, with 37% willing to pay 11–17% more for sustainable products. Grocers like Kroger committed to eliminating single-use plastic bags and tracking food waste by 2025, while others partnered with companies like SuperMeat to offer cultivated meats, addressing concerns about methane emissions and animal welfare. In 2025, sustainability remains a priority, with retailers enhancing transparency through electronic shelf labels (ESLs) that display product sustainability information. Companies looking to Scrape Grocery Shopping Behavior Data 2025 can identify environmentally-conscious shifts in purchasing habits.

3. Omnichannel Shopping and E-Commerce Growth

Online grocery shopping has seen exponential growth, outpacing in-store sales nearly threefold in 2024 compared to 2023. U.S. online grocery sales reached $9.8 billion in April 2025, a 15.2% increase from $8.5 billion in April 2024. Delivery accounted for $4.2 billion in April 2025, reflecting 29% year-over-year growth. Statista projects U.S. grocery delivery sales to hit $257 billion in 2024 and $422 billion by 2028. Walmart led with a 28.4% share of the U.S. online grocery market in 2023, followed by Amazon (22%) and Kroger (9.9%). Retailers are blending online and in-store experiences, offering personalized promotions redeemable across channels to enhance omnichannel experiences. In 2025, grocers are expected to refine omnichannel strategies, incorporating social commerce and shoppable media to target Gen Z, whose global spending power reached $9.8 trillion in 2024. This omnichannel rise demands businesses to Extract Online Grocery Trends Data 2025 to understand evolving cross-platform preferences.

4. Private Label Expansion

Private labels have emerged as a cornerstone of grocery retail strategy. In Europe, private label sales grew to 39.1% of total grocery sales value in 2024, up 0.3 percentage points from 2023, with projections estimating a rise to 40–42% by 2030. In the U.S., private label growth was driven by retailers like Costco, Aldi, and Sprouts Farmers Market, which introduced affordable yet high-quality store brands. Consumers increasingly view private labels as comparable to national brands, with 84% of European shoppers in 2025 stating they would continue purchasing them even with increased purchasing power. This trend reflects a shift in brand loyalty, challenging consumer packaged goods (CPG) companies as grocers innovate with curated, specialty private label lines. Private label performance is also a key indicator for those aiming to Extract 2025 Grocery Consumer Insights for long-term planning.

5. Technological Integration and Automation

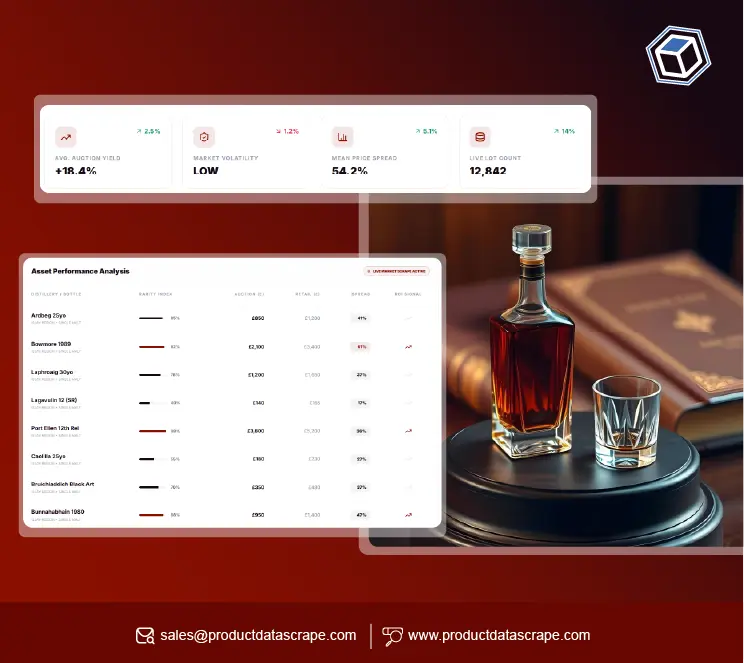

Technology is transforming grocery retail operations and customer experiences. In 2024, 73% of U.S. consumers preferred self-checkout over staffed registers, reducing labor costs. Retailers adopted ESLs, and Walmart plans to implement them in 2,300 locations by 2026, enhancing pricing accuracy and inventory management. Artificial intelligence (AI) is increasingly used for demand forecasting, inventory management, and developing alternative supply chains amid disruptions like crop failures and geopolitical issues. In 2025, ESLs are expected to incorporate pick-to-light features, improving product location for shoppers and staff. Additionally, apps that guide shoppers to deals and in-store navigation tools are gaining traction, enhancing the in-store experience. These tools are pivotal for analysts conducting Quick Commerce Grocery & FMCG Data Scraping to monitor real-time pricing and stock levels.

6. Convenience and Foodservice Growth

The demand for convenience has driven growth in ready-to-eat meals and on-the-go food options. Foodservice grew 3.8% in Europe from 2023 to 2024, 1.6 times faster than modern grocery retail. In 2024, 54% of consumers purchased ready-to-eat items like sandwiches and salads at least monthly, with the share of those buying prepackaged or frozen meals dropping from 41% in 2023 to 36% in 2024. Grocers are expanding meal solutions and food service options to compete with restaurants, as dining-out spending rose 4.4% in 2024 compared to a 1.8% increase in grocery spending. In 2025, this trend is expected to continue, driven by Gen Z and millennials who prioritize convenience over cooking. The changing food preferences make it necessary to Scrape Grocery & Gourmet Food Data for better merchandising and supply forecasting.

7. Shifting Store Dynamics and Foot Traffic

Despite e-commerce growth, brick-and-mortar stores accounted for 83% of U.S. grocery sales 2024. Grocery store foot traffic rose to 17.2 billion visits in 2024, a 1% increase from 2023 and 10.9% from 2019. However, average in-store dwell time decreased to 23.4 minutes in 2024, down 0.3 minutes from 2023, as consumers visited multiple stores to compare prices. Specialty grocers like Trader Joe’s saw a 6.1% increase in foot traffic in 2024, reflecting demand for curated selections. In 2025, grocery-anchored retail vacancy is projected to remain low at 3.5%, driven by limited new supply and strong demand. Analysts and pricing strategists now turn to Web Scraping Grocery Price Data to maintain competitive pricing and detect regional anomalies in cost inflation.

Key Analysis

The trends from 2023 to 2025 highlight a grocery retail sector adapting to economic, technological, and societal shifts. Value-driven shopping reflects consumer sensitivity to inflation, pushing retailers to expand private labels and promotions. Sustainability is no longer a niche concern but a mainstream driver, with consumers willing to pay premiums for eco-friendly products. Omnichannel strategies bridge physical and digital shopping, catering to convenience-seeking consumers, particularly younger demographics. Technological advancements, including AI and ESLs, enhance operational efficiency and customer experience, while the growth of food service and ready-to-eat options addresses time-pressed lifestyles. These trends underscore the need for retailers to balance affordability, quality, and innovation to maintain loyalty and competitiveness.

Trends Included

- Value-Driven Shopping: Emphasis on cost-effectiveness through private labels and promotions.

- Sustainability and Health: Increased demand for sustainable and healthier food options.

- Omnichannel Shopping: Integration of online and in-store experiences with e-commerce growth.

- Private Label Expansion: Growing market share and consumer trust in store brands.

- Technological Integration: Use of AI, ESLs, and self-checkout to optimize operations.

- Convenience and Foodservice: Rise in ready-to-eat meals and on-the-go options.

- Store Dynamics: Sustained in-store traffic with shorter dwell times and low retail vacancy.

Data Tables

Table 1: U.S. Online Grocery Sales and Market Share (2023–2025)

| Retailer |

2023 Sales ($B) |

2025 Projected Sales ($B) |

Market Share (2023) |

Annual Growth Rate |

| Walmart |

45.71 |

63.79 |

28.4% |

17.5% |

| Amazon |

35.46 |

48.42 |

22.0% |

17.6% |

| Kroger |

15.96 |

20.90 |

9.9% |

13.1% |

| Target |

7.72 |

9.16 |

4.8% |

8.8% |

| Albertsons |

5.48 |

6.38 |

3.4% |

6.5% |

| Source: Capital One Shopping, 2024 |

|

|

|

|

Table 2: Consumer Behavior Metrics (2023–2025)

| Metric |

2023 Value |

2024 Value |

2025 Projection |

| Food-at-Home Price Increase |

5.8% |

1.2% |

2.1% |

| Online Grocery Sales ($B) |

Not Available |

9.5 (Aug 2024) |

9.8 (Apr 2025) |

| Private Label Sales (% of Total) |

19% (US) |

39.1% (Europe) |

40–42% (Europe) |

| Foot Traffic (Billion Visits) |

17.0 |

17.2 |

Not Available |

| Average In-Store Dwell Time (Min) |

23.7 |

23.4 |

Not Available |

| Sources: USDA ERS, Brick Meets Click, McKinsey |

|

|

|

Conclusion

The grocery retail sector from 2023 to 2025 reflects a dynamic interplay of economic pressures, consumer preferences, and technological innovation. Retailers must prioritize value, sustainability, and omnichannel strategies to remain competitive. Private labels and technology-driven efficiencies offer opportunities to enhance margins and loyalty, while convenience-driven foodservice caters to evolving lifestyles. The data underscores the sector’s resilience, with projected growth in online sales and sustained in-store demand. By aligning with these trends, grocers can navigate uncertainties and capture growth opportunities in 2025 and beyond. For those seeking a deeper understanding of these shifts, leveraging Grocery & Supermarket Data Scraping Services becomes essential to track real-time market behavior. As the competition intensifies, more brands turn to Grocery Data Scraping Services to identify pricing trends, competitor assortment, and promotional dynamics using a rich Grocery Store Dataset as the analytical foundation.

At Product Data Scrape, we strongly emphasize ethical

practices across all our services,

including Competitor Price Monitoring and Mobile

App Data Scraping. Our commitment to

transparency and integrity is at the heart of everything we do. With a global presence and a

focus on personalized solutions, we aim to exceed client expectations and drive success in data

analytics. Our dedication to ethical principles ensures that our operations are both responsible

and effective.

-01.webp)

.webp)